In this video titled “How to Get Your Credit Card Debt Forgiven with a 1099C Cancellation of Debt from Creditor,” presented by The Credit Repair Shop, you’ll learn valuable information on how to potentially eliminate your credit card debt. Stephen A Williams, the president and founder of Creditrepairshop.com, shares his solution to tackling the overwhelming burden of credit card debt. With the average American consumer carrying $8,000 to $30,000 of credit card debt, Williams aims to offer a solution through a 1099-C cancellation of debt. By contacting the hardship department of your credit card companies and providing detailed financial information, you may have a chance of having your debt forgiven. However, it’s important to note that any forgiven debt will be added to your income for tax purposes. If you’re seeking help with credit repair and credit reports/scores, Williams suggests visiting the Creditrepairshop.com website. So, join Stephen A Williams as he guides you through the steps to potentially eliminate your credit card debt and take control of your financial future.

In this informative and eye-opening video presentation, Stephen A Williams, the president and founder of the Creditrepairshop.com, addresses the prevalent issue of credit card debt in America. With the average American carrying a staggering $8,000 to $30,000 of credit card debt, Williams reveals a potential solution through a 1099-C cancellation of debt. By reaching out to the hardship department of your credit card companies and crafting a detailed hardship letter, you may have the opportunity to have your debt forgiven. However, it’s crucial to be aware that any forgiven debt will be counted as taxable income. Williams recommends visiting the Creditrepairshop.com website for assistance with credit repair, obtaining credit reports, and scores. Don’t miss out on this invaluable advice that could potentially help you free yourself from the weight of credit card debt and regain control of your financial well-being.

Overview of Credit Card Debt and the 1099C Cancellation of Debt

Credit card debt is a widespread issue in America, affecting millions of individuals. With the convenience of credit cards, it is easy for people to accumulate debt without realizing the long-term consequences. The average amount of credit card debt carried by consumers has been steadily increasing over the years, reaching alarming levels. As people struggle to repay their debts and face financial hardships, they may find themselves exploring options for debt relief.

