So, you’re looking to improve your creditworthiness? Well, guess what? You’re in the right place. In this article, we’re going to delve into the topic of improving your creditworthiness from the perspective of lenders. We’ll uncover the secrets to boosting your credit score, debunk some common myths, and give you practical tips on how to build credit. Trust us, by the end of this article, you’ll have a better understanding of what it takes to be seen as a trustworthy borrower in the eyes of lenders.

Now, I know you’re probably eager to dive right in and start learning all the juicy details, but hold on for just a moment. In the following paragraphs, we’re going to cover a wide range of topics related to credit repair. From understanding the basics of credit scores to dealing with late payments and collections, we’ve got you covered. We’ll also explore the pros and cons of hiring credit repair companies versus taking a DIY approach. So, if you’re ready to take control of your credit and improve your financial future, keep reading. You won’t want to miss what we have in store for you.

This image is property of dn9orhlaqaw0i.cloudfront.net.

Understanding Creditworthiness

Creditworthiness refers to a borrower’s ability to repay a loan or debt. It is a crucial factor that lenders consider when deciding to approve a loan application and determine the interest rate. Understanding creditworthiness is essential for individuals looking to improve their credit scores and secure favorable borrowing terms.

What is creditworthiness?

Creditworthiness is assessed through various factors, including credit history, income, employment stability, and debt-to-income ratio. Lenders use this information to evaluate the likelihood of a borrower repaying their debts on time. A good creditworthiness indicates a higher probability of loan approval, lower interest rates, and more favorable terms.

Importance of creditworthiness

Having a good creditworthiness is crucial for several reasons. Firstly, it enables individuals to secure loans easily and at lower interest rates. This can result in significant savings over time, especially when borrowing for major expenses like buying a home or a car.

Additionally, creditworthiness is essential when it comes to renting an apartment, obtaining insurance, and even getting a job. Landlords, insurance companies, and employers often consider an individual’s creditworthiness as an indicator of their responsibility and trustworthiness.

Factors affecting creditworthiness

Several factors influence an individual’s creditworthiness. One of the primary factors is their credit history, which includes information about their payment history, debt load, and length of credit history. A longer, positive credit history tends to indicate a higher creditworthiness.

Income and employment stability also play a significant role. Lenders want to ensure borrowers have a steady income that can cover their monthly debt obligations. Individuals with consistent employment and higher incomes are considered more creditworthy.

Another factor is the debt-to-income ratio, which measures the proportion of an individual’s monthly income that goes towards debt payments. Lenders prefer borrowers with a lower debt-to-income ratio, as it indicates a greater ability to manage and repay debts.

Basics of Credit Scores

What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness. It is calculated based on the information found in their credit report, such as their payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries.

Credit scores range from 300 to 850, with higher scores indicating better creditworthiness. Different credit bureaus, such as Experian, Equifax, and TransUnion, may use slightly different scoring models, but the FICO Score and VantageScore are the most commonly used.

How credit scores are calculated

Credit scores are calculated using complex algorithms that analyze the information in an individual’s credit report. The specific calculations used by credit scoring models are not publicly disclosed, but the general factors and their importance in determining credit scores are well-known. These factors include:

- Payment history (35%): Timely payment of bills and accounts is a crucial factor in credit scoring.

- Credit utilization (30%): The amount of credit being used in relation to the total credit available.

- Length of credit history (15%): A longer credit history tends to result in higher credit scores.

- Types of credit in use (10%): A diverse credit portfolio, including different types of credit accounts (e.g., credit cards, loans, mortgages), can positively impact a credit score.

- Recent credit inquiries (10%): Recent applications for credit can slightly lower a credit score.

Understanding credit score ranges

Credit scores are typically categorized into different ranges, indicating varying levels of creditworthiness. While specific ranges may vary depending on the credit scoring model used, the following ranges are a general guideline:

- Excellent (800-850): Individuals in this range are likely to qualify for the best interest rates and borrowing terms.

- Very Good (740-799): Borrowers with scores in this range typically have no trouble obtaining loans with favorable terms.

- Good (670-739): This range is considered average, and individuals may qualify for loans but with slightly higher interest rates.

- Fair (580-669): Borrowers in this range may face more difficulties obtaining credit and may be charged higher interest rates.

- Poor (300-579): Individuals with scores in this range may struggle to get approved for loans and may face limited borrowing options.

Understanding credit score ranges is important to gauge one’s creditworthiness and recognize areas for improvement.

Fixing Errors on Your Credit Report

Identifying and disputing errors

Errors on credit reports can negatively impact credit scores and creditworthiness. It is essential to regularly review credit reports for inaccuracies and take the necessary steps to correct them. Common errors include incorrect personal information, outdated accounts, fraudulent activity, and accounts that have been mistakenly reported as delinquent.

