Have you been searching for a reliable and efficient way to empower your credit repair company? Look no further than Advanced Merchant Services. With their cutting-edge solutions and innovative technologies, Advanced Merchant Services provides credit repair companies with the tools they need to succeed in the industry. From seamless payment processing to personalized customer support, they offer a comprehensive range of services that will take your business to the next level. Discover how Advanced Merchant Services can empower your credit repair company today.

Understanding the Interconnected Role of Credit Repair Companies and Merchant Services

Definition of Credit Repair Companies

When it comes to understanding the interconnected role of credit repair companies and merchant services, it is essential to first define what credit repair companies are. Credit repair companies are organizations that help individuals and businesses improve their credit scores by working with credit bureaus and creditors to address errors, mistakes, and negative items on credit reports. These companies use their expertise and knowledge of the credit system to advocate for their clients and help them achieve better financial standing.

Definition and Functions of Merchant Services

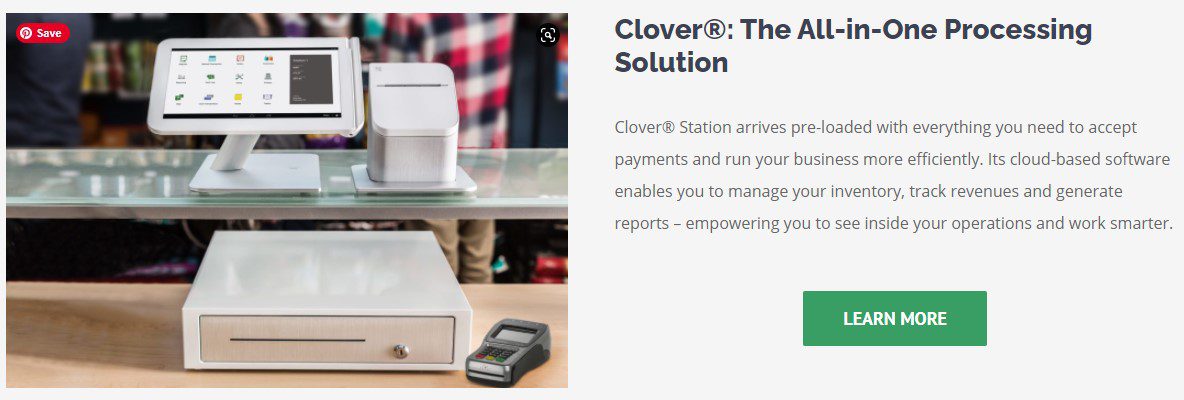

Merchant services, on the other hand, refer to the range of financial services and solutions that enable businesses to accept and process electronic payments from their customers. These services include credit card processing, online payment gateways, point-of-sale systems, and other tools that facilitate smooth and secure transactions. Merchant services providers act as intermediaries between businesses and financial institutions, ensuring the efficient handling of payments and the movement of funds.

How They Complement Each Other

Although credit repair companies and merchant services may seem like two distinct entities, they actually complement each other in several ways. Credit repair companies often work with individuals who have had poor credit history and are looking to improve their financial standing. By partnering with a reputable merchant services provider, these credit repair companies can offer their clients convenient and secure payment options, enabling them to rebuild their credit through responsible financial transactions.

Additionally, merchant services providers that specialize in working with credit repair companies can offer tailored solutions and tools that streamline the credit repair process. These solutions may include integration with credit bureaus and financial institutions, advanced fraud protection measures, and seamless integration with other business systems such as customer relationship management (CRM) software. This interconnectedness between credit repair companies and merchant services ultimately helps facilitate the achievement of financial goals for both businesses and individuals.

The Importance of Merchant Services for Credit Repair Businesses

Boosting Business Efficiency

Merchant services play a crucial role in boosting the overall efficiency of credit repair businesses. As these businesses often handle a large volume of transactions, having a reliable and efficient payment processing system is essential. Merchant services providers offer businesses robust payment gateways and tools that can handle high transaction volumes, making it easier for credit repair companies to manage their operations smoothly.

