So you’ve found yourself in a financial predicament with bad credit personal loans, but don’t worry, there’s a way out. In this article, we’ll explore practical strategies to help improve your situation. Whether you’re looking to boost your credit score, negotiate better loan terms, or simply gain more control over your finances, we’ve got you covered. Let’s discover the steps you can take to turn things around and secure a more promising financial future.

This image is property of www.finder.com.

Understanding Bad Credit Personal Loans

What are bad credit personal loans?

Bad credit personal loans are financial products designed for individuals with low credit scores or a history of financial difficulties. These loans provide an opportunity for people with bad credit to access the funds they need, whether it’s for debt consolidation, medical expenses, home repairs, or other personal needs. Unlike traditional loans, bad credit personal loans consider factors beyond credit scores, such as income, employment history, and overall financial situation.

How do bad credit personal loans work?

Bad credit personal loans work similarly to other types of personal loans. After assessing your financial situation and creditworthiness, lenders will determine the loan amount, interest rate, and repayment terms. These loans can be secured or unsecured, meaning you might need collateral or a cosigner to qualify. Once approved, you’ll receive the funds and repay the loan in regular installments over a specified period of time.

Types of bad credit personal loans

There are different types of bad credit personal loans available, each catering to specific needs and circumstances:

-

Installment loans: These loans provide a lump sum upfront, which is then repaid over a fixed term with fixed monthly payments. Installment loans are often secured by collateral or require a cosigner.

-

Payday loans: Payday loans are short-term, high-interest loans that are typically repaid on your next payday. However, they often come with exorbitant interest rates and fees, making them a less favorable option.

-

Credit-builder loans: Designed specifically for improving credit, credit-builder loans are small loans that help you establish a positive payment history. The loan amount is held in an account and released to you once the loan is repaid in full.

Benefits of bad credit personal loans

Despite their reputation, bad credit personal loans offer several advantages:

-

Accessibility: Bad credit personal loans provide an opportunity for individuals with poor credit to access the funds they need when other options have been closed off.

-

Flexible use of funds: You can utilize bad credit personal loans for various purposes, including debt consolidation, home improvement, medical bills, or unexpected expenses.

-

Improving credit score: Consistently making timely loan repayments can positively impact your credit score, helping you in the long run when applying for other financial products.

