Have you ever wondered how your credit score affects your financial future? In “The Basics of Credit Repair: Understanding Your Credit Score,” you will find all the answers you need. Whether you’re looking to fix errors on your credit report, build your credit from scratch, or simply improve your creditworthiness, this article has got you covered.

But that’s not all! In this comprehensive guide, you’ll also learn about common credit score myths that could be holding you back, strategies for negotiating with creditors, and even success stories from people who have successfully repaired their credit. So, if you’re ready to take control of your financial health and pave the way for a brighter future, keep reading!

Introduction

When it comes to navigating the world of finance, your credit score is one of the most important factors to consider. A credit score is a numerical representation of your creditworthiness, and it can have a significant impact on your ability to secure loans, obtain favorable interest rates, and even land that dream job. In this article, we will delve into the basics of credit scores, discuss how they are calculated, and explore various strategies for credit repair.

What is a Credit Score?

A credit score is a three-digit number that lenders use to evaluate your creditworthiness. It is a reflection of your borrowing and repayment history, as well as your overall financial health. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

This image is property of www.creditrepair.com.

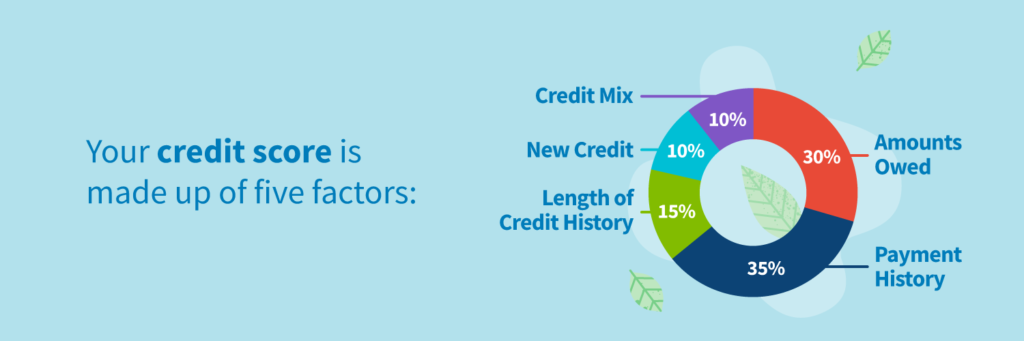

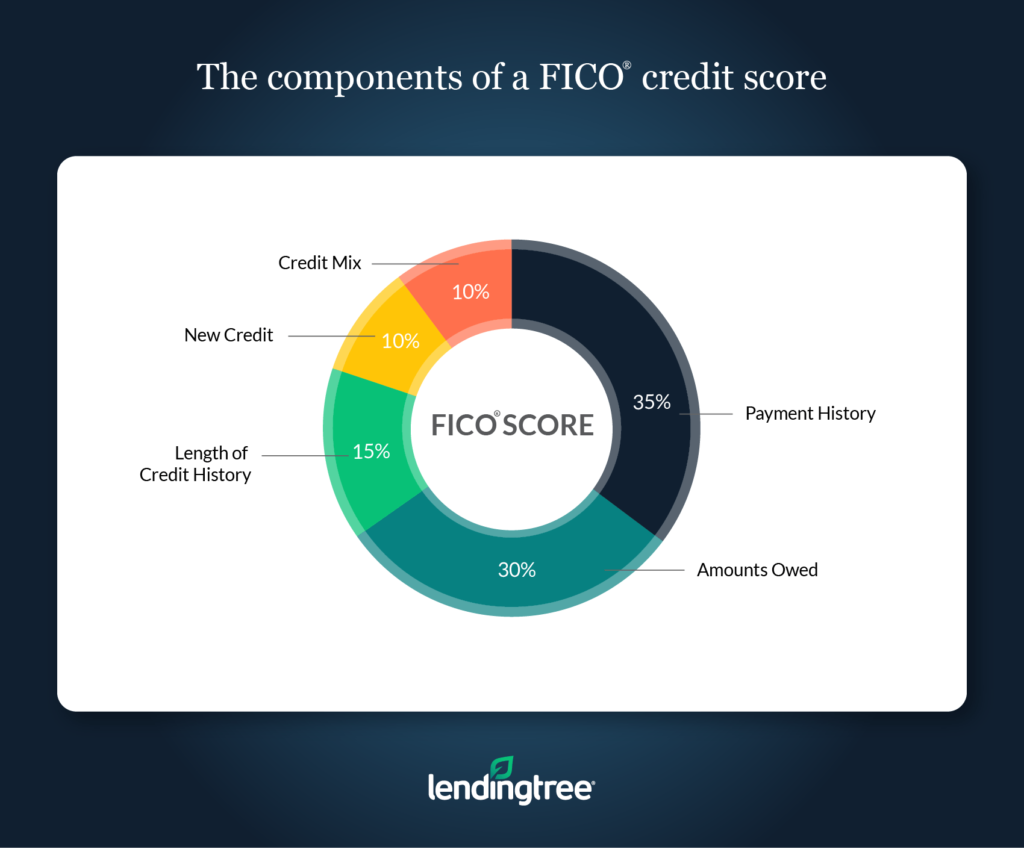

How is Credit Score Calculated?

Credit scores are calculated using various factors, including payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Payment history plays a significant role in determining your credit score, as it showcases your ability to make timely payments on your debts. Credit utilization refers to the percentage of your available credit that you are currently using. Length of credit history considers the age of your oldest account and the average age of all your accounts. The types of credit used, such as credit cards and loans, also contribute to your credit score. Finally, new credit inquiries, such as applying for multiple credit cards in a short period, can also impact your score.

Understanding Credit Score Ranges

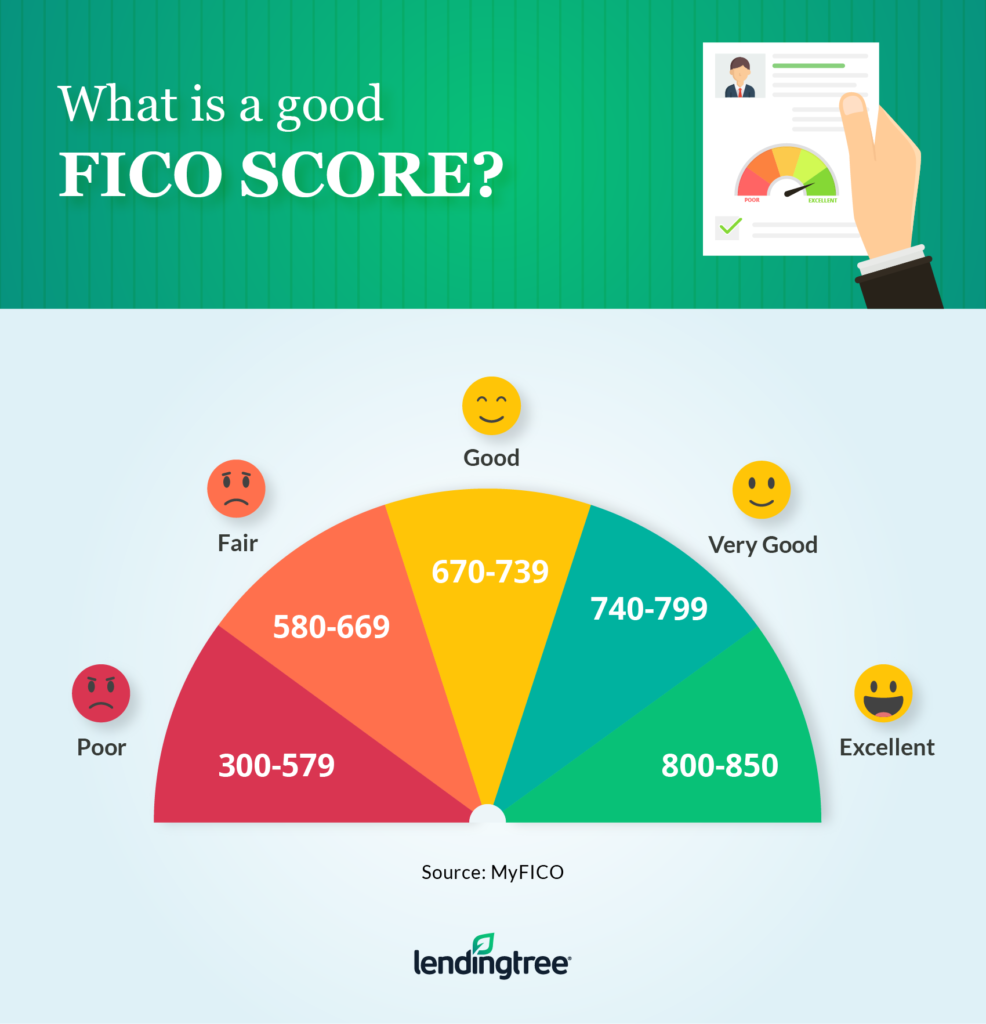

Credit scores can be categorized into different ranges, each indicating varying levels of creditworthiness. While the specific ranges may vary depending on the credit scoring model used, here is a general breakdown:

- Excellent: 750-850

- Good: 700-749

- Fair: 650-699

- Poor: 600-649

- Bad: Below 600

Having a higher credit score not only increases your chances of being approved for loans but also helps you secure more favorable interest rates, saving you money in the long run.