In addition, merchant services providers usually offer features such as automated invoicing, recurring payments, and real-time reporting, which significantly reduce the administrative burden on credit repair businesses. By automating various tasks and streamlining payment processes, these advanced merchant services help credit repair companies focus their efforts on providing better services to their clients and improving their overall operational efficiency.

Safe and Secure Transactions

For credit repair businesses, ensuring the security and confidentiality of their clients’ financial information is of utmost importance. One of the key functions of merchant services is to provide secure payment processing solutions that protect sensitive data and prevent fraud. Advanced merchant services providers implement robust security measures, such as encryption and tokenization, to safeguard credit card information and prevent unauthorized access.

Moreover, merchant services providers also offer additional security features like chargeback protection and fraud detection, which are particularly crucial for credit repair companies. These businesses often handle transactions involving disputed charges or payments, and having robust fraud protection measures in place helps mitigate financial risks and protect the interests of both the credit repair company and its clients.

Enhanced Customer Experience

In today’s digital age, customers expect seamless and convenient payment options. Merchant services provide credit repair businesses with the tools and capabilities to offer their clients a superior customer experience. With advanced payment gateways and online payment options, credit repair companies can enable their clients to make payments quickly and securely, regardless of their location or preferred payment method.

Furthermore, merchant services providers often offer features such as customizable payment pages, personalized invoicing, and recurring billing, which allow credit repair businesses to tailor their payment processes to the unique needs and preferences of their clients. By providing a convenient and user-friendly payment experience, credit repair businesses can enhance customer satisfaction and loyalty, ultimately leading to increased referrals and business growth.

Features of Advanced Merchant Services for Credit Repair Companies

Tailored Solutions for Different Business Sizes

Credit repair companies come in various sizes, ranging from small startups to large enterprises. Advanced merchant services providers understand the different requirements and challenges faced by credit repair businesses of different sizes and offer tailored solutions to meet their specific needs.

For smaller credit repair companies, these providers may offer cost-effective payment processing solutions that are scalable and easy to set up. This allows smaller businesses to get up and running quickly without incurring significant upfront costs. On the other hand, larger credit repair companies may require more advanced features, such as customized reporting and integration with existing business systems. Advanced merchant services providers can offer these functionalities, allowing larger businesses to streamline their operations and achieve greater efficiency.

Robust Fraud Protection Measures

Credit repair companies often deal with high-risk transactions and the potential for fraudulent activities. Therefore, advanced merchant services providers offer robust fraud protection measures to mitigate these risks.

One such measure is real-time transaction monitoring, which alerts credit repair businesses of any suspicious or potentially fraudulent activities as they occur. This enables businesses to take immediate action to prevent financial loss and protect their clients’ interests.

Additionally, advanced merchant services providers employ machine learning algorithms and artificial intelligence technologies to detect patterns and anomalies in transaction data, further enhancing fraud prevention capabilities. These sophisticated tools can identify fraudulent behaviors and ensure that credit repair companies are equipped with the necessary tools to combat fraud effectively.

Integration with Other Business Systems

To achieve maximum efficiency and effectiveness, credit repair businesses often rely on various systems and tools to manage their operations. Advanced merchant services providers recognize this need and offer seamless integration capabilities with other business systems.

Integration with CRM systems, for example, allows credit repair companies to centralize customer data, track payment histories, and automate customer communication processes. This integration streamlines the customer management process, enabling businesses to provide a more personalized and efficient service to their clients.

Furthermore, integration with accounting software simplifies financial reconciliation and reporting processes, reducing manual errors and saving time for credit repair businesses. By having a unified system that seamlessly connects payment processing with other critical business functions, credit repair companies can optimize their operations and enhance overall productivity.

Challenges Faced by Credit Repair Companies in Transaction Processing

High-Risk Status

One of the main challenges faced by credit repair companies in transaction processing is their high-risk status. As these businesses often deal with clients who have poor credit histories and are at a higher risk of defaulting on payments, they are categorized as high-risk by financial institutions and merchant services providers.

Being labeled as high-risk can result in higher processing fees, stricter underwriting requirements, and limited access to payment processing services. This poses a significant challenge for credit repair companies as they need reliable and cost-effective merchant services to support their operations.

