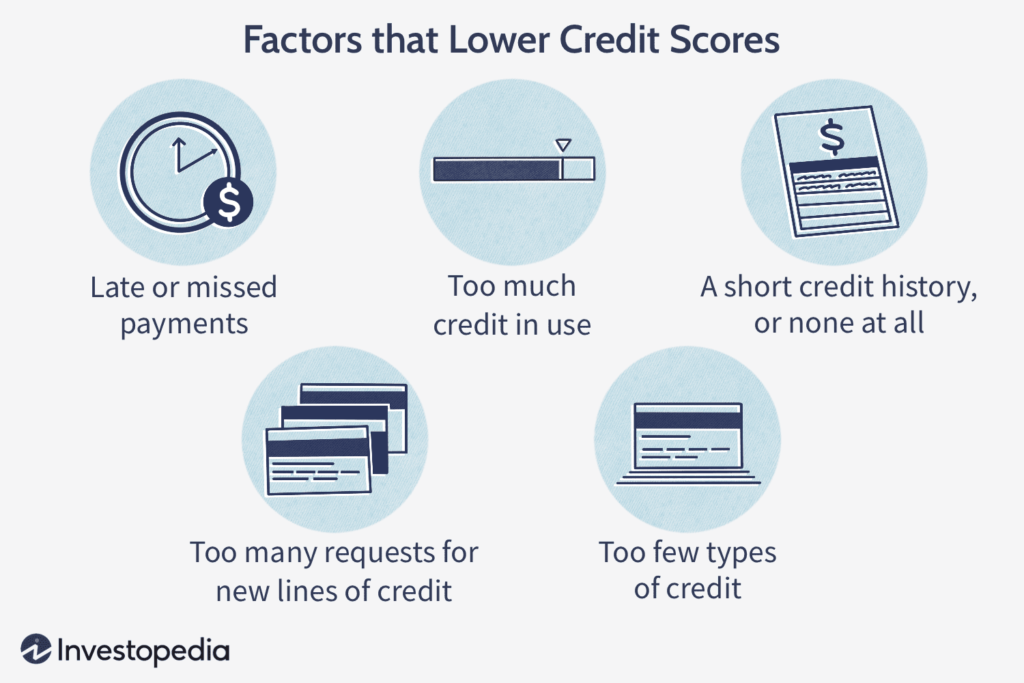

So you’re wondering how to stay clear of those pesky credit mistakes and keep your credit score in tip-top shape? Well, the good news is, you’ve come to the right place. Let’s break it down for you.

First things first, it’s important to make sure you’re staying on top of your payments. Paying your bills on time, whether it’s credit card dues or loan repayments, shows responsible financial behavior and can have a positive impact on your credit score. Late payments, on the other hand, can drag down your score. So, set up reminders, automate your payments if possible, and make sure you keep track of your due dates.

Next, be mindful of your credit utilization ratio. This fancy term simply refers to the amount of credit you’re using compared to your overall credit limit. Keeping this ratio low, ideally below 30%, can improve your credit score. So, try not to max out your cards and aim for a healthy balance between what you owe and your total available credit.

By being vigilant with payments and managing your credit wisely, you’ll be well on your way to avoiding those common credit mistakes and maintaining a healthy credit score. Simple, right?

This image is property of www.investopedia.com.

Creating a Budget

Income and Expense Tracking

To create a budget, the first step is to track your income and expenses. Start by listing all sources of income, such as your salary, side gigs, or rental income. Then, categorize your expenses into fixed expenses (like rent or mortgage payments) and variable expenses (like groceries or entertainment). By tracking your income and expenses, you’ll have a clear picture of your financial situation and be able to make informed decisions about your spending habits.

Setting Financial Goals

Once you have a clear understanding of your income and expenses, it’s important to set financial goals. These goals can be short-term, such as saving for a vacation or paying off a credit card, or long-term, such as saving for retirement or buying a house. Setting goals helps you stay motivated and focused on improving your financial well-being. Make sure your goals are specific, measurable, attainable, relevant, and time-bound (SMART), and regularly evaluate your progress towards achieving them.

Managing Debt

Managing debt is crucial for maintaining a healthy credit score. Start by listing all your debts, including credit card balances, student loans, or car loans. Determine the interest rates and minimum monthly payments for each debt. Consider strategies like the snowball or avalanche method to pay off your debts strategically. The snowball method involves paying off the smallest debts first, while the avalanche method focuses on paying off debts with the highest interest rates first. Choose the method that aligns with your financial goals and commitments and start reducing your debt gradually.

Paying Bills on Time

Understanding Payment Due Dates

To avoid late fees and negative impacts on your credit score, it’s essential to understand payment due dates. Different bills may have different due dates, and they can vary from month to month. Create a calendar or set reminders to ensure you never miss a payment. Pro tip: it’s always a good idea to pay your bills a few days before the due date to account for any processing delays.