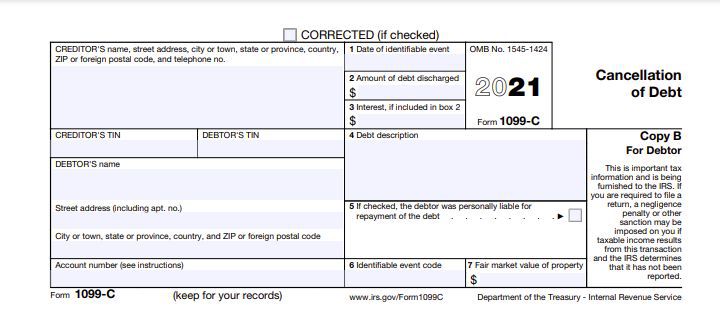

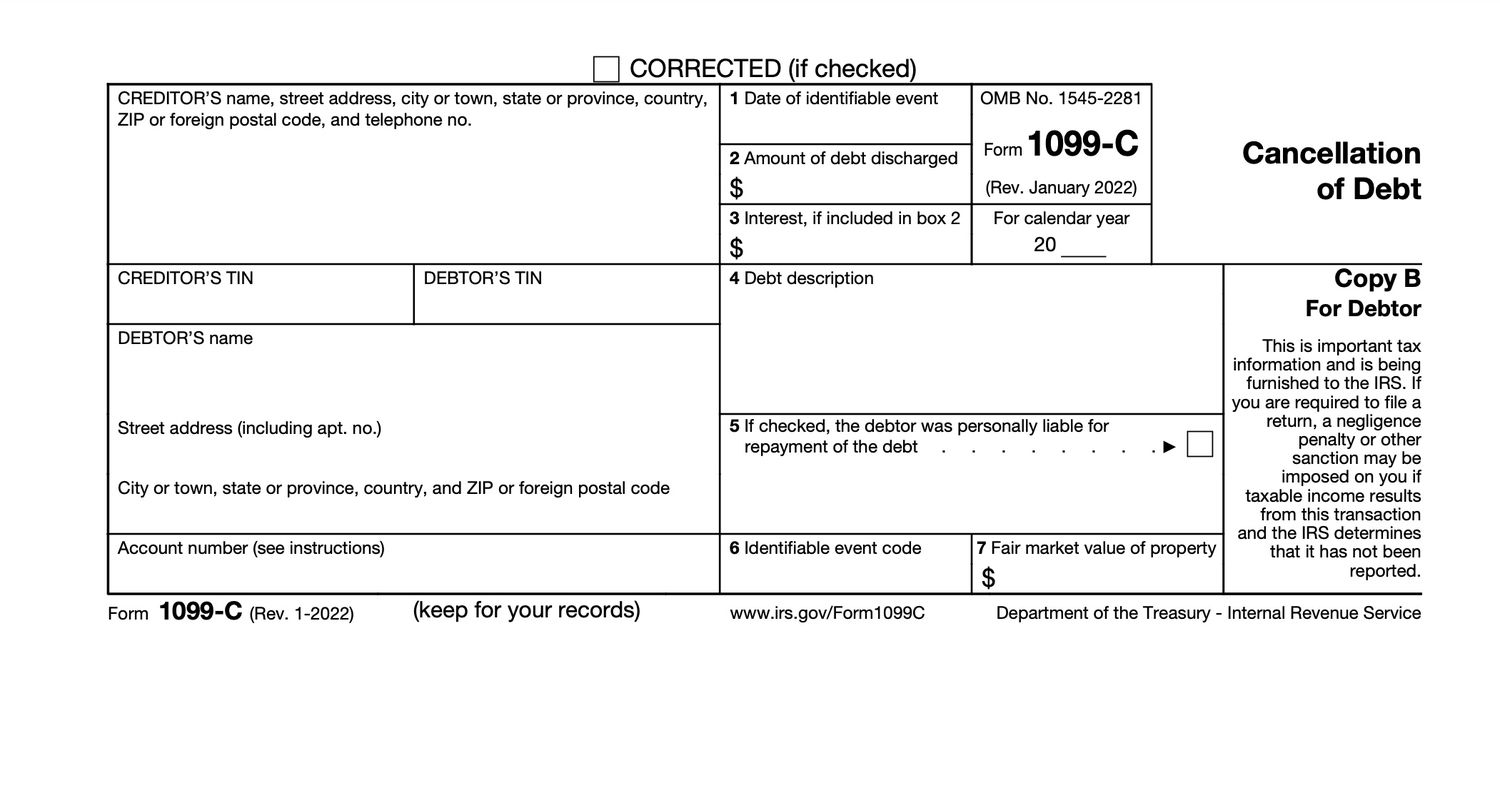

One avenue for debt relief is the 1099C cancellation of debt. This is a legal process that allows creditors to cancel a portion of a consumer’s outstanding debt if they can prove they are facing financial hardship. While this may provide some relief, it is important to understand the process and potential consequences before pursuing this avenue.

Understanding the Process

If you find yourself in a situation where credit card debt has become overwhelming, it is essential to take action. One of the first steps is to contact the hardship department of your credit card company. These departments are dedicated to helping customers in financial distress and can provide information on the available options.

When reaching out to the hardship department, it is crucial to have all your financial information ready. This includes gathering detailed information about your income, expenses, assets, and liabilities. It is important to provide accurate and updated information to present a clear picture of your financial situation.

After gathering all the necessary financial information, you will need to write a hardship letter to explain your situation in detail. This letter will serve as a formal request to the credit card company to consider your case for debt cancellation.

Contacting the Hardship Department

Reaching out to the hardship department is a crucial step in navigating your credit card debt. These departments are equipped to assist customers who are facing financial difficulties and can provide valuable information on hardship programs offered by the credit card companies.

To ensure a successful contact, it is essential to find the correct contact information for the hardship department. This information can usually be found on the credit card company’s website or by calling their customer service line. It may take some time and effort to locate the correct department, but it is worth it to reach the right people who can assist you.

Once you have reached the hardship department, it is important to explain your financial situation clearly and accurately. Be prepared to provide information about your income, expenses, assets, and liabilities. The more detailed and transparent you are about your financial difficulties, the better chance you have of receiving assistance.

Gathering Detailed Financial Information

When reaching out to the hardship department, it is crucial to have all your financial information organized and readily available. This will not only help you provide accurate information but also make the process smoother and more efficient.

Start by understanding what financial information is necessary for the credit card company to assess your situation. This may include recent pay stubs, bank statements, tax returns, and any other official documents that reflect your income and expenses. Collecting these documents in advance will save you time and allow you to provide accurate and up-to-date information.

Organize the information in a clear and systematic way to make it easy for reference. Use folders, spreadsheets, or any other method that suits you best. The goal is to present a comprehensive and organized overview of your financial situation to the credit card company.

Writing a Hardship Letter

The hardship letter is an essential component of the debt cancellation process. It is your opportunity to share your financial difficulties, explain the reasons behind your situation, and request the creditor’s consideration for debt cancellation.

