Have you ever dreamed of financial stability but felt held back by a poor credit score? Look no further. “Unlocking Financial Potential: Credit repair merchant services” is here to provide you with the key to improving your credit and unlocking a world of financial opportunities. Whether you’ve faced past financial hardships or simply want to enhance your credit standing, these merchant services offer tailored solutions to help repair, rebuild, and establish a solid credit foundation. With their expertise and guidance, you can chart a course towards financial success and unlock the potential for a brighter future.

Understanding Credit Repair Merchant Services

Defining credit repair merchant services

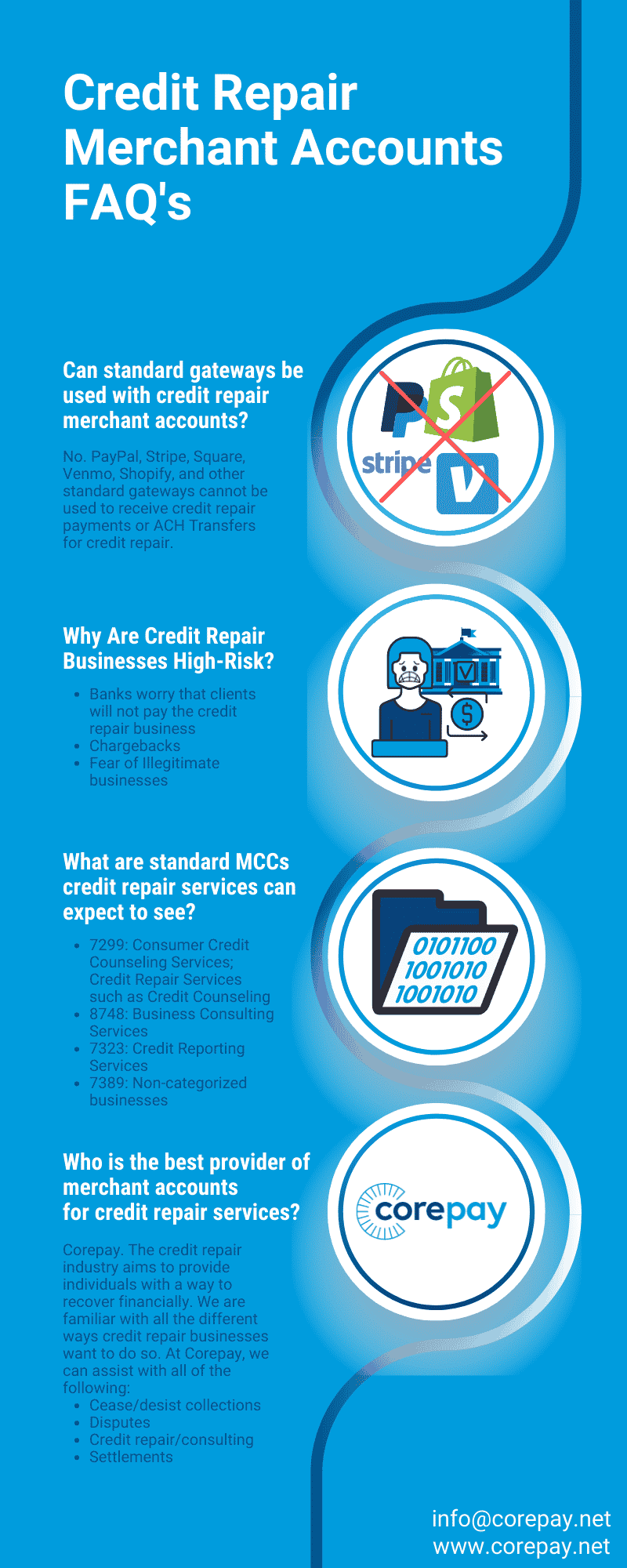

Credit repair merchant services refer to the specialized services provided by companies that help individuals and businesses improve their credit score and repair their credit history. These services involve analyzing credit reports, identifying negative items, and disputing erroneous entries with credit bureaus. Credit repair merchant services aim to enhance creditworthiness, increase chances of loan approvals, and potentially lower interest rates.