Chargebacks and their Impact

Another challenge that credit repair companies face is the potential for chargebacks. Chargebacks occur when a customer disputes a transaction and requests a refund directly from their credit card issuer. For credit repair businesses, this can have a significant impact on their cash flow and overall financial stability.

Chargebacks not only result in immediate financial loss but may also lead to increased processing fees, fines, and even the termination of merchant accounts. It is crucial for credit repair companies to effectively deal with chargebacks by implementing robust customer dispute resolution processes and maintaining clear communication channels with their clients.

Choosing the Right Merchant Services Provider

Selecting the right merchant services provider is a critical decision for credit repair companies. With the myriad of options available in the market, it can be challenging to identify the provider that best meets their specific needs and requirements. Credit repair companies need to consider factors such as pricing, security features, customer support, and industry expertise when choosing a merchant services provider.

Moreover, credit repair companies must ensure that the chosen provider has experience working with high-risk businesses and understands the unique challenges they face. By partnering with a reputable and knowledgeable merchant services provider, credit repair companies can overcome the challenges associated with transaction processing and effectively support their clients’ financial goals.

Overcoming the ‘High Risk’ Stigma With Advanced Merchant Services

Risk Management Strategies

To overcome the ‘high-risk’ stigma associated with credit repair companies, implementing effective risk management strategies is crucial. Advanced merchant services providers offer tools and solutions that help credit repair businesses assess and manage their financial risks.

One such strategy is conducting thorough client assessments and credit checks before entering into business relationships. By screening potential clients and evaluating their creditworthiness, credit repair companies can minimize the risk of working with individuals who may default on payments.

Additionally, credit repair businesses can implement clear and transparent billing practices to minimize disputes and the likelihood of chargebacks. Charging reasonable fees, offering refund policies, and establishing open lines of communication with clients can help build trust and reduce the risk of financial disputes.

Using High-Risk Merchant Services

Another effective way to overcome the ‘high-risk’ stigma is to utilize specialized high-risk merchant services. These services are specifically designed to cater to the needs of credit repair companies and other high-risk businesses.

High-risk merchant services providers understand the unique challenges faced by credit repair businesses and offer solutions that align with their risk profiles. These providers are well-versed in navigating the complexities of high-risk industries and have established relationships with financial institutions that are more willing to work with credit repair companies.

By partnering with a high-risk merchant services provider, credit repair businesses can access the necessary tools and expertise to support their operations effectively. These providers offer tailored solutions, competitive pricing, and personalized support, helping credit repair companies overcome the barriers associated with their high-risk status.

Key Benefits of High-Risk Merchant Services

Utilizing high-risk merchant services brings several key benefits to credit repair companies. Firstly, these services offer better rates and pricing structures compared to traditional merchant services providers. High-risk merchant services providers understand the unique risk profiles of credit repair businesses and offer competitive pricing that reflects the associated risks.

Secondly, high-risk merchant services providers have advanced fraud prevention measures in place to ensure the security of transactions. These providers employ advanced risk assessment tools, chargeback monitoring systems, and fraud detection technologies to minimize the occurrence of fraudulent activities.

Lastly, high-risk merchant services providers offer personalized and dedicated customer support to credit repair businesses. Understanding the specific challenges faced by these businesses, high-risk providers provide ongoing assistance, proactive monitoring, and quick response times to address any issues that may arise.

By leveraging the benefits of high-risk merchant services, credit repair companies can overcome the inherent challenges of their industry and establish a solid foundation for sustainable growth.

Utilization of Advanced Payment Gateways For Credit Repair

Delivering More Convenience and Flexibility

Advanced payment gateways play a crucial role in the credit repair process by delivering convenience and flexibility to both credit repair businesses and their clients. These gateways allow credit repair companies to accept payments through various channels, including online, mobile, and in-person.

By offering multiple payment options, such as credit cards, debit cards, and electronic wallets, credit repair businesses can cater to their clients’ preferences and provide a seamless payment experience. Clients can make payments conveniently through their preferred method, whether it be online, over the phone, or in person, enhancing customer satisfaction and improving the overall payment process.

