In this article, you will discover real-life examples of credit repair success stories. You’ll learn about individuals who were able to improve their credit scores and turn their financial situations around. These stories will provide inspiration and practical strategies for anyone looking to repair their credit and achieve financial stability.

In the first success story, you will read about Sarah, a single mother who was overwhelmed by a mountain of debt and a low credit score. Through determination and hard work, she was able to systematically pay off her debts, negotiate with creditors, and develop smart financial habits. As a result, Sarah’s credit score increased significantly, and she was able to secure a better interest rate on a car loan. Her story serves as a reminder that with the right strategies and mindset, anyone can improve their credit and regain control of their finances.

In the second success story, you will learn about John, a recent college graduate burdened by student loan debt and a lack of credit history. With guidance from a credit counselor, he developed a solid plan to improve his credit. By making consistent on-time payments, diversifying his credit mix, and utilizing secured credit cards, John was able to build a positive credit history and increase his credit score. His story demonstrates that even individuals with limited credit experience can take steps to repair their credit and set themselves up for future financial success.

What is Credit Repair?

Credit repair refers to the process of improving and fixing issues with your credit history and credit score. Your credit score is a numerical representation of your creditworthiness, which is used by lenders and creditors to assess your ability to repay borrowed money. A good credit score is crucial for obtaining loans, securing low interest rates, and even renting an apartment or getting a job.

Understanding Credit Scores

Before diving into credit repair success stories, it’s important to have a clear understanding of credit scores. Credit scores typically range from 300 to 850, with a higher score indicating better creditworthiness. Several factors contribute to your credit score, including your payment history, amount of debt, length of credit history, types of accounts, and new credit applications.

Common Credit-Related Problems

Many individuals face credit-related problems that can have a significant impact on their credit scores. Some common issues include missed or late payments, high credit card balances, accounts in collections, bankruptcies, and identity theft. These problems can have long-lasting consequences and make it challenging to obtain credit or secure favorable terms.

Importance of Credit Repair

Repairing your credit is essential for several reasons. Firstly, it allows you to qualify for better loan options and interest rates, saving you money in the long run. Additionally, it can help you gain access to financial opportunities such as buying a home, starting a business, or getting approved for a credit card. Ultimately, repairing your credit empowers you to take control of your financial future.

Fixing Errors on Your Credit Report

One of the first steps in credit repair is identifying and rectifying any errors on your credit report. Your credit report contains information about your credit history, including accounts, loans, and payment history. Unfortunately, errors can occur, and these inaccuracies can negatively impact your credit score.

Identifying Errors on Your Credit Report

Review your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion – to identify any errors. Look for incorrect personal information, accounts that do not belong to you, inaccurate balances, late payments that were actually made on time, and any duplicates or outdated information. Keep documentation of these errors for future reference.

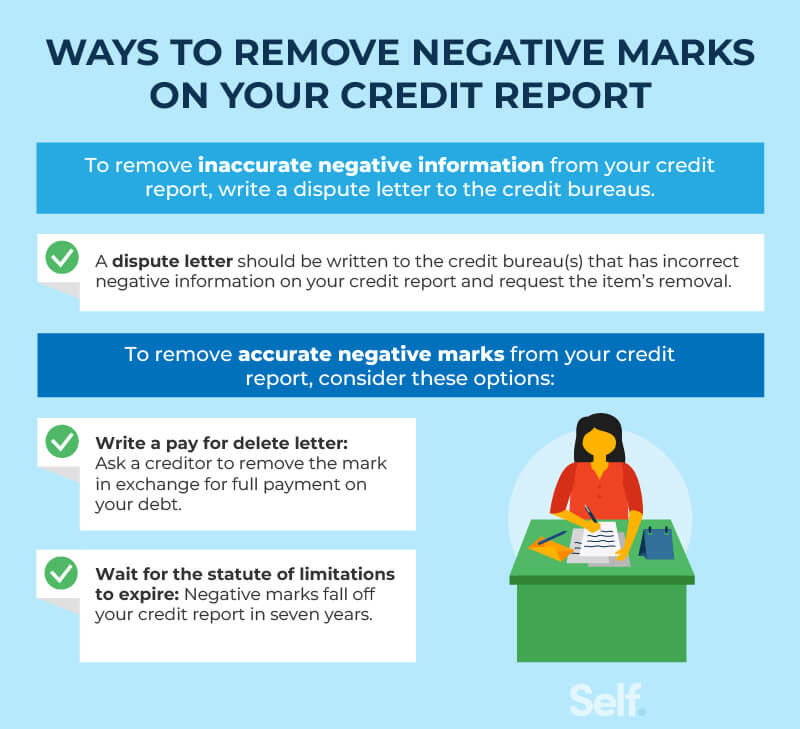

Disputing Inaccuracies with Credit Bureaus

If you find errors on your credit report, it’s crucial to dispute them with the credit bureaus. Contact each credit bureau in writing, providing detailed information about the inaccuracies and including supporting documents. The credit bureaus are legally obligated to investigate and respond to your dispute within a specific timeframe. If the errors are confirmed, the credit bureaus must update your credit report accordingly.

