In this article, we will discuss the various factors that can impact your credit score and provide some tips on how to improve it. Understanding these factors is crucial as your credit score plays a significant role in your financial health. By the end of this article, you will have a better understanding of what actions you can take to boost your credit score.

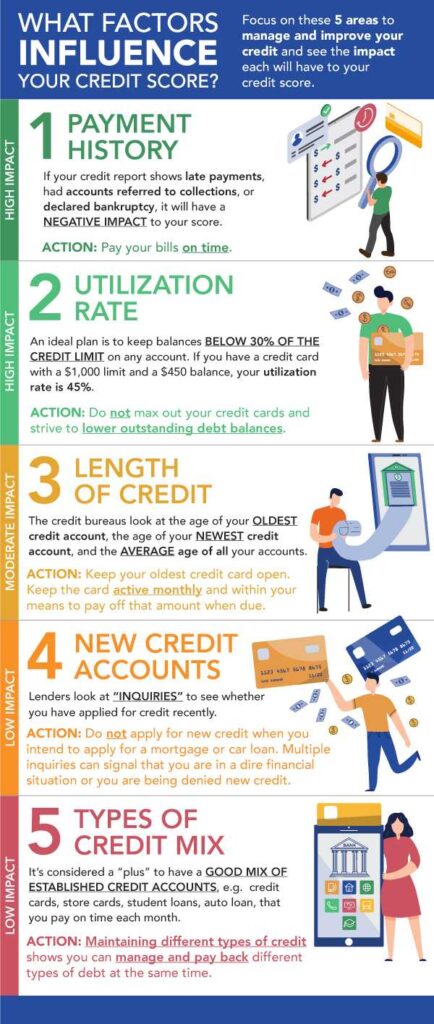

There are several factors that can influence your credit score, including your payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Your payment history is one of the most important factors, as it reflects whether you have paid your bills on time. Another crucial factor is your credit utilization, which is the amount of credit you are using compared to your total credit limit. To improve your credit score, it is essential to make timely payments and keep your credit utilization low. Additionally, maintaining a longer credit history, diversifying your credit mix, and avoiding too many new credit inquiries can also positively impact your credit score.

Understanding Credit Scores

What is a credit score?

A credit score is a numerical representation of your creditworthiness. It is a three-digit number generated by credit bureaus, such as Equifax, Experian, and TransUnion, based on the information in your credit report. Your credit score is used by lenders, landlords, and even potential employers to assess your financial responsibility and trustworthiness.

Why is a credit score important?

Your credit score plays a crucial role in many aspects of your financial life. Lenders use it to determine whether to approve your loan or credit card application, landlords use it to assess your rental application, and employers may consider it during the hiring process. A higher credit score generally indicates that you are a low-risk borrower, making it easier to access credit and secure better terms and interest rates.

How are credit scores calculated?

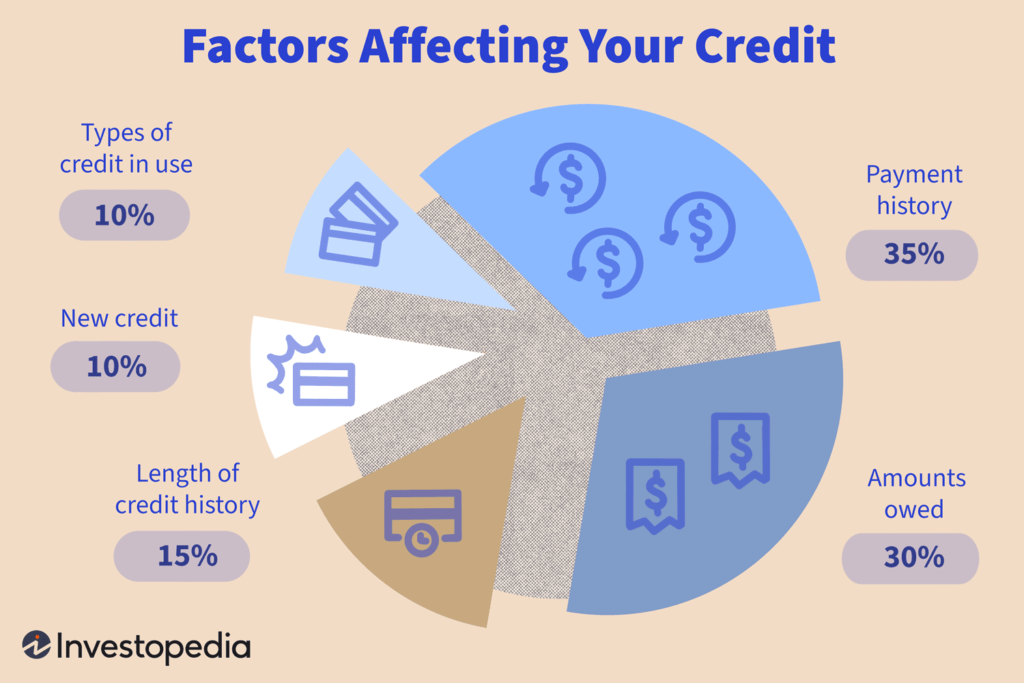

Credit scores are typically calculated using a formula called a credit scoring model. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. The factors that contribute to your credit score include payment history, credit utilization, length of credit history, types of credit used, and credit inquiries.