Assessing Your Current Financial Situation

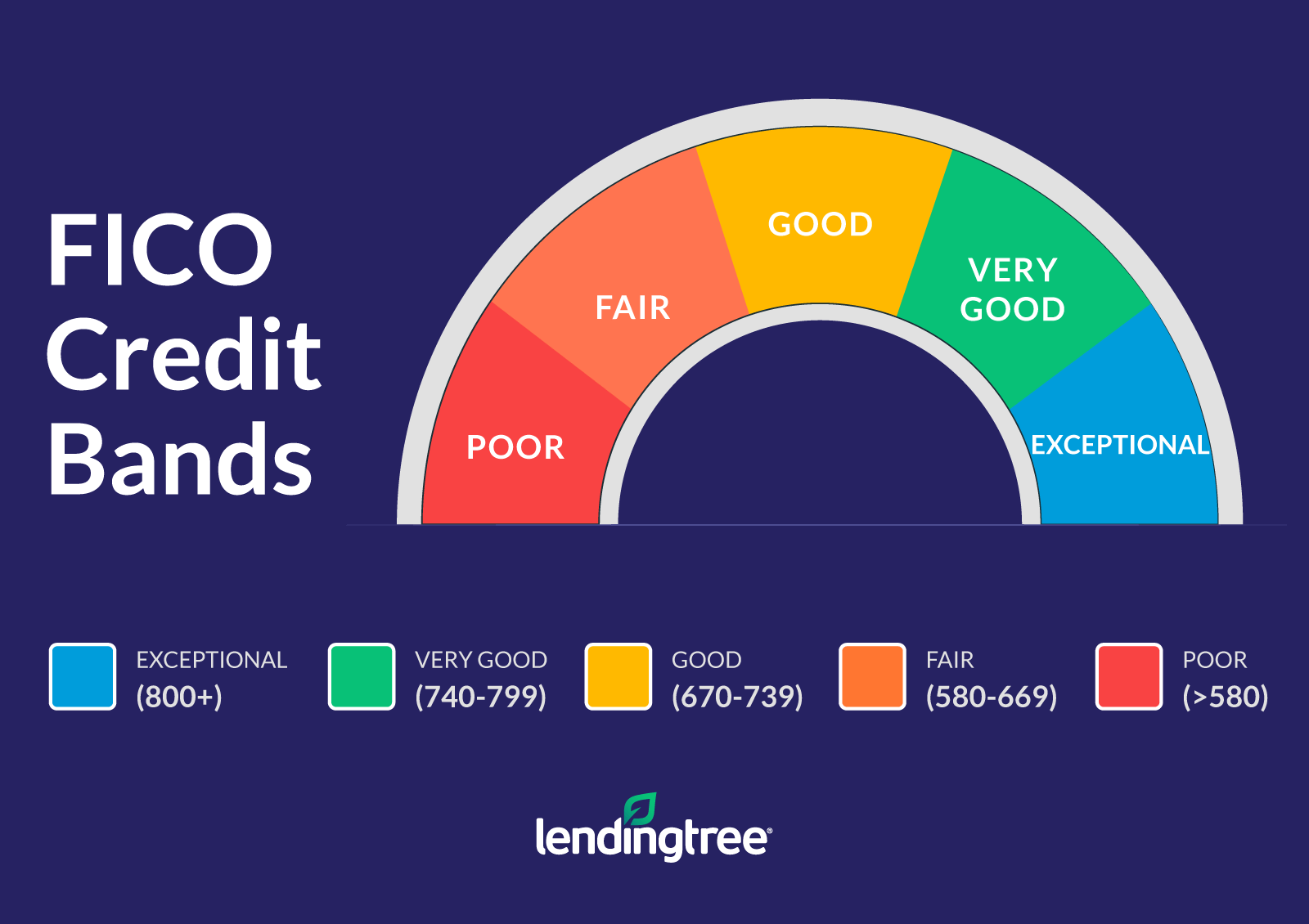

Determining your credit score

Before applying for a bad credit personal loan, it’s important to know where you stand financially. Start by determining your credit score, which is a numerical representation of your creditworthiness. You can access your credit score through credit reporting agencies or online platforms. Understanding your credit score will give you an idea of the loan eligibility and interest rates you can expect.

Reviewing your credit report

In addition to your credit score, it’s crucial to review your credit report. It contains detailed information about your credit history, including credit accounts, payment history, and any negative marks. Carefully go through the report to ensure its accuracy and address any errors or discrepancies. Understanding your credit report will help you identify areas for improvement and guide your financial decisions.

Evaluating your income and expenses

Assessing your income and expenses is vital to determine how much you can afford to borrow and comfortably repay. Calculate your monthly income from all sources, including salaries, bonuses, freelance work, and investments. Then, list all your fixed and variable expenses, such as rent or mortgage payments, utility bills, groceries, transportation, and entertainment. This evaluation will help you establish a clear picture of your financial circumstances.

Calculating your debt-to-income ratio

Your debt-to-income (DTI) ratio is a crucial measure used by lenders to assess your ability to repay a loan. It is calculated by dividing your total monthly debts by your gross monthly income, expressed as a percentage. Most lenders prefer a DTI ratio of 40% or lower. To calculate your DTI ratio, sum up all your monthly debt payments, including credit cards, loans, and mortgage or rent payments. Then, divide that total by your monthly gross income and multiply by 100. The result is your DTI ratio.

Creating a Realistic Budget

Listing your income sources

To create a realistic budget, start by listing all your income sources. This includes your salary, freelance work, side gigs, investments, and any other sources of income. Be as thorough as possible to ensure an accurate representation of your available funds.

Identifying necessary expenses

Next, identify your necessary expenses that must be paid each month. These include rent or mortgage payments, utility bills, groceries, transportation costs, insurance premiums, minimum debt payments, and other essential expenses. By listing these expenses, you’ll have a clear understanding of your financial obligations.

Reducing discretionary spending

To free up more funds for loan repayment, it’s important to identify areas where you can reduce discretionary spending. This includes items such as dining out, entertainment, travel, and non-essential shopping. Be mindful of your spending habits and consider making adjustments to prioritize your financial goals.

Allocating funds for debt repayment

Once you have a clear overview of your income and expenses, allocate a portion of your funds specifically for debt repayment. Determine an amount that is feasible for you to pay off each month while still covering your necessary expenses. Having a designated portion of your income for debt repayment will help you stay on track and make consistent progress in reducing your outstanding debts.