To identify errors, individuals should obtain their credit reports from each of the three major credit bureaus (Experian, Equifax, and TransUnion) and review them thoroughly. If any inaccuracies are found, they should be disputed with supporting documentation.

The process of correcting errors

The process of correcting errors on a credit report typically involves notifying the credit bureau about the mistake in writing. The dispute letter should clearly outline the error, provide any supporting documentation, and request its removal or correction. The credit bureau is required to investigate the dispute within 30 days and provide a response.

If the credit bureau verifies the error, it must update the credit report accordingly. The individual should also request a revised credit report to ensure the changes have been made. In some cases, additional steps may be necessary, such as contacting the creditor directly or seeking legal assistance.

Monitoring your credit report

Regularly monitoring credit reports is essential for staying on top of one’s creditworthiness. Checking credit reports allows individuals to identify errors, detect potential fraudulent activity, and ensure their credit information is accurate.

Many online platforms offer credit monitoring services that provide real-time updates on changes to credit reports, such as new inquiries, accounts, or negative information. Some services may also provide access to credit scores, credit education resources, and identity theft protection.

Monitoring credit reports can help individuals spot and address any issues promptly, preventing them from negatively affecting creditworthiness.

Debunking Credit Repair Myths

Common misconceptions about credit repair

Credit repair is often misunderstood, leading to many misconceptions about its effectiveness and legality. Common misconceptions include:

- Credit repair can magically erase negative information from a credit report.

- Only credit repair companies can fix credit.

- Credit repair is illegal or unethical.

Separating fact from fiction

While it’s true that credit repair cannot simply erase accurate negative information from a credit report, it can help individuals address errors or outdated information. Additionally, individuals can successfully repair their credit without the assistance of credit repair companies. The process involves understanding credit reports, disputing errors, and implementing proactive credit management strategies.

Credit repair is legal in most countries, including the United States, provided that individuals follow the correct procedures and do not engage in fraudulent activities, such as identity theft or creating false identities.

Misleading practices to avoid

Some credit repair companies may promise quick fixes or claim to have insider connections that can improve credit scores substantially. However, these practices can be misleading and may even be illegal.

It is important to be cautious when considering credit repair services and research reputable companies thoroughly. Legitimate credit repair companies will provide transparent information about their services and fees, and they will not make false promises or guarantees.

Individuals can take control of their credit repair journey by understanding the process, disputing errors on their own, and implementing responsible credit management habits.

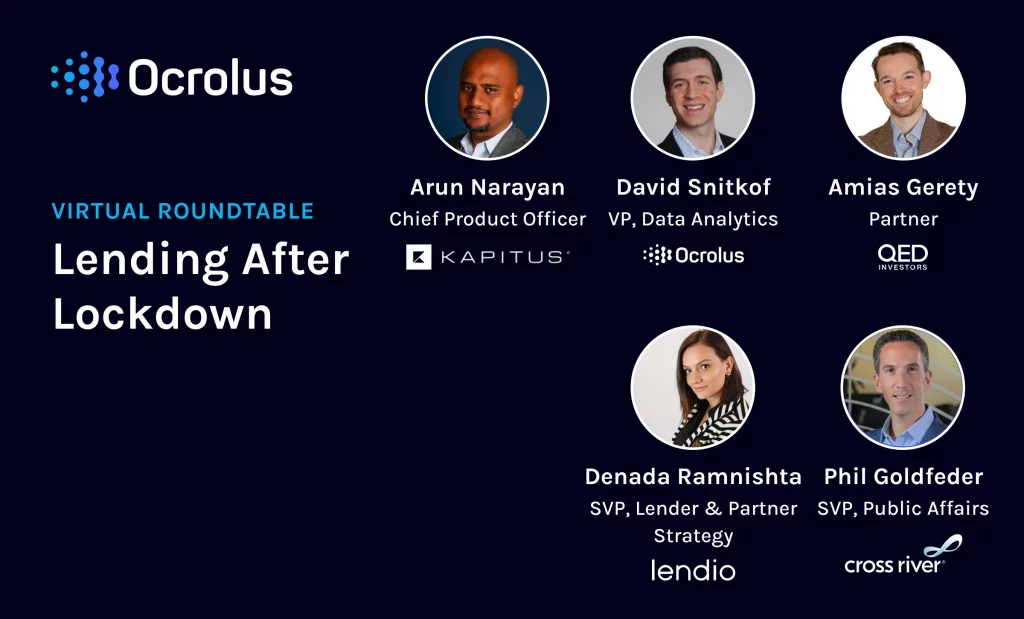

This image is property of www.ocrolus.com.

Building Credit from Scratch

Establishing a credit history

Building credit from scratch can seem challenging, but it is a necessary step for individuals who have little or no credit history. There are several strategies to help establish a credit history:

- Apply for a secured credit card: Secured credit cards require a cash deposit as collateral, making them more accessible for individuals with limited or no credit history.

