In this article, you will learn some valuable tips on how to improve your credit score in Fort Wayne, IN. Having a good credit score is crucial when it comes to obtaining loans, credit cards, or even renting an apartment. By following these strategies, you can take control of your credit and work towards improving your overall financial situation.

Firstly, it’s important to regularly check your credit report for any errors or discrepancies. You can request a free copy of your credit report from each of the three major credit bureaus, and review it carefully for any inaccuracies. If you notice any errors, such as incorrect late payments or accounts that don’t belong to you, be sure to dispute them with the credit bureau. Resolving these errors can significantly improve your credit score. Additionally, it’s essential to make your payments on time, as payment history accounts for a significant portion of your credit score. Set up automatic payments or reminders to ensure you never miss a payment, and consider paying more than the minimum required amount if possible. By consistently making on-time payments, you can demonstrate responsible financial behavior and boost your credit score over time.

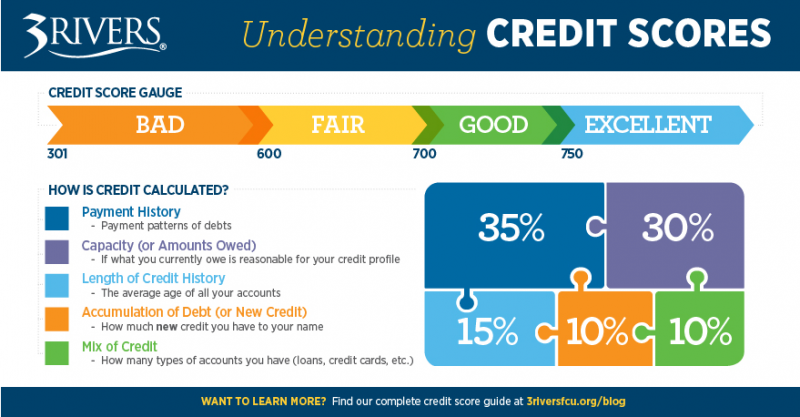

This image is property of www.3riversfcu.org.

Understanding Credit Scores

What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness. It is a three-digit number that is calculated based on various factors, such as payment history, credit utilization ratio, length of credit history, types of credit used, and new credit inquiries. Credit scores are used by lenders, landlords, and insurance companies to assess the risk associated with lending money or providing services to an individual.

Importance of a good credit score

Having a good credit score is crucial because it affects your ability to obtain credit and the terms and interest rates that lenders will offer you. A high credit score indicates that you are a responsible borrower who is likely to repay your debts on time. This can result in lower interest rates, higher credit limits, and better terms for loans and credit cards. It can also make it easier to rent an apartment, get favorable insurance rates, or even secure a job.

