Welcome to “Top 5 Credit Repair Strategies for Improving Your Credit Score”! In this article, we’ll be diving into some valuable information and tips to help you on your credit repair journey.

If you’re looking for ways to boost your credit score and improve your financial standing, you’re in the right place. We’ll be covering a range of topics, from the basics of credit scores to debunking common myths. Whether you’re dealing with errors on your credit report or navigating the complexities of credit repair, we’ve got you covered. So stick around and get ready to learn more about how you can take control of your credit and achieve a healthier financial future.

This image is property of www.lexingtonlaw.com.

Basics of Credit Scores

Understanding credit scores

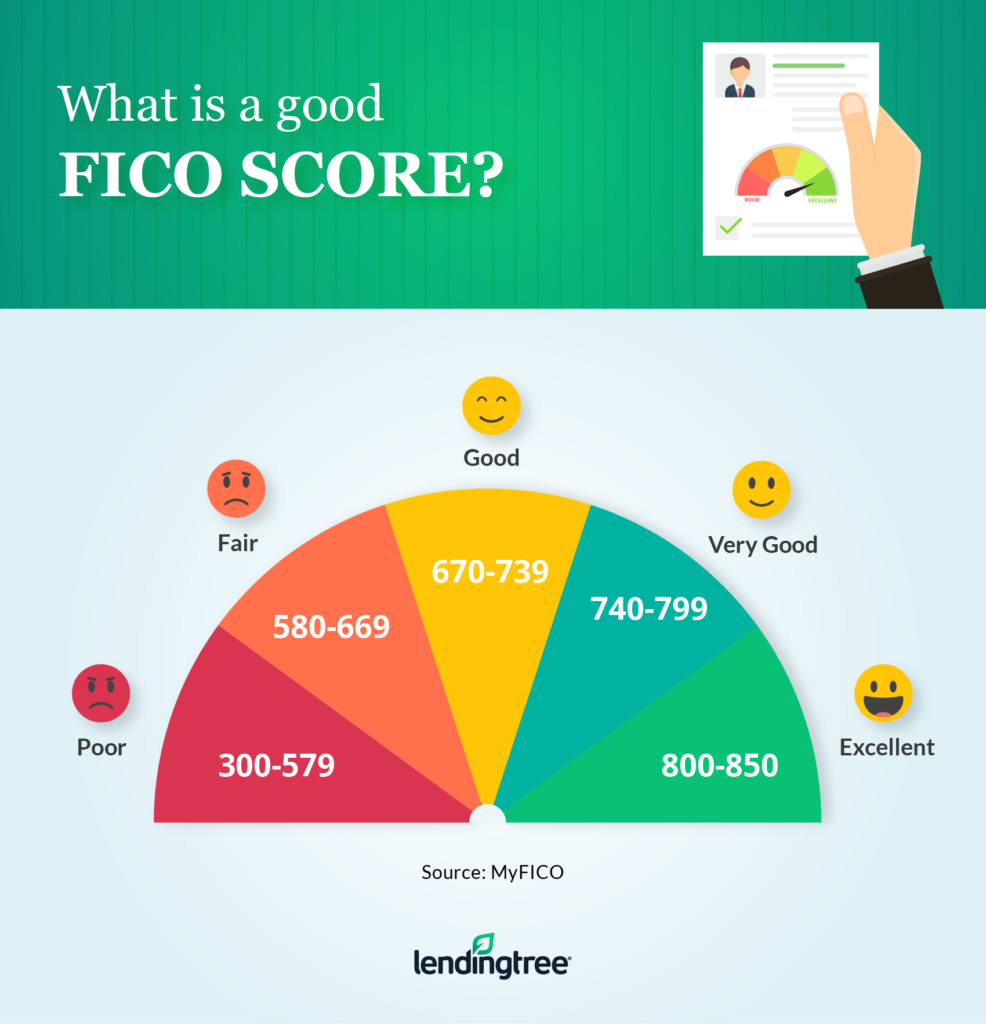

Your credit score is a numerical representation of your creditworthiness and is used by lenders to assess your financial reliability. It is a three-digit number that ranges from 300 to 850, with a higher score indicating better creditworthiness. Understanding how your credit score is calculated and what factors it is based on can help you make informed decisions to improve it.

