In this article, you will learn about the potential impact of using credit repair services on your credit score. We’ll discuss whether or not using these services can have a negative effect on your overall creditworthiness and what you should consider before deciding to use a credit repair service.

When it comes to using credit repair services, it’s important to understand that there is no one-size-fits-all answer. While using a reputable credit repair service may help you address errors or inaccuracies on your credit report, the impact on your credit score can vary. It’s essential to keep in mind that credit repair is not a magic solution, and it won’t instantly fix all your credit issues. Before using a credit repair service, it’s crucial to carefully consider their fees, guarantees, and the potential impact on your credit score.

What are credit repair services?

The definition and purpose of credit repair services

Credit repair services are companies or organizations that offer assistance in improving an individual’s credit score. Their primary goal is to help individuals remove negative items from their credit report, such as late payments, collections, or bankruptcies, that may be impacting their creditworthiness. These services aim to address and rectify any errors or inaccuracies that may exist on a person’s credit report, thereby potentially improving their credit score.

How credit repair services work

Credit repair services work by analyzing an individual’s credit report and identifying any negative or erroneous information. Once these items are identified, the credit repair company will then take action to dispute and remove them from the person’s credit report. This process typically involves communication with the credit bureaus and the various creditors associated with the negative items.

The potential negative impact on credit score

Factors that can negatively affect credit score when using credit repair services

Although credit repair services have the intention of improving a person’s credit score, there are potential negative factors that individuals should be aware of. One factor is the possibility of receiving a lower credit score temporarily during the credit repair process. This may occur due to the removal of previously reported positive items that the credit repair company identifies as inaccurate or questionable. As a result, the credit score may decrease until the disputed items are resolved.

Another potential negative impact on credit score is the length of time it takes to complete the credit repair process. While credit repair companies aim to expedite the process, it can still take several months to see improvements in credit score. During this time, individuals may experience challenges in obtaining new credit or loans due to their lower credit score.

Why some people experience a decrease in credit score after using credit repair services

In some cases, individuals may experience a decrease in their credit score after using credit repair services due to the way the credit bureaus interpret credit repair efforts. Despite the intention of improving creditworthiness, credit bureaus may view excessive disputes by credit repair companies as potential indicators of fraudulent activity or simply as an attempt to manipulate the credit reporting system. This cautiousness on the part of the credit bureaus can lead to a temporary decline in a person’s credit score.

It is important to note that the impact on credit score will vary based on individual circumstances, the extent of negative items being addressed, and the effectiveness of the credit repair services used.

This image is property of images.ctfassets.net.

The importance of choosing reputable credit repair services

Researching and selecting reliable credit repair services

When considering credit repair services, it is crucial to research and choose a reputable company. Take the time to read reviews, check for certifications or accreditations, and verify the company’s track record with previous clients. Reputable credit repair services will provide transparent information about their process, fees, and success rates.

Avoiding scams and fraudulent services

Unfortunately, the credit repair industry is not immune to scams and fraudulent service providers. It is essential to be cautious and aware of red flags when selecting a credit repair company. Avoid companies that make unrealistic promises, request upfront payments before any services are performed, or engage in unethical practices. Legitimate credit repair services will abide by regulations and offer clear and honest communication.

The role of credit bureaus in credit repair services

How credit bureaus handle credit repair requests

Credit bureaus play a significant role in the credit repair process. When a credit repair company disputes negative items on behalf of an individual, the credit bureaus are responsible for investigating these claims. The bureaus have a legal obligation to investigate the accuracy and legitimacy of any disputed items within a specific timeframe.

During the investigation, the credit bureaus will contact the creditors associated with the disputed items and request validation or verification of the reported information. If the creditors fail to respond or cannot provide sufficient evidence to support their claims, the credit bureaus will remove the negative items from the individual’s credit report.

The impact of credit bureau investigations on credit score

While credit bureau investigations are crucial for the credit repair process, they may have a temporary negative impact on credit score. During the investigation period, the disputed items remain on the credit report as “under investigation.” These items can still contribute to a lower credit score during this time. However, once the investigation is complete, and if the disputed items are successfully removed, the individual’s credit score has the potential to improve.

