Have you ever found yourself in a financial bind, struggling to improve your credit score? The world of credit repair companies can be overwhelming, especially when trying to navigate through the scams and fraudsters. In this article, you will discover the most notorious and disreputable companies that promise to repair your credit but often leave you worse off than before. Brace yourself for a deep dive into the dark side of the industry, as we expose the worst credit repair companies that you should avoid at all costs.

Understanding Credit Repair Companies

Definition of credit repair companies

Credit repair companies are specialized firms that offer services aimed at improving the creditworthiness of individuals. These companies work on behalf of their clients to try and remove negative or inaccurate information from their credit reports. Their ultimate goal is to help individuals improve their credit scores, which in turn can increase their chances of obtaining loans, mortgages, and other financial opportunities.

Roles and responsibilities of credit repair companies

Credit repair companies play a crucial role in helping individuals navigate the complexities of the credit system. Their responsibilities typically include reviewing the client’s credit report, identifying incorrect or outdated information, and disputing these items with the credit bureaus. They also educate clients on credit management techniques and provide guidance on improving credit scores.

How credit repair companies work

Credit repair companies employ various strategies to assist individuals in repairing their credit. Upon engaging their services, the company will first request the client’s credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. These reports are thoroughly examined to identify any discrepancies or errors that may be negatively affecting the client’s credit score.

Once errors or inaccuracies are identified, the credit repair company will proceed with disputing these items on behalf of the client. This involves submitting formal dispute letters to the credit bureaus, providing supporting documentation if necessary. Throughout the process, the company will closely monitor the progress and keep the client updated on any developments.

