Imperial Ethics credit repair provides a comprehensive and professional solution for individuals looking to improve their credit scores. By employing a systematic approach and ethical practices, Imperial Ethics Credit Repair aims to assist clients in navigating the complex world of credit repair. With their expertise and commitment to excellence, they work diligently to identify and resolve credit-related issues, ultimately helping their clients achieve financial stability and increased borrowing power.

This image is property of m.bbb.org.

Understanding the Basics of Credit History

What is a Credit History?

Credit history refers to a detailed record of an individual’s borrowing and repayment activities. It contains information about the individual’s credit accounts, including credit cards, loans, mortgages, and other debts. This information is compiled by credit reporting agencies based on data provided by lenders and other financial institutions. A credit history is used by lenders to assess the creditworthiness of an individual and determine their eligibility for loans, credit cards, or other forms of credit.

How does a bad credit score impact you?

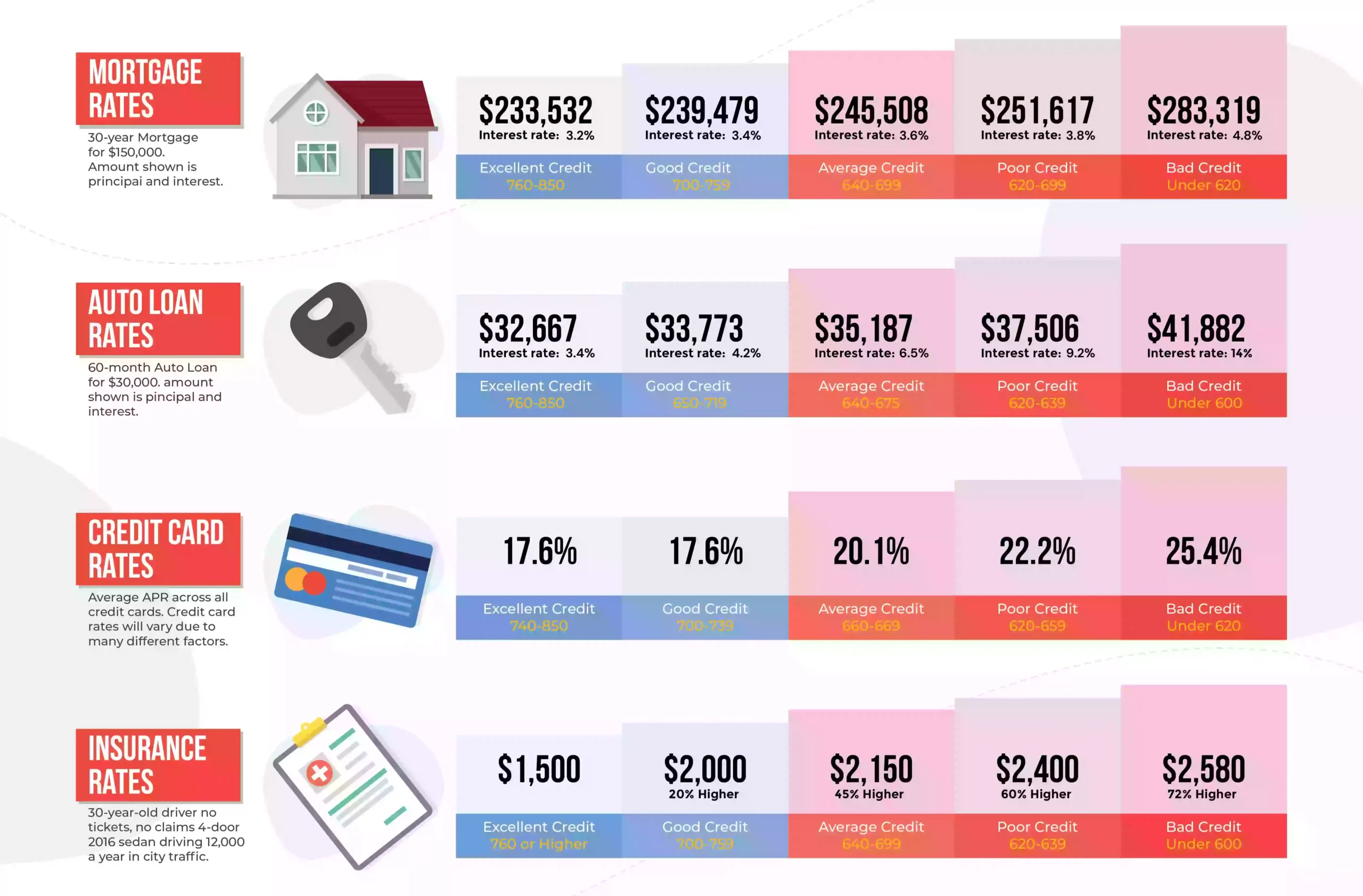

A bad credit score can have significant implications for an individual’s financial well-being. It can make it difficult to obtain credit, as lenders may view the individual as a high-risk borrower. This can result in higher interest rates, lower credit limits, or outright denial of credit applications. Furthermore, a bad credit score can make it challenging to rent an apartment, get approved for a mortgage, or even secure employment. Employers may conduct credit checks as part of the hiring process, and a poor credit history could raise concerns about the individual’s financial responsibility and trustworthiness.

