In this article, we will discuss how long it usually takes for improvements to be visible in your credit score. We will explore factors that can affect the timeline, such as the type of negative information on your credit report and the steps you take to improve your credit. By the end of this article, you will have a better understanding of the time frame you can expect when working towards a better credit score. Improving your credit score is a process that requires time and patience. It is important to understand the various factors that affect your credit score in order to take the necessary steps towards improvement. In this article, we will discuss the factors that influence your credit score as well as provide insights on how long it may take to see noticeable improvements.

This image is property of www.creditsesame.com.

Factors Affecting Credit Score Improvement

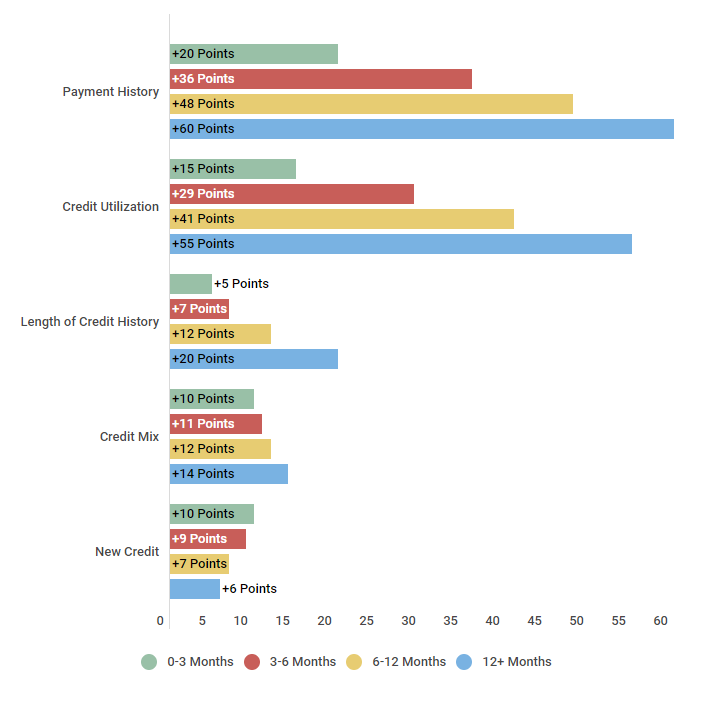

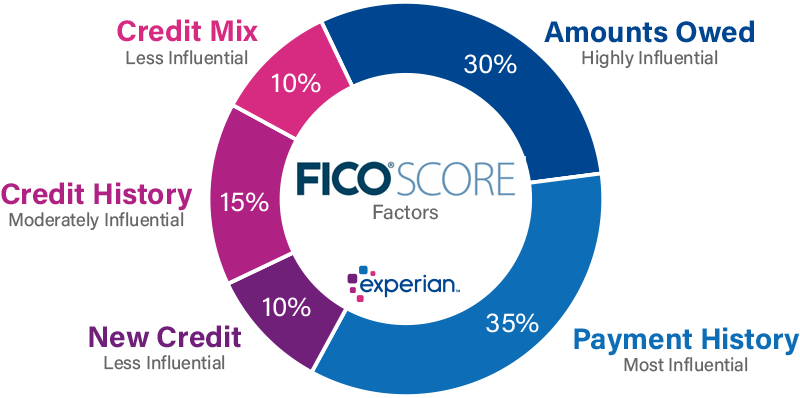

When it comes to credit score improvement, there are several key factors that play a significant role. These factors include payment history, credit utilization ratio, length of credit history, types of credit, and new credit inquiries. Let’s take a closer look at each one.

Payment History

Your payment history is one of the most important factors that lenders consider when evaluating your creditworthiness. It provides insight into your ability to manage your debts responsibly. Late payments, defaults, and bankruptcies can have a negative impact on your credit score. To improve your payment history, it is crucial to make timely payments and ensure that all your outstanding debts are settled.