Common Problems with Credit Repair Companies

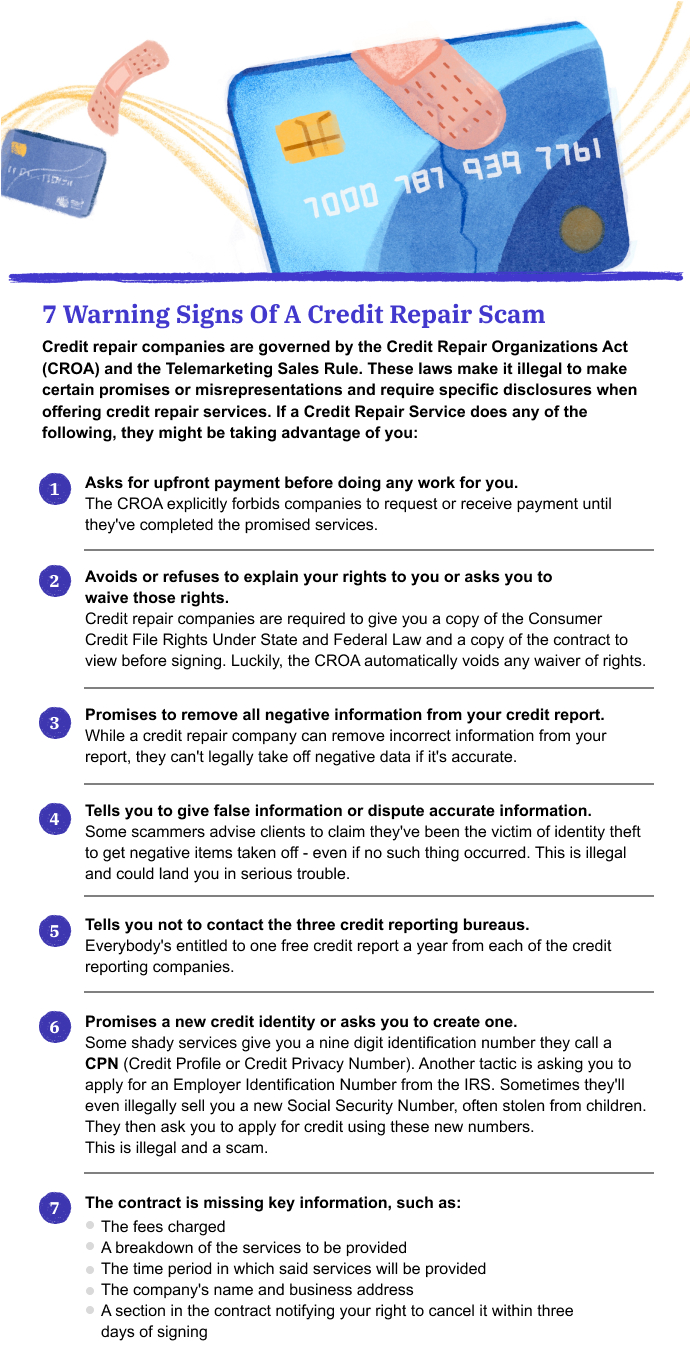

Predatory practices

Unfortunately, not all credit repair companies operate ethically. Some companies engage in predatory practices, taking advantage of individuals who are desperate to improve their credit. These unethical companies may charge exorbitant fees, make false promises, and fail to deliver on their services.

Misleading promises

One of the most common problems associated with credit repair companies is the deceptive promises they make to potential clients. Some companies guarantee unrealistic results, such as the complete removal of accurate negative information from credit reports. It’s important to remember that while credit repair companies can dispute errors or inaccuracies, they cannot remove accurate information from credit reports.

Inefficient service

Another common issue with credit repair companies is the lack of efficiency in their services. Some companies may take months to complete the credit repair process, causing frustration and delaying the improvement of the client’s credit score. This inefficiency can hinder individuals from achieving their financial goals within their desired timeframe.

Signs of a Bad Credit Repair Company

Sky-high fees

One of the red flags to watch out for when evaluating credit repair companies is sky-high fees. Some companies charge exorbitant upfront fees, often without any guarantee of results. It’s important to carefully review the fees and understand what services are included before committing to a credit repair company.

Guarantees to remove accurate information

Any credit repair company that guarantees the removal of accurate negative information from credit reports should be approached with caution. It is simply not possible to remove accurate information. While companies can dispute errors or outdated information, they cannot erase accurate negative remarks from credit reports.

Lack of transparency

Transparency is essential in the credit repair process. A reputable credit repair company should provide clear and concise explanations of their services, fees, and strategies. If a company lacks transparency and fails to answer your questions, it may be a sign that they are not trustworthy.

Risks Associated with Worst Credit Repair Companies

Further financial setbacks

Engaging with the worst credit repair companies can lead to further financial setbacks for individuals. Unethical practices, such as charging excessive fees and making false promises, can worsen an individual’s financial situation rather than improving it. It’s crucial to carefully evaluate credit repair companies to avoid exacerbating existing financial challenges.

Possibility of encountering scams

Worst credit repair companies may also be involved in scams and fraudulent activities. These companies may prey on vulnerable individuals, promising quick fixes to their credit problems while taking advantage of their desperation. Falling victim to such scams can result in financial losses and further damage to credit.

Damage to credit score

Ironically, some of the worst credit repair companies can actually damage a client’s credit score. Inaccurate disputes or improper handling of credit reports can lead to negative repercussions, including additional negative marks on credit reports. It is essential to choose a reputable credit repair company to avoid any unintended harm to creditworthiness.

Top Worst Credit Repair Companies

Company 1 Description and issues

Company 1 is notorious for its predatory practices, charging excessively high fees and pressuring clients into paying upfront before any work is done. Numerous customers have reported feeling deceived and frustrated with the lack of tangible results. Additionally, there have been cases where Company 1 failed to properly handle credit disputes, resulting in further damage to clients’ credit scores.

Company 2 Description and issues

Company 2 has been criticized for its misleading promises and lack of transparency. It has made unrealistic guarantees of removing accurate negative information from credit reports, leading many customers to feel cheated when these promises are not fulfilled. Furthermore, the company has shown a lack of transparency regarding its fee structure and the specific strategies it employs.

Company 3 Description and issues

Company 3 has faced legal actions and complaints due to its inefficiency and poor customer service. Many clients have reported delays in the credit repair process, with some waiting several months without any progress. Additionally, the company’s unresponsive customer support and failure to address client concerns have resulted in widespread dissatisfaction.

Reports and Reviews on Worst Credit Repair Companies

Company 1 client reviews and complaints

Clients of Company 1 have expressed their frustration through negative reviews and complaints. They have highlighted issues such as predatory fees, unresponsive customer support, and failure to deliver on promised results. Many clients regret engaging with Company 1 and caution others to avoid their services.

