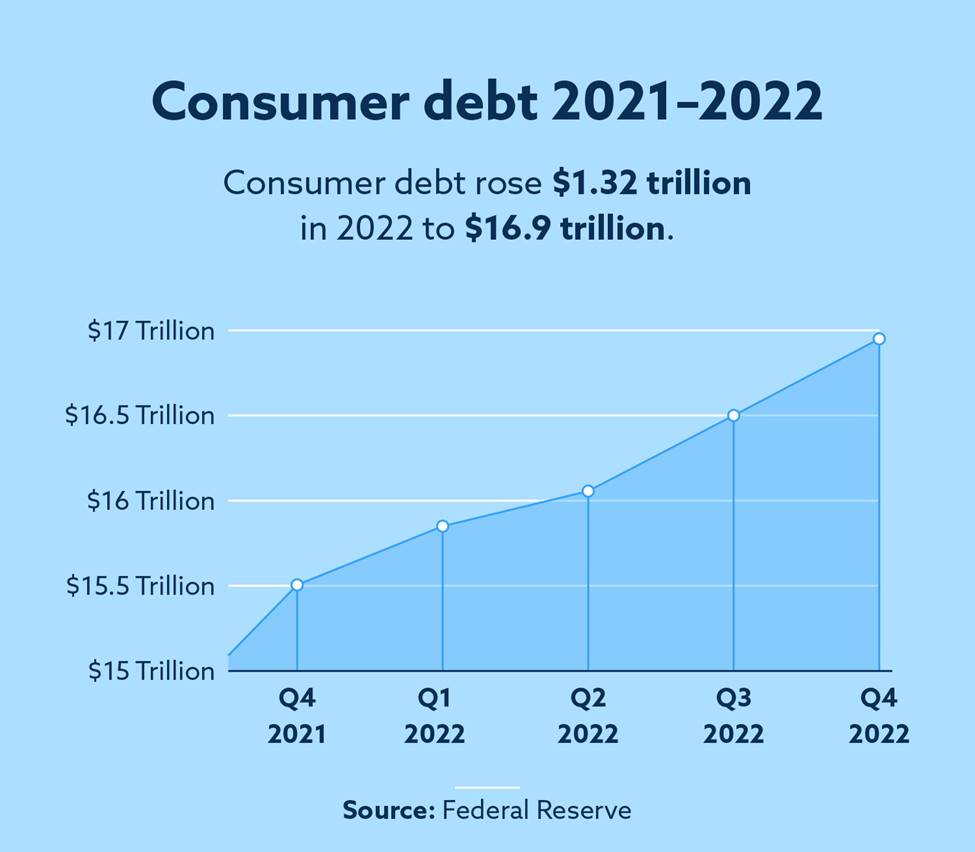

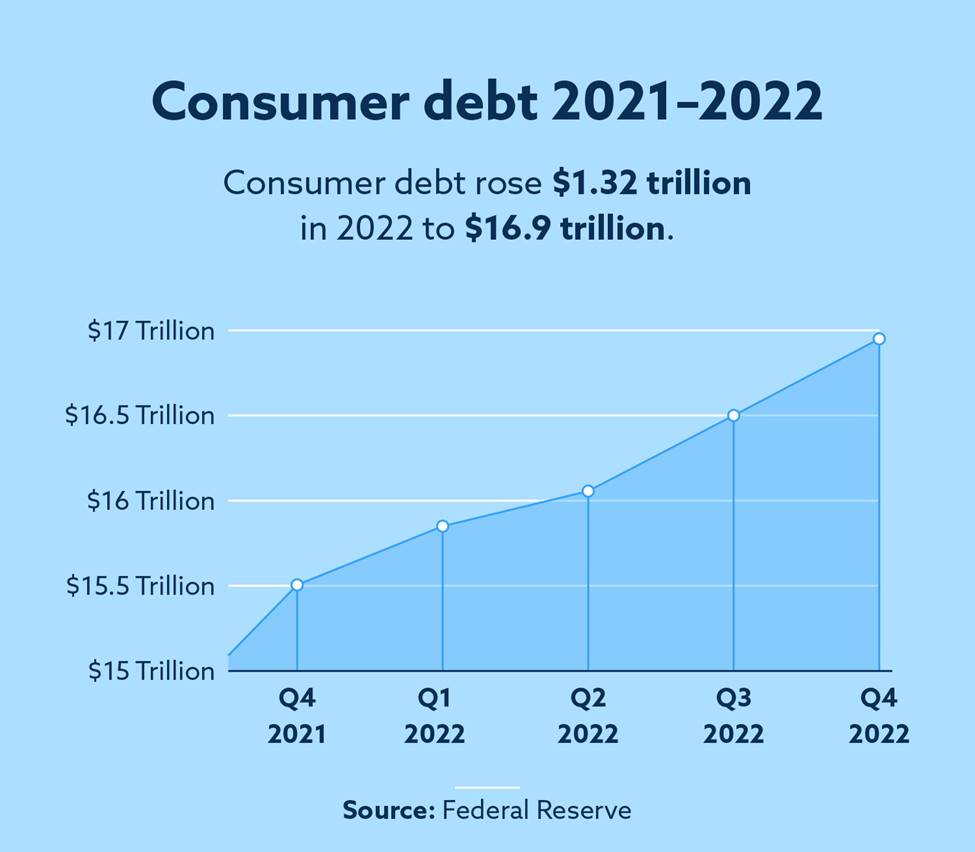

In a staggering revelation, the total consumer debt in the United States has hit an all-time high, crossing the $16.9 trillion mark by the close of 2022. As reported by the Federal Reserve Bank of New York, this figure equates to almost 10 percent of Americans’ disposable income, encompassing a variety of debts such as mortgages, car and student loans, and credit card debt. To tackle this alarming increase, recent studies have suggested that improving financial literacy education could offer a viable solution. By the end of Q4 in 2022, credit card balances rose to a whopping $986 billion, with student loans reaching $1.60 trillion and auto loans totaling $1.55 trillion. The numbers speak for themselves, indicating a pressing need for decisive action to address the mounting consumer debt crisis.

This image is property of www.lexingtonlaw.com.

Magnitude of US Consumer Debt in 2022

Consumer debt in the United States has reached staggering levels, with total debt among Americans reaching a staggering $16.9 trillion by the end of 2022, according to the Federal Reserve Bank of New York. This represents a significant increase compared to previous years and raises concerns about the impact of such high levels of debt on individuals and the overall economy. In this article, we will explore the concrete numbers that represent the total consumer debt, compare it to previous years’ figures, and look at government reports about the debt increase.

Concrete numbers representing the total consumer debt

As previously mentioned, total consumer debt in the US stood at $16.9 trillion by the end of 2022. This includes various types of debt such as mortgages, car and student loans, and credit card debt. These numbers reflect the growing reliance on borrowing among American consumers and highlight the need for a closer examination of the factors contributing to this trend.