Moreover, advanced payment gateways enable credit repair companies to accept recurring payments, which is particularly beneficial for clients who require ongoing credit repair services. By setting up automated recurring payments, credit repair businesses can ensure a steady and predictable cash flow, while clients can enjoy the convenience of automated billing without the need for manual intervention.

Embrace Omnichannel Commerce

With the increasing popularity of online and mobile transactions, credit repair companies need to embrace omnichannel commerce to stay competitive. Advanced merchant services providers offer payment gateways that facilitate seamless integration across multiple channels, enabling credit repair businesses to provide a consistent payment experience across various touchpoints.

Whether clients prefer to make payments through a website, mobile app, or in person at a physical location, advanced payment gateways ensure that the payment process is smooth and efficient. This omnichannel approach not only enhances the overall customer experience but also allows credit repair businesses to expand their reach and cater to a wider audience.

Integration with CRM Systems

To maximize operational efficiency and improve customer management, credit repair businesses can leverage the integration capabilities between advanced payment gateways and CRM systems. CRM systems allow businesses to track and manage customer information, interactions, and payment histories in a centralized and organized manner.

By integrating payment gateways with CRM systems, credit repair companies can streamline their customer management processes. This integration enables businesses to automatically update customer information, track payment histories, generate invoices, and send payment reminders, all within the CRM system. This seamless integration eliminates manual data entry, reduces errors, and enhances overall efficiency, allowing credit repair companies to focus more on providing personalized services and improving customer satisfaction.

Impact of Evolving Compliance Landscape on Credit Repair Merchant Services

Key Regulations and their Implications

The credit repair industry operates within a complex regulatory landscape, and credit repair merchant services must navigate the evolving compliance requirements. Some of the key regulations that impact credit repair businesses include the Fair Credit Reporting Act (FCRA), the Credit Repair Organizations Act (CROA), and the Electronic Fund Transfer Act (EFTA).

The Fair Credit Reporting Act regulates the collection, dissemination, and use of consumer credit information and establishes the rights and responsibilities of consumers regarding their credit reports. Credit repair businesses need to ensure compliance with FCRA by obtaining necessary consents from clients, providing required disclosures, and handling credit report disputes appropriately.

The Credit Repair Organizations Act, on the other hand, imposes specific regulations on credit repair companies to protect consumers from fraudulent practices. This act requires credit repair businesses to provide clear and accurate information to clients, refrain from making false claims, and follow specific disclosure requirements. Compliance with CROA is essential for credit repair businesses to maintain their reputation and credibility in the industry.

The Electronic Fund Transfer Act governs electronic fund transfers, including debit card transactions and automated clearinghouse (ACH) transfers. Credit repair businesses that accept electronic payments need to comply with EFTA by providing proper disclosures, obtaining necessary authorizations, and ensuring the security of clients’ financial information.

Ensuring Compliance with Advanced Features

As the compliance landscape continues to evolve, credit repair merchant services need to adapt to new requirements and regulations. Advanced merchant services providers play a crucial role in ensuring compliance by offering features and tools that facilitate adherence to regulatory standards.

For example, advanced payment gateways may include built-in functionalities that automate compliance-related tasks, such as generating required disclosures and obtaining necessary authorizations from clients. These features streamline the compliance process and minimize the risk of human error, ensuring that credit repair businesses remain in full compliance with applicable regulations.

Furthermore, advanced merchant services providers often stay up to date with regulatory changes and provide ongoing support and guidance to credit repair businesses. By partnering with a knowledgeable and experienced merchant services provider, credit repair companies can navigate the complex compliance landscape effectively and focus on their core business objectives with confidence.

The Role of PCI DSS Compliance

In addition to industry-specific regulations, credit repair businesses must also adhere to general data security standards, such as the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS sets forth a comprehensive framework for safeguarding cardholder data and preventing unauthorized access or data breaches.

Credit repair businesses that accept credit card payments must maintain PCI DSS compliance by implementing specific security measures and procedures. These measures include secure transmission and storage of cardholder data, regular network vulnerability assessments, and employee training on data security best practices.