Factors that affect credit scores

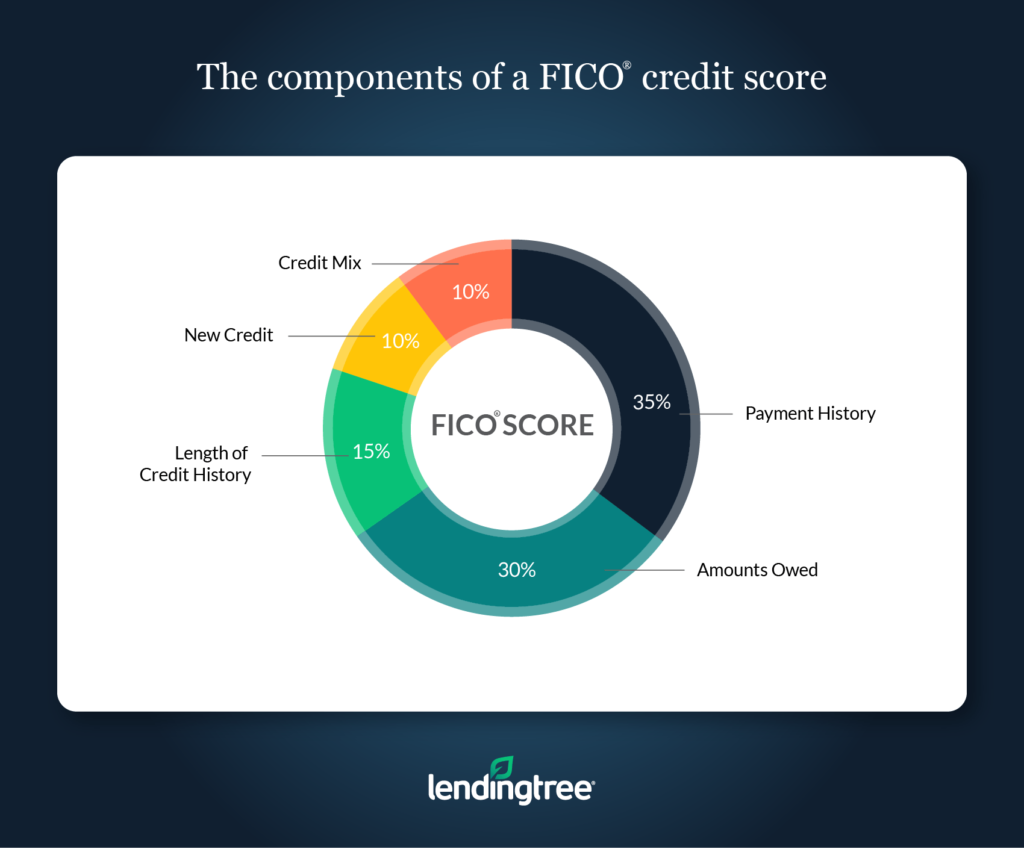

Several factors contribute to the calculation of your credit score. These include:

-

Payment History: Your track record of making payments on time is a significant factor in determining your credit score. Late payments, defaults, and bankruptcies can have a negative impact on your score.

-

Credit Utilization Ratio: This ratio measures the amount of credit you are using compared to your total available credit limit. A high utilization ratio can suggest that you are relying too heavily on credit and may negatively affect your score.

-

Length of Credit History: The length of time you have had credit accounts is taken into consideration. A longer credit history can indicate stability and can positively impact your credit score.

-

Credit Mix: Having a diverse credit portfolio, including credit cards, loans, and mortgages, can show that you can handle different types of credit responsibly.

-

New Credit Inquiries: Every time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your credit score. It is important to be mindful of how often you apply for credit.

Importance of credit scores

Having a good credit score is crucial as it can affect your financial opportunities. Lenders use credit scores to decide whether to extend credit to you, and it also plays a role in determining the terms and interest rates you receive on loans and credit cards. A higher credit score can give you access to better borrowing options and lower interest rates, potentially saving you money in the long run.

Fixing Errors in Credit Reports

Identifying errors in credit reports

Credit report errors can happen, and it is important to regularly review your credit reports to identify any inaccuracies. Look for incorrect personal information, accounts that you don’t recognize, or any late payment or delinquency that you believe is not accurate.

Disputing inaccuracies with credit bureaus

If you spot any errors on your credit reports, you have the right to dispute them with the credit bureaus. You can do this by writing a letter explaining the error and providing any supporting documentation. The credit bureaus will then investigate the disputed items and update your credit report accordingly.

Monitoring credit reports regularly

To ensure the accuracy of your credit reports, it is essential to monitor them regularly. You can obtain a free copy of your credit report from each of the three major credit bureaus once a year. Consider staggering your requests so that you can check your report from a different bureau every four months. Additionally, there are several online services that offer credit monitoring and alerts for any changes to your credit report.

