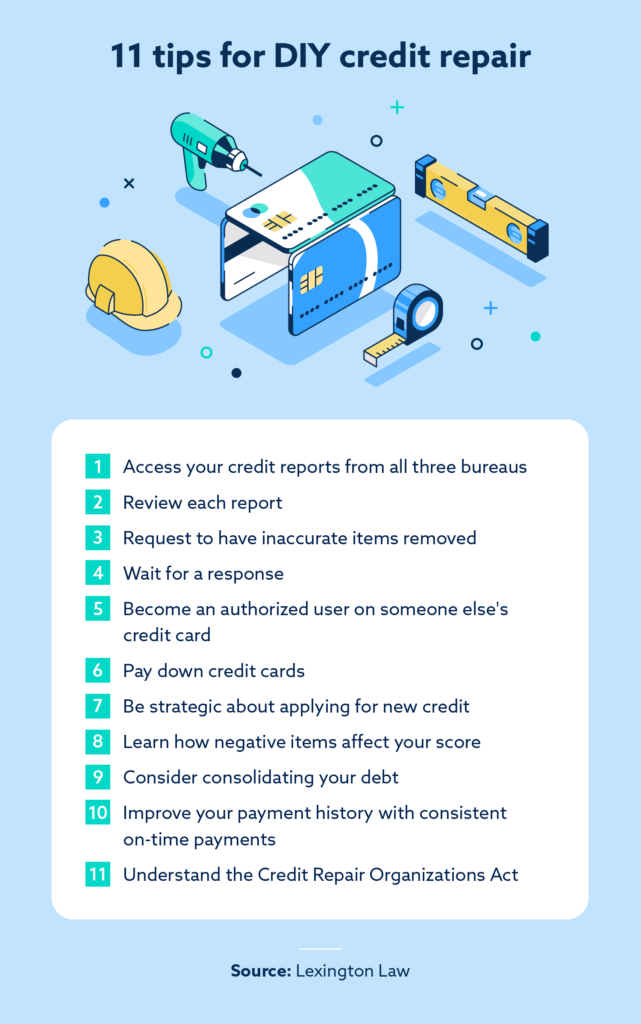

In this article, you’ll learn some useful DIY credit repair tips for Fort Wayne. If you’re someone who wants to improve your credit score or fix any errors on your credit report, these tips can be helpful. We’ll discuss strategies such as reviewing your credit report, disputing inaccuracies, paying your bills on time, and managing your credit utilization ratio.

Firstly, it’s important to review your credit report regularly to identify any errors or inaccuracies that may be negatively impacting your credit score. You can request a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every year. If you notice any mistakes, such as accounts that don’t belong to you or inaccurate personal information, you should dispute them with the credit reporting agencies. By correcting these errors, you can potentially improve your credit score.

This image is property of www.lexingtonlaw.com.

What is Credit Repair?

Having good credit is essential when it comes to achieving your financial goals. Whether you want to buy a car, rent an apartment, or apply for a loan, your credit score plays a crucial role in determining your eligibility. But what happens if your credit score is less than perfect? This is where credit repair comes in.

Understanding the basics of credit repair

Credit repair is the process of improving your credit score by addressing any negative factors that may be affecting it. This can include correcting errors on your credit report, resolving outstanding debts, and adopting responsible financial habits. The goal of credit repair is to demonstrate to lenders and creditors that you are trustworthy and reliable when it comes to managing your finances.

The importance of credit scores

Your credit score is a three-digit number that lenders use to assess your creditworthiness. It is based on your credit history and provides an indication of your ability to repay borrowed money. A higher credit score makes it easier to qualify for loans and credit cards with favorable terms, such as lower interest rates and higher credit limits. On the other hand, a low credit score can result in limited access to credit and higher interest rates.

Why is DIY Credit Repair Important?

While there are credit repair companies that claim to improve your credit score for a fee, taking a do-it-yourself (DIY) approach can be just as effective. DIY credit repair allows you to take control of your financial future and save money in the process.

Taking control of your financial future

By taking on the responsibility of repairing your own credit, you gain a better understanding of your financial situation. You become aware of any negative factors that may be impacting your credit score and have the opportunity to rectify them. DIY credit repair empowers you to take charge of your financial future by learning about credit management and building positive financial habits.

Saving money by doing it yourself

Credit repair companies often charge hefty fees for their services, sometimes exceeding $1,000. By choosing to repair your credit yourself, you can avoid these unnecessary expenses. Instead of paying someone else to do the work, you can allocate those funds towards paying off your debts or building an emergency fund. DIY credit repair not only saves you money but also allows you to make a positive impact on your overall financial well-being.

