Imagine having complete control over your credit. No more worrying about high interest rates, late payments, or credit card debt. With Total Control Credit, you have the power to manage and improve your credit like never before. Whether you’re looking to buy a new car, apply for a mortgage, or simply boost your credit score, Total Control Credit provides you with the tools and resources to take charge of your financial future. Say goodbye to financial stress and hello to total control.

Understanding Total Control Credit

Definition of Total Control Credit

Total Control Credit is a financial concept that allows individuals to have complete oversight and management of their credit usage. It involves an approach to credit utilization that promotes responsible spending, financial stability, and the maintenance of a good credit score. By understanding the key components of Total Control Credit and learning how it works, individuals can take charge of their financial health and maintain control over their credit.

How Total Control Credit Works

Total Control Credit works by emphasizing the importance of self-discipline and responsible spending. It encourages individuals to closely monitor their credit usage, make timely payments, and avoid unnecessary debt. By implementing strategies such as setting budgets, tracking expenses, and limiting credit utilization, individuals can maintain control over their credit and avoid the potential pitfalls of overspending or accumulating excessive debt.

Key Components of Total Control Credit

The key components of Total Control Credit include financial stability, self-discipline, avoidance of overspending, and budget control. These components work together to help individuals achieve and maintain control over their credit. By prioritizing financial stability and adopting responsible spending habits, individuals can effectively manage their credit and improve their overall financial well-being.

Advantages of Total Control Credit

Increase in Financial Stability

One of the main advantages of Total Control Credit is the increase in financial stability it brings. By closely monitoring credit usage and making timely payments, individuals are better equipped to manage their financial obligations. This leads to reduced financial stress and an improved ability to plan for the future.

Promotion of Self-Discipline in Spending

Total Control Credit promotes self-discipline by encouraging individuals to make conscious decisions regarding their spending habits. By setting budgets and tracking expenses, individuals develop greater awareness of their financial situation and are more likely to make prudent choices when it comes to credit usage.

Avoidance of Overspending

With Total Control Credit, individuals are empowered to avoid overspending. By setting limits on credit utilization and regularly reviewing their expenses, individuals can identify potential areas of overspending and take corrective actions. This helps prevent the accumulation of unnecessary debt and promotes more responsible financial behavior.

Budget Control

Total Control Credit emphasizes the importance of maintaining control over your budget. By implementing strategies such as tracking expenses, setting spending limits, and prioritizing financial goals, individuals can establish and maintain a balanced budget. This control allows for better planning and decision-making, ultimately contributing to overall financial well-being.

The Role of Credit Bureaus in Total Control Credit

Understanding Credit Bureaus

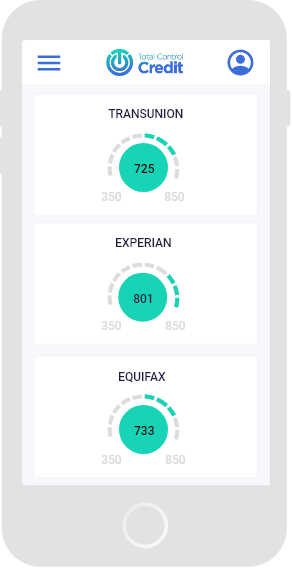

Credit bureaus are institutions that collect and maintain financial information on individuals, such as their credit history and payment patterns. They gather data from various sources, including lenders, banks, and credit card companies, and use this information to calculate individuals’ credit scores. Examples of widely recognized credit bureaus include Equifax, Experian, and TransUnion.

How Credit Bureaus Aid in Total Control Credit

Credit bureaus play a crucial role in Total Control Credit by providing individuals with access to their credit reports and credit scores. By regularly reviewing their credit reports, individuals can identify any errors or discrepancies and take appropriate actions to rectify them. Additionally, credit reports provide insights into an individual’s credit history, allowing them to assess their financial standing and make informed decisions regarding credit utilization.

