As you embark on a journey to explore the intricacies of the financial industry, there is one role that stands out, a credit repair specialist. Curiosity surrounds what compensation this position offers as it requires a unique skill set and a deep understanding of credit systems. In this article, we will examine the credit repair specialist salary, shedding light on the factors that influence it and providing insights into the potential earnings in this field. By the end, you will have a comprehensive understanding of the financial rewards that await those who choose this career path.

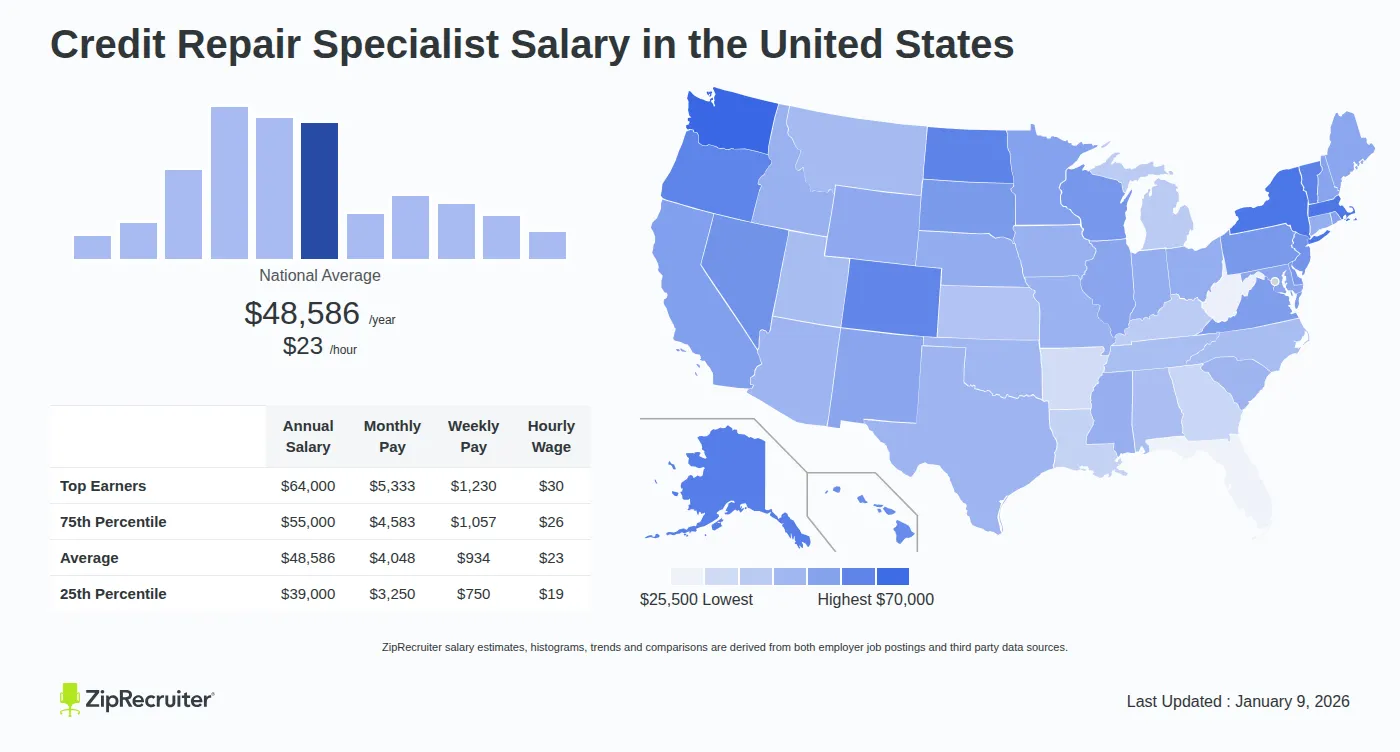

This image is property of www.ziprecruiter.com.

Overview of Credit Repair Specialist Salary

What is a Credit Repair Specialist?

A Credit Repair Specialist is a professional who helps individuals and businesses improve their credit scores by identifying errors in credit reports, disputing inaccurate information, and developing strategies to manage and improve credit. They work closely with clients to assess their financial situations, negotiate with creditors and collection agencies, and educate them on credit management.

Why is Credit Repair Important?

Credit repair is crucial for individuals and businesses because a good credit score is essential for obtaining loans, credit cards, mortgages, and other financial opportunities. A poor credit score can result in higher interest rates, limited access to credit, and difficulty in securing financial assistance. By working with a Credit Repair Specialist, individuals and businesses can improve their credit profiles and enhance their financial prospects.