This image is property of www.lendingtree.com.

Fixing Errors on Your Credit Report

Errors on your credit report can have a significant impact on your credit score, potentially lowering it and affecting your financial opportunities. Identifying and correcting these errors is crucial to maintaining a healthy credit profile.

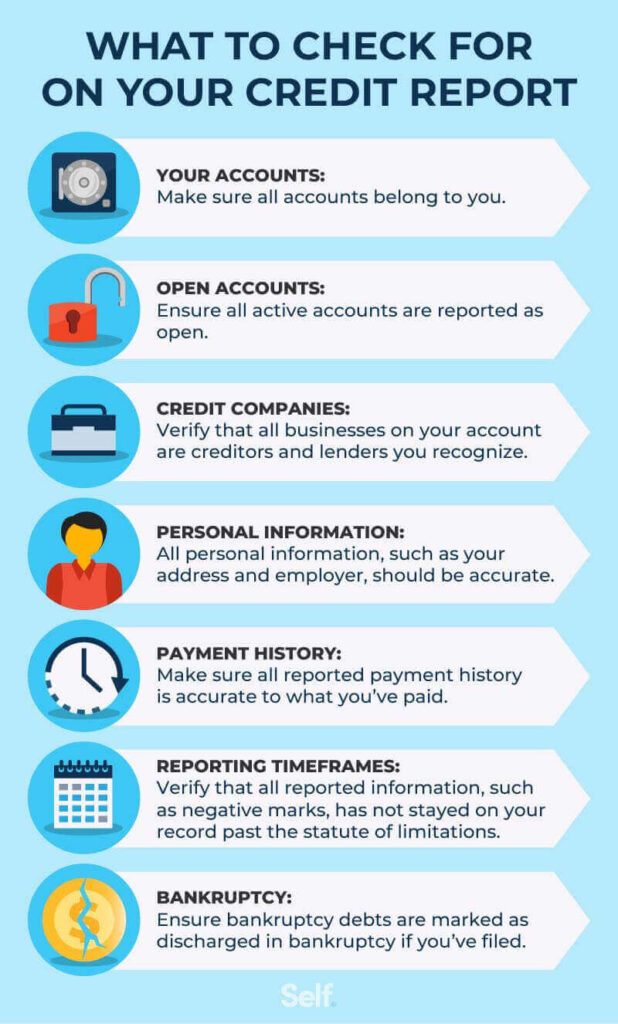

Identifying Errors on Your Credit Report

To identify errors on your credit report, you should regularly review your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Look for any inaccuracies, such as accounts that don’t belong to you, late payments that you made on time, or incorrect personal information.

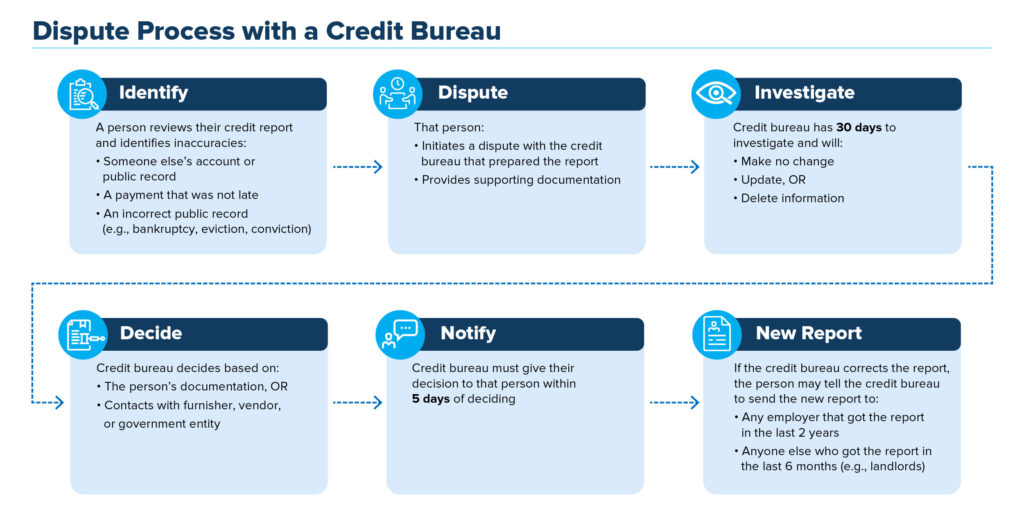

Disputing Inaccurate Information

If you find inaccuracies on your credit report, you have the right to dispute them. Contact the credit reporting agency and provide them with evidence to support your claim, such as receipts, statements, or other relevant documents. The credit reporting agencies are required to investigate your dispute within 30 days and correct any errors they find.