The Role of Credit Scores in Total Control Credit

Credit scores, which are calculated based on the information provided by credit bureaus, serve as a numeric representation of an individual’s creditworthiness. They play a significant role in Total Control Credit as they determine an individual’s access to credit, interest rates, and borrowing options. By understanding their credit scores and actively working to improve them, individuals can have better control over their credit utilization and ultimately achieve their financial goals.

Establishing Total Control Credit

Step-by-Step Process

Establishing Total Control Credit requires a systematic approach. To begin, it is essential to evaluate your current financial situation and set realistic goals. This includes assessing your credit history, identifying any outstanding debts, and creating a budget that aligns with your financial capabilities. Once this foundation is established, individuals can start implementing key strategies such as monitoring credit usage, making timely payments, and avoiding unnecessary debt.

Important Factors to Consider

When establishing Total Control Credit, several factors should be considered. These include maintaining a good credit utilization ratio, keeping debt levels manageable, and diversifying credit accounts. It is also crucial to prioritize responsible spending habits, such as avoiding impulse purchases and understanding the terms and conditions of credit agreements.

Tips for Enhancing Total Control Credit

To enhance Total Control Credit, individuals can follow some helpful tips. These include regularly checking credit reports, reporting any inaccuracies, setting reminders for bill payments, and establishing an emergency fund. Additionally, individuals can consider seeking professional advice from credit counselors or financial advisors who can provide personalized guidance based on their unique financial circumstances.

Effect of Total Control Credit on Credit Score

How Total Control Credit Impacts Credit Score

Total Control Credit has a positive impact on an individual’s credit score. By practicing responsible spending habits, making timely payments, and controlling credit utilization, individuals can demonstrate their creditworthiness to lenders and creditors. This, in turn, leads to improved credit scores, which opens up opportunities for better interest rates and more favorable borrowing terms.

Ways to Improve Credit Score While Maintaining Total Control Credit

While actively maintaining Total Control Credit, individuals can take steps to further improve their credit scores. These include paying down existing debts, diversifying credit accounts, avoiding new credit applications unless necessary, and keeping credit utilization low. Regularly reviewing credit reports and addressing any discrepancies is also crucial in maintaining and improving credit scores.

Maintaining Total Control Credit

Daily Financial Habits

Maintaining Total Control Credit requires cultivating healthy daily financial habits. This includes tracking expenses, adhering to budgets, and prioritizing savings. By making conscious choices regarding spending and consistently practicing responsible financial behaviors, individuals can establish a solid foundation for maintaining control over their credit.

Regular Credit Reports and Reviews

Regularly reviewing credit reports is an essential part of maintaining Total Control Credit. By monitoring credit reports, individuals can quickly identify any fraudulent activities, errors, or discrepancies. This allows for prompt action to rectify such issues and ensures the accuracy of credit reports, providing a comprehensive view of an individual’s financial position.

Setting Up Direct Debits

Setting up direct debits for bill payments can greatly assist in maintaining Total Control Credit. By automating payments, individuals can ensure that bills are paid on time, avoiding late payment fees and potential negative impacts on their credit reports. This approach also helps individuals stay organized and reduces the likelihood of overlooking payment due dates.

Avoiding Unnecessary Debt

One crucial aspect of maintaining Total Control Credit is avoiding unnecessary debt. By distinguishing between wants and needs and making informed decisions based on financial capabilities, individuals can prevent the accumulation of debt that might strain their financial situation. Practicing restraint and financial discipline can lead individuals towards long-term financial success and control.

Total Control Credit and Debt Management

Role of Total Control Credit in Debt Management

Total Control Credit plays a significant role in debt management as it encourages responsible borrowing and spending habits. By maintaining control over credit usage, individuals can avoid excessive debt and better manage existing debts. This is achieved through strategies such as consolidating high-interest debts, creating repayment plans, and seeking professional advice to effectively manage debt obligations.