Company 2 client reviews and complaints

Numerous clients have voiced their disappointment with Company 2 through reviews and complaints. They have shared experiences of misleading promises, lack of transparency, and the company’s failure to remove accurate negative information. These reviews serve as a warning to potential clients considering Company 2’s services.

Company 3 client reviews and complaints

Clients of Company 3 have expressed their dissatisfaction through negative reviews and complaints. Many have complained about the company’s inefficiency, citing excessive delays in the credit repair process and inadequate customer service. These reports highlight the importance of avoiding Company 3 to prevent unnecessary setbacks in credit repair.

Legal Actions Against Worst Credit Repair Companies

Company 1 Legal issues

Company 1 has faced legal actions due to its predatory practices. Regulatory bodies and consumer protection agencies have taken action against the company for charging excessive fees and making false promises. These legal actions aim to protect consumers from falling victim to Company 1’s unethical practices.

Company 2 Legal issues

Legal actions have been taken against Company 2 for deceptive practices and misleading promises. Authorities have intervened to address the company’s false claims of removing accurate negative information from credit reports. These legal actions seek to hold Company 2 accountable for its misleading marketing tactics.

Company 3 Legal issues

Company 3 has faced legal challenges due to its inefficiency and poor customer service. Clients who have experienced significant delays in the credit repair process have sought legal remedy against the company. These legal actions aim to address the company’s disregard for client concerns and its failure to deliver timely and satisfactory services.

Ways to Avoid Worst Credit Repair Companies

Be wary of unrealistic promises

To avoid the worst credit repair companies, it is essential to be skeptical of any promises that seem too good to be true. Companies that guarantee the removal of accurate negative information or claim to magically transform credit scores are likely engaging in deceptive practices. Choose a reputable company that provides realistic expectations and focuses on legitimate credit repair strategies.

Understand your rights

Educating yourself on your rights as a consumer is crucial in navigating the credit repair industry. Understanding the laws governing credit repair and the obligations of credit repair companies can help you identify any potential violations. This knowledge will empower you to make informed decisions and protect yourself from fraudulent or unethical practices.

Investigate company’s reputation

Before engaging with a credit repair company, conduct thorough research into its reputation and track record. Look for customer reviews, ratings, and any complaints filed against the company. This research will provide insights into the experiences of past clients and help you gauge the company’s reliability and credibility.

Alternatives to Credit Repair Companies

DIY Credit Repair

One alternative to credit repair companies is the do-it-yourself (DIY) approach. By directly engaging with the credit bureaus and creditors, individuals can dispute errors or inaccuracies on their credit reports themselves. DIY credit repair requires time, effort, and knowledge of the relevant laws and regulations. However, it can be a cost-effective solution for those who are willing to invest the necessary resources.

Non-profit credit counseling agencies

Non-profit credit counseling agencies provide guidance and support to individuals seeking to improve their credit. These organizations offer free or low-cost services, including credit counseling, debt management plans, and financial education. Working with a reputable non-profit credit counseling agency can provide individuals with the tools and knowledge needed to regain control of their financial health.

Bankruptcy

In situations where individuals are overwhelmed by unmanageable debt and have no viable alternative, bankruptcy may be an option to consider. Bankruptcy can provide a fresh start by eliminating or reorganizing debts. However, it should only be considered as a last resort, as it has significant long-term consequences and should be approached with careful consideration and guidance from a qualified bankruptcy attorney.

Conclusion

Takeaway points

Understanding credit repair companies is essential for anyone seeking to improve their credit. While many credit repair companies operate ethically and provide valuable services, it is crucial to be aware of the common problems associated with the industry. Predatory practices, misleading promises, and inefficient service can hinder the credit repair process and potentially worsen an individual’s financial situation.

Practical advice for consumers

To avoid falling victim to the worst credit repair companies, consumers should be cautious of sky-high fees, unrealistic promises, and a lack of transparency. Conducting thorough research, seeking reputable alternatives, and self-educating about credit repair rights and regulations can empower individuals to make informed decisions and protect themselves from fraudulent practices.

Encouragement for self-education and awareness

Ultimately, credit repair is a journey that demands personal involvement and awareness. Empowering yourself with knowledge about credit repair, consumer rights, and alternatives is key to navigating the credit repair industry successfully. While there are reputable credit repair companies, understanding the associated risks, exploring alternatives, and taking proactive steps towards self-education will help individuals make informed decisions and secure a healthier financial future.