The role of credit repair merchant services in the finance industry

Credit repair merchant services play a crucial role in the finance industry. They act as intermediaries between individuals or businesses with poor credit scores and credit bureaus. By utilizing their expertise and knowledge of credit reporting laws, credit repair merchant services assist clients in navigating the complex credit repair process. They help clients understand their credit reports, identify inaccuracies, and take necessary steps to correct them. These services ensure fairness and accuracy in credit reporting, ultimately benefiting both individuals and the lending industry.

The Importance of Credit Repair Merchant Services

How credit repair merchant services assist businesses

Credit repair merchant services offer essential assistance to businesses facing credit challenges. When a business has a poor credit score, it may encounter difficulties in obtaining loans, securing favorable terms on credit lines, or attracting potential partners or investors. Credit repair merchant services help businesses by reviewing their credit reports, identifying negative items impacting their score, and developing customized dispute processes to address these issues. By improving the creditworthiness of a business, these services enhance its reputation, credibility, and financial ability to achieve growth and success.

The impact on personal and business finances

Credit repair merchant services have a significant impact on both personal and business finances. For individuals, a poor credit score can restrict access to loans, increase borrowing costs, limit housing options, and even impact job prospects. By improving credit scores, credit repair merchant services provide individuals with increased financial opportunities, improved eligibility for loans and credit cards, and potentially lower interest rates. Similarly, businesses benefit from enhanced creditworthiness, which opens doors to more favorable financing options, lower interest rates, and increased trust from suppliers, vendors, and customers. Ultimately, credit repair merchant services empower individuals and businesses to achieve their financial goals.

The Process of Credit Repair through Merchant Services

Analyzing the client’s credit reports

The first step in the credit repair process is to analyze the client’s credit reports thoroughly. Credit repair merchant services obtain credit reports from major credit bureaus and meticulously review them for errors, inaccuracies, and negative items that may be lowering the client’s credit score. They examine the details of the reports, including payment history, outstanding debts, credit utilization, and any derogatory remarks or public records. This analysis forms the foundation for developing a personalized credit repair strategy.

Identifying negative items on the credit reports

Once credit repair merchant services have analyzed the credit reports, they identify negative items that are adversely impacting the client’s credit score. These negative items may include late payments, charge-offs, collections, bankruptcies, or other derogatory remarks. By identifying these items, credit repair merchant services can focus their efforts on disputing them with the credit bureaus and creditors. This step is crucial for removing inaccuracies and unfair reporting, which can significantly improve the client’s credit score.

Disputing erroneous entries with credit bureaus

One of the key responsibilities of credit repair merchant services is to dispute erroneous entries with credit bureaus. Using their expertise in credit reporting laws and regulations, these services initiate disputes on behalf of the client to challenge inaccurate or unfair information on their credit reports. The credit repair merchant services gather evidence, draft dispute letters, and submit them to the credit bureaus, demanding an investigation. The credit bureaus then have a legal obligation to investigate the disputed items within a specific timeframe. If the credit bureaus cannot verify the information, they must remove it from the client’s credit report, resulting in an improved credit score.

Features of Credit Repair Merchant Services

Customized dispute processes

Credit repair merchant services offer customized dispute processes tailored to each client’s unique credit situation. They understand that every individual or business faces different credit challenges and requires a personalized approach. These services work closely with clients to develop dispute strategies that target the specific negative items impacting their credit scores. By customizing the dispute processes, credit repair merchant services can maximize the effectiveness of their efforts and achieve the best possible outcomes for their clients.

Progress tracking and reporting

One of the essential features of credit repair merchant services is progress tracking and reporting. These services keep clients informed about the progress of their credit repair journey, providing regular updates on disputes, removals, and improvements to their credit profiles. Transparency and communication are vital in building trust and confidence between the credit repair merchant services and the clients. Progress tracking and reporting allow clients to see the tangible results of the services provided and make informed decisions about their financial future.

Secure client portals

Credit repair merchant services often provide secure client portals where individuals or businesses can access and monitor their credit repair progress. These portals are password-protected and encrypted to ensure the security and privacy of sensitive information. Clients can log in to their portals to track the status of their disputes, view updates and correspondence from credit bureaus, and access educational resources related to credit repair. Secure client portals offer convenience and peace of mind, giving clients direct access to the credit repair process.