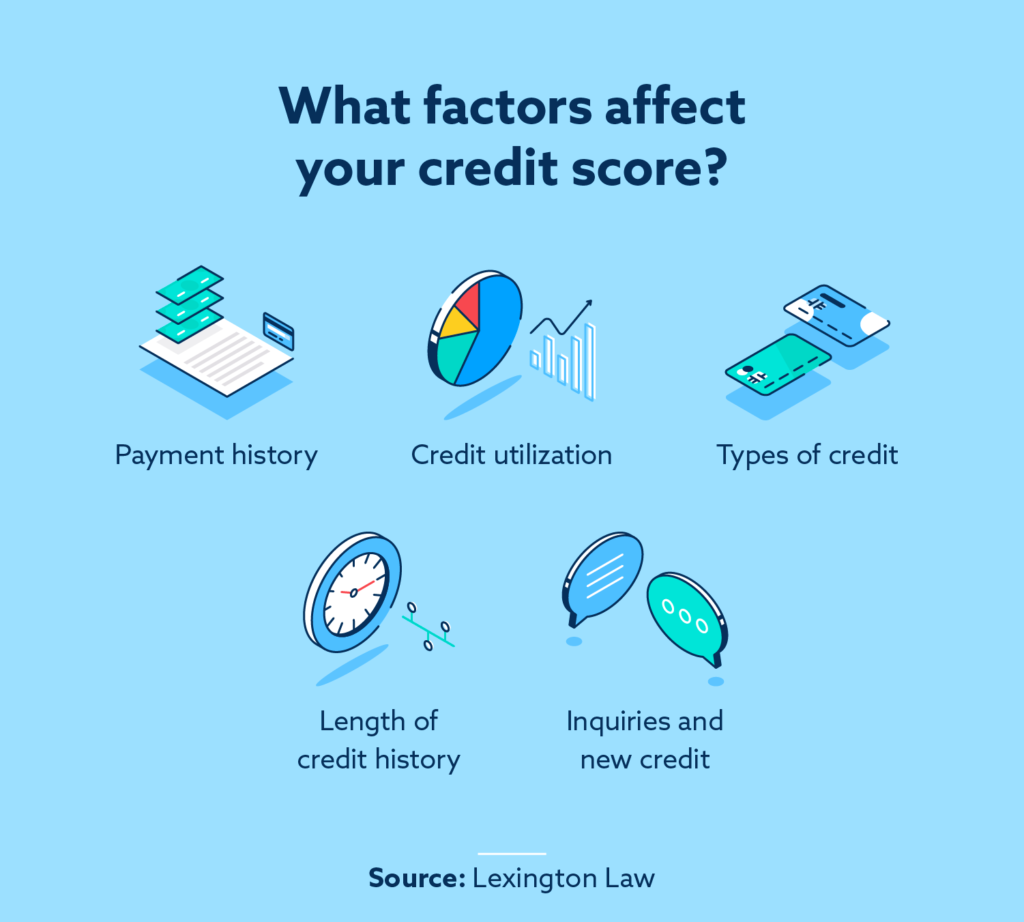

Factors that Impact Credit Scores

Payment history

Your payment history has the most significant impact on your credit score. It accounts for approximately 35% of your total score. Paying your bills on time and in full demonstrates financial responsibility and reliability, while late or missed payments can negatively impact your credit score.

Credit utilization ratio

The credit utilization ratio is the amount of credit you are currently using compared to your total available credit. It accounts for around 30% of your credit score. Keeping your credit utilization ratio below 30% shows responsible credit management and can improve your score.

Length of credit history

The length of your credit history contributes to around 15% of your credit score. Lenders generally prefer to see a longer credit history as it provides a more comprehensive picture of your borrowing habits. It is important to establish credit early and maintain accounts over time to build a positive credit history.

Types of credit used

The types of credit you have (e.g., credit cards, loans, mortgage) impact approximately 10% of your credit score. Having a diverse mix of credit types can demonstrate your ability to manage different forms of credit responsibly.

New credit inquiries

When you apply for new credit, such as a loan or credit card, a hard inquiry is made on your credit report. This can temporarily lower your credit score. Multiple inquiries within a short period can be seen as a red flag by lenders. It is best to limit new credit inquiries and only apply for credit when necessary.

Obtaining a Credit Report

Requesting a free credit report

You have the right to request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. To obtain your credit report, visit AnnualCreditReport.com or call 1-877-322-8228. It is important to review your credit report regularly to ensure its accuracy.

Reviewing the credit report

Upon receiving your credit report, carefully review it for any errors or inconsistencies. Look for incorrect personal information, unfamiliar accounts, late payments that you believe were made on time, and any other discrepancies. Correcting errors on your credit report is essential to maintain an accurate credit profile.

Identifying and Correcting Errors

Identifying inaccuracies

If you identify any errors or inaccuracies on your credit report, gather any supporting documentation that proves the information is incorrect. This can include payment receipts, correspondence with creditors, or any other relevant documents. Keep detailed records of your disputes and communications with the credit bureaus.

Disputing errors with credit bureaus

To dispute errors on your credit report, send a written dispute letter to the credit bureau(s) that issued the report. Clearly explain the errors you have identified and provide copies of the supporting documentation. The credit bureaus are required to investigate your dispute within 30 days and provide a response.

Following up on disputes

It is essential to follow up on your disputes with the credit bureaus to ensure they are resolved. If the investigation confirms the errors, the credit bureaus must correct them and provide you with an updated credit report. If the errors persist, you may consider seeking legal assistance or filing a complaint with regulatory agencies.