Monitoring Changes on Your Credit Report

Once you have disputed errors on your credit report, it is essential to monitor any changes that occur. Regularly check your credit reports to ensure that the inaccuracies have been corrected and that your credit score reflects the accurate information. You can also sign up for credit monitoring services that alert you to any changes or suspicious activity on your credit report.

Debunking Credit Repair Myths

There are several common myths about credit repair that can hinder your progress in improving your credit score. It’s crucial to separate fact from fiction to make informed decisions about credit repair.

Common Myths About Credit Repair

One common myth is that credit repair is illegal or unethical. In reality, credit repair is a legitimate and legal process of improving your creditworthiness. Another myth is that you can’t repair your credit on your own and need to hire a credit repair company. While professional help can be beneficial, many individuals successfully repair their credit through DIY methods.

Separating Fact from Fiction

Credit repair takes time and effort, and there are no quick fixes or overnight solutions. It’s essential to be patient and persistent in your efforts to improve your credit score. Additionally, closing unused credit accounts will not necessarily improve your credit score. In fact, it can sometimes have a negative impact, as it reduces your available credit and may increase your credit utilization ratio.

Understanding the Truth About Credit Repair

The truth about credit repair is that it requires a proactive approach. By reviewing your credit reports, disputing errors, and adopting responsible financial habits, you can gradually improve your credit score over time. It’s important to focus on paying your bills on time, reducing your debt load, and keeping your credit utilization ratio low. These actions can have a positive impact on your creditworthiness.

This image is property of consumer.ftc.gov.

Building Credit from Scratch

If you have little to no credit history, building credit from scratch can be a daunting task. However, there are several strategies you can employ to establish a solid credit foundation.

Establishing Credit History

To establish credit history, start by opening a credit account such as a credit card or a small loan. Payments on these accounts will be reported to the credit bureaus and contribute to your credit score. It’s important to make consistent, on-time payments to demonstrate your creditworthiness.

Using Secured Credit Cards

Secured credit cards are an excellent option for individuals with no credit history or poor credit. These cards require a security deposit that serves as collateral in case of non-payment. By using a secured credit card responsibly, you can build a positive credit history and eventually qualify for an unsecured credit card.

Building Credit with Small Loans

Another strategy for building credit is to take out a small loan, such as a personal loan or a credit-builder loan. These loans are designed specifically to help individuals establish or rebuild credit. Making regular, on-time payments on these loans can demonstrate responsible financial behavior and positively impact your credit score.

Understanding Credit Utilization

Credit utilization refers to the percentage of your available credit that you are currently using. It is an essential factor in your credit score calculation and can significantly impact your creditworthiness.

What is Credit Utilization?

Credit utilization is calculated by dividing your total credit card balances by your total credit limits. For example, if you have a total credit limit of $10,000 and a current balance of $2,000, your credit utilization ratio would be 20%.

Impact of High Credit Utilization

High credit utilization can negatively impact your credit score. Lenders may interpret high utilization as a sign of financial distress or over-reliance on credit. Aim to keep your credit utilization ratio below 30% to maintain a good credit score.

Strategies to Manage Credit Utilization

To manage your credit utilization, consider several strategies. First, make more than the minimum payments each month to reduce your balances faster. Secondly, try to pay off your balances in full each month to avoid accruing interest charges. Lastly, consider requesting a credit limit increase to lower your credit utilization ratio. However, be mindful not to use the increased credit limit as an opportunity to accumulate more debt.

This image is property of images.ctfassets.net.

Dealing with Late Payments

Late payments can have a significant impact on your credit score and overall creditworthiness. Therefore, it’s crucial to avoid late payments whenever possible.

Consequences of Late Payments

Late payments can result in late fees, increased interest rates, and a negative impact on your credit score. Each missed payment remains on your credit report for seven years and can be a red flag to lenders. Late payments can also make it more challenging to secure loans or obtain favorable interest rates in the future.

Tips to Avoid Late Payments

To avoid late payments, consider setting up automatic payments for your bills. This ensures that payments are made on time and can save you from worrying about missing due dates. Another helpful tip is to set up payment reminders, whether it’s through your smartphone’s calendar or email notifications. By staying organized and proactive, you can avoid the consequences of late payments.