Assessing Your Credit Situation

Before you begin your DIY credit repair journey, it’s important to assess your current credit situation. This involves obtaining a free credit report and reviewing your credit score.

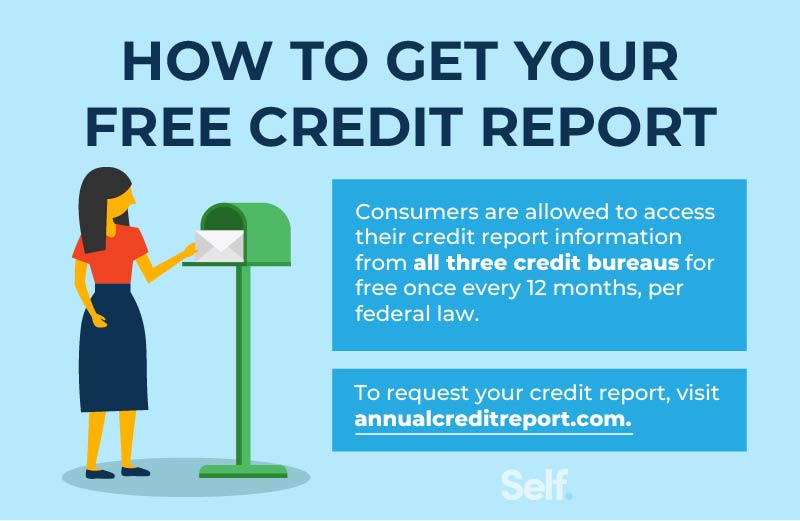

Obtaining a free credit report

You are entitled to a free credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – once a year. To obtain your credit report, visit annualcreditreport.com. It’s important to review all three reports as they may contain different information. Look for any errors or inaccuracies that could be negatively impacting your credit score.

Reviewing your credit score

Your credit score is a numerical representation of your creditworthiness. You can access your credit score through various online platforms or by signing up for a credit monitoring service. Take note of your credit score and compare it to the average credit score in your area. This will give you an idea of where you stand and how much improvement is needed.

Identifying errors or inaccuracies

While reviewing your credit report, keep an eye out for any errors or inaccuracies. These can include incorrect personal information, accounts that don’t belong to you, or late payments that were reported incorrectly. If you come across any discrepancies, make a note of them, as they will need to be addressed later in the credit repair process.

Creating a Credit Repair Strategy

Once you have assessed your credit situation, it’s time to create a credit repair strategy. This involves setting achievable goals, developing a budget and payment plan, and prioritizing your debts.

Setting achievable goals

When it comes to credit repair, it’s important to set realistic and achievable goals. Identify areas where you can make immediate improvements, such as paying off small debts or disputing errors on your credit report. By setting smaller goals and accomplishing them, you will gain momentum and be motivated to continue improving your credit score.

Developing a budget and payment plan

Creating a budget is an essential part of any credit repair strategy. Start by analyzing your income and expenses to determine how much money you can allocate towards paying off debts. Consider eliminating non-essential expenses and cutting back on discretionary spending to free up additional funds. Once you have established a budget, create a payment plan that outlines how much you will pay towards each debt and when.

Prioritizing debts

Not all debts are created equal. Some may have a more significant impact on your credit score than others. Start by prioritizing debts with the highest interest rates or those in collections. By focusing on these debts first, you can minimize the damage they may be causing to your credit score. As you pay off these high-priority debts, gradually work your way down the list, paying off each debt one by one.

This image is property of images.ctfassets.net.

Disputing Inaccurate Information

One of the most effective ways to improve your credit score is by disputing any errors or inaccuracies on your credit report. By writing a formal dispute letter and gathering supporting documentation, you can increase the chances of having the inaccurate information removed.

Writing a formal dispute letter

To dispute inaccurate information on your credit report, you must write a formal dispute letter to the credit bureau that provided the report. In the letter, clearly state the inaccurate information you are disputing and provide any evidence or documentation that supports your claim. Be sure to include your contact information and request that the credit bureau investigates the matter.

Gathering supporting documentation

Supporting documentation plays a crucial role in the dispute process. Gather any paperwork that supports your claim, such as payment receipts, letters from creditors, or identity verification documents. Make copies of these documents to include with your dispute letter. The more evidence you can provide, the stronger your case will be when disputing inaccurate information.

Negotiating with Creditors

In some cases, negotiating with creditors can help improve your credit situation. By understanding the negotiation process and advocating for yourself, you may be able to negotiate lower interest rates or more manageable payment terms.

Understanding the negotiation process

Negotiating with creditors requires preparation and a clear understanding of your financial situation. Start by reviewing your budget and determining how much you can reasonably afford to pay. Contact your creditors and explain your circumstances, emphasizing your willingness to pay but expressing the need for more affordable terms. Be persistent and patient, as negotiations may take time.