Key factors affecting your credit score

Several factors contribute to the determination of an individual’s credit score. These include payment history, which is the most significant factor and measures an individual’s track record of making timely payments. The amount owed, or credit utilization ratio, is another crucial factor that considers the total outstanding debt compared to the available credit limit. The length of credit history, types of credit used, and new credit applications also impact the credit score. By understanding these factors, individuals can take proactive steps to improve their credit and maintain a healthy credit score.

The Importance of Credit Repair

Defining credit repair

Credit repair refers to the process of improving an individual’s creditworthiness by addressing and rectifying negative items on their credit report. This involves identifying errors, disputing inaccurate information, and working towards the removal or correction of such items. The goal of credit repair is to increase an individual’s credit score, thereby improving their financial opportunities and access to credit. While credit repair can be done independently, many individuals choose to enlist the help of credit repair service providers like Imperial Ethics to navigate the complex process more effectively.

Reasons why credit repair is essential

Credit repair is crucial for individuals seeking to improve their financial standing. A higher credit score opens doors to better interest rates and terms on loans, credit cards, and mortgages. This can result in substantial savings over time. Additionally, credit repair can help individuals qualify for credit they would otherwise be denied, enabling them to pursue their goals and aspirations. Moreover, an improved credit score can enhance an individual’s overall financial security and peace of mind, granting them the ability to handle unforeseen circumstances more confidently.

Potential outcomes of ignoring negative credit

Ignoring negative credit can have severe consequences on an individual’s financial well-being. Negative items on a credit report can lower an individual’s credit score, making it harder to obtain credit or secure favorable borrowing terms. As a result, individuals may find themselves trapped in a cycle of high-interest debt or limited financial opportunities. Additionally, negative credit information can remain on a credit report for several years, continuing to impact creditworthiness even if the individual’s financial situation has improved. Therefore, addressing negative credit through credit repair is essential to mitigate these long-term effects.

Introducing Imperial Ethics

The background of Imperial Ethics

Imperial Ethics is a leading credit repair service provider with a reputation for excellence and professionalism. With years of experience in the industry, they have developed a deep understanding of credit reporting and scoring systems. The company is committed to helping individuals overcome credit challenges and achieve their financial goals. Imperial Ethics takes pride in its ethical approach and dedication to delivering personalized solutions based on individual circumstances. Their emphasis on professionalism, transparency, and customer satisfaction has earned them the trust and loyalty of countless clients.

Service offerings of Imperial Ethics

Imperial Ethics offers a comprehensive range of credit repair services tailored to meet the unique needs of each client. Their services include a thorough evaluation of an individual’s credit history, identification of errors or inaccuracies, and guidance on dispute resolutions. The company also provides assistance in developing a customized credit repair strategy to address negative items and improve the client’s credit score. Throughout the process, Imperial Ethics offers ongoing monitoring of credit progress, ensuring that individuals stay informed and empowered as they navigate the journey towards credit repair.

Why choose Imperial Ethics for credit repair?

There are several compelling reasons why individuals should consider choosing Imperial Ethics for their credit repair needs. Firstly, the company’s extensive experience and expertise in the field instill confidence in their ability to navigate the complexities of credit reporting and repair. Their ethical approach ensures that clients receive fair and honest guidance throughout the entire process. Additionally, Imperial Ethics takes a personalized approach, recognizing that each client’s situation is unique and tailoring their services accordingly. This commitment to individualized attention sets Imperial Ethics apart from other credit repair providers and contributes to their track record of success.

Imperial Ethics Approach to Credit Repair

Initial credit evaluation

Imperial Ethics begins the credit repair process with a comprehensive evaluation of an individual’s credit history. This evaluation involves a thorough review of the client’s credit reports from the major credit bureaus. By analyzing these reports, Imperial Ethics can identify any errors, inaccuracies, or negative items that may be adversely impacting the client’s credit score. This evaluation provides a solid foundation for developing an effective credit repair strategy.

Creating a repair strategy

Based on the findings of the initial credit evaluation, Imperial Ethics collaborates with the client to create a tailored credit repair strategy. This strategy outlines the specific steps and actions required to address negative items and improve the client’s credit score. Imperial Ethics leverages their deep understanding of credit reporting systems and dispute procedures to navigate the complexities of the credit repair process. The company ensures that the strategy aligns with the client’s goals and objectives, promoting a sense of ownership and empowerment throughout the journey.