Credit Utilization Ratio

The credit utilization ratio refers to the amount of credit you are currently using compared to the total credit available to you. A high credit utilization ratio can negatively impact your credit score, as it suggests that you may be relying too heavily on credit. To improve your credit utilization ratio, it is advisable to keep your balances low and avoid maxing out your credit cards.

Length of Credit History

The length of your credit history is another important factor that affects your credit score. Generally, a longer credit history demonstrates a track record of responsible credit management. If you have a short credit history, it may take longer to see improvements in your credit score. However, by consistently making timely payments and responsibly managing your credit, you can gradually build a positive credit history.

Types of Credit

Having a diverse mix of credit accounts can have a positive impact on your credit score. Lenders like to see that you can manage different types of credit, such as credit cards, loans, and mortgages. It is important to note that opening multiple accounts at once can potentially harm your credit score. It is advisable to only take on credit that you genuinely need and can manage responsibly.

New Credit Inquiries

Every time you apply for new credit, an inquiry is made to check your creditworthiness. Multiple credit inquiries within a short period of time can raise red flags for lenders and negatively impact your credit score. It is important to be mindful of the number of credit inquiries you make and only apply for credit when necessary.

Timeframe for Credit Score Improvement

While it is difficult to provide an exact timeframe for credit score improvement, there are factors that can influence the speed of improvement. Variances in credit score changes can occur due to individual circumstances, so it is important to remember that everyone’s credit situation is unique. However, on average, it can take several months to start seeing noticeable improvements in your credit score.

The specific time it takes to see improvements in your credit score depends on various factors, such as the severity of negative marks on your credit report, the actions you take to improve your credit, and how consistently you practice good credit habits. Generally, it is recommended to allow at least 6 to 12 months to see significant improvements in your credit score.

This image is property of www.thebalancemoney.com.

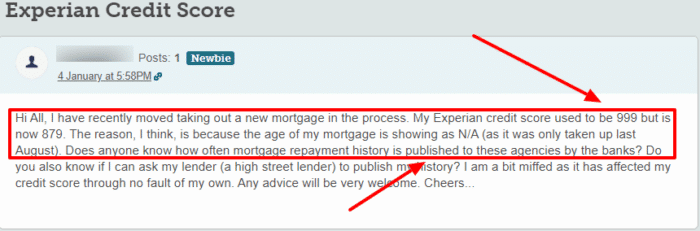

Monitoring Your Credit Score

As you work towards improving your credit score, it is important to regularly monitor your credit report. Monitoring your credit allows you to keep track of any changes or inaccuracies in your credit history. There are several tools and platforms available that can help you monitor your credit, such as credit monitoring services or free credit score websites.

When monitoring your credit, it is important to review your credit report for any errors or inconsistencies. If you notice any inaccurate information, it is crucial to take action and dispute it with the credit bureaus. Inaccurate information can potentially harm your credit score, so it is important to address any discrepancies as soon as possible.

This image is property of www.experian.com.

Staying Consistent with Good Credit Habits

Improving your credit score is not a one-time fix, but rather an ongoing process that requires consistent effort. Here are a few key habits to maintain in order to continue improving your credit score:

Maintaining Healthy Payment History

Making timely payments is crucial for maintaining a healthy credit score. Set up payment reminders or automatic payments to ensure that you never miss a due date. Consistently making on-time payments will demonstrate your reliability to lenders and positively impact your credit score.

Keeping Utilization Ratio Low

Strive to keep your credit card balances low and avoid maxing out your credit cards. A high credit utilization ratio can negatively affect your credit score. Aim to keep your utilization ratio below 30% to demonstrate responsible credit management.

Being Mindful of New Credit Applications

When considering new credit applications, it is important to apply responsibly. Avoid applying for credit that you do not need and only apply for credit when necessary. Applying for multiple credit accounts within a short period of time can raise concerns for lenders and negatively impact your credit score.

This image is property of moneynerd.co.uk.