- Become an authorized user: Being added as an authorized user on a family member’s or friend’s credit card can help establish credit history as long as the primary cardholder has good credit habits.

- Apply for a credit builder loan: Credit builder loans are specifically designed to help individuals build credit. These loans typically require individuals to make regular payments, and the funds are held in a savings account until the loan is repaid.

Building positive credit habits

Building credit is not just about obtaining credit; it also involves developing responsible credit habits. Some key habits to cultivate include:

- Pay bills on time: Consistently paying bills on time is one of the most important factors affecting credit scores. Setting up automatic payments or reminders can help ensure timely payments.

- Keep credit utilization low: Credit utilization refers to the amount of credit being used compared to the total available credit. Keeping credit utilization below 30% is recommended to maintain good credit scores.

- Avoid applying for too much credit: Applying for multiple credit accounts within a short period can negatively impact credit scores. It’s important to be selective and only apply for credit when necessary.

Secured credit cards and credit-builder loans

Secured credit cards and credit-builder loans are useful tools for building credit. Secured credit cards require a cash deposit as collateral, which serves as the credit limit. Making regular, on-time payments on a secured credit card can help establish a positive credit history.

Credit-builder loans, on the other hand, are loans specifically designed to help individuals build credit. The funds borrowed are typically held in a savings account until the loan is repaid. Making timely payments on a credit-builder loan can demonstrate creditworthiness and improve credit scores.

Building credit from scratch may take time, but with consistent effort and responsible credit habits, individuals can establish a solid credit foundation.

Understanding Credit Utilization

What is credit utilization?

Credit utilization refers to the percentage of available credit that an individual is currently using. It is a significant factor in determining credit scores and creditworthiness. A high credit utilization ratio can negatively impact credit scores, while a low ratio can help improve them.

How it affects your creditworthiness

Credit utilization plays a crucial role in determining creditworthiness. Lenders prefer borrowers with low credit utilization ratios as it demonstrates responsible credit management. High credit utilization can indicate financial stress and a higher risk of default, which may lead to lower credit scores and limited borrowing options.

Strategies for managing credit utilization

To manage credit utilization effectively and improve creditworthiness, individuals can consider the following strategies:

- Pay down debts: Paying down debts can help lower credit utilization ratios. This can be achieved by making regular payments and allocating extra funds towards paying off balances.

- Increase credit limits: Requesting a credit limit increase can help lower credit utilization ratios. However, it is essential to use the increased limit responsibly and avoid accumulating additional debt.

- Pay multiple times a month: Making multiple payments throughout the month can keep credit card balances low and decrease credit utilization ratios.

- Consider using multiple credit cards: Spreading purchases across multiple credit cards can help keep individual credit utilization ratios lower. However, it is crucial to use credit cards responsibly and avoid carrying large balances.

By managing credit utilization effectively, individuals can demonstrate their creditworthiness to lenders and improve their chances of obtaining favorable borrowing terms.

This image is property of www.investopedia.com.

Addressing Late Payments

Consequences of late payments

Late payments can have significant consequences on credit scores and creditworthiness. When payments are not made on time, creditors may report the late payment to credit bureaus, which can result in negative marks on credit reports. These negative marks can lower credit scores and make it more challenging to secure loans at favorable interest rates.

Additionally, late payments may lead to penalty fees, increased interest rates, and even legal action in extreme cases. It is crucial to address late payments promptly to minimize their impact.

Tips for avoiding late payments

To avoid late payments and their negative consequences, consider the following tips:

- Set up automatic payments: Configuring automatic payments for bills and credit card payments can ensure timely payments and reduce the risk of forgetfulness.

- Create a payment calendar: Maintaining a calendar or using reminder apps can help individuals stay organized and aware of upcoming payment dates.

- Set reminders: Enable reminders on smartphones or use email alerts to receive notifications ahead of payment due dates.

- Create an emergency fund: Having an emergency fund can help individuals manage unexpected expenses and avoid using credit to cover them.

Recovering from past late payments

Recovering from past late payments requires a combination of proactive steps and time. Implementing the following strategies can help individuals recover from late payments:

- Make payments on time moving forward: Consistently making on-time payments moving forward is crucial for demonstrating improved creditworthiness.

- Contact creditors: In some cases, individuals may be able to negotiate with creditors to remove late payment records from their credit reports. Explaining any extenuating circumstances or setting up a payment plan may help.

- Practice responsible credit management: Developing positive credit habits, such as keeping credit utilization low and regularly monitoring credit reports, can help individuals rebuild their creditworthiness over time.

It is important to remember that rebuilding credit after late payments takes time and patience. By implementing responsible credit management practices and learning from past mistakes, individuals can ultimately improve their creditworthiness.