Debunking Credit Repair Myths

Common misconceptions about credit repair

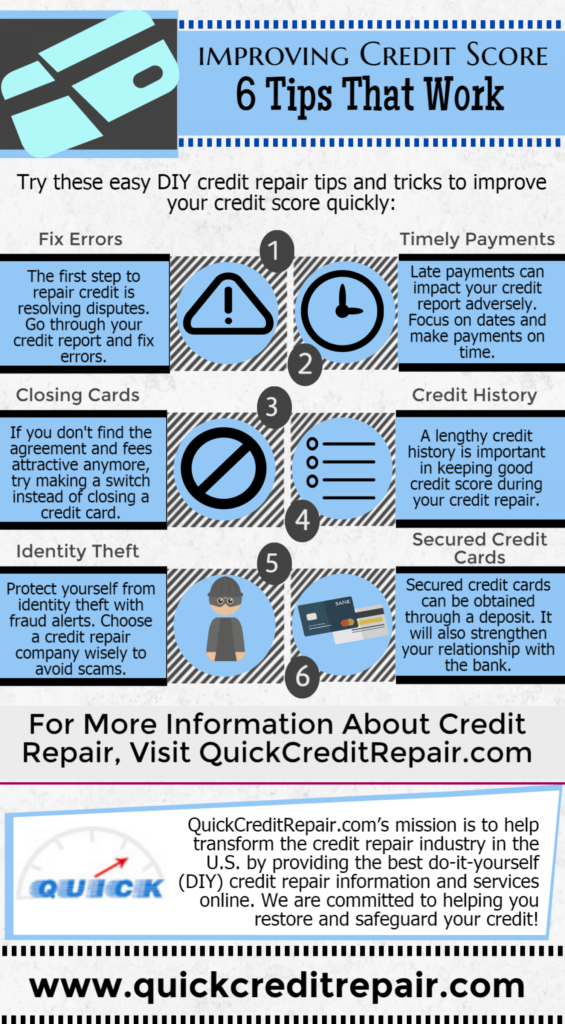

Credit repair is often misunderstood, and there are many myths surrounding it. Some common misconceptions include:

-

Credit repair is illegal: Credit repair is a legitimate and legal process. There are laws in place, such as the Fair Credit Reporting Act, to protect consumers’ rights when it comes to credit reporting and credit repair.

-

Only time can repair bad credit: While time is a factor in improving credit, there are proactive steps that individuals can take to repair their credit and improve their credit scores.

Separating myths from facts

When it comes to credit repair, it is important to separate myths from facts. Some key facts to keep in mind include:

-

Negative items can be removed: Inaccurate or unverifiable negative items can be disputed and potentially removed from your credit report.

-

DIY credit repair is possible: You can undertake credit repair yourself by understanding the laws and processes involved. However, it can be time-consuming and complex, so seeking professional help is an option.

Understanding the truth about credit repair

Credit repair is about addressing inaccuracies, disputing errors, and taking steps to improve your creditworthiness. It is not about magically erasing legitimate negative information from your credit report. Understanding the truth about credit repair can empower you to take the necessary steps to improve your credit score.

Building Credit From Scratch

Establishing new credit accounts

If you have little to no credit history, building credit can be challenging, but it is not impossible. One way to start is by opening a secured credit card. These cards require a cash deposit, serving as collateral, and can help you establish a positive credit history.

Choosing the right credit cards

When building credit, it is important to choose the right credit cards that suit your needs. Look for credit cards with low annual fees, reasonable interest rates, and perks that align with your spending habits. Avoid applying for multiple cards at once, as it can negatively impact your credit score.

Building a positive credit history

To build a positive credit history, make all your payments on time, maintain low credit card balances, and avoid opening unnecessary accounts. It is crucial to establish good financial habits early on to set yourself up for a strong credit profile in the future.

This image is property of i.visual.ly.

Utilization: Managing Credit Balances

Understanding credit utilization ratio

Credit utilization ratio is the percentage of your available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit card limits. For example, if you have a total credit limit of $10,000 and your outstanding balances are $2,000, your credit utilization ratio is 20%.

Managing credit card balances effectively

To manage your credit card balances effectively, aim to keep your credit utilization ratio below 30%. Maintaining a low ratio shows lenders that you are responsible with credit, which can positively impact your credit score. It is also a good practice to pay off your credit card balances in full each month to avoid accruing unnecessary interest charges.