Advanced merchant services providers can help credit repair companies achieve and maintain PCI DSS compliance by offering solutions that align with the requirements of the standard. These solutions may include tokenization, which replaces sensitive cardholder data with unique tokens, and point-to-point encryption, which protects data throughout the entire payment process. By implementing these advanced security measures, credit repair businesses can not only comply with industry standards but also assure their clients of the safety and confidentiality of their financial information.

Embracing Automation in Credit Repair Through Merchant Services

Improving Operational Efficiency

Automation plays a vital role in credit repair businesses by improving operational efficiency and reducing manual errors. Merchant services providers offer advanced automation features that streamline various aspects of the credit repair process.

For instance, credit repair businesses can automate customer onboarding processes by integrating their payment gateways with CRM systems. By setting up automated workflows, businesses can eliminate manual data entry and ensure accurate and timely customer information updates. This automation reduces administrative overhead and allows credit repair companies to focus on more value-added activities, such as credit analysis and dispute resolution.

Additionally, automation can be applied to invoice generation, payment reminders, and reporting processes. Instead of manually creating invoices and sending payment reminders, credit repair businesses can utilize the automation capabilities of advanced payment gateways to perform these tasks automatically. This not only saves time but also ensures consistency and accuracy in these critical processes.

Minimizing Errors and Fraud

Manual data entry and processing are prone to errors, which can have significant implications for credit repair businesses and their clients. Advanced merchant services providers offer automation features that minimize the occurrence of errors and mitigate the risk of fraudulent activities.

For example, by integrating payment gateways with CRM systems, credit repair businesses can automatically populate transaction data, reducing the need for manual entry and the associated errors. This automation ensures accurate transaction records, simplifies reconciliation processes, and minimizes the risk of payment discrepancies.

Moreover, advanced fraud prevention measures such as machine learning algorithms and artificial intelligence technologies can detect and flag potentially fraudulent transactions in real time. This automation not only mitigates financial risks but also protects the reputation and credibility of credit repair businesses.

Streamlining Customer Experience

Merchant services providers offer automation features that streamline the customer experience and enhance satisfaction. For credit repair businesses, providing a seamless and efficient payment process is essential for building customer trust and loyalty.

By utilizing advanced payment gateways, credit repair companies can offer features like self-service payment portals, automatic payment confirmations, and personalized payment options. These automation features empower clients to make payments conveniently and securely without the need for manual intervention.

Furthermore, automation can be used to improve communication with clients by sending automated payment reminders, update notifications, and personalized offers. These automated communications not only save time for credit repair businesses but also ensure that clients are kept informed and engaged throughout the credit repair process.

By embracing automation through merchant services, credit repair businesses can streamline their operations, minimize errors and fraud, and deliver a superior customer experience.

Case Study: Success Stories of Using Advanced Merchant Services

How Advanced Features Boosted Business Growth

Several credit repair businesses have experienced significant growth and success by leveraging advanced merchant services and their associated features.

One such example is a small credit repair startup that struggled with manual payment processing and limited payment options. By partnering with an advanced merchant services provider, the startup was able to implement an automated payment gateway that offered multiple payment options and seamless integration with their CRM system. This integration streamlined their operations, reduced administrative overhead, and improved the overall customer experience. As a result, the startup experienced rapid growth, expanded their client base, and achieved higher customer satisfaction ratings.

In another case, a large credit repair company faced challenges in managing chargebacks and fraudulent transactions. By switching to a high-risk merchant services provider, the company gained access to advanced fraud prevention tools and real-time transaction monitoring capabilities. With these features in place, the company was able to detect and handle fraudulent activities more effectively, significantly reducing chargebacks and financial losses. This allowed the company to focus on scaling their operations and growing their business without the burden of chargeback disputes.

Lessons Learnt and Best Practices

The success stories of credit repair companies highlight several key lessons and best practices for utilizing advanced merchant services effectively:

-

Understand your specific business needs and challenges: Before choosing a merchant services provider, assess your business requirements, and identify the areas where advanced features can make a significant impact. Determine the specific goals you want to achieve with merchant services and select a provider that offers solutions tailored to your needs.