Benefits of Using Credit Repair Merchant Services

Improvement in credit score

The primary benefit of using credit repair merchant services is the improvement in credit scores. By identifying and disputing negative items on credit reports, these services work diligently to remove inaccuracies and unfair reporting. This process can result in a substantial increase in credit scores over time. As credit scores improve, individuals and businesses gain access to better financial opportunities, including lower interest rates, higher credit limits, and increased chances of loan approvals. A higher credit score is a key indicator of financial responsibility and can have a significant positive impact on overall financial well-being.

Increased chances of loan approvals

Another significant benefit of using credit repair merchant services is the increased chances of loan approvals. When applying for loans, lenders rely heavily on credit scores to assess the borrower’s creditworthiness and determine the risk involved in lending. A poor credit score can lead to loan denials or higher interest rates, making it challenging for individuals or businesses to secure funding. Credit repair merchant services work to improve credit scores, making individuals and businesses more attractive to lenders. By addressing negative items and inaccuracies on credit reports, these services increase the likelihood of loan approvals and improve the borrower’s negotiating power.

Potential lower interest rates

One of the long-term benefits of using credit repair merchant services is the potential for lower interest rates. When individuals or businesses have a poor credit score, they often face higher interest rates on loans, credit cards, and other forms of credit. However, as credit scores improve through the efforts of credit repair merchant services, borrowers become less risky in the eyes of lenders. This decreased risk can translate into lower interest rates, resulting in substantial savings over time. Lower interest rates not only reduce the cost of borrowing but also contribute to improved financial stability and the ability to achieve financial goals more efficiently.

Risks and Challenges in Credit Repair Merchant Services

Understanding the regulatory landscape

Credit repair merchant services operate in a highly regulated environment. It is essential for these services to have a thorough understanding of the regulatory landscape to ensure compliance with relevant laws and regulations. Failure to comply with these regulations can lead to legal consequences and reputational damage. Credit repair merchant services must stay up to date with changes in regulations, licensing requirements, and ethical standards. By operating within the legal framework and adhering to industry best practices, credit repair merchant services can provide reliable and trustworthy services to their clients.

Potential fraud risks

Like any industry, credit repair merchant services face potential fraud risks. Unscrupulous individuals might try to take advantage of vulnerable individuals or businesses seeking credit repair help. It is crucial for clients to choose reputable and trusted credit repair merchant services to mitigate these risks. Clients should research service providers thoroughly, read reviews, and check for accreditation or certifications. Additionally, credit repair merchant services must implement robust security measures to protect clients’ sensitive information, such as Social Security numbers and financial details, to prevent identity theft and fraud.

Managing client expectations

One of the challenges in credit repair merchant services is managing client expectations. It is important for credit repair merchant services to set realistic expectations and communicate openly and honestly with clients. While credit repair can be highly effective in improving credit scores, it is not a magical overnight solution. The process requires time, consistent effort, and collaboration between the service provider and the client. Credit repair merchant services should educate clients about the credit repair process, the potential timeline for improvements, and the limitations of services. Managing client expectations ensures transparency, builds trust, and fosters a productive working relationship.

Selecting a Credit Repair Merchant Services Provider

Factors to consider when selecting a provider

When selecting a credit repair merchant services provider, there are several factors to consider. Firstly, clients should assess the provider’s reputation and track record. Researching online reviews, checking for references, and verifying the provider’s credentials can help determine their credibility. Transparency is crucial, so clients should look for providers who offer clear pricing structures and disclosure of services. It is also essential to evaluate the provider’s expertise and knowledge in credit repair, including their understanding of relevant laws and regulations. Finally, clients should consider the level of customer support and communication provided by the credit repair merchant services provider.

Key questions to ask potential providers

To make an informed decision, clients should ask key questions when evaluating potential credit repair merchant services providers. Some of these questions include:

- What is your process for analyzing credit reports and identifying negative items?

- How do you develop customized dispute processes for clients?

- Can you provide examples of your previous success in improving credit scores?

- How do you track progress and keep clients informed?