Building a Positive Credit History

Paying bills on time

One of the most crucial factors in building a positive credit history is paying your bills on time. Late payments can negatively impact your credit score and make it more difficult to obtain credit in the future. Set up reminders or automatic payments to ensure you never miss a due date.

Reducing outstanding debt

High levels of outstanding debt can significantly affect your credit score and financial health. Make a plan to reduce your debt by paying more than the minimum payment each month or exploring debt consolidation options. By gradually reducing your outstanding debt, you will improve your credit utilization ratio and demonstrate responsible financial behavior.

Avoiding new credit applications

While it may be tempting to apply for new credit, doing so when you have bad credit can further damage your credit score. The multiple inquiries and new accounts can lower your credit score and indicate financial instability. Focus on improving your current credit situation before considering new credit applications.

Regularly checking your credit report

Regularly monitoring your credit report is essential to understand your progress in building a positive credit history. Look for any errors, inaccuracies, or potential signs of identity theft. By staying vigilant and taking prompt action, you can protect your credit and ensure its accuracy.

This image is property of www.lendingtree.com.

Exploring Debt Consolidation Options

Consolidating multiple debts into one

Debt consolidation is a strategy that allows individuals with multiple debts to combine them into a single loan. This simplifies repayment by having only one monthly payment and potentially reduces your interest rate or fees. Debt consolidation loans can be an effective tool when managing multiple high-interest debts.

Using home equity loans

If you own a home and have built up equity, you may qualify for a home equity loan or a home equity line of credit (HELOC). These loans use your home as collateral, allowing you to borrow a larger sum of money at a lower interest rate. However, be aware that this option puts your home at risk in case of default.

Considering balance transfer credit cards

Balance transfer credit cards are another option for consolidating debt. With these cards, you can transfer outstanding balances from high-interest credit cards to a new card with a low or 0% introductory APR. This can save you money on interest payments, but read the terms carefully, as there might be fees or higher rates once the introductory period ends.

Seeking assistance from credit counseling agencies

Credit counseling agencies can provide valuable guidance and support when dealing with multiple debts. They can help you create a budget, provide debt management plans, negotiate with creditors, and offer financial education resources. Be sure to research and choose a reputable agency to ensure you receive legitimate assistance.

Securing a Cosigner or Collateral

Understanding the role of a cosigner

A cosigner is someone with good credit and stable income who agrees to take joint responsibility for the loan. Having a cosigner can increase your chances of approval and secure better loan terms. However, it’s essential to communicate openly with your cosigner about the loan, as any missed payments or defaults will also negatively affect their credit.

Finding a reliable cosigner

When seeking a cosigner, choose someone who trusts and believes in your commitment to repaying the loan. They should have good credit, a stable income, and a clear understanding of their responsibilities as a cosigner. It’s crucial to maintain open communication and transparency throughout the loan process to preserve the relationship.

Exploring collateral-backed loans

Collateral-backed loans are secured loans that require you to pledge an asset, such as a car, home, or personal savings account, as collateral. By providing collateral, you reduce the risk for lenders, which may result in lower interest rates and higher loan amounts. However, carefully evaluate the risks involved, as defaulting on the loan may result in the loss of the pledged asset.

Assessing the risks involved

Securing a loan with a cosigner or collateral carries risks for both parties involved. If you default on the loan, your cosigner’s credit will be negatively affected, and they will be responsible for repayment. With collateral-backed loans, you risk losing the pledged asset if you’re unable to repay the loan. Assess your financial capabilities and carefully consider the potential consequences before pursuing these options.

This image is property of dn9orhlaqaw0i.cloudfront.net.

Comparing Different Lenders

Researching reputable lenders

When looking for a bad credit personal loan, it’s essential to research and compare various lenders. Look for reputable lenders with positive customer reviews, fair lending practices, and transparent terms. Consider factors such as loan options, interest rates, fees, and repayment terms. Take your time to ensure you choose a lender that best suits your needs and financial situation.

Comparing interest rates and fees

Different lenders may offer different interest rates and fees for bad credit personal loans. Higher interest rates are common for borrowers with poor credit, but it’s still important to compare rates among lenders to find the most favorable terms. Similarly, watch out for any hidden fees that could significantly impact the total cost of the loan.