Factors Affecting Credit Scores

Payment history

Your payment history is one of the most significant factors influencing your credit score. It reflects your track record for making payments on time. Late or missed payments can significantly lower your credit score, while a history of on-time payments can boost it.

Credit utilization

Credit utilization is the percentage of your available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit limits. As a general rule, it is advisable to keep your credit utilization below 30%. A higher credit utilization ratio can indicate that you are relying too heavily on credit, which may negatively impact your credit score.

Length of credit history

The length of your credit history also affects your credit score. A longer credit history demonstrates your ability to manage credit responsibly over time. If you are new to credit, it may take some time to establish a strong credit history. However, it is important to note that closing old credit accounts can shorten your credit history, which may have a negative impact on your credit score.

Types of credit used

Having a mix of credit types can positively impact your credit score. Lenders like to see that you can manage different types of credit, such as credit cards, loans, and mortgages. However, it is essential to only take on credit that you can comfortably handle and avoid applying for credit unnecessarily.

Credit inquiries

When you apply for new credit, such as a loan or credit card, the lender will typically request a copy of your credit report. This is known as a credit inquiry. While a few inquiries may have a minimal impact on your credit score, multiple inquiries within a short period can signal to lenders that you are actively seeking credit, which may lower your score.

This image is property of www.investopedia.com.

Impact of Factors on Credit Scores

How payment history affects credit scores

Your payment history has the most significant impact on your credit score. Making payments on time consistently can help build a positive credit history and boost your credit score. On the other hand, late or missed payments can have a detrimental effect on your credit score, as they demonstrate a lack of responsibility and reliability in managing credit.

The role of credit utilization in credit scores

Credit utilization, also known as the credit utilization ratio, compares your outstanding credit card balances to your credit limits. It is one of the factors that heavily influence your credit score. High credit utilization can suggest that you are relying too heavily on credit, which may indicate financial instability and result in a lower credit score. Keeping your credit utilization below 30% is generally recommended for maintaining a healthy credit score.

Importance of length of credit history

The length of your credit history is an important consideration for lenders when assessing your creditworthiness. A longer credit history demonstrates your ability to manage credit responsibly over time. It allows lenders to assess your payment patterns and stability. If you are new to credit, it may take some time to build a strong credit history. However, it is important to avoid closing old credit accounts, as this can shorten your credit history and potentially lower your credit score.

How types of credit used affect credit scores

Having a diverse mix of credit types can positively impact your credit score. Lenders like to see that you can manage different types of credit, such as credit cards, loans, and mortgages. However, it is important to exercise caution and only take on credit that you can comfortably handle. Taking on too much credit or applying for credit unnecessarily may negatively affect your credit score.

The impact of credit inquiries on credit scores

When you apply for new credit, such as a loan or credit card, the lender may request a copy of your credit report. This will result in a credit inquiry, which can impact your credit score. While a single credit inquiry may have a minor impact, multiple inquiries within a short period can signal to lenders that you are actively seeking credit. This may indicate financial instability and lead to a lower credit score. It is important to be mindful of unnecessary credit inquiries and only apply for credit when necessary.

Improving Credit Scores

Pay bills on time

Paying bills on time is one of the most effective ways to improve your credit score. Set up reminders or automated payments to ensure that you never miss a payment. Consistent on-time payments can help rebuild a positive credit history and raise your credit score over time.

Reduce credit card balances

Reducing credit card balances can significantly improve your credit score, especially if you have high credit utilization. Aim to pay off your credit card balances in full each month or at least keep them below 30% of your credit limits.

Avoid closing old credit accounts

Closing old credit accounts can shorten your credit history, which may negatively impact your credit score. Unless necessary, try to keep your oldest accounts open to maintain a longer credit history.

Maintain a mix of credit types

Having a mix of credit types, such as credit cards, loans, and mortgages, can demonstrate your ability to manage different types of credit. However, it is important to only take on credit that you can comfortably handle and avoid applying for unnecessary credit.

Minimize credit applications

While it is essential to apply for credit when needed, unnecessary credit applications can negatively impact your credit score. Only apply for credit when necessary and be selective about the types of credit you are seeking.