What is the Salary Range for Credit Repair Specialists?

The salary range for Credit Repair Specialists can vary depending on factors such as experience, education, location, and the industry they work in. According to the Bureau of Labor Statistics, the median annual wage for credit counselors, a similar occupation, was $49,380 in May 2020. However, it is important to note that this figure may not reflect the exact salary range for Credit Repair Specialists, as there is limited specific data available for this occupation.

Factors that Influence Credit Repair Specialist Salary

Several factors can influence the salary of a Credit Repair Specialist. These include:

-

Experience: As with many professions, experience plays a significant role in determining salary. Credit Repair Specialists with more years of experience often command higher salaries due to their expertise and knowledge in the field.

-

Education and Certification: The level of education and certification a Credit Repair Specialist possesses can impact their earning potential. Advanced degrees, specialized certifications, and training in credit repair can increase their value in the job market and lead to higher salaries.

-

Geographic Location: The location where a Credit Repair Specialist works can affect their salary. Areas with a higher cost of living or higher demand for credit repair services may offer higher salaries to attract and retain talent.

-

Industry: Credit Repair Specialists can work in various industries, such as credit counseling agencies, financial institutions, or as independent consultants. Different industries may offer different salary structures and opportunities for advancement.

Educational Requirements for Credit Repair Specialists

High School Diploma or Equivalent

In terms of formal education, a high school diploma or equivalent is typically the minimum requirement for becoming a Credit Repair Specialist. This level of education provides a foundation of knowledge in basic math, communication skills, and critical thinking, which are essential for the role.

College Degree or Certification

While a college degree is not always required to become a Credit Repair Specialist, having one can increase job prospects and earning potential. A degree in finance, business administration, economics, or a related field can provide a more comprehensive understanding of credit repair principles and financial management strategies. Additionally, obtaining certifications in credit repair, such as the Certified Credit Repair Specialist (CCRS) designation, can demonstrate expertise and dedication to the profession.

Continuing Education

To stay abreast of industry changes and best practices, Credit Repair Specialists should engage in continuing education. This can involve attending workshops, seminars, and webinars focused on credit repair, credit laws and regulations, and emerging trends in the field. Continuing education can not only enhance a specialist’s knowledge but also help them maintain their certifications and professional standing.

Skills and Qualities of a Credit Repair Specialist

To be successful in the role of a Credit Repair Specialist, individuals should possess the following skills and qualities:

Knowledge of Credit Laws and Regulations

Credit Repair Specialists must have a thorough understanding of federal and state credit laws and regulations, such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA). This knowledge enables them to navigate the legal landscape, identify potential violations, and advocate for their clients’ rights.

Strong Communication and Negotiation Skills

Effective communication is essential for Credit Repair Specialists to interact with clients, creditors, and collection agencies. They must be able to explain complex credit repair concepts in a clear and concise manner, negotiate with creditors on behalf of their clients, and present their findings and recommendations in a professional manner.

Attention to Detail

Attention to detail is critical in the credit repair process, as even minor errors or discrepancies in credit reports can have significant consequences. Credit Repair Specialists must possess a meticulous eye for detail to identify inaccuracies, verify information, and ensure the proper documentation and submission of disputes.

Analytical and Problem-Solving Skills

Analytical and problem-solving skills are fundamental to the role of a Credit Repair Specialist. They need to analyze credit reports, financial statements, and other relevant documents to identify patterns, trends, and areas of improvement. Additionally, they must be able to develop tailored strategies and solutions to address their clients’ unique credit challenges.

Customer Service Skills

Credit Repair Specialists work closely with clients, providing guidance, support, and reassurance throughout the credit repair process. Excellent customer service skills are essential for building rapport, managing expectations, and maintaining a positive client experience.

Organizational and Time Management Skills

Given the multitude of tasks involved in credit repair, including analyzing credit reports, submitting disputes, and monitoring progress, Credit Repair Specialists must possess strong organizational and time management skills. They must be able to prioritize and manage their workload efficiently, ensuring that all client files are handled timely and effectively.

Ethical and Trustworthy

Maintaining high ethical standards and trustworthiness is paramount in the credit repair industry. Credit Repair Specialists have access to sensitive personal and financial information, and clients rely on their expertise and integrity to represent their best interests. Upholding ethical principles, safeguarding client data, and adhering to professional standards are essential qualities for success in this field.