Reading customer reviews

Customer reviews provide valuable insights into the lending experience and customer service provided by each lender. Read reviews from reputable sources or online platforms to get a sense of other borrowers’ experiences. Pay attention to common themes and complaints, and consider these factors when making your decision.

Considering flexible repayment options

While it’s important to ensure you can make your loan repayments, it’s also beneficial to choose a lender that offers flexible repayment options. Look for lenders that provide the possibility of changing payment dates, adjusting repayment terms, or offering temporary payment suspensions in case of financial hardship. These features can help you manage your loan more effectively.

Understanding Loan Terms and Conditions

Reading the fine print

Before signing any loan agreement, carefully read through the terms and conditions. Pay close attention to the repayment schedule, interest rates, fees, penalties, and any additional costs. Understanding all the details of the loan will help you avoid any surprises or potential misunderstandings in the future.

Analyzing interest rates and APR

Interest rates and annual percentage rates (APR) are critical factors to consider when comparing loan options. The interest rate determines the cost of borrowing, while the APR includes both the interest rate and any additional fees or charges. Comparing APRs will give you a more accurate picture of the total cost of the loan.

Checking for hidden fees

Some lenders may have hidden fees that are not immediately apparent. These could include origination fees, prepayment penalties, or fees for late or missed payments. Be sure to ask the lender about all potential fees and read the loan agreement thoroughly to ensure you’re aware of any additional costs.

Understanding repayment terms

The repayment terms outline the schedule and amount of each loan repayment. It’s crucial to understand the frequency of payments, the due dates, and the consequences of missing a payment. Additionally, be aware of any grace periods, late payment fees, or options for early repayment. Clear comprehension of the repayment terms will help you meet your obligations responsibly.

This image is property of cm-cdn.creditmantri.com.

Applying for a Bad Credit Personal Loan

Gathering necessary documents

Before applying for a bad credit personal loan, gather the necessary documents to streamline the application process. Commonly requested documents include proof of identity, proof of residence, proof of income (such as pay stubs or income tax returns), and bank statements. Prepare these documents in advance to avoid delays in the application process.

Completing the application accurately

Accurate completion of the loan application is crucial to increase your chances of approval. Make sure to provide correct personal and financial information, double-checking for any errors or omissions. Providing false information can not only result in rejection but also have legal consequences.

Submitting the application online or in-person

Most lenders offer the convenience of applying for a bad credit personal loan online. This saves time and allows for a quicker review process. However, if you prefer a personal touch, you can also apply in-person at a physical branch. Choose the application method that suits your preferences and needs.

Following up on the application status

After submitting your loan application, it’s essential to follow up on the application status. Some lenders provide a tracking system online, while others may require contacting customer service. Stay proactive and inquire about any additional documents or information that might be needed. This will help ensure a smooth and efficient loan approval process.

Managing Your Loan Responsibly

Making timely repayments

Once approved for a bad credit personal loan, it’s crucial to make timely repayments as scheduled. Set up automatic payments or mark due dates on your calendar to avoid missing payments. Making consistent, on-time payments will not only improve your credit score but also demonstrate responsible financial behavior to future lenders.

Avoiding default or late payments

Defaulting on a loan or making late payments can have severe consequences, including additional fees, increased interest rates, damage to your credit score, and potential legal actions. If you foresee any difficulties in making a payment, contact your lender as soon as possible to discuss potential solutions.

Tracking your payment schedule

Maintaining a clear overview of your loan repayment schedule is essential to manage your loan responsibly. Create a spreadsheet or use a budgeting app to track each payment made and monitor your progress. This will help you stay organized and ensure you don’t miss any payments.

Seeking help if you face difficulties

If you face financial difficulties that make it challenging to meet your loan obligations, don’t hesitate to seek help. Contact your lender to discuss potential options, such as refinancing, adjusting repayment terms, or seeking financial counseling. Taking proactive steps will help you avoid further financial hardship and maintain control of your overall financial well-being.

By understanding bad credit personal loans, assessing your financial situation, creating a realistic budget, building a positive credit history, exploring debt consolidation options, securing a cosigner or collateral, comparing different lenders, understanding loan terms and conditions, applying effectively, and managing your loan responsibly, you can navigate the world of bad credit personal loans with confidence and work towards improving your financial situation. Remember to stay proactive, dedicated, and adaptable, as financial success is attainable with the right strategies and mindset.

This image is property of www.maxloans.co.nz.