Dealing with Errors Caused by Identity Theft

Identity theft poses a serious threat to your credit. If you suspect fraudulent activity on your credit report, such as accounts opened in your name without your knowledge, contact the credit bureaus and file an identity theft report with the Federal Trade Commission (FTC). Take immediate steps to protect your identity, such as placing a fraud alert or credit freeze on your accounts. It’s crucial to act swiftly to minimize the damage and restore your credit.

This image is property of www.moneyunder30.com.

Debunking Credit Repair Myths

As you embark on your credit repair journey, it’s important to separate fact from fiction. There are many myths and misconceptions surrounding credit repair that can mislead and discourage individuals from taking action.

Separating Fact from Fiction

One common myth is that negative information can never be removed from your credit report. While it’s true that accurate negative information can remain on your report for several years, you have the right to dispute and remove any errors or outdated information. Another myth is that using credit repair services is illegal or ineffective. While there are scams and fraudulent companies to be wary of, legitimate credit repair companies can help you navigate the process and advocate on your behalf.

Dispelling Misconceptions about Credit Repair

Another misconception is that credit repair is a quick fix. It’s important to understand that credit repair takes time and effort. Improving your credit score involves consistently making timely payments, reducing debt, and demonstrating responsible financial behavior. Don’t fall for promises of overnight miracles; instead, focus on long-term strategies for credit improvement.

Understanding the Reality of Improving Credit

Improving your credit requires discipline and patience. It involves establishing positive credit habits, such as paying bills on time, keeping credit card balances low, and diversifying your credit mix. Regularly monitoring your credit report and being proactive about addressing any issues is crucial. By understanding the realities of credit repair, you can set realistic expectations and work towards long-term success.

Building and Rebuilding Credit

Building a good credit history or rebuilding credit after financial setbacks is a crucial aspect of credit repair. Taking proactive steps to establish and improve your credit can open up opportunities and improve your overall financial well-being.

Establishing a Good Credit History

If you’re just beginning to build credit, consider starting with a secured credit card or becoming an authorized user on someone else’s credit card. Ensure that payments are made on time and in full to establish a positive payment history. Over time, you can apply for additional forms of credit, such as an installment loan or a traditional credit card.

Utilization and Managing Credit Responsibly

Another important factor in building good credit is managing credit responsibly. Keep your credit card balances low in relation to your credit limits, ideally below 30% utilization. Avoid maxing out your credit cards and aim to pay off the balances in full each month. Responsible credit management demonstrates to lenders that you can handle credit responsibly.

Rebuilding Credit after Financial Setbacks

If you’ve experienced financial setbacks, such as bankruptcy or foreclosure, rebuilding your credit may seem daunting, but it’s not impossible. Begin by addressing any outstanding debts and making payment arrangements with creditors. Consider obtaining a secured credit card and using it responsibly to demonstrate improved financial habits. Over time, rebuilding credit is achievable with consistent effort and responsible financial behavior.

This image is property of images.bestcompany.com.

Navigating Late Payments and Collections

Late payments and accounts in collections can have a significant impact on your credit score. It’s crucial to address these issues promptly and navigate them effectively.

Effects of Late Payments on Credit

Late payments can result in negative marks on your credit report and significantly lower your credit score. Even a single late payment can have a detrimental impact. It’s important to make payments on time, set up automatic payments or reminders, and communicate with creditors if you’re facing financial hardship. Timely payments are key to maintaining a positive credit history.

Strategies for Dealing with Collections

Accounts that have been sent to collections can have a severe impact on your credit score. If you have accounts in collections, it’s essential to address them proactively. Consider negotiating payment arrangements with the collection agency or even offering a settlement. Ensure that any agreements reached are documented in writing and that you follow through on your end of the agreement.

Negotiating Payment Plans with Creditors

If you’re struggling to make payments and fear falling behind, it’s worth contacting your creditors to explore payment plan options. Many creditors are willing to work with you to create a manageable repayment plan. Exploring this option can help you avoid further damage to your credit and alleviate the stress of overwhelming debt.

Credit Repair vs. Debt Settlement

When facing credit-related problems, it’s important to understand the differences between credit repair and debt settlement. Each approach has its pros and cons.

Understanding the Differences

Credit repair focuses on improving your credit history and score through addressing errors and inaccuracies. It involves working with credit bureaus and disputing any incorrect information. Debt settlement, on the other hand, involves negotiating with creditors to settle outstanding debts for a reduced amount. Both approaches aim to improve your financial situation, but they tackle different aspects of credit and debt.