-

Partner with a reputable and experienced provider: Look for a merchant services provider with a proven track record of working with credit repair companies and a deep understanding of the industry’s unique challenges. Research their reputation, read customer reviews, and evaluate their customer support capabilities to ensure they can meet your long-term needs.

-

Leverage automation to improve efficiency and customer experience: Identify manual processes that can be automated, such as customer onboarding, invoicing, and reporting. Utilize advanced payment gateways that integrate with other business systems, such as CRM, to streamline operations and enhance the overall customer experience.

-

Prioritize data security and regulatory compliance: Ensure your chosen merchant services provider offers advanced security features and complies with industry standards, such as PCI DSS. Protect your clients’ sensitive financial information by implementing encryption, tokenization, and other security measures.

-

Continuously monitor and optimize payment processes: Regularly review payment analytics and reports provided by your merchant services provider to identify areas for improvement. Monitor transaction trends, fraud patterns, and client payment behaviors to fine-tune your payment processes and maximize efficiency.

By applying these lessons learned and best practices, credit repair companies can leverage advanced merchant services to achieve significant growth, enhance customer satisfaction, and overcome industry challenges effectively.

Future of Merchant Services in Credit Repair: Trends to Watch Out For

Blockchain and Its Potential Impacts

Blockchain technology holds significant potential for transforming various industries, including credit repair. Blockchain is a decentralized and tamper-resistant digital ledger that allows for secure and transparent transactions without the need for intermediaries.

In the context of credit repair, blockchain can enhance data security and privacy by securely storing and sharing credit-related information. By utilizing blockchain-based systems, credit repair businesses can ensure the immutability and authenticity of client data, reducing the risk of data breaches and unauthorized access.

Furthermore, blockchain technology can enable secure identity verification and authentication, simplifying the client onboarding process and reducing fraudulent activities. By leveraging blockchain’s decentralized nature, credit repair businesses can establish greater trust and transparency with their clients and industry stakeholders.

AI and Machine Learning for Fraud Prevention

Artificial intelligence (AI) and machine learning (ML) technologies have already made significant strides in fraud prevention across various industries. In the credit repair industry, AI and ML algorithms can be utilized to detect patterns, identify anomalies, and predict potential fraud in real-time.

By continuously analyzing transaction data, AI-powered fraud detection systems can learn and adapt to new fraud patterns, making them more effective at detecting and preventing fraudulent activities. This technology can help credit repair businesses mitigate financial risks, protect their clients, and maintain the integrity of their operations.

As AI and ML algorithms continue to evolve, credit repair merchant services are expected to integrate these advanced technologies to enhance their fraud prevention capabilities further. Real-time fraud alerts, predictive risk scoring, and adaptive transaction monitoring are just a few examples of how AI and ML can revolutionize fraud prevention in the credit repair industry.

Contactless and Mobile Payments

The shift towards contactless and mobile payments is a trend that is expected to continue in the credit repair industry. Contactless payments, facilitated by near-field communication (NFC) technology, enable cardholders to make payments by simply tapping their cards or smartphones on payment terminals.

As credit repair businesses embrace mobile and online channels, offering contactless payment options becomes increasingly important. Integrated mobile payment solutions, such as digital wallets and mobile apps, provide a convenient and secure payment experience for clients, promoting customer satisfaction and loyalty.

Moreover, the COVID-19 pandemic has accelerated the adoption of contactless and mobile payments, as it reduces the need for physical contact and minimizes the risk of virus transmission. Credit repair businesses must adapt to this trend by integrating contactless payment capabilities into their existing merchant services, offering clients a safe and seamless payment experience.

In conclusion, the future of merchant services in the credit repair industry is poised for transformative advancements. Technologies like blockchain, AI, and contactless payments hold significant potential for enhancing the efficiency, security, and customer experience in credit repair processes. By staying abreast of these trends and leveraging advanced merchant services, credit repair businesses can position themselves for success in an ever-evolving industry.