Job Responsibilities of a Credit Repair Specialist

Assessing Credit Reports

One of the primary responsibilities of a Credit Repair Specialist is assessing clients’ credit reports to identify inaccuracies, errors, or outdated information that may be negatively impacting their credit scores. They go through various sections of the credit report, including personal information, credit accounts, inquiries, and public records, to gain a comprehensive understanding of their clients’ credit profiles.

Identifying Errors and Disputing Inaccurate Information

Upon identifying errors or inaccuracies in the credit reports, Credit Repair Specialists initiate the dispute process to have them corrected or removed. They gather the necessary documentation, prepare dispute letters, and communicate with credit bureaus, creditors, and collection agencies to rectify the identified issues. This process involves diligent follow-up and meticulous documentation to support their clients’ claims.

Negotiating with Creditors and Collection Agencies

Credit Repair Specialists often engage in negotiations with creditors and collection agencies on behalf of their clients. They work to settle outstanding debts, negotiate repayment plans, or request the removal of negative information from credit reports. Strong negotiation skills and knowledge of credit laws are vital in advocating for their clients’ interests and achieving favorable outcomes.

Developing Financial Plans and Strategies

Based on their analysis of clients’ credit reports and financial situations, Credit Repair Specialists develop customized financial plans and strategies to improve their clients’ credit scores. These plans may include debt repayment strategies, budgeting recommendations, and advice on building positive credit history. Credit Repair Specialists guide their clients through the implementation of these plans, providing ongoing support and monitoring progress.

Educating Clients on Credit Management

An essential aspect of the Credit Repair Specialist role is educating clients on credit management. They explain credit scores, credit utilization, and the impact of different financial behaviors on creditworthiness. By enhancing their clients’ understanding of credit, Credit Repair Specialists empower them to make informed financial decisions and develop healthy credit habits for the long term.

Monitoring Progress and Providing Updates

Throughout the credit repair process, Credit Repair Specialists monitor progress meticulously, track changes in credit reports, and evaluate the effectiveness of implemented strategies. They provide regular updates to clients, highlighting improvements, addressing concerns, and adjusting strategies as needed. This ongoing support and feedback are crucial for maintaining client engagement and achieving desired outcomes.

