So, you’re wondering about the possible impact of filing for bankruptcy on your credit score in Kokomo? Well, let’s delve into that topic and find out what you need to know.

When it comes to filing for bankruptcy, it’s important to understand that it can have significant consequences on your credit score. You see, bankruptcy is a major red flag for lenders and creditors, and it can stay on your credit report for up to seven or ten years, depending on the type of bankruptcy you file. During that time, your credit score is likely to take a hit, making it more challenging for you to obtain credit or loans. It’s worth noting that the exact impact on your credit score can vary depending on various factors, such as your previous credit history, the amount of debt discharged in bankruptcy, and your overall financial situation. Therefore, it’s crucial to consult with a financial advisor or a bankruptcy attorney in Kokomo to fully understand how filing for bankruptcy might affect your credit score specifically.

This image is property of images.ctfassets.net.

Effects of Filing for Bankruptcy on Credit Score

Understanding the Impact of Bankruptcy on Credit Score

Filing for bankruptcy can have significant consequences on an individual’s credit score. It is important to understand the impact it can have in order to make informed financial decisions. Bankruptcy is a legal process that helps individuals or businesses who are unable to repay their debts by providing them with the opportunity for a fresh start. However, this fresh start comes at a cost, particularly when it comes to one’s credit score.

Factors Influencing Credit Score After Bankruptcy in Kokomo

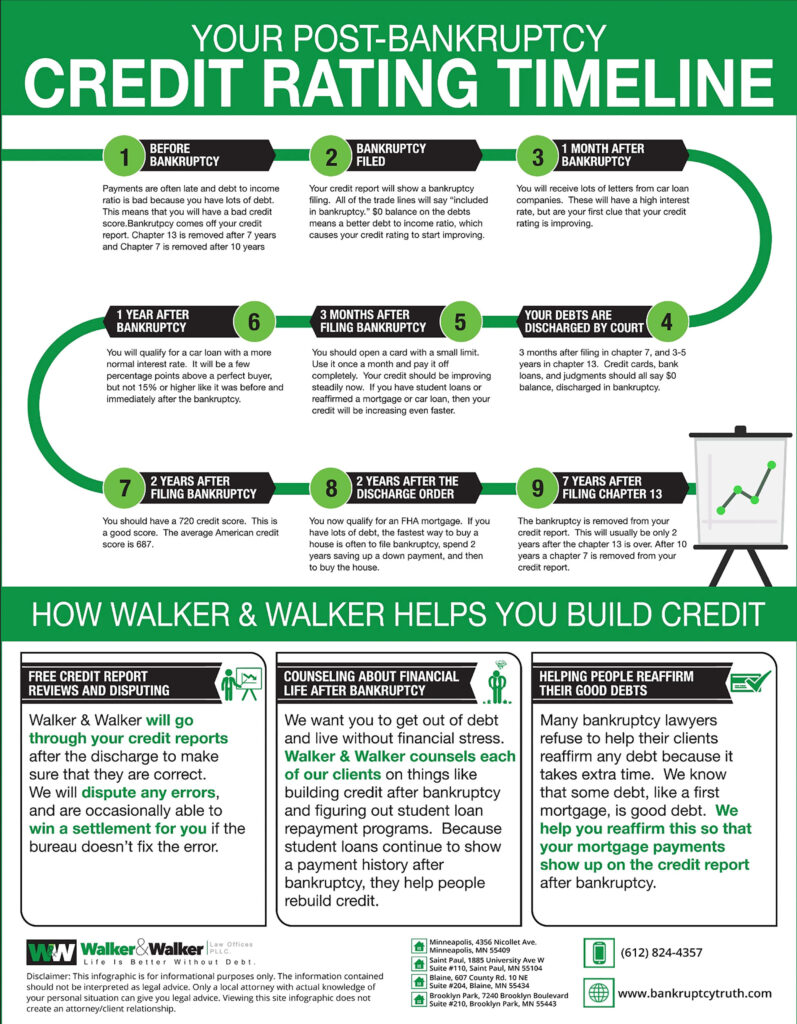

After filing for bankruptcy in Kokomo, several factors can influence an individual’s credit score. One of the most immediate and noticeable consequences is the drop in credit score. This drop can be significant and may take some time to recover from. Additionally, access to credit becomes limited, making it more challenging to qualify for loans and credit cards. The bankruptcy filing becomes a red flag for lenders, as it indicates a higher risk borrower.

How Bankruptcy Appears on a Credit Report

Bankruptcy has a significant impact on how it appears on a credit report. In Kokomo, bankruptcy filing can be reported as a Chapter 7 or Chapter 13 bankruptcy. A Chapter 7 bankruptcy stays on a credit report for ten years, while a Chapter 13 bankruptcy remains for seven years. These listings can be detrimental to an individual’s creditworthiness and financial standing. Lenders typically view bankruptcies as a sign of financial instability and may be hesitant to extend credit.

