Confused by the world of mortgages? You’re not alone. But don’t worry, because understanding the different types of mortgages and how they impact your monthly payments is key to making informed decisions on your path to homeownership. In this comprehensive guide, we’ll break down the basics of mortgages, explain how monthly payments are calculated, and explore various mortgage types to help you determine the best option for your unique situation. Whether you’re a first-time homebuyer or looking to refinance, this guide will provide you with the knowledge you need to navigate the mortgage market with confidence. Have you ever found yourself confused by the world of mortgages? You’re not alone. However, understanding the different types of mortgages and the factors that influence your monthly payments can help you make informed decisions on your path to homeownership. In this comprehensive guide, we’ll delve into the basics of mortgages, explain how monthly mortgage payments are calculated, and explore various mortgage types to help you determine the best option for your unique situation.

Short Summary

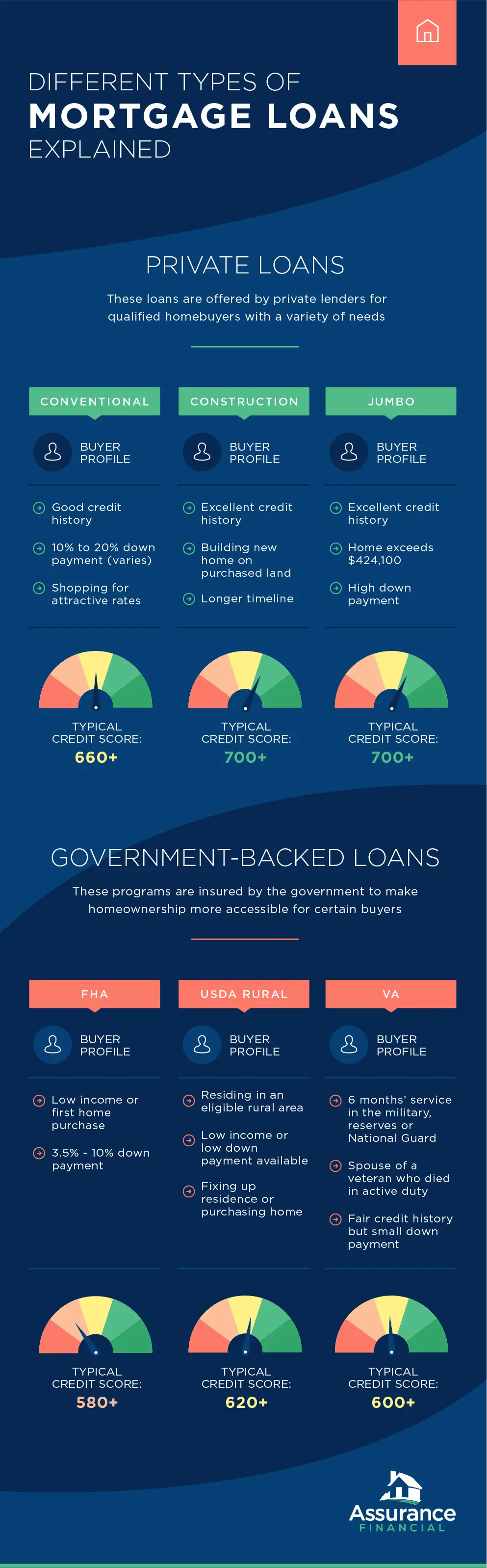

- This article provides an overview of the different types of mortgages available to homebuyers, including conventional, government-backed and jumbo loans.

- Factors such as credit score, interest rate and loan term affect monthly payments while a down payment is typically required when buying a home.

- Homebuyers can also take advantage of various programs and assistance which provide low-interest loans, down payment assistance and mortgage credit certificates.

Introduction to Mortgages: What You Need to Know

Mortgages play a crucial role in personal finance, allowing individuals to purchase a home without having to pay the full amount upfront. Instead, homebuyers can obtain a loan from a mortgage lender, who provides the funds for the home purchase and establishes the terms of the loan.

Mortgage payments, which are typically made monthly, consist of the principal, interest, mortgage insurance (in some cases), property taxes (in some cases), and homeowners insurance (in some cases).

The loan amount, interest rate, and loan term are the primary factors that determine your monthly mortgage payment. By understanding how these factors work together, you can select the right mortgage type, obtain the best interest rate, and ultimately save money on your monthly mortgage payments and overall loan costs.

In the following sections, we’ll explore these factors in more detail.

This image is property of newventureescrow.com.

What Is a Mortgage, and How Does It Work?

A mortgage is a loan used to purchase a residence, with the property serving as collateral. You’ll need to make a monthly payment of both the principal and interest. These payments are essential for staying on top of your loan balance. Initially, you’ll pay more interest than principal, but over time, the balance will shift until you’ve paid off the loan.