Setting Up Automatic Payments

One way to ensure you never miss a bill payment is by setting up automatic payments. Many banks and service providers offer the option to automatically deduct the bill amount from your bank account on the due date. However, it’s important to regularly review your bank statements and ensure you have sufficient funds to cover the automatic payments.

Setting Payment Reminders

If you prefer to have more control over your payments, setting up payment reminders can be a useful solution. This can be done through calendar alerts or apps that help you remember when bills are due. By receiving timely reminders, you can stay on top of your financial obligations and avoid any late payments.

Monitoring Credit Reports

Importance of Regular Monitoring

Regularly monitoring your credit reports is crucial for detecting any inaccuracies or signs of identity theft. Credit reports contain information about your credit history, including opened accounts, payment history, and inquiries. By monitoring your reports, you can ensure that the information is accurate, up to date, and reflects your financial behavior.

Checking for Errors and Inaccuracies

When reviewing your credit reports, keep an eye out for any errors or inaccuracies. These can include discrepancies in personal information or incorrect account details. If you spot any errors, it’s important to dispute them with the credit bureaus to have them corrected promptly. Remember, any inaccuracies on your credit report can negatively impact your credit score.

Disputing Inaccurate Information

If you find inaccurate information on your credit reports, you have the right to dispute it. Contact the credit bureaus in writing, providing all necessary documentation to support your claim. The credit bureaus will investigate the dispute and make any necessary corrections. Regularly reviewing and disputing inaccurate information on your credit reports helps ensure the accuracy of your credit history.

Managing Credit Utilization

Understanding Credit Utilization Ratio

Credit utilization ratio refers to the percentage of your available credit that you are using at any given time. It’s a significant factor in determining your credit score. To calculate your credit utilization ratio, divide your total credit card balances by your total credit card limits and multiply the result by 100. Ideally, you should aim to keep your credit utilization ratio below 30%.

Keeping Credit Card Balances Low

To maintain a healthy credit score, it’s important to keep your credit card balances low. Holding high balances relative to your credit limits indicates a higher credit utilization ratio, which can negatively impact your credit score. Paying off your credit card balances in full each month or reducing your balances as much as possible can help keep your credit utilization ratio in check.

Paying off Debt

Paying off debt not only helps you achieve financial freedom but also positively impacts your credit utilization ratio. By reducing your debts, you lower your credit utilization ratio, which can improve your credit score. Make a plan to consistently pay more than the minimum payment on your debts to accelerate the repayment process. Consider prioritizing high-interest debts to save money on interest charges.

This image is property of s28126.pcdn.co.

Avoiding Excessive Credit Applications

Understanding Credit Inquiries

Every time you apply for new credit, a credit inquiry is added to your credit report. While a few inquiries are normal, excessive credit applications within a short period can raise red flags to lenders. These inquiries may negatively impact your credit score and make lenders question your financial stability and responsibility.

Limiting Credit Applications

To avoid unnecessary credit inquiries, limit your credit applications to only when necessary. Before applying for new credit, evaluate whether it aligns with your financial goals and whether you have a high likelihood of approval. Applying for credit only when needed can help you maintain a healthy credit score and avoid potential rejections.

Considering Soft Inquiries

Some inquiries are considered “soft” and do not impact your credit score. These inquiries typically occur when you check your own credit report or when a lender preapproves you for a credit offer. Soft inquiries can provide you with valuable information about your creditworthiness without impacting your score. Therefore, consider utilizing soft inquiries whenever possible to gather insights about your credit situation.

Maintaining a Diverse Credit Mix

Importance of Having Different Types of Credit

Maintaining a diverse credit mix is beneficial for your credit score. Lenders like to see that you can responsibly handle different types of credit, such as credit cards, mortgages, and installment loans. Having a diverse credit mix shows that you can manage various financial obligations effectively, which can positively influence your creditworthiness.

Building a Good Credit Mix

If you currently only have one type of credit account, consider diversifying your credit mix. For example, if you only have credit cards, consider applying for a small personal loan or a mortgage. However, remember to apply for new credit sparingly and consider other factors, such as interest rates and terms, before applying.

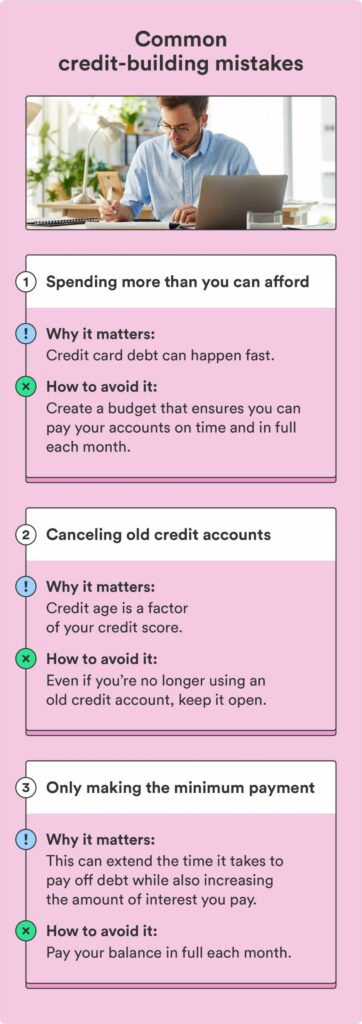

Avoiding Unnecessary Credit Closures

Closing old credit accounts may seem like a wise decision, but it can actually hurt your credit score, especially if those accounts have a positive payment history. Closing accounts reduces your total available credit, potentially increasing your credit utilization ratio. Instead, consider keeping those accounts open, even if you no longer actively use them, to maintain a diverse credit mix and improve your credit score.