Credit Repair vs. Debt Settlement

Differences between credit repair and debt settlement

Credit repair and debt settlement are two different approaches to addressing credit issues, and they serve different purposes:

- Credit repair focuses on identifying and correcting errors on credit reports, improving credit scores, and building positive credit habits. It primarily aims to improve creditworthiness and create a solid foundation for future borrowing.

- Debt settlement, on the other hand, involves negotiating with creditors to settle outstanding debts for less than the total amount owed. It is typically pursued by individuals struggling with overwhelming debt and aims to alleviate financial burdens.

The pros and cons of each approach

Credit repair and debt settlement each have their pros and cons that individuals should consider based on their specific circumstances:

Credit Repair:

- Pros:

- Can help improve credit scores and creditworthiness.

- Empowers individuals to take control of their credit journey.

- Encourages responsible credit management and financial habits.

- Cons:

- Requires time and effort to review credit reports, dispute errors, and implement strategies for improvement.

- May not be effective for individuals with significant outstanding debts.

Debt Settlement:

- Pros:

- Can help individuals struggling with overwhelming debt reduce their overall financial burden.

- May provide relief from creditor harassment and collections activities.

- Cons:

- Can negatively impact credit scores and creditworthiness.

- May result in tax consequences if forgiven debts are considered taxable income.

- Can incur fees and requires careful negotiation with creditors.

Choosing the best option for your situation

Choosing between credit repair and debt settlement depends on individual circumstances, financial goals, and the extent of outstanding debts. If individuals have minor credit issues, such as errors on their credit reports or a lack of positive credit history, credit repair may be the most suitable approach.

On the other hand, individuals struggling with overwhelming debt and facing financial hardship may find debt settlement to be a more viable option. It is crucial to thoroughly assess the advantages and disadvantages of each approach, seek professional advice when needed, and choose the option that aligns best with long-term financial goals.

This image is property of brill.com.

Hiring Credit Repair Companies

Researching reputable credit repair companies

When considering hiring a credit repair company, it is essential to research reputable and legitimate organizations. Unfortunately, some dishonest companies engage in illegal practices and make unrealistic promises. To avoid falling victim to fraudulent companies, consider the following steps:

- Verify legitimacy: Check if the credit repair company is registered with the appropriate authorities and has the necessary licenses to operate.

- Review customer reviews: Look for reviews and testimonials from previous customers to gain insights into their experiences with the company.

- Check for accreditations: Look for certifications or accreditations from reputable organizations, such as the Better Business Bureau or the National Association of Credit Services Organizations (NACSO).

- Consider their services and fees: Understand the specific services provided by the credit repair company and ensure their fees are transparent and reasonable.

Understanding their services and fees

Credit repair companies provide various services to assist individuals in improving their creditworthiness. These services may include:

- Reviewing credit reports for errors and inaccuracies.

- Preparing and submitting dispute letters to credit bureaus.

- Offering guidance and education on credit management and building positive credit habits.

- Monitoring credit reports for changes and updates.

The fees charged by credit repair companies can vary based on the nature and scope of services provided. Common fee structures include monthly fees or fees per credit bureau inquiry.

It is essential to thoroughly understand the services offered and their corresponding fees before engaging with a credit repair company. Carefully reviewing the terms and conditions of any agreement is crucial to ensure a clear understanding of the services provided and the associated costs.

Evaluating the effectiveness of credit repair services

While credit repair services can be beneficial for individuals looking to improve their creditworthiness, it is important to set realistic expectations. Credit repair cannot guarantee the removal of accurate negative information from credit reports, and it requires active participation from individuals.

To evaluate the effectiveness of credit repair services, individuals should monitor their credit reports regularly and ensure that any errors or inaccuracies are being addressed. They should also keep track of any changes in their credit scores and assess whether the strategies and actions recommended by the credit repair company are producing the desired results.

Ultimately, individuals should take an active role in their credit repair journey and collaborate with credit repair companies to ensure they are working towards shared goals.

Conclusion

Improving creditworthiness is a crucial step towards financial security and achieving one’s goals. By understanding what creditworthiness entails, individuals can make informed decisions that positively impact their credit scores and borrowing prospects.

Through credit repair, individuals can address errors on their credit reports and implement strategies to enhance their creditworthiness. Building credit from scratch requires patience and responsible credit habits, but it can pave the way for future financial success.

Managing credit utilization, addressing late payments, and choosing between credit repair and debt settlement are essential considerations for those aiming to improve their creditworthiness. Hiring reputable credit repair companies can provide guidance and support in navigating the credit repair process effectively.

Ultimately, individuals must take control of their financial future by understanding their creditworthiness, implementing strategies for improvement, and maintaining responsible credit management habits. By doing so, they can unlock opportunities and achieve their financial goals with confidence.

This image is property of www.nationalbusinesscapital.com.