Comparison to previous years’ figures

When comparing the total consumer debt in 2022 to previous years’ figures, it becomes evident that there has been a significant increase in debt levels. This suggests a concerning trend of mounting debt burdens among Americans. To fully understand the implications of this increase, it is essential to delve deeper into the breakdown of consumer debt and examine how each type of debt contributes to the overall picture.

Government reports about the debt increase

The government has been closely monitoring the rise in consumer debt and has released reports outlining its concerns. The Federal Reserve Bank of New York has consistently highlighted the need for prudent borrowing practices and raised alarm bells about the potential consequences of high debt levels. These reports play a crucial role in shaping policies and formulating strategies to address the growing debt burden on individuals and the economy as a whole.

Breakdown of US Consumer Debt

To gain a comprehensive understanding of the magnitude of consumer debt in the US, it is crucial to break it down into its various components. Consumer debt encompasses several types, including mortgages, car and student loans, and credit card debt. Each of these types contributes differently to the total debt, and analyzing their individual impacts can provide valuable insights.

Types of consumer debt: mortgages, car and student loans, credit card debt

Mortgages, car loans, student loans, and credit card debt are the primary types of consumer debt in the US. Mortgages represent loans taken out to finance the purchase of homes, while car loans help individuals purchase vehicles. Student loans are specifically tailored to fund higher education expenses. Lastly, credit card debt refers to balances owed on credit cards.