Recovering from Late Payments

If you have missed payments in the past, don’t lose hope. Over time, the impact of late payments on your credit score diminishes. Focus on making on-time payments moving forward and consistently practicing responsible financial habits. Over time, you can rebuild your credit and improve your creditworthiness.

Credit Repair vs. Debt Settlement

Credit repair and debt settlement are two different approaches to improve your financial situation. Understanding the differences between these approaches can help you choose the right option for your specific circumstances.

Differences Between Credit Repair and Debt Settlement

Credit repair focuses primarily on improving your credit score and removing errors or inaccuracies from your credit report. It involves reviewing your credit reports, disputing errors, and adopting responsible financial habits. On the other hand, debt settlement involves negotiating with creditors to settle your debts for less than the full amount owed. Debt settlement can be a viable option for individuals struggling with overwhelming debt but may have long-term implications on creditworthiness.

Pros and Cons of Each Approach

The primary advantage of credit repair is that it can have a positive impact on your credit score, enabling you to secure loans and obtain more favorable interest rates. Conversely, debt settlement can provide immediate relief from overwhelming debt but may have a negative impact on your credit score.

Choosing the Right Option for Your Situation

The right option for your situation depends on your specific financial circumstances. If you have significant debt but are still financially stable, credit repair may be the best approach to gradually improve your creditworthiness. However, if you are struggling with unmanageable debt and need immediate relief, debt settlement may be worth considering. It’s crucial to carefully weigh the pros and cons of each approach and consult with a financial advisor or credit counselor to make an informed decision.

This image is property of www.lendingtree.com.

Collections and Charge-offs

Collections and charge-offs are unfavorable financial events that can significantly impact your credit score and creditworthiness. Understanding how to deal with these events is essential for credit repair.

Understanding Collections and Charge-offs

Collections occur when a creditor or debt collector attempts to collect on a debt that you have not paid, typically after a certain period of delinquency. Charge-offs, on the other hand, occur when a creditor writes off your debt as uncollectible. Both collections and charge-offs indicate financial default and can have a significant negative impact on your credit score.

Implications on Credit Score

Collections and charge-offs can have a severe impact on your credit score, often resulting in a significant drop. They serve as red flags to lenders, indicating a lack of financial responsibility and making it challenging to secure future credit.

Strategies to Deal with Collections and Charge-offs

If you have collections or charge-offs on your credit report, it’s important to address them promptly. First, review the details of the debt to ensure its accuracy. If you believe the debt is not valid, you can dispute it with the credit reporting agencies. If the debt is legitimate, consider negotiating a settlement with the creditor or debt collector to pay off the debt for less than the full amount owed. Once the debt is paid, it’s crucial to obtain written verification and request that the collection or charge-off is updated on your credit report.

Hiring Credit Repair Companies

Credit repair companies can be a valuable resource for individuals seeking professional assistance in improving their credit. However, it’s important to carefully consider the pros and cons before making a decision.

Pros and Cons of Hiring Credit Repair Companies

One advantage of hiring a credit repair company is that they have experience and expertise in navigating the credit repair process. They can handle disputes on your behalf, provide guidance and advice, and save you time and effort. However, it’s important to be cautious as not all credit repair companies are reputable. Some may make lofty promises or engage in unethical practices. It’s essential to research and choose a reputable company that has a proven track record of success.

How to Choose a Reputable Company

When choosing a credit repair company, consider several factors. Look for a company that is transparent about its services and fees, provides clear explanations, and has positive customer reviews. Check for any accreditation or affiliations with reputable organizations, such as the Better Business Bureau. Additionally, consider consulting with a financial advisor or credit counselor who can provide recommendations based on your specific needs.

What to Expect from Credit Repair Services

Credit repair services can provide various services, including reviewing your credit reports, disputing errors, and offering guidance on how to improve your credit score. Expect the process to take time, as credit repair is not an overnight fix. A reputable credit repair company will communicate with you regularly, update you on the progress of your case, and educate you on responsible financial habits.

Conclusion

Understanding the basics of credit repair, including your credit score, how it is calculated, and various strategies for improving your creditworthiness, is crucial for your financial success. By taking proactive steps to review your credit reports, dispute errors, adopt responsible financial habits, and seek professional assistance when needed, you can navigate the world of credit repair with confidence. Remember, credit repair is a journey that requires patience and persistence, but the rewards of a healthy credit score are well worth the effort.