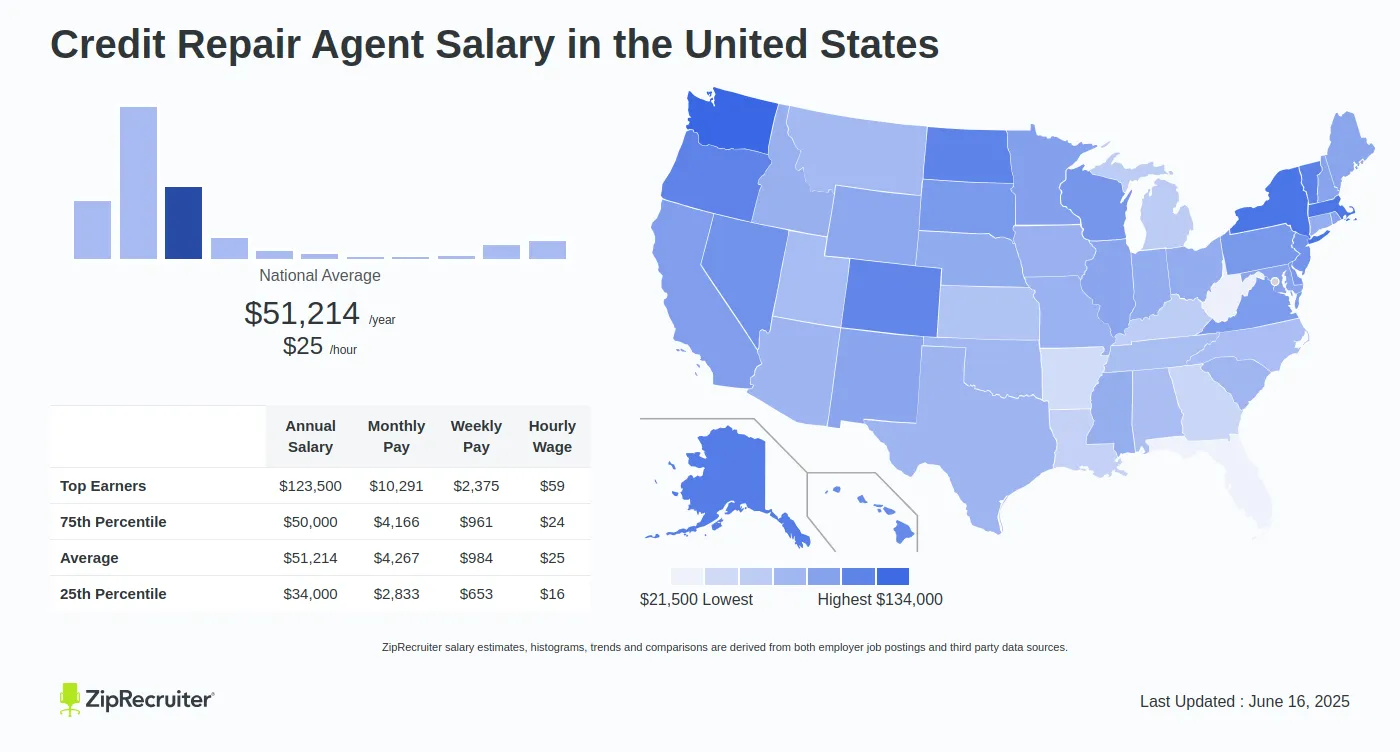

This image is property of www.ziprecruiter.com.

Salary Range for Credit Repair Specialists

Entry-Level Salary

As an entry-level Credit Repair Specialist, individuals can expect a salary within the lower range of the overall salary spectrum. Entry-level salaries typically range from $30,000 to $40,000 per year. However, this can vary based on factors such as the organization’s size, location, and the individual’s qualifications and experience.

Mid-Level Salary

After gaining a few years of experience and solidifying their skills, Credit Repair Specialists can expect a mid-level salary. The mid-level salary range for Credit Repair Specialists usually falls between $40,000 and $60,000 per year. This range reflects the increased value and expertise they bring to their role.

Senior-Level Salary

Credit Repair Specialists who have reached senior-level positions and have extensive experience and a proven track record of success can command higher salaries. Senior-level salaries for Credit Repair Specialists generally range from $60,000 to $100,000 or more per year. These professionals often have additional responsibilities, such as mentoring junior staff, managing client portfolios, and driving business development.

Additional Benefits and Incentives

In addition to base salaries, Credit Repair Specialists may receive additional benefits and incentives that can further enhance their overall compensation packages. Some common benefits and incentives in this field include:

Commission or Performance-Based Bonuses

Credit Repair Specialists may have opportunities to earn commissions or performance-based bonuses based on their individual or team achievements. These incentives can motivate them to achieve targets, drive results, and provide exceptional service to their clients.

Health Insurance and Retirement Plans

Many organizations offer comprehensive health insurance plans and retirement benefits to their employees, including Credit Repair Specialists. These benefits can contribute to overall job satisfaction and provide financial security for the future.

Training Opportunities

Continuing education and ongoing professional development are crucial for Credit Repair Specialists to stay updated on industry trends and enhance their skills. Many employers offer training opportunities to support their specialist’s growth, which may include attending conferences or workshops, pursuing certifications, or accessing online learning platforms.

Flexible Work Schedules

Flexible work schedules are becoming increasingly common in many industries, including credit repair. Credit Repair Specialists may have the option to work remotely, have flexible hours, or choose alternative work arrangements. This flexibility can enhance work-life balance and job satisfaction.

Work From Home Options

Given recent shifts in work practices, some Credit Repair Specialists have the opportunity to work remotely or from home. This option allows for increased flexibility, eliminates commuting time and costs, and may contribute to a better work-life balance.