Negotiating lower interest rates or payment terms

When negotiating with creditors, focus on requesting lower interest rates or more favorable payment terms. Lower interest rates can reduce the overall amount you owe and make it easier to pay off your debts. Additionally, requesting more manageable payment terms, such as extended repayment periods or reduced monthly payments, can help alleviate financial strain. Keep in mind that not all creditors may be willing to negotiate, but it’s always worth exploring your options.

This image is property of miro.medium.com.

Managing Your Finances Wisely

While repairing your credit, it’s important to adopt responsible financial habits that will contribute to your long-term financial success. By tracking expenses, creating a budget, building an emergency fund, and avoiding unnecessary debt, you can maintain a healthy financial lifestyle.

Tracking expenses and creating a budget

Tracking your expenses is a fundamental aspect of financial management. Keep a record of all your income and expenses to get a clear picture of your financial situation. From there, create a budget that aligns with your goals and priorities. A budget will help you allocate your income wisely, ensuring that you can meet your financial obligations and save for the future.

Building an emergency fund

Life is unpredictable, and unexpected expenses can arise at any time. That’s why it’s important to build an emergency fund. Aim to save three to six months’ worth of living expenses in a separate savings account. This will provide a safety net in case of emergencies, preventing you from relying on credit cards or loans when unexpected costs arise.

Avoiding unnecessary debt

While it may be tempting to rely on credit for purchases, it’s important to avoid unnecessary debt whenever possible. Before making a purchase, consider whether it is essential and whether you can afford to pay for it in cash. If you do need to use credit, make sure to pay off the balance in full each month to avoid accruing interest and potentially damaging your credit score.

Building Positive Credit Habits

Repairing your credit is not a one-time fix, but rather an ongoing process. Building positive credit habits is essential to maintaining a good credit score in the long run. By paying bills on time, using credit responsibly, and avoiding excessive credit applications, you can establish a solid credit history.

Paying bills on time

Paying your bills on time is one of the most crucial factors in maintaining good credit. Late or missed payments can significantly impact your credit score. Set up reminders or automatic payments to ensure that bills are paid on time each month. Even a single late payment can have a negative effect on your credit, so it’s important to make timely payments a priority.

Using credit responsibly

While having a credit card can be beneficial for building credit, it’s important to use it responsibly. Keep your credit card balances low and pay off your balance in full each month if possible. Avoid maxing out your credit limit and only borrow what you can afford to repay. Responsible credit usage demonstrates to lenders and creditors that you are a reliable borrower.

Avoiding excessive credit applications

Each time you apply for credit, a hard inquiry is made on your credit report. Too many hard inquiries can lower your credit score and signify to lenders that you may be experiencing financial difficulties. Limit the number of credit applications you make and only apply for credit when it is necessary. Be selective in your choices and research the best options before submitting applications.

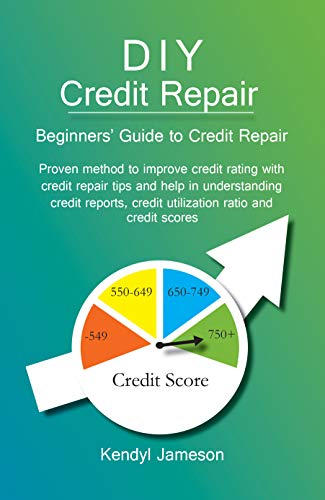

This image is property of Amazon.com.

Utilizing Credit Repair Resources

There are numerous online tools and resources available to assist with DIY credit repair. These resources can provide valuable information and guidance throughout the credit repair process.

Online tools and resources

Websites such as Credit Karma, Experian, and TransUnion offer free access to credit reports, credit scores, and credit monitoring services. They also provide educational resources and tips on how to improve your credit score. Take advantage of these tools to stay informed and track your progress as you work towards repairing your credit.

Working with credit counseling agencies

If you find the DIY credit repair process overwhelming or need additional guidance, consider working with a credit counseling agency. These organizations offer personalized advice and can help you develop a customized credit repair plan. They can also negotiate with creditors on your behalf and provide ongoing support as you work towards improving your credit.

Conclusion

Taking control of your financial future by engaging in DIY credit repair can be a rewarding and empowering experience. By understanding the basics of credit repair, assessing your credit situation, creating a credit repair strategy, disputing inaccurate information, negotiating with creditors, managing your finances wisely, building positive credit habits, and utilizing credit repair resources, you can improve your credit score and pave the way for a brighter financial future. Remember, repairing your credit takes time and effort, but the benefits are immeasurable.

This image is property of images.ctfassets.net.