Percentages each type of debt contributes to the total

While each type of debt is significant in its own right, their varying contributions to the total consumer debt shed light on where the burdens are heaviest. Mortgages typically constitute the largest portion of consumer debt, given the high cost of housing. Car loans and student loans follow closely behind, reflecting the expenses associated with transportation and education. Credit card debt, while also significant, tends to comprise a smaller portion of the total debt.

Most significant increases among the types

Among the different types of consumer debt, certain categories have experienced more notable increases in recent years. Student loans, in particular, have skyrocketed, reaching a total of $1.60 trillion by the end of 2022. This surge in student loan debt has significant implications for young professionals, who may struggle to repay their loans while starting their careers. Additionally, credit card debt has also seen substantial growth, with the total balance rising to $986 billion at the end of Q4 in 2022.

Income Versus Debt

The balance between income and debt is a crucial factor in understanding the magnitude of the consumer debt issue. Assessing the percentage of disposable income that is owed to household debt gives valuable insight into Americans’ financial circumstances and the challenges they face when managing their debt.

Percentage of disposable income owed to household debt

Recent data suggests that Americans owe nearly 10 percent of their disposable income to household debt. This means that a significant portion of their income is being allocated to servicing debt obligations, leaving less room for savings and other essential expenses. This percentage serves as an important indicator of the financial strain many individuals and households are facing.

Impact of increasing debt in relation to static or decreasing income

Compounding the issue of high debt levels is the fact that income growth has not kept pace with the increasing debt burdens. When debt continues to rise while income remains static or even decreases, individuals and households find themselves in a precarious financial situation. This can lead to a cycle of borrowing to meet basic needs and struggling to make ends meet, ultimately perpetuating the cycle of debt.

Government observations of the income-debt situation

Government entities have been closely monitoring the income-debt situation and acknowledging the challenges it poses. Agencies such as the Federal Reserve and the Consumer Financial Protection Bureau have voiced concerns about the impact of high debt-to-income ratios on financial stability and economic growth. Recognizing the urgency of the issue, policymakers and regulators are exploring ways to address this imbalance and safeguard the financial well-being of individuals and households.

Credit Card Debt in 2022

Credit card debt represents a significant portion of consumer debt and has experienced its own set of challenges in recent years. A closer look at credit card debt in 2022 provides insights into the current state of affairs and the implications for consumers.

Total balance of credit card debt by end of Q4

By the end of Q4 in 2022, the total balance of credit card debt in the United States stood at $986 billion. This sizable amount reflects a steady increase in credit card borrowing and raises concerns about the ability of consumers to manage their finances effectively. As credit card balances continue to rise, it is crucial to evaluate the impact of this growing debt on individuals and their financial well-being.

Comparison to previous credit card debt balances

When comparing the current credit card debt balance to previous years’ figures, the upward trajectory becomes apparent. The increasing prevalence of credit card usage, coupled with rising consumer spending, has contributed to higher debt levels. This calls for a closer examination of the underlying reasons for the growth in credit card debt and the potential consequences for consumers.

Impact of growing credit card debt on consumers

The growing credit card debt carries several implications for consumers. High credit card balances can lead to increased financial stress and anxiety, as individuals struggle to make minimum payments and meet their financial obligations. Furthermore, the accumulation of credit card debt can negatively impact credit scores, making it more challenging to secure favorable interest rates on future borrowing. As such, it is crucial for consumers to be aware of the potential pitfalls of credit card debt and take steps to manage it effectively.

This image is property of www.lexingtonlaw.com.

Student Loans Debt in 2022

Student loan debt has become a significant concern in recent years, with many young professionals burdened by substantial loan balances. Examining the state of student loans in 2022 can provide valuable insights into this specific category of consumer debt.

Total amount of student loans by Q4

By Q4 of 2022, the total amount of student loans in the United States reached a staggering $1.60 trillion. This represents a substantial increase compared to previous years and underscores the challenges faced by individuals seeking higher education. As young professionals enter the workforce burdened by student loan debt, it is essential to understand the impact it has on their financial well-being and overall economic stability.