This image is property of www.lexingtonlaw.com.

Managing Debt Responsibly

Creating a budget

Developing a budget is crucial for managing your finances effectively. Determine your monthly income and expenses to assess how much you can allocate towards paying off debts. Creating a budget allows you to track your spending, prioritize debt payments, and avoid unnecessary expenses.

Paying bills on time

Paying your bills on time is one of the most impactful ways to improve and maintain a good credit score. Set up automatic payments or reminders to ensure you never miss a payment. Late payments can remain on your credit report for up to seven years and significantly lower your credit score.

Reducing credit card balances

High credit card balances can negatively impact your credit score. Aim to keep your credit card balances below 30% of your available credit. Paying down your balances consistently can improve your credit utilization ratio and demonstrate responsible credit management.

Avoiding new debt

Taking on new debt can increase your risk of financial instability, especially if you are already struggling to manage your existing debts. Avoid unnecessary purchases and focus on paying off your debts before considering new credit.

Building a Positive Credit History

Using credit responsibly

Responsible credit usage entails using credit for necessary purchases, staying within your means, and paying off balances in full and on time. Using credit responsibly demonstrates to lenders that you are a reliable borrower and can positively impact your credit score.

Diversifying credit accounts

Having a diverse mix of credit accounts can potentially boost your credit score. This includes credit cards, loans, and mortgages. However, it is important to only take on credit that you can manage effectively and avoid opening multiple accounts solely for the purpose of diversifying your credit mix.

Keeping accounts open and active

Closing old credit accounts can impact your credit history and credit utilization ratio. Instead, keep these accounts open and use them occasionally to demonstrate ongoing credit activity. However, ensure you are using these accounts responsibly and paying off any balances promptly.

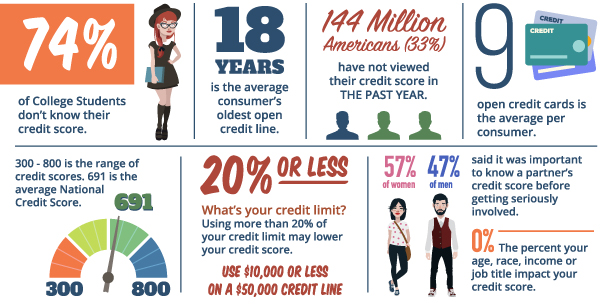

This image is property of fortwayne.vandykmortgage.com.

Negotiating with Creditors

Communicating with creditors

If you are struggling to make payments, it is important to communicate with your creditors. Explain your financial situation and explore options for repayment, such as lowering interest rates, extending payment terms, or setting up a payment plan. Building a positive relationship with your creditors can help you find mutually beneficial solutions.

Negotiating payment terms

When negotiating payment terms, it is important to be realistic and propose a plan that you can maintain. Consider seeking professional guidance from credit counseling agencies or reputable professionals to assist you in negotiating with creditors.

Setting up payment plans

If you reach an agreement with your creditors, ensure the payment plan is documented in writing. Make payments consistently and timely to demonstrate your commitment to honoring the agreement. Successfully adhering to a payment plan can improve your credit history and increase your creditworthiness over time.

Seeking Professional Help

Consulting credit counseling agencies

Credit counseling agencies offer financial education, budgeting assistance, and debt management plans. They can help you navigate your financial situation, negotiate with creditors, and develop strategies for improving your credit score. Research and select reputable credit counseling agencies in your area.

Hiring a credit repair company

Credit repair companies promise to fix your credit and improve your credit score. However, be cautious when considering these services, as some companies may engage in unethical practices or charge exorbitant fees. Research reputable credit repair companies, read reviews, and understand the services they provide before hiring them.

Researching reputable professionals

If you decide to seek professional assistance, it is important to research and verify the credentials of any professionals you consider working with. Look for certifications, licenses, and affiliations with reputable organizations. Be cautious of scams and companies that make unrealistic promises.