To select the right mortgage, you should consider your credit score, financial situation, objectives, and eligibility requirements. A 30-year fixed-rate mortgage offers a secure, consistent payment throughout the loan term, making it a popular choice for many homebuyers.

How Is a Monthly Mortgage Payment Calculated?

Calculating your monthly mortgage payment involves factoring in the loan amount, interest rate, and loan term. You can use an online mortgage calculator to get a clear understanding of how much you can afford and whether you should modify your loan term.

This image is property of assurancemortgage.com.

Why Does Interest Rate Matter in a Mortgage?

The interest rate in a mortgage is significant because it directly affects the amount of your monthly payment. A higher interest rate means a higher monthly payment, and vice versa. It’s crucial to compare rates and fees offered by different mortgage lenders to ensure you’re getting the best possible interest rate.

How Does Your Credit Score Affect Your Mortgage?

Your credit score plays a vital role in determining the mortgage you’re offered, as lenders use it to calculate the interest rate. Generally, a high credit score results in a lower interest rate, while a lower credit score leads to a higher interest rate. maintaining a good credit score by consistently making on-time payments on all of your debts, including your mortgage, is important.

This image is property of image.isu.pub.

What Is a Down Payment, and How Much Do You Need?

A down payment is the initial sum of money you’ll pay when purchasing a home. The amount required varies depending on the type of loan you’re obtaining and the lender you’re working with. Generally, a minimum of 3-5% of the purchase price must be put down.

A larger down payment can lower your loan amount, help you avoid paying private mortgage insurance (PMI), and give you more equity in your home right from the start.

How Does Loan Term Impact Your Mortgage?

The loan term, or the duration of your mortgage, can greatly impact your monthly payment and the total amount of interest you’ll pay over the life of the loan. A 15-year mortgage has a shorter loan term and a lower interest rate compared to a 30-year mortgage, which has a longer loan term and a higher interest rate. Making extra payments directly to the principal early in the loan term can significantly reduce the amount of time required to pay off the loan.

This image is property of ic-cdn.flipboard.com.

Understanding Mortgage Types: Conventional, Government-Backed, and Jumbo Loans

When shopping for a mortgage, you’ll come across three main types: conventional, government-backed, and jumbo loans. Each type caters to different homebuyers and offers unique benefits and requirements.

Conventional loans are the most common type of mortgage and are provided by private lenders. They come in two types: conforming and non-conforming. Conforming loans adhere to the loan limits set by Fannie Mae and Freddie Mac, while non-conforming loans, such as jumbo loans, exceed these limits.

Government-backed loans, on the other hand, are insured or guaranteed by federal agencies like the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), and the Department of Agriculture (USDA). These loans cater to specific groups of borrowers and often provide more flexible terms and reduced interest rates compared to conventional loans.

Jumbo loans are a type of non-conforming conventional loan designed for home purchases that exceed the conforming loan limits. They come with stricter requirements, such as higher credit scores and larger down payments.

Fixed-Rate vs. Adjustable-Rate Mortgages: Which Is Best for You?

When it comes to choosing a mortgage, you’ll also need to decide between fixed-rate and adjustable-rate mortgages (ARMs). Fixed-rate mortgages offer a consistent interest rate and monthly payment throughout the loan term, while ARMs have a variable interest rate that can change based on market conditions.

Fixed-rate mortgages provide consistency and predictability in monthly payments, but you won’t be able to benefit from decreased rates without refinancing. ARMs may be suitable for shorter-term living or those comfortable with a certain degree of risk.

This image is property of image.isu.pub.

Mortgage Prequalification vs. Preapproval: What’s the Difference?

Prequalification is an initial assessment conducted by a lender to determine how much credit or loan a borrower may be eligible for based on their financial information. Preapproval, on the other hand, is a more formal process where a lender verifies a borrower’s financial information and provides a conditional commitment for a specific loan amount.

Prequalification can give borrowers a clear understanding of their borrowing potential, while preapproval conveys to sellers and agents that you’re a serious buyer and gives you a better understanding of the loan amount and terms you qualify for.

First-Time Homebuyer? Explore Programs and Assistance

If you’re a first-time homebuyer, you may be eligible for various programs and assistance designed to make homeownership more affordable and accessible. These programs often offer low-interest-rate loans, down payment assistance, closing cost assistance, and mortgage credit certificates.

By understanding the different types of mortgages available, the factors that influence your monthly payments, and the programs and assistance you may qualify for, you can navigate the homebuying process more effectively and make informed decisions. Remember to compare rates and terms from multiple lenders to ensure you get the best mortgage for your needs.