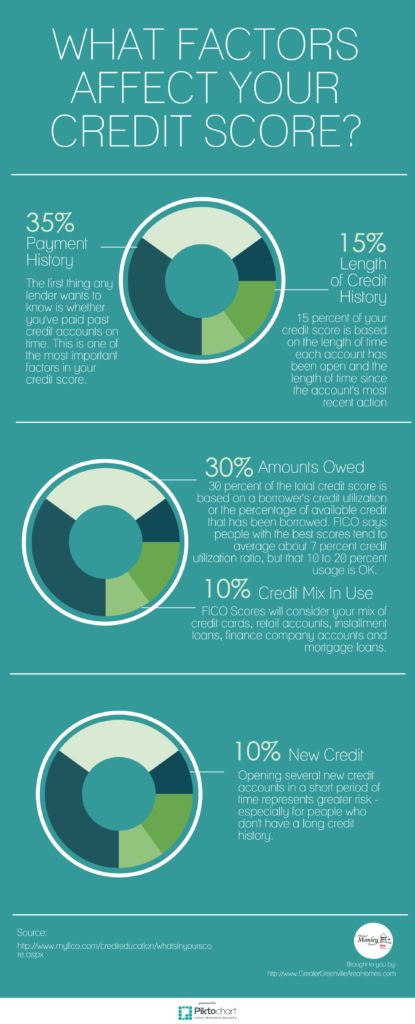

This image is property of bt-wpstatic.freetls.fastly.net.

Actions That Can Harm Credit Scores

Late or missed payments

Late or missed payments can significantly harm your credit score. Always prioritize making payments on time to maintain a positive credit history.

Maxing out credit cards

Using a high percentage of your available credit, also known as maxing out your credit cards, can negatively impact your credit score. Aim to keep your credit utilization below 30% to maintain a healthy credit profile.

Closing old credit accounts

Closing old credit accounts can shorten your credit history, potentially lowering your credit score. Unless absolutely necessary, try to keep your oldest accounts open to maintain a longer credit history.

Applying for multiple credit cards

Applying for multiple credit cards within a short period can signal to lenders that you are actively seeking credit. This may lower your credit score. Be selective in your credit card applications and only apply for cards that you genuinely need.

Credit Score Myths

Closing credit cards improves credit score

Contrary to popular belief, closing credit cards can actually lower your credit score. Closing accounts reduces your available credit, which may increase your credit utilization ratio and negatively impact your credit score. It is generally recommended to keep old credit accounts open, even if you no longer use them.

Checking credit scores decreases score

Checking your own credit score, also known as a soft inquiry, does not impact your credit score. It is considered a responsible financial behavior and can even help you monitor your credit health. Only hard inquiries, which occur when you apply for new credit, have the potential to affect your credit score.

Income affects credit score

Your income is not a direct factor in calculating your credit score. Credit scores are based on your credit history and how you have managed credit in the past. However, lenders may consider your income when assessing your overall creditworthiness and ability to repay loans.