This image is property of www.chime.com.

Lengthening Credit History

Understanding the Impact of Credit History Length

The length of your credit history is an important factor in calculating your credit score. Lenders prefer borrowers with an established history of timely payments and responsible credit behavior. The longer your credit history, the more data lenders have to assess your creditworthiness. Therefore, it’s crucial to maintain a long credit history to demonstrate your financial reliability.

Avoiding Closing Old Credit Accounts

As mentioned earlier, closing old credit accounts can negatively impact your credit history length. If you have old accounts with positive payment history, keep them open to show a longer credit history. However, make sure to periodically review those accounts for any signs of fraudulent activity or unnecessary fees.

Maintaining Active Credit Accounts

To lengthen your credit history, it’s important to maintain active credit accounts. Use your credit cards occasionally and make timely payments to demonstrate your creditworthiness. Keeping your accounts in good standing and consistently managing your credit responsibly can help you maintain a healthy credit history.

Being Cautious with Co-Signing

Understanding Co-Signing Risks

Co-signing involves taking on the responsibility of someone else’s debt. While it can be done with good intentions, co-signing poses risks to both parties involved. If the primary borrower defaults on payments, it can negatively impact the co-signer’s credit history and score. It’s important to carefully assess the financial situation and trustworthiness of the person requesting co-signing before making a decision.

Considering Alternatives to Co-Signing

If someone asks you to co-sign a loan or credit application, consider exploring alternative options. For example, you can offer to provide guidance on improving their credit or exploring different lenders that may be more willing to approve their application. Helping someone establish their independent credit history can be more beneficial in the long run than taking on the risks of co-signing.

Establishing Independent Credit History

Building your own independent credit history is crucial for your financial well-being. By opening credit accounts on your own and maintaining a good payment history, you show lenders that you are capable of managing credit independently. Establishing and maintaining your own credit can provide you with greater financial freedom and reduce the need for co-signing in the future.

This image is property of www.truenorthwealth.com.

Avoiding Maxing Out Credit Cards

Understanding Credit Card Limits

Credit card limits refer to the maximum amount of credit that a lender is willing to extend to you. It’s important to understand your credit card limits and avoid approaching or surpassing them. Maxing out your credit cards indicates a higher credit utilization ratio, which can negatively impact your credit score and financial health.

Using Credit Cards Responsibly

To avoid maxing out your credit cards, it’s important to use them responsibly. Only charge what you can afford to pay off in full each month and avoid unnecessary purchases. Treat your credit card as a tool for convenience and building credit, rather than a means to fund your lifestyle beyond your means.

Paying off Balances

To maintain a healthy credit score, it’s crucial to pay off your credit card balances in full and on time each month. By doing so, you avoid accruing interest charges and establish a positive payment history. If you’re unable to pay off the full balance, aim to at least make the minimum payment on time to avoid any negative impacts on your credit score.

Seeking Professional Financial Advice

Consulting Credit Counselors

If you’re struggling with debt management or have complex financial situations, it can be helpful to seek professional advice from credit counselors. Credit counselors can provide guidance on budgeting, debt repayment strategies, and overall credit management. They can work closely with you to create a personalized plan to improve your credit and achieve your financial goals.

Engaging with Financial Planners

If you have long-term financial goals or want a comprehensive financial plan, consider engaging with financial planners. Financial planners can help you assess your current situation, provide advice on investment strategies, and create a roadmap to achieve your financial aspirations. They can offer valuable insights and expertise to ensure you’re on the right track towards long-term financial success.

Educating Yourself on Credit Management

While seeking professional advice can be beneficial, it’s important to educate yourself on credit management as well. Understanding how credit works, how it impacts your financial health, and how to optimize your credit score empowers you to make informed decisions. Educate yourself through online resources, books, or workshops to become more confident in managing your personal finances.

In conclusion, avoiding common credit mistakes and maintaining a healthy credit score requires careful financial management. By creating a budget, paying bills on time, monitoring credit reports, managing credit utilization, avoiding excessive credit applications, maintaining a diverse credit mix, lengthening credit history, being cautious with co-signing, avoiding maxing out credit cards, and seeking professional financial advice, you can make significant strides towards a healthier credit profile and overall financial well-being. Remember, improving your credit takes time and effort, but the benefits of a healthy credit score are well worth it.

This image is property of www.investopedia.com.