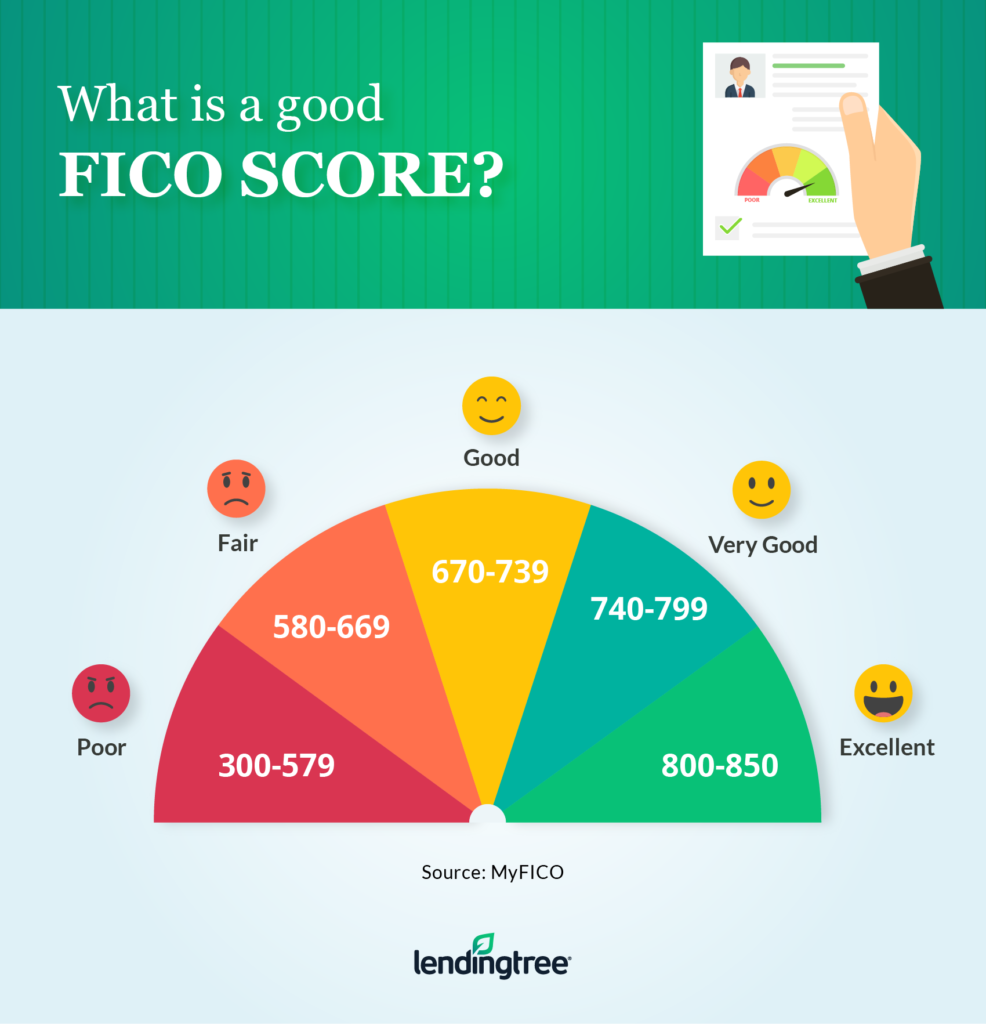

This image is property of www.lendingtree.com.