Short-Term Consequences

Immediate Drop in Credit Score

Once a bankruptcy filing is made, there is an immediate drop in an individual’s credit score. This drop can be significant, depending on the person’s financial standing prior to filing. It may take time and effort to rebuild the credit score to pre-bankruptcy levels.

Limited Access to Credit

Following bankruptcy, access to credit becomes limited. Many lenders are hesitant to extend credit to individuals who have recently filed for bankruptcy due to the perceived higher risk. This limited access to credit can make it more difficult to secure loans and credit cards, hindering financial flexibility.

Difficulty Qualifying for Loans and Credit Cards

Qualifying for loans and credit cards can become a challenge after filing for bankruptcy. Lenders may view a bankruptcy filing as a red flag, making it difficult for individuals to meet the eligibility criteria for various financial products. This can have long-term implications, as it may take several years to reestablish creditworthiness and regain the trust of lenders.

Long-Term Consequences

Duration of Bankruptcy Listing on Credit Report

One of the long-term consequences of filing for bankruptcy is the duration it stays on a credit report. As previously mentioned, Chapter 7 bankruptcies can stay on a credit report for ten years, while Chapter 13 bankruptcies remain for seven years. During this time, the bankruptcy listing acts as a constant reminder to potential lenders and can impact creditworthiness.

Challenges in Rebuilding Credit

Rebuilding credit after bankruptcy can be a challenging task. The immediate drop in credit score and limited access to credit make it difficult to demonstrate financial responsibility and rebuild trust with lenders. It requires disciplined financial management, timely payment of bills, and a pattern of responsible borrowing to gradually improve creditworthiness.

Higher Interest Rates on Future Credit

Another long-term consequence of bankruptcy is the likelihood of being offered higher interest rates on credit products. Lenders often view individuals who have filed for bankruptcy as higher-risk borrowers. To compensate for this perceived risk, they may require higher interest rates on loans and credit cards. This can lead to increased costs and financial burdens for individuals seeking credit opportunities.

Employment and Housing Implications

Impact on Job Applications

Bankruptcy filings can have implications beyond the financial realm. When applying for a job, some employers may conduct credit checks as part of their hiring process. A bankruptcy filing on one’s credit report may raise concerns for employers, indicating potential financial irresponsibility. This can negatively impact an individual’s chances of securing employment, particularly in positions that involve handling finances or sensitive information.

Potential Discrimination by Employers

While it is illegal for employers to discriminate solely based on bankruptcy filings, it may still influence their decision-making process. Employers may perceive individuals who have filed for bankruptcy as less trustworthy or financially responsible. This bias can result in missed employment opportunities and hinder career advancement.

Obstacles in Renting or Purchasing a Home

Bankruptcy can also create obstacles when it comes to renting or purchasing a home. Landlords and mortgage lenders may view individuals with a bankruptcy history as high-risk tenants or borrowers. They may require larger security deposits, higher interest rates, or even reject rental or purchase applications altogether. This can make finding suitable housing more challenging and potentially lead to financial strain.

This image is property of www.lexingtonlaw.com.

Alternatives to Bankruptcy

Debt Consolidation

Before considering bankruptcy, individuals in Kokomo can explore alternatives such as debt consolidation. Debt consolidation involves combining multiple debts into a single loan. This can simplify repayment and potentially lower interest rates, making it easier to manage financial obligations.

Debt Settlement

Another alternative is debt settlement, which involves negotiating with creditors to reduce the overall debt amount. This option can help individuals avoid bankruptcy by reaching an agreement that is mutually beneficial for both parties involved.

Credit Counseling

Credit counseling is a valuable resource for individuals facing financial difficulties. Credit counselors provide guidance, education, and support to help individuals regain control of their finances. They can help create personalized debt management plans, negotiate with creditors, and offer financial education.

Bankruptcy Exemptions in Kokomo

Understanding Personal and Asset Exemptions

Bankruptcy exemptions in Kokomo allow individuals to protect certain assets from being seized or sold during the bankruptcy process. These exemptions vary by state and can include items such as a primary residence, personal belongings, retirement accounts, and more. Understanding the available exemptions is crucial when considering bankruptcy.

Types of Property Exempt from Bankruptcy

In Kokomo, certain types of properties are exempt from bankruptcy proceedings. These exemptions typically include a primary residence, a certain amount of equity in a vehicle, household goods, tools of trade, and qualified retirement accounts. Exempt property is protected from being sold to repay debts, providing individuals with a sense of security during the bankruptcy process.

Impact of Exemptions on Creditors

Bankruptcy exemptions can have an impact on creditors during the bankruptcy process. Exemptions determine which assets creditors can access to repay debts. If a significant portion of an individual’s assets is exempt, it may limit the amount that can be recovered by creditors. This can influence their decision to pursue bankruptcy cases and affect the overall outcome.

This image is property of www.bankruptcytruth.com.

Rebuilding Credit After Bankruptcy

Importance of Timely Payments

One of the most effective ways to rebuild credit after bankruptcy is by making timely payments. Timely payments demonstrate financial responsibility and a commitment to repaying debts. It is crucial to prioritize making payments on time, especially for any new credit accounts or existing debts that were not discharged in bankruptcy.