- What security measures do you have in place to protect client data?

- How do you manage potential regulatory risks and ensure compliance?

- How do you handle potential fraud risks and protect clients from scams?

- What is your approach to managing client expectations and fostering productive relationships?

- Can you provide references or testimonials from previous clients?

- How do you differentiate your services from other credit repair providers in the industry?

Asking these questions allows clients to assess the suitability and credibility of credit repair merchant services providers and make an informed decision.

Case Studies: Successes with Credit Repair Merchant Services

Businesses that benefited from credit repair merchant services

Many businesses have benefited greatly from credit repair merchant services. For example, a small retail business struggling with a poor credit score approached a credit repair merchant services provider for assistance. The provider thoroughly analyzed the business’s credit reports, identified negative items, and devised a customized dispute strategy. Through persistent and strategic disputing efforts, the credit repair merchant services provider successfully removed several inaccurate and unfair entries from the business’s credit reports. As a result, the business’s credit score significantly improved, allowing them to secure favorable terms on financing and expand their operations. The successful collaboration with the credit repair merchant services provider played a vital role in the business’s growth and development.

Individual success stories of credit score improvement

Individuals have also experienced remarkable success in improving their credit scores through credit repair merchant services. For instance, an individual with a history of late payments, collections, and a low credit score sought assistance from a credit repair merchant services provider. The provider carefully analyzed the individual’s credit reports, identified negative items impacting the credit score, and initiated disputes with the credit bureaus and creditors. Through effective communication, evidence gathering, and persistence, the credit repair merchant services provider successfully removed several negative items from the individual’s credit reports. As a result, the individual’s credit score improved significantly, enabling them to secure better interest rates on loans, obtain credit cards with favorable terms, and ultimately achieve greater financial stability and security.

Trends in Credit Repair Merchant Services

Emerging technologies in credit repair merchant services

The credit repair merchant services industry is embracing emerging technologies to enhance efficiency and effectiveness. One of the emerging trends is the use of artificial intelligence (AI) and machine learning algorithms to automate parts of the credit repair process. AI-powered credit repair software can analyze credit reports, identify patterns, and recommend tailored strategies for dispute resolution. This technology streamlines the credit repair process, reduces manual labor, and improves accuracy. Additionally, credit repair merchant services are leveraging advanced data analytics to gain insights into credit trends, identify common errors, and develop targeted dispute strategies. These technological advancements are revolutionizing the credit repair industry and providing clients with faster and more accurate results.

Market trends and future prospects

The credit repair merchant services market is experiencing significant growth due to increasing awareness of the importance of credit scores and the need for professional assistance in credit repair. With the rising demand for credit repair services, the market is becoming more competitive. This competition drives credit repair merchant services providers to innovate, improve service quality, and differentiate themselves in the market. Going forward, the market is expected to continue to grow as individuals and businesses recognize the long-term benefits of credit repair. Additionally, as credit reporting regulations evolve and new laws are enacted, credit repair merchant services will need to adapt and stay abreast of these changes to deliver effective and compliant services.

Conclusion: Unlocking Potential with Credit Repair Merchant Services

In conclusion, credit repair merchant services play a crucial role in helping individuals and businesses improve their credit scores and repair their credit histories. These services analyze credit reports, identify negative items, and dispute inaccurate or unfair entries with credit bureaus. By utilizing customized dispute processes, providing progress tracking and reporting, and offering secure client portals, credit repair merchant services help clients unlock their financial potential. The benefits of utilizing these services include improved credit scores, increased chances of loan approvals, and potential lower interest rates. However, there are risks and challenges involved, including understanding the regulatory landscape, managing client expectations, and mitigating fraud risks. Selecting a reputable credit repair merchant services provider requires careful consideration of factors such as reputation, expertise, and customer support. Through case studies, it is evident that both businesses and individuals have achieved success in improving their credit scores through credit repair merchant services. Emerging technologies and market trends continue to shape the industry, offering enhanced efficiency and driving the growth of the credit repair merchant services market. Overall, credit repair merchant services are essential tools for individuals and businesses seeking to improve their creditworthiness, unlock financial opportunities, and achieve their long-term financial goals.