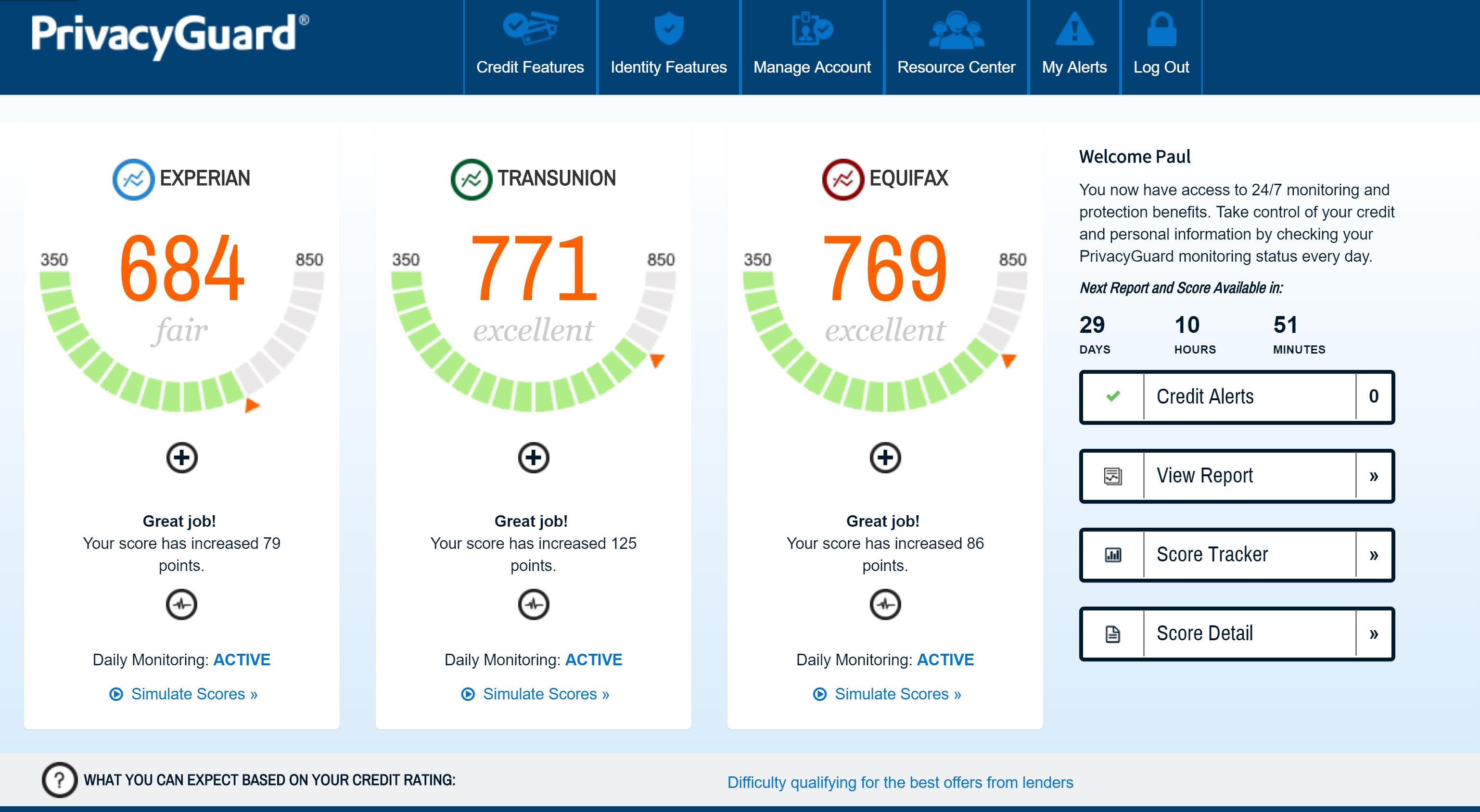

This image is property of static.zippia.com.

Job Outlook for Credit Repair Specialists

Growing Demand for Credit Repair Specialists

As the importance of credit scores and financial management continues to be recognized, the demand for Credit Repair Specialists is expected to grow. Individuals and businesses alike are seeking the expertise of these professionals to improve their credit profiles and navigate complex financial systems. This growing demand presents opportunities for those interested in pursuing a career as a Credit Repair Specialist.