Securing Secured Credit Cards

Secured credit cards can be instrumental in rebuilding credit after bankruptcy. These cards require a cash deposit as collateral, reducing the risk for lenders. By using a secured credit card responsibly and making timely payments, individuals can gradually improve their creditworthiness over time.

Building a Positive Payment History

Building a positive payment history is essential for improving credit after bankruptcy. By paying bills on time, including utilities, rent, and other recurring expenses, individuals can showcase their financial responsibility and establish a track record of on-time payments. This can help boost credit scores and open doors to more favorable credit opportunities.

Credit Counseling Services in Kokomo

Resources for Credit Counseling

In Kokomo, individuals have access to various resources for credit counseling. Local nonprofits, financial institutions, and counseling agencies offer services to help individuals better understand their financial situations and develop strategies for managing debt. These resources provide valuable support and guidance during challenging times.

Benefits of Professional Guidance

Seeking professional guidance from credit counselors can offer numerous benefits. Credit counselors can assess an individual’s financial situation, provide personalized advice, and create customized debt management plans. They can also negotiate with creditors on behalf of the individual, aiming to reduce interest rates or monthly payments.

Debt Management Strategies

Credit counseling services in Kokomo also offer debt management strategies. These strategies may include budgeting techniques, debt consolidation options, negotiation with creditors, and advice on improving financial habits. Debt management plans can help individuals regain control over their finances and work towards long-term financial stability.

This image is property of www.debt.com.

Educating Yourself on Bankruptcy

Seeking Legal Advice

When considering bankruptcy, it is crucial to seek legal advice. Bankruptcy laws can be complex and vary from state to state. A bankruptcy attorney can provide insight into the specific rules and regulations in Kokomo, ensuring individuals make informed decisions regarding bankruptcy.

Researching Bankruptcy Laws in Kokomo

Researching bankruptcy laws in Kokomo is an important step in understanding the process and its implications. Understanding the different chapters of bankruptcy and the requirements involved can help individuals navigate the process more effectively. The more knowledge one possesses, the better equipped they are to make informed decisions.

Understanding the Different Types of Bankruptcy

There are different types of bankruptcy, including Chapter 7 and Chapter 13. Understanding the differences between these chapters is essential when considering bankruptcy. Each chapter has specific requirements, eligibility criteria, and implications, which individuals need to comprehend before proceeding with the bankruptcy process.

Final Thoughts

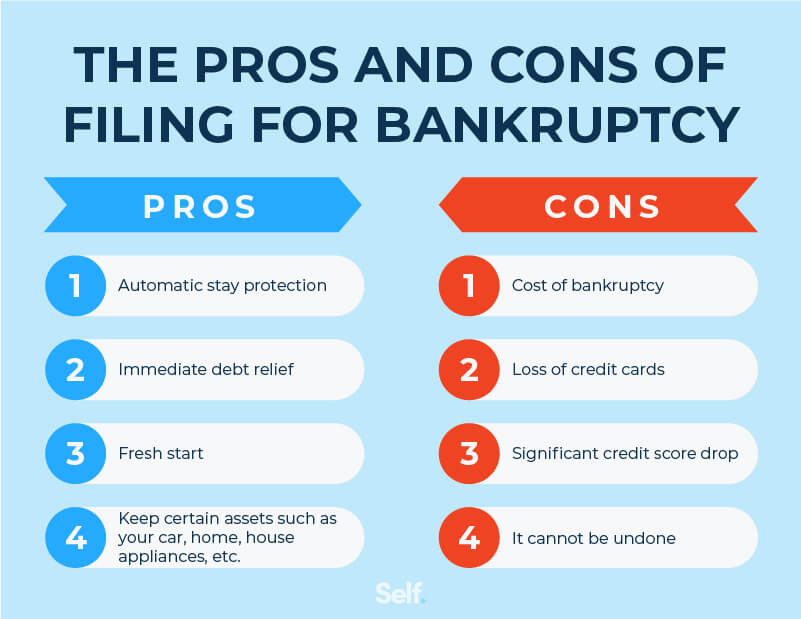

Weighing the Pros and Cons

Deciding whether to file for bankruptcy is a significant decision that requires careful consideration. It is important to weigh the pros and cons, considering the immediate and long-term consequences on credit score, employment prospects, housing opportunities, and financial well-being.

Considering Personal Financial Goals

When evaluating bankruptcy as an option, individuals must also consider their personal financial goals. Analyzing short-term and long-term objectives, such as homeownership, career aspirations, and savings goals, can help individuals determine the most suitable path to take.

Determining the Right Path

Ultimately, the decision to file for bankruptcy or pursue alternatives depends on an individual’s specific circumstances. It is essential to seek professional advice, educate oneself, and carefully evaluate all available options before making a decision. By doing so, individuals can make informed choices that align with their financial goals and pave the way for a brighter financial future.

This image is property of www.indybankruptcylaw.com.