Alternative options to credit repair services

Self-help credit repair strategies

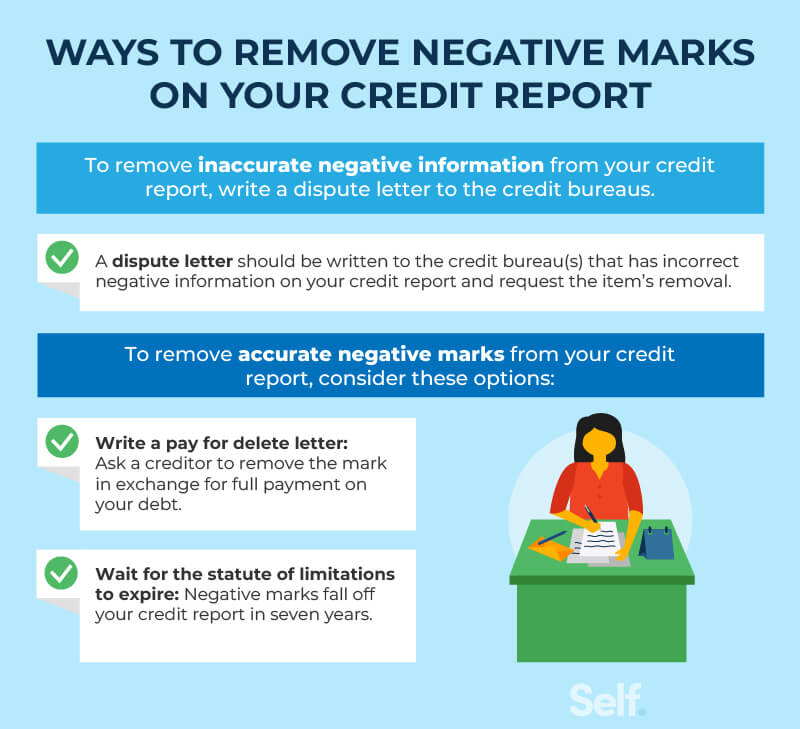

For individuals who prefer not to use credit repair services or are unable to afford them, there are self-help credit repair strategies available. These strategies include reviewing and monitoring your credit report, disputing any errors or inaccuracies directly with the credit bureaus, and maintaining good financial habits over time to improve creditworthiness.

Seeking financial counseling or coaching

Another alternative to credit repair services is seeking financial counseling or coaching. These services can provide guidance on budgeting, debt management, and credit improvement strategies. A financial counselor or coach can help individuals develop a personalized plan to address their financial situation and improve their credit score.

Understanding the credit repair process

Steps involved in the credit repair process

The credit repair process typically involves several steps. First, an individual must request their credit reports from the major credit bureaus – Equifax, Experian, and TransUnion. Once the reports are obtained, they should be carefully reviewed to identify any errors or inaccuracies.

Next, the individual must gather documentation or evidence to support their disputes. This can include payment receipts, letters of explanation, or any other relevant documentation. The credit repair company or the individual themselves will then initiate the dispute process by contacting the credit bureaus and the creditors associated with the disputed items.

The credit bureaus will initiate investigations into the disputed items and reach out to the creditors for verification or validation. If the creditors fail to provide sufficient evidence or respond within the required timeframe, the credit bureaus will remove the negative items from the individual’s credit report.

Timeframe for seeing improvements in credit score

The timeframe for seeing improvements in credit score after using credit repair services can vary. While credit repair companies aim to expedite the process, it typically takes several months to a year to see significant improvements in credit score. This is because the credit bureaus and creditors have specific timeframes to respond to disputes and complete investigations.

It is important for individuals to have realistic expectations and understand that credit repair is not an instant fix. Consistency, patience, and continued efforts in maintaining good financial habits are essential for long-term credit score improvements.