Strategies for Combining Total Control Credit with Debt Management

To combine Total Control Credit with effective debt management, individuals can consider various strategies. These include creating detailed budgets, prioritizing debt repayments, negotiating with creditors for lower interest rates or extended payment terms, and exploring debt consolidation options. By integrating Total Control Credit principles into debt management strategies, individuals can work towards eliminating debt and achieving financial stability.

Challenges in Achieving Total Control Credit

Common Pitfalls in Total Control Credit

While striving to achieve Total Control Credit, individuals may encounter several common pitfalls. These include falling into the trap of impulsive spending, not regularly monitoring credit reports, and neglecting to make timely payments. Additionally, individuals may face challenges in maintaining discipline and balance, especially when faced with unexpected financial emergencies or temptations to overspend.

Ways to Overcome These Challenges

To overcome the challenges in achieving Total Control Credit, individuals can implement specific measures. These include adopting and sticking to a budget, seeking accountability through support groups or financial mentors, setting realistic financial goals, and creating an emergency fund. Seeking professional assistance from credit counselors or financial advisors can also provide individuals with valuable guidance and support.

How to Deal with Potential Drop in Credit Score

In some instances, individuals may experience a temporary drop in their credit score while working towards Total Control Credit. This can occur when implementing credit utilization limits or paying off existing debts. While a drop in credit score may be discouraging, it is important to remember that these impacts are temporary and can be improved with consistent responsible financial behavior. Sticking to the established Total Control Credit strategies and maintaining a disciplined approach will ultimately lead to a rebound in credit score over time.

Impact of Total Control Credit on Financial Freedom

Understanding Financial Freedom

Financial freedom refers to a state in which individuals have the ability to make choices and pursue their desired lifestyle without being constrained by financial limitations. It involves having control over one’s finances, being free from overwhelming debt, and having the means to achieve personal and financial goals.

How Total Control Credit Can Lead to Financial Freedom

Total Control Credit can play a significant role in leading individuals towards financial freedom. By maintaining control over their credit, individuals can avoid excessive debts, improve their credit scores, and gain access to better borrowing opportunities. This, in turn, provides greater financial flexibility and allows individuals to make informed decisions regarding their personal and professional lives.

Factors That Hinder Total Control Credit from Leading to Financial Freedom

While Total Control Credit can contribute to financial freedom, certain factors can hinder its effectiveness. These include unforeseen financial emergencies, inadequate income, lack of financial literacy, or external economic factors. It is important to remain adaptable and continually reassess and update financial strategies to ensure continued progress towards financial freedom.

Case Studies on Total Control Credit

Success Stories of Total Control Credit

Numerous success stories highlight the effectiveness of Total Control Credit. These stories often involve individuals who have successfully implemented strategies such as budgeting, discipline, and debt management. They outline the positive impact that Total Control Credit has had on individuals’ financial well-being, leading to improved credit scores, reduced debt, and increased financial freedom.

Lessons Learned from Failed Attempts at Total Control Credit

Failed attempts at Total Control Credit can also provide valuable lessons. These stories often involve individuals who faced challenges in maintaining discipline, succumbed to overspending, or neglected to address financial issues promptly. By analyzing these experiences, individuals can learn from the mistakes of others and gain insights into the potential pitfalls of Total Control Credit.

Analysis of Successful and Failed Approaches

Analyzing both successful and failed approaches to Total Control Credit can provide individuals with valuable insights and guidance. Through a careful examination of these cases, individuals can identify common patterns, determine strategies that may work best for their unique circumstances, and avoid potential pitfalls. Implementing the lessons learned from successful approaches and avoiding the mistakes made in failed attempts can significantly increase the chances of achieving and maintaining Total Control Credit.

In conclusion, Total Control Credit offers individuals the opportunity to take charge of their financial health and actively manage their credit. By understanding the key components, advantages, and challenges associated with Total Control Credit, individuals can adopt responsible spending habits, maintain control over their credit usage, and work towards financial stability and freedom. With consistent effort and adherence to Total Control Credit principles, individuals can achieve their financial goals and enjoy long-term financial well-being.