Pros and Cons of Credit Repair

The main advantage of credit repair is that it can potentially improve your credit score, making it easier to obtain credit and secure favorable terms. However, credit repair requires active involvement and may take time to see substantial results. Additionally, it’s important to be mindful of scams and fraudulent companies posing as credit repair services.

Pros and Cons of Debt Settlement

Debt settlement can be an option for individuals struggling with overwhelming debt. The main advantage is the potential to reduce the amount owed and eliminate debt faster. However, debt settlement can have a negative impact on your credit and may not be suitable for all situations. It’s important to carefully consider the consequences and consult with professionals before pursuing debt settlement.

This image is property of images.ctfassets.net.

Hiring Credit Repair Companies

If you find the credit repair process overwhelming or time-consuming, you may consider hiring a credit repair company. However, it’s crucial to choose a reputable company and understand the services they provide.

Choosing a Reputable Credit Repair Company

When selecting a credit repair company, research their reputation, read reviews, and ensure they have proper licensing and credentials. Look for companies that offer transparent pricing, clear communication, and a proven track record of success. Avoid companies that make unrealistic promises or require upfront payment before providing services.

Understanding the Services they Provide

Credit repair companies offer a range of services, including credit report analysis, disputing inaccuracies, negotiating with creditors, and providing guidance on improving credit habits. They can also provide education and resources to help you better understand credit and financial management. Understand exactly what services the company offers and how they can assist you in your credit repair journey.

Avoiding Scams and Fraudulent Practices

Unfortunately, there are scams and fraudulent practices in the credit repair industry. Be cautious of companies that guarantee specific results or promise to remove accurate negative information from your credit report. Legitimate credit repair companies cannot delete accurate information from your credit report, but they can assist with disputing any errors or inaccuracies.

DIY Credit Repair Tips

While hiring a credit repair company can be beneficial for some individuals, many aspects of credit repair can be done on your own. Taking a DIY approach can save you money and empower you to actively participate in improving your credit.

Steps to Take for Self-Credit Repair

Start by obtaining copies of your credit reports from all three major credit bureaus. Review them carefully for any errors or inaccuracies. If you find any, follow the appropriate dispute process with the credit bureaus. Pay your bills on time, keep credit card balances low, and focus on improving your credit habits overall. Educate yourself on credit management and seek out reliable resources and tools to aid in your DIY credit repair journey.

Improving Credit Scores on Your Own

Improving your credit score on your own is achievable with dedication and persistence. Make a plan to pay down outstanding debts, prioritize payments, and establish a positive payment history. Monitor your credit reports regularly and address any issues promptly. Utilize tools such as budgeting apps and credit monitoring services to stay on top of your finances and credit.

Resources and Tools to Aid in DIY Credit Repair

There are numerous resources available to assist with DIY credit repair. Online credit monitoring services can help you stay informed about changes to your credit report and offer tips for improving your credit score. Various financial websites and blogs provide valuable information and guides on credit repair and building good credit habits. Take advantage of these resources to gain knowledge and insight into effective credit repair strategies.

This image is property of images.ctfassets.net.

Success Stories and Case Studies

Real-life examples of credit repair success can provide inspiration and motivation on your credit repair journey. Hearing about individuals who have achieved their financial goals can serve as a reminder that progress is possible.

Real-Life Examples of Credit Repair Success

One success story involves Sarah, who had a low credit score due to missed payments and high credit card balances. She enrolled in a credit repair program, learned about responsible credit management, and diligently worked to improve her credit habits. Over time, Sarah saw her credit score rise, allowing her to qualify for a mortgage and purchase her dream home.

Testimonials from Individuals who Achieved Financial Goals

Another inspiring success story comes from John, who was burdened with significant debt and a poor credit score. Through disciplined budgeting, negotiating with creditors, and educating himself on credit repair strategies, John successfully paid off his debts and rebuilt his credit. He now enjoys the financial freedom and peace of mind that comes with improved creditworthiness.

Analyzing Case Studies to Learn Effective Credit Repair Strategies

By examining case studies, you can gain valuable insights into effective credit repair strategies. Look for common themes, such as prioritizing payments, disputing inaccuracies, and establishing positive credit habits. Analyze the steps taken by successful individuals and tailor them to your own credit repair journey.

Conclusion

Credit repair success stories demonstrate that improving your credit is possible, regardless of your current situation. By understanding credit scores, addressing errors on your credit report, dispelling myths, and taking proactive steps to build and rebuild credit, you can achieve financial goals and regain control of your financial future.

Remember that credit repair is a long-term process that requires patience, discipline, and ongoing effort. By maintaining good credit habits, staying informed about your credit, and utilizing resources and tools available, you can continue to improve your creditworthiness. Your credit repair journey is unique, and with determination and perseverance, you can achieve the credit score and financial freedom you desire.

This image is property of mlsjoxwh2dv5.i.optimole.com.