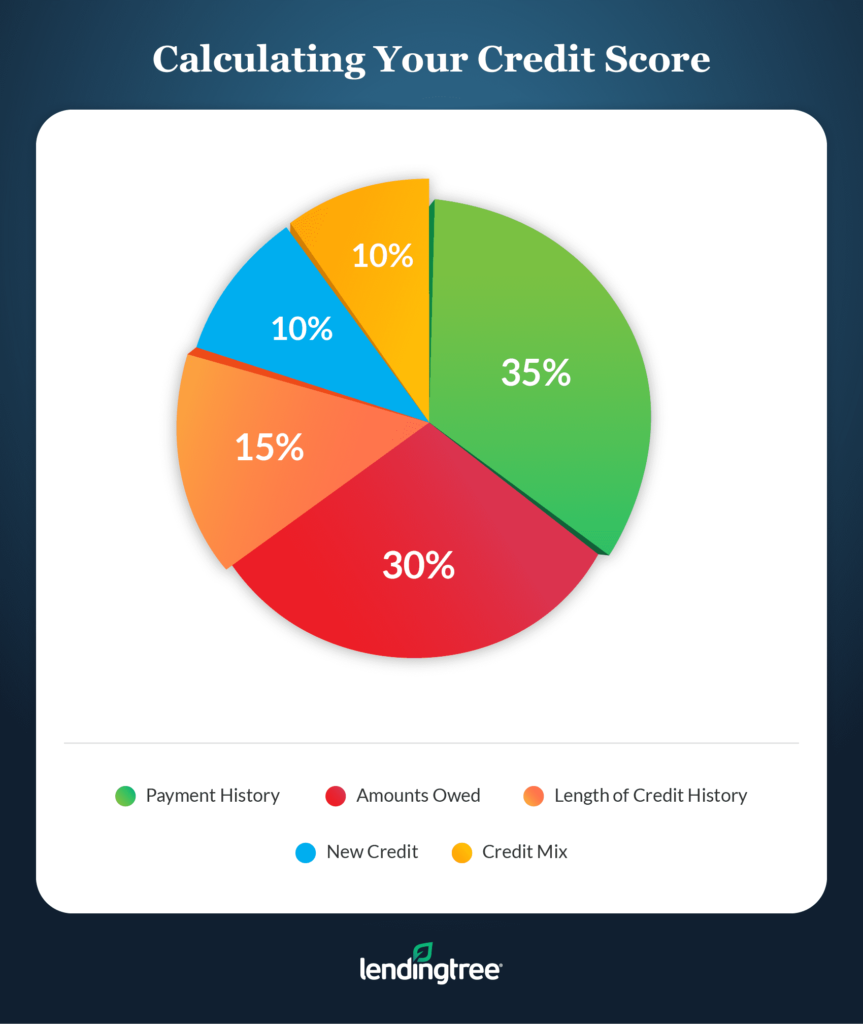

This image is property of www.lendingtree.com.

Monitoring Credit Scores

Importance of checking credit scores regularly

Checking your credit score regularly is essential for monitoring your credit health and identifying potential issues or errors. It allows you to catch any discrepancies and take corrective measures to protect your credit.

How to obtain a free credit report

Under the Fair Credit Reporting Act, you are entitled to a free credit report from each of the three major credit bureaus once a year. You can request your free credit reports from Equifax, Experian, and TransUnion through AnnualCreditReport.com.

Using credit monitoring services

Credit monitoring services are available to help you keep a close eye on your credit. These services alert you to any changes or potential fraudulent activity on your credit report. Monitoring your credit can help you quickly address any issues and protect your credit score.

Rebuilding Credit Scores

Steps to take after a credit setback

If you have experienced a credit setback, such as late payments or collections, there are steps you can take to rebuild your credit score. Focus on making on-time payments, reducing outstanding balances, and addressing any derogatory marks on your credit report. Over time, responsible credit behavior can help improve your credit score.

Building positive credit history

Building positive credit history is crucial for improving your credit score. Make consistent on-time payments, keep credit card balances low, and avoid unnecessary credit inquiries. Over time, these responsible credit habits will help establish a positive credit history and raise your credit score.

Seeking professional assistance

If you find it challenging to navigate the process of rebuilding your credit score, seeking professional assistance may be beneficial. Credit counseling agencies and credit repair companies can provide guidance and support in improving your credit profile. However, it is important to do thorough research and choose reputable and legitimate entities.

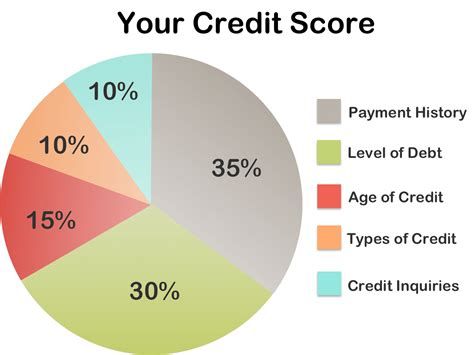

This image is property of dpsnetwork.com.

Relevance of Credit Score

How credit scores impact financial decisions

Credit scores have a significant impact on various financial decisions. Lenders use credit scores to determine the terms and conditions of loans and credit cards. Higher credit scores can result in better interest rates, higher credit limits, and more favorable loan terms. Having a good credit score can also positively influence employment background checks and rental applications.

Loan and credit card approvals

A higher credit score increases your chances of getting approved for loans and credit cards. Lenders view borrowers with higher credit scores as lower risk and more likely to repay debts on time. They may offer you better interest rates and more favorable terms, giving you access to affordable credit.

Interest rates on loans

Your credit score plays a crucial role in determining the interest rates you are offered on loans. A higher credit score could result in lower interest rates, saving you money over the term of the loan. Conversely, a lower credit score may lead to higher interest rates, making borrowing more expensive.

Employment background checks

Certain employers may conduct credit checks as part of their background screening process. While credit checks are more common for jobs in the financial industry or positions involving handling sensitive information, an employer’s decision to consider credit history may vary. It is important to maintain a good credit score to avoid potential negative consequences during employment background checks.

Conclusion

Understanding the factors that affect your credit score is essential for maintaining a healthy credit profile. Payment history, credit utilization, length of credit history, types of credit used, and credit inquiries all play a vital role in calculating your credit score. By focusing on improving these factors, such as making on-time payments, reducing credit card balances, and building a positive credit history, you can actively work towards improving your credit score. Monitoring your credit regularly, avoiding common credit score myths, and seeking professional assistance when needed can also contribute to maintaining a good credit score. By taking steps to improve and maintain a healthy credit score, you are better positioned to access credit, secure favorable terms, and make informed financial decisions.

This image is property of finlocker.com.