Exploration of growing student loans impact on young professionals

The growth of student loan debt has particularly significant consequences for young professionals. High levels of student loan debt can hinder career progression, delay major life milestones such as homeownership, and limit financial flexibility. These burdens can create substantial stress and affect the financial stability of young professionals, potentially leading to long-term consequences for their personal and professional lives.

Government initiatives towards student loans

Recognizing the pressing issue of student loan debt, the government has implemented several initiatives to address the challenges faced by borrowers. Programs such as income-driven repayment plans and loan forgiveness options aim to alleviate the burden of student loans and provide borrowers with more manageable repayment options. These initiatives, along with ongoing discussions about student loan reform, reflect the government’s commitment to finding solutions to the growing problem of student loan debt.

Automobile Loans Debt in 2022

Automobile loans are another significant component of consumer debt in the United States. Examining the state of auto loans in 2022 provides insights into the challenges faced by households and the potential implications for the economy.

Total amount of auto loans by end of 2022

By the end of 2022, auto loans in the United States had reached a total of $1.55 trillion. This substantial amount illustrates the reliance on auto financing and the impact it has on household budgets. As auto loans continue to grow, it is essential to assess the consequences for individuals and households and explore potential solutions.

Impact of escalating auto loans on households

Escalating auto loans can have a severe impact on households’ financial well-being. Higher loan balances, combined with rising interest rates, can result in larger monthly payments and increased financial strain. This can limit individuals’ ability to save, invest, or allocate funds towards other essential expenses. Furthermore, the potential consequences of defaulting on auto loans can have long-lasting effects on credit scores and overall financial stability.

Proposed solutions to reduce auto loans

To mitigate the challenges posed by escalating auto loans, various solutions have been proposed. Encouraging responsible borrowing practices, promoting financial literacy, and exploring viable alternatives to traditional auto financing are some strategies that could help reduce auto loan burdens. By implementing these measures, individuals and households can make more informed choices when it comes to auto financing and reduce the potential negative impacts on their financial stability.

This image is property of www.lexingtonlaw.com.

Financial Literacy Education

Financial literacy education plays a vital role in equipping individuals with the knowledge and skills to make informed financial decisions. Assessing the current state of financial literacy education in the United States reveals opportunities for improvement and highlights the potential impact it can have on addressing consumer borrowing trends.

The role of financial literacy in addressing consumer borrowing

Financial literacy education has the potential to empower individuals to make well-informed decisions about their finances, including borrowing and managing debt. By providing individuals with the knowledge and tools to understand credit, interest rates, and the consequences of borrowing, financial literacy education can help individuals navigate the complexities of consumer debt and make choices that promote financial well-being.

Current state of financial literacy education in the US

Despite the importance of financial literacy education, the current state of financial literacy in the United States leaves room for improvement. Many individuals graduate from high school or college without essential financial knowledge, making them vulnerable to poor borrowing decisions and financial mismanagement. While efforts have been made to incorporate financial literacy into educational curricula, more comprehensive and widespread initiatives are needed to ensure individuals have access to the necessary financial education.

Suggestions for improving financial literacy education

Improving financial literacy education requires a multi-faceted approach involving schools, businesses, and government entities. Incorporating financial literacy into school curricula, offering workplace financial education programs, and providing easily accessible resources are a few strategies that can enhance financial literacy. Additionally, collaboration between educational institutions, financial institutions, and community organizations can help establish comprehensive programs that address the diverse needs of individuals at different stages of life.

Effects of High Consumer Debt

The high levels of consumer debt in the United States have far-reaching effects on both the overall economy and individual households. Understanding these effects is crucial to formulating effective strategies and policies to address the issue and mitigate its potential consequences.

Effects on the overall economy

High consumer debt levels can have a detrimental impact on the overall economy. When individuals are burdened with excessive debt, their ability to spend, invest, and contribute to economic growth is constrained. This can lead to decreased consumer spending, reduced business growth, and overall economic slowdown. Moreover, the risk of defaulting on debt increases, which can trigger financial instability and negatively affect financial institutions and markets.