Conclusion

Improving your credit score takes time and effort. Understanding the factors that affect your credit score, such as payment history, credit utilization ratio, length of credit history, types of credit, and new credit inquiries, is essential for taking the necessary steps towards improvement.

While it may take several months to see noticeable improvements in your credit score, staying consistent with good credit habits will set you on the path to long-term credit score growth. Remember to monitor your credit regularly, address any inaccuracies, and practice responsible credit management. With commitment and patience, you can improve your credit score and achieve financial success.

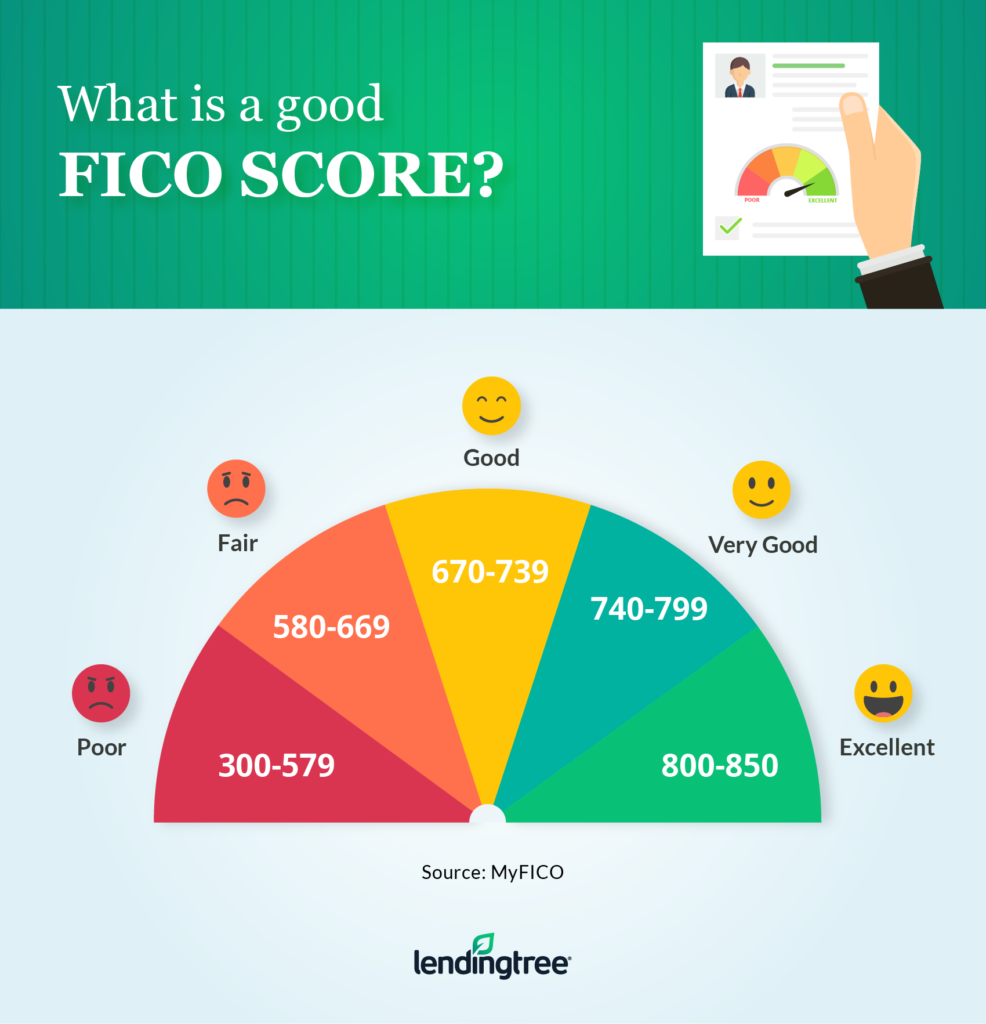

This image is property of www.lendingtree.com.