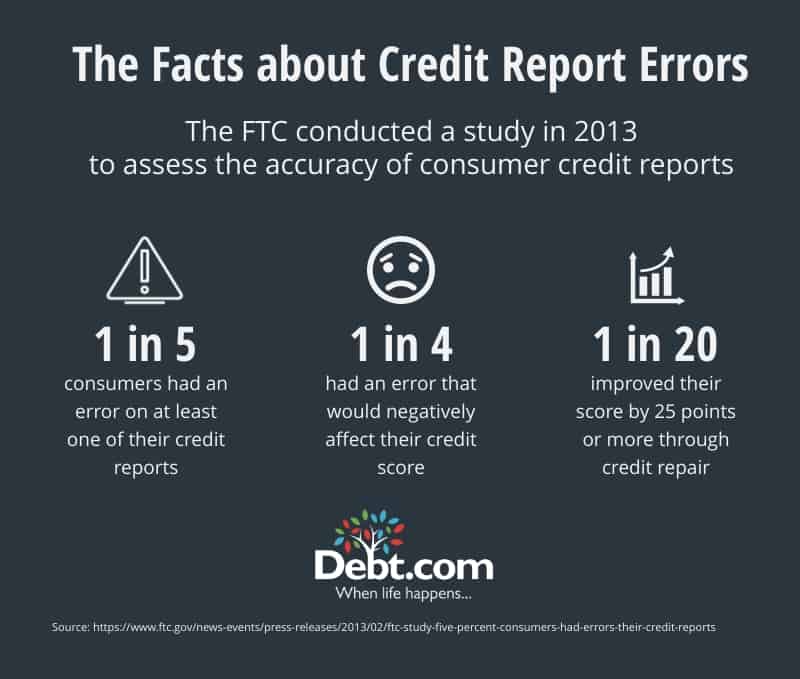

This image is property of www.debt.com.

The potential benefits of using credit repair services

Improving creditworthiness for future financial opportunities

One of the potential benefits of using credit repair services is the improvement of an individual’s creditworthiness. A higher credit score can open doors to better financial opportunities, such as obtaining favorable interest rates on loans, qualifying for credit cards with better rewards, or even securing a mortgage for a home purchase. By addressing and resolving negative items on their credit report, individuals may enhance their chances of being approved for future credit or financial endeavors.

Increased chances of getting approved for loans or credit

Another benefit of using credit repair services is the increased likelihood of getting approved for loans or credit. A higher credit score is often viewed favorably by lenders and can result in more favorable loan terms and interest rates. By addressing and removing negative items from their credit report, individuals are demonstrating their commitment to improving their creditworthiness, which can increase their chances of loan or credit approval.

The importance of monitoring credit score during credit repair

Tracking and evaluating changes in credit score

During the credit repair process, it is crucial to monitor and track changes in your credit score. Regularly reviewing your credit report and credit score allows you to assess the effectiveness of the credit repair efforts and identify any potential errors or inaccuracies that may exist. Monitoring your credit score also enables you to stay informed of any changes or improvements in your creditworthiness.

Maintaining good financial habits to prevent further credit score decline

While credit repair services can assist in improving your credit score, it is equally important to maintain good financial habits to prevent any further decline. Timely payments, responsible credit utilization, and avoiding excessive debt are all key factors in maintaining a healthy credit score. By establishing and maintaining these good financial habits, individuals can prevent the need for future credit repair services and ensure long-term financial stability.

This image is property of images.ctfassets.net.

Considering the cost of credit repair services

Understanding the fees associated with credit repair services

Credit repair services are not free, and it is essential to understand the fees associated with these services. The cost of credit repair can vary depending on the extent of negative items being addressed and the complexity of the individual’s financial situation. Some credit repair companies charge a monthly fee, while others may charge a flat fee for their services. Before committing to any credit repair service, individuals should carefully review and understand the associated fees.

Weighing the potential benefits against the financial investment

When considering whether to use credit repair services, it is crucial to weigh the potential benefits against the financial investment. Assess the potential impact on your credit score, the savings or benefits that may result from an improved credit score, and the cost of the credit repair services. This evaluation allows individuals to make an informed decision and determine if the potential benefits outweigh the financial commitment.

Conclusion

In conclusion, using credit repair services can have both positive and negative impacts on your credit score. While credit repair services aim to improve your creditworthiness by addressing and removing negative items from your credit report, there is a possibility of a temporary decrease in your credit score during the process. It is essential to choose reputable credit repair services, understand the credit repair process, and monitor your credit score throughout the journey.

Alternatives to credit repair services, such as self-help strategies or financial counseling, should also be considered. Ultimately, taking an informed and proactive approach to credit repair can lead to long-term improvements in credit score and overall financial health.

This image is property of img.money.com.