Impacts on individual households and personal finances

On an individual level, high consumer debt can have numerous negative impacts on personal finances. The financial strain of meeting monthly debt obligations can limit individuals’ ability to save for emergencies, invest for future goals, or enjoy a certain quality of life. Additionally, high debt can lead to increased stress, strained relationships, and compromised mental well-being. It is crucial for individuals to understand the consequences of excessive borrowing and take steps to manage their debt effectively.

Predicted potential future outcomes of the increasing debt

Looking ahead, the increasing consumer debt raises concerns about potential future outcomes. If debt continues to rise unchecked, it could lead to a vicious cycle of borrowing, defaulting, and financial instability. Additionally, increased debt servicing costs and limited disposable income could hinder economic mobility and exacerbate income inequality. To avoid these potential outcomes, proactive measures must be taken to address the root causes of high consumer debt and promote responsible borrowing practices.

This image is property of www.lexingtonlaw.com.

Government Response to Rising Debt

Recognizing the severity of the rising consumer debt issue, the government has implemented regulations and measures aimed at controlling and mitigating the impact of debt. These efforts reflect a commitment to safeguarding the financial well-being of individuals and the stability of the economy.

Government regulations and measures aimed at controlling the debt

Government regulations and measures play a crucial role in controlling and managing the rising consumer debt. This includes implementing lending standards, oversight of financial institutions, and consumer protection laws. By enforcing regulations and ensuring responsible lending practices, the government aims to reduce the risk of excessive borrowing, predatory lending, and financial instability.

Response from the Federal Reserve Bank of New York

The Federal Reserve Bank of New York has been at the forefront of monitoring and responding to the issue of rising consumer debt. With its broad oversight responsibilities, the Federal Reserve Bank plays a vital role in assessing the impact of high debt levels on the economy and formulating appropriate policies. Through regular reporting, research, and collaboration with other government entities, the Federal Reserve Bank provides valuable insights and recommendations to address the challenges associated with consumer debt.

Future strategies proposed by the government

Moving forward, the government has proposed various strategies to address the rising consumer debt. These strategies include improved financial literacy education, targeted support for struggling borrowers, and enhanced lender accountability. By implementing these strategies, the government aims to promote responsible borrowing, equip individuals with the necessary skills and knowledge to manage their finances, and create a framework that safeguards against excessive debt burdens.

Moving Forward to 2023

Looking ahead to 2023, it is essential to consider the predicted debt trends and recommend strategies for consumers to reduce and better manage their debt. Furthermore, the potential impact of proposed government initiatives must be considered in relation to future debt dynamics.

Predicted debt trends for the coming year

Predicting debt trends for the coming year is challenging, given the dynamic nature of the economy and the influence of numerous factors. However, based on current indicators, it is anticipated that consumer debt levels will continue to rise, albeit at varying rates across different types of debt. The overall trajectory suggests the need for proactive measures to ensure responsible borrowing and effective debt management.

Recommendations for consumers to reduce and better manage debt

As consumers, there are several steps we can take to reduce and better manage our debt. Prioritizing debt repayment, budgeting effectively, and exploring opportunities to refinance or consolidate debt are some strategies that can help individuals regain control over their financial situation. Seeking professional advice, such as credit counseling or financial planning services, can provide valuable guidance tailored to specific circumstances and goals.

Potential impact of proposed government initiatives on future debt

The proposed government initiatives aimed at addressing consumer debt have the potential to make a significant impact on future debt dynamics. Improved financial literacy education can empower individuals to make informed borrowing decisions and manage their debt effectively. Targeted support for struggling borrowers and enhanced lender accountability can provide relief and protection for those most vulnerable to the adverse effects of debt. By implementing these initiatives, the government seeks to create a more sustainable and equitable financial landscape for individuals and the economy as a whole.

In conclusion, the magnitude of consumer debt in the United States has reached unprecedented levels, raising concerns about its implications for individuals and the overall economy. Analyzing concrete numbers, examining the breakdown of different debt types, and considering the impact on income, credit card debt, student loans, and auto loans provides valuable insights into the challenges faced by American consumers. It is crucial for individuals, government entities, and financial institutions to work collaboratively to address the root causes of high consumer debt, promote financial literacy, and implement responsible borrowing practices. By doing so, we can strive toward a more financially resilient and stable future for all.

This image is property of www.lexingtonlaw.com.