Monitoring credit progress

Throughout the credit repair process, Imperial Ethics places a strong emphasis on monitoring and tracking the client’s credit progress. They provide regular updates on any changes to the individual’s credit reports and scores, ensuring that the client remains informed and engaged. This monitoring allows Imperial Ethics to evaluate the effectiveness of the credit repair strategy and make necessary adjustments if required. By keeping a close eye on credit progress, Imperial Ethics ensures that clients are on the right track towards achieving their desired financial outcomes.

This image is property of s3-media0.fl.yelpcdn.com.

Navigating the Credit Repair Process with Imperial Ethics

Step-by-step process breakdown

The credit repair process with Imperial Ethics can be broken down into several key steps. The first step involves the initial credit evaluation, where the company analyzes the client’s credit reports to identify any errors or negative items. Once these items are identified, Imperial Ethics assists the client in disputing them with the credit bureaus. This involves submitting formal disputes, providing supporting documentation, and following up until the disputes are resolved. Throughout this process, Imperial Ethics maintains open lines of communication with the credit bureaus, ensuring that the client’s concerns are addressed and resolved promptly and efficiently.

Duration expectation for credit repair

The duration of the credit repair process can vary depending on factors such as the complexity of the client’s credit history and the responsiveness of the credit bureaus. Generally, credit repair can take several months to a year or longer. It is important to note that credit repair is not an overnight solution, and patience is required. However, by enlisting the support of Imperial Ethics and following their expert guidance, individuals can improve their credit score over time and achieve their financial goals.

The role of Imperial Ethics in facilitating the process

Imperial Ethics plays a vital role in facilitating the credit repair process. Their expertise and knowledge of credit reporting systems and dispute procedures enable them to effectively navigate the complexities of credit repair on behalf of their clients. They act as a trusted advisor and advocate, ensuring that the client’s rights are protected and their concerns addressed. Imperial Ethics takes on the administrative tasks associated with credit repair, freeing up the client’s time and energy to focus on other important aspects of their financial well-being.

Comparing Imperial Ethics to Other Credit Repair Providers

Key points of differentiation for Imperial Ethics

Imperial Ethics stands out from other credit repair providers in several key areas. Firstly, their ethical approach sets them apart, as they prioritize honesty, transparency, and fairness in all their dealings with clients. Additionally, their deep experience and knowledge of credit reporting systems give them a competitive edge in navigating the credit repair process effectively. Moreover, Imperial Ethics’ personalized approach ensures that each client receives tailored solutions based on their unique circumstances, promoting a sense of trust and confidence.

Analysis of major competitors in the credit repair industry

When comparing Imperial Ethics to other credit repair providers, it is important to consider the competitive landscape. Several companies operate in the credit repair industry, offering similar services to individuals seeking to improve their credit. However, not all providers possess the same level of expertise, experience, or commitment to ethical practices. Some may engage in questionable tactics or make false promises, which can deceive and harm clients. Therefore, it is essential to thoroughly research and consider the reputation, track record, and testimonials of credit repair providers before making a choice.

Understanding market position of Imperial Ethics

Within the credit repair industry, Imperial Ethics has established a strong market position as a trusted and reputable service provider. Their commitment to ethical practices and personalized solutions has earned them a loyal customer base and positive word-of-mouth recommendations. Imperial Ethics is recognized for their expertise and professionalism, positioning them as a reliable option for individuals seeking effective credit repair solutions. Their market position reflects their dedication to customer satisfaction and their ability to deliver results in a competitive industry.

This image is property of s3-media0.fl.yelpcdn.com.

Understanding the Costs of Credit Repair with Imperial Ethics

Overview of the pricing structure

Imperial Ethics offers transparent and competitive pricing for their credit repair services. The company provides a clear breakdown of their fees, ensuring that clients have a complete understanding of the costs involved. While pricing may vary depending on the complexity of the individual’s credit repair needs, Imperial Ethics strives to offer fair and reasonable rates that align with the value they provide. By providing upfront information on pricing, Imperial Ethics fosters trust and transparency in their client relationships.

Cost comparison with other providers

When considering the costs of credit repair, it is important to compare the pricing of different providers. While the fees charged by credit repair companies can vary, it is essential to consider the value and expertise offered by each provider. While some providers may offer lower prices, they may lack the experience or dedication to deliver effective results. Therefore, clients should carefully evaluate the overall value proposition of each provider rather than solely focusing on the upfront costs.