When composing your hardship letter, it is essential to keep a few tips in mind. First, be honest and transparent about your financial situation. Clearly state the challenges you are facing and how they have impacted your ability to repay your debts. Second, include detailed financial information to support your claims. This includes providing accurate figures for your income, expenses, assets, and liabilities. Finally, explain the reasons behind your financial situation. Whether it’s job loss, medical expenses, or other unforeseen circumstances, make sure to convey the reasons that have led to your financial distress.

The Potential Benefits and Consequences

Successfully obtaining debt forgiveness through the 1099C cancellation of debt can have significant benefits for individuals struggling with credit card debt. It provides a path to alleviate the burden of excessive debt and start fresh financially. However, it is essential to understand the potential consequences as well.

One potential benefit is the elimination of a portion of your debt. If the credit card company approves your hardship request, they may cancel a portion of your outstanding debt, reducing the overall burden on your finances.

However, it is important to note that the amount of forgiven debt may be considered as income for tax purposes. This means that you may have to report the forgiven debt as part of your income when filing your tax returns. This can potentially result in a higher tax liability, which should be considered when exploring debt cancellation options.

To navigate the potential benefits and consequences effectively, it is advisable to consult a professional, such as an accountant or legal advisor. They can provide guidance and assistance specific to your financial situation and help you make informed decisions.

Seeking Help from Creditrepairshop.com

Creditrepairshop.com is a valuable resource for individuals looking for assistance with credit repair. They offer a range of services designed to help individuals recover from financial difficulties and improve their credit scores.

As part of their services, Creditrepairshop.com provides access to credit reports and scores. This allows individuals to monitor their credit history, identify potential errors or discrepancies, and take the necessary steps to address them. By having a clear understanding of their credit status, individuals can work towards improving their scores and overall financial well-being.

Creditrepairshop.com also offers guidance and assistance throughout the credit repair process. Their team of professionals can help you understand the steps involved in repairing your credit, offer personalized advice based on your situation, and provide ongoing support as you navigate your financial journey.

Conclusion

Understanding the process of obtaining credit card debt forgiveness through the 1099C cancellation of debt is crucial for individuals facing financial hardship. By contacting the hardship department, gathering detailed financial information, and writing a hardship letter, individuals can present their case for debt cancellation effectively.

However, it is important to consider the potential benefits and consequences of debt forgiveness. While it may provide relief from excessive debt, it may also have tax implications that should be taken into account. Seeking professional advice from accountants or legal advisors is advisable to make informed decisions.

In addition, utilizing resources like Creditrepairshop.com can provide valuable assistance throughout the credit repair journey. Accessing credit reports and scores, as well as receiving guidance and support, can help individuals take control of their financial situation and work towards a brighter future. Remember, you are not alone, and there are resources and professionals available to help you on your path to financial stability.

If you want to get your credit card debt forgiven with a 1099C cancellation of debt from your creditor, you may find the following resources helpful:

- Stop Debt Collectors with these 3 Letters: You can click here to access these letters.

- Letters Made for You to Creditors / Debt Collectors: To get letters customized for you, click here.

- See Your Current FICO Scores: You can click here to view the scores that lenders see to determine your creditworthiness.

- Free Statute of Limitation Letter, Statute of Limitations Letter, and Debt Validation Letter: You can access these letters by clicking here.

- Stress-Free Longer Life Audio: For a stress-free longer life audio, click here.

- Credit Coaching Services: If you need guaranteed financing with a primary tradeline added, you can check out the credit coaching services by clicking here.

- Free Debt Validation Letter: Access a free debt validation letter by visiting this link.

- Getting Sued in Court – Need Help: If you’re facing a lawsuit and need assistance, click here.

- Learn How to Defer Your Monthly Payments: Find out how to defer your monthly payments by clicking here.

- Need Your Credit Reports and Scores: If you require your credit reports and scores, click here.

- Help Repairing Your Credit: For assistance with credit repair, you can click here.

- Increase Your Credit Scores by 50 to 150 Points in 20-30 Days: To learn how to boost your credit scores, click here.

- 3 Things You Should Know About Credit Repair and Increasing Scores: Click here to find out three important things about credit repair and increasing scores.

- Get the T-Shirt: If you’re interested in getting a T-shirt, you can check it out here.

- Credit Card Offers: To see credit card offers, visit this link.

Please note that all the information provided in this channel should not be considered as legal or accounting advice. It is purely for informational purposes. If you require accounting or legal advice, it is recommended to consult with a competent professional in your area.