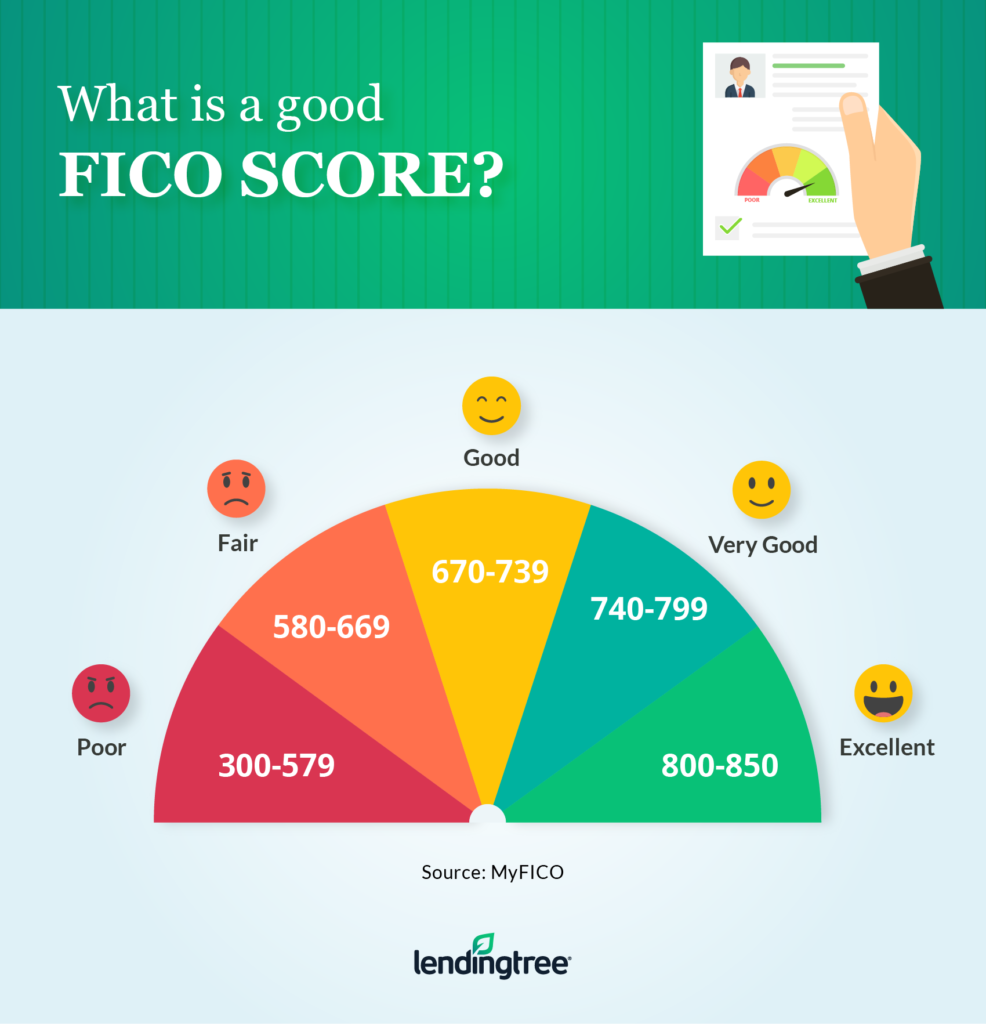

This image is property of blog.121fcu.org.

Monitoring Progress

Tracking credit score changes

Monitor your credit score regularly to track your progress. Many credit card companies and financial institutions offer free credit score monitoring tools. By keeping an eye on your credit score, you can identify areas of improvement and celebrate milestones as your score increases.

Reviewing credit reports regularly

In addition to monitoring your credit score, regularly review your credit reports for any changes or inaccuracies. Ensuring the accuracy of your credit reports is essential for maintaining a positive credit profile. By reviewing your reports, you can identify potential errors or signs of identity theft.

Conclusion

Improving your credit score takes time and effort, but it is well worth the investment. By understanding the factors that impact your credit score and taking proactive steps to manage your credit responsibly, you can gradually improve your creditworthiness in Fort Wayne, IN. Remember to review your credit reports regularly, address any errors or inaccuracies promptly, and seek professional help when necessary. With persistence and patience, you can achieve a higher credit score and enjoy the financial benefits that come with it.

This image is property of www.lendingtree.com.