Discussion on the value proposition of Imperial Ethics

Imperial Ethics offers a strong value proposition to individuals seeking credit repair services. Their expertise and experience in the industry, coupled with their ethical approach, provide clients with a sense of confidence and trust. By enlisting the services of Imperial Ethics, individuals gain access to personalized solutions, ongoing monitoring, and support throughout the credit repair process. This value proposition extends beyond the upfront cost and encompasses the potential long-term savings, improved financial opportunities, and peace of mind that can be achieved through effective credit repair.

Case Studies of Successful Credit Repair with Imperial Ethics

Detailed case study of credit repair with Imperial Ethics

To illustrate the effectiveness of Imperial Ethics’ credit repair services, a detailed case study can be examined. In this case study, a client with a low credit score sought assistance from Imperial Ethics. The company conducted a thorough evaluation of the client’s credit history and identified several errors and inaccuracies. Imperial Ethics worked diligently to dispute these items, providing the necessary documentation and following up with the credit bureaus. Over time, the client’s credit score improved significantly, granting them access to better borrowing terms and increased financial opportunities.

Analyzing success rate of Imperial Ethics

Imperial Ethics has a proven track record of success when it comes to credit repair. Their expertise and commitment to excellence have resulted in numerous success stories for their clients. By resolving errors and inaccuracies on credit reports, Imperial Ethics has helped individuals improve their credit scores and achieve their financial goals. While success rates can vary depending on individual circumstances, Imperial Ethics’ extensive experience, personalized approach, and ethical practices contribute to their high success rate in credit repair.

Client testimonials and their experiences

The experiences of past clients provide valuable insights into the effectiveness of Imperial Ethics’ credit repair services. Numerous testimonials attest to the positive outcomes achieved through their partnership with Imperial Ethics. Clients have highlighted the professionalism, expertise, and personalized attention they received, which exceeded their expectations. These testimonials serve as a testament to the trustworthiness and ability of Imperial Ethics to deliver results in the realm of credit repair.

This image is property of imperialethics.com.

Common Challenges and How Imperial Ethics Addresses Them

Identifying common credit repair challenges

Credit repair can present various challenges for individuals seeking to improve their credit score. Some common challenges include identifying errors on credit reports, navigating the dispute process with credit bureaus, and understanding complex credit reporting systems. Additionally, individuals may face challenges related to time constraints, lack of knowledge, or difficulties in gathering required documentation. It is important to recognize these challenges to effectively address them in the credit repair process.

Solutions provided by Imperial Ethics for these challenges

Imperial Ethics offers a range of solutions to help individuals overcome common credit repair challenges. Their initial credit evaluation ensures that errors and inaccuracies are identified promptly, enabling them to be addressed in the dispute process. The company’s expertise in navigating credit reporting systems and dispute procedures allows them to guide clients through the complexities of credit repair. Imperial Ethics also provides ongoing support and monitoring, reducing the burden on individuals and ensuring timely progress towards credit improvement.

Success ratio in overcoming these challenges

Imperial Ethics has a high success ratio in helping clients overcome common credit repair challenges. By leveraging their experience and expertise, they are equipped to handle complex credit situations and address errors or inaccuracies on credit reports effectively. Through their proactive and personalized approach, Imperial Ethics empowers clients to overcome obstacles and achieve their credit repair goals. The company’s track record of success in overcoming these challenges demonstrates their commitment to providing effective solutions to their clients.

Closing Thoughts on Choosing Imperial Ethics for Credit Repair

Final thoughts on the effectiveness of Imperial Ethics

Imperial Ethics has proven to be a reliable and effective partner for individuals seeking credit repair. With their ethical approach, extensive experience, and track record of success, they have earned the trust and loyalty of numerous clients. By enlisting the services of Imperial Ethics, individuals can benefit from a personalized credit repair strategy, ongoing monitoring, and support throughout their credit repair journey. Imperial Ethics’ commitment to excellence and their dedication to delivering results make them a highly effective choice for credit repair.

Recommendations for people considering credit repair

For individuals considering credit repair, it is essential to conduct thorough research and carefully evaluate service providers. It is crucial to choose a company with a strong reputation, expertise in the field, and an ethical approach to credit repair. Imperial Ethics aligns with these criteria and is a recommended choice for individuals seeking effective credit repair solutions. By choosing Imperial Ethics, individuals can navigate the credit repair process with confidence, knowing that they have a trustworthy partner committed to their success.

The future of credit repair with continuous support from Imperial Ethics

With continuous support from Imperial Ethics, the future of credit repair looks promising for individuals seeking to improve their creditworthiness. By leveraging their expertise and guidance, individuals can overcome credit challenges and achieve their financial goals. Imperial Ethics’ commitment to ongoing monitoring and support ensures that individuals remain empowered and well-informed throughout the credit repair process. With their ethical approach and dedication to customer satisfaction, Imperial Ethics is well-positioned to provide long-term support and guidance for individuals on their journey towards credit repair.

This image is property of s3-media0.fl.yelpcdn.com.