Strategies to lower credit utilization

If your credit utilization ratio is high, there are a few strategies you can use to lower it:

-

Pay down debt: Focus on paying off your credit card balances to decrease your credit utilization ratio.

-

Request credit limit increases: Contact your credit card issuers and ask for a credit limit increase. This can help decrease your credit utilization ratio if you maintain low balances.

-

Use multiple credit cards: Distribute your balances across multiple credit cards to keep individual credit utilization ratios low.

Dealing with Late Payments

Consequences of late payments

Late payments can have significant consequences on your credit score and financial well-being. They can result in increased interest rates, late payment fees, and penalties. Late payments can also stay on your credit report for up to seven years, affecting your ability to obtain credit in the future.

Negotiating with creditors for late payment removal

If you have a legitimate reason for a late payment, such as a billing error or a temporary financial hardship, you can try negotiating with your creditors to have the late payment removed from your credit report. However, there is no guarantee that they will agree to it, and it is always best to make payments on time to maintain a strong credit history.

Preventing late payments in the future

To prevent late payments in the future, consider setting up automatic payments or reminders to ensure you never miss a due date. Budgeting and managing your finances effectively can also help you stay on top of your payment obligations.

This image is property of www.lendingtree.com.

Credit Repair vs. Debt Settlement

Differences between credit repair and debt settlement

Credit repair focuses on improving your credit score by addressing inaccuracies and errors on your credit report. It involves disputing negative items and working towards building a positive credit history. Debt settlement, on the other hand, involves negotiating with creditors to settle debts for less than the full amount owed.

Choosing the right approach for your situation

The approach you choose, whether credit repair or debt settlement, depends on your specific financial circumstances. If you have inaccuracies on your credit report and are looking to improve your credit score, credit repair may be the right option for you. If you are struggling with overwhelming debt and need to negotiate with creditors to settle your debts, debt settlement may be more suitable.

Understanding the impact on credit scores

Credit repair and debt settlement can both have an impact on your credit scores. With credit repair, you may see an improvement in your credit score over time as negative items are removed and positive credit habits are established. Debt settlement, on the other hand, can initially have a negative impact on your credit score, as settled accounts may be reported as “settled” or “paid, settled for less than full balance.” However, taking steps to settle your debts can eventually lead to improved financial health.

Handling Collections and Charge-Offs

Dealing with collection agencies

If you have debts that have been sent to collection agencies, it is important to address them promptly. Contact the collection agency to understand the details of the debt and negotiate a repayment plan if necessary. Ensure to get all agreements in writing and keep a record of any payments made.

Negotiating for settlement or deletion

When dealing with collection agencies, you may have the opportunity to negotiate a settlement for less than the full amount owed. This can help you satisfy the debt and potentially improve your credit score. Additionally, you can also negotiate with the collection agency to have the account deleted from your credit report upon payment.

Rebuilding credit after charge-offs

Charge-offs occur when a creditor writes off a debt as uncollectible. They can have a significant negative impact on your credit score. To rebuild your credit after charge-offs, focus on establishing positive credit habits, such as making all payments on time, keeping credit card balances low, and opening new credit accounts to create a positive credit history.

This image is property of www.lendingtree.com.

Hiring Credit Repair Companies

Pros and cons of hiring credit repair companies

Hiring a credit repair company can provide convenience and expertise in navigating the credit repair process. They can handle the dispute process on your behalf and help you develop a personalized credit repair strategy. However, it is important to research and choose a reputable credit repair agency to avoid scams or unethical practices.

Choosing a reputable credit repair agency

When selecting a credit repair agency, research their reputation, customer reviews, and accreditations. Look for agencies that are transparent about their fees and processes. Avoid any agencies that promise quick fixes or guarantee specific results, as credit repair takes time and individual circumstances can vary.

Understanding the cost and process

Credit repair companies typically charge a fee for their services. These fees can vary depending on the agency and the complexity of your credit repair needs. Before engaging a credit repair company, make sure you understand the cost structure, including any upfront or monthly fees. Additionally, ensure that the agency provides clear information on their process and timeline for credit repair.

Conclusion

Improving your credit score and repairing your credit can be a daunting task, but it is achievable with the right strategies and knowledge. By understanding the basics of credit scores, identifying and disputing errors in your credit reports, and implementing effective credit repair strategies, you can take control of your financial future. Whether you choose to DIY credit repair or seek professional assistance, the key is to be proactive and consistent in your efforts. Remember, improving your credit score takes time, perseverance, and responsible financial habits.

This image is property of img.money.com.