Opportunities for Career Advancement

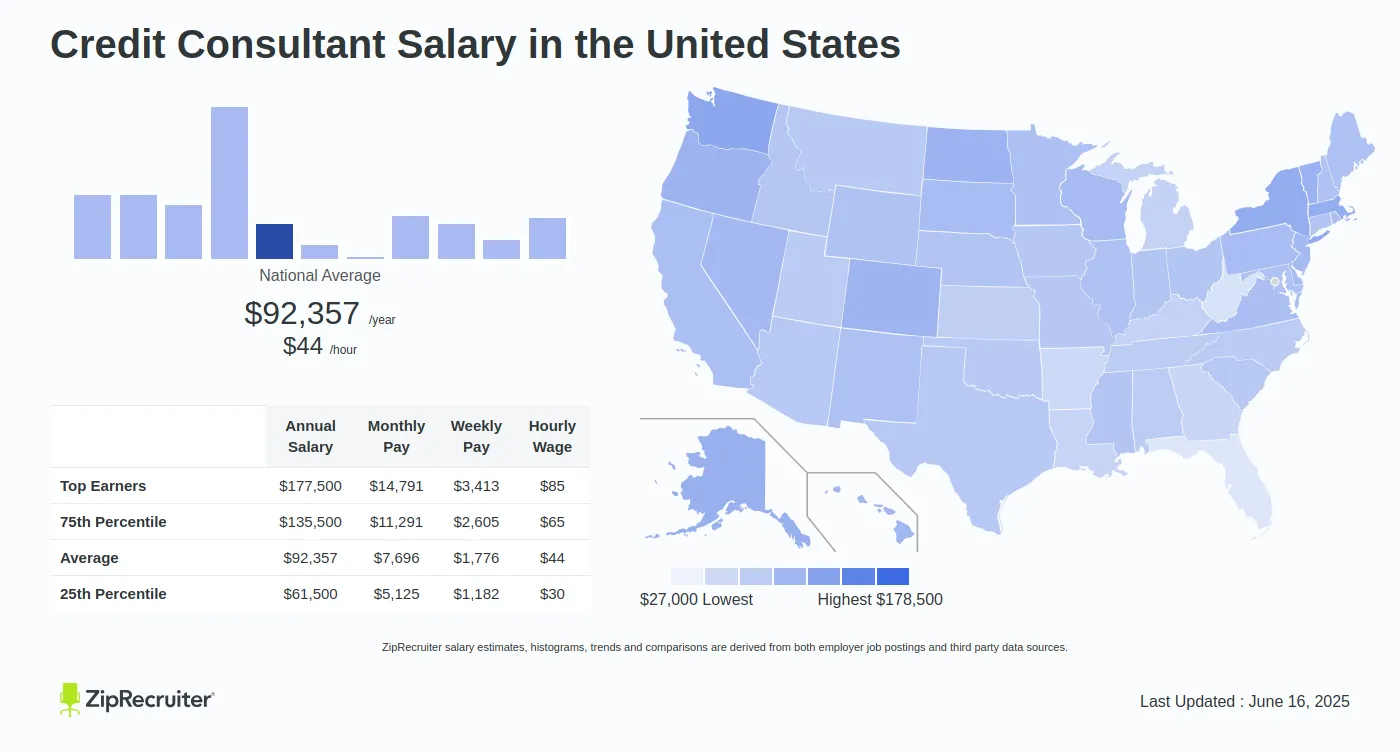

Credit Repair Specialists can pursue various avenues for career advancement. With experience and additional certifications or degrees, they can take on managerial roles, supervising teams of specialists or overseeing entire credit repair departments. Alternatively, they may choose to start their own credit repair business, offering their services as independent consultants or entrepreneurs.

Industry and Location Factors Impacting Salary

Credit Repair Industry

The specific industry in which a Credit Repair Specialist works can influence their salary range. Those employed by credit counseling agencies or financial institutions may receive steady salaries characterized by incremental increases over time. Conversely, Credit Repair Specialists working independently or as consultants may have more varied income streams, with potential for higher earnings based on client volume and success rates.

Geographic Location

The geographic location of employment can also impact the salary range for Credit Repair Specialists. Salaries tend to be higher in areas with a higher cost of living, such as major metropolitan areas. Additionally, states or regions with a strong demand for credit repair services may offer higher salaries to attract and retain qualified professionals.

This image is property of fiverr-res.cloudinary.com.

Alternatives and Related Careers

Credit Counselor

Credit Counselors work closely with individuals and businesses to provide guidance and assistance in managing their credit and financial situations. They assess clients’ financial health, offer personalized advice and solutions, and educate them on credit management. While there is some overlap in job responsibilities, Credit Counselors typically focus more on financial counseling and long-term financial planning.

Financial Analyst

Financial Analysts evaluate investment opportunities, analyze financial data, and make recommendations to individuals and organizations regarding investment strategies, economic trends, and financial risks. They rely heavily on financial modeling, statistical analysis, and data interpretation to support their findings and guide decision-making. While there are differences in the specific focus and skill set required, both Credit Repair Specialists and Financial Analysts work with financial information to support the financial well-being of their clients.

Financial Planner

Financial Planners help clients develop comprehensive financial plans to achieve their short-term and long-term goals. They assess clients’ financial situations, provide investment advice, and offer strategies for retirement planning, tax optimization, insurance coverage, and estate planning. Although Financial Planners encompass a broad range of financial planning services, some areas, such as credit repair, may overlap with the responsibilities of a Credit Repair Specialist.

Loan Officer

Loan Officers specialize in evaluating loan applications, assessing creditworthiness, and making recommendations on loan approvals. They work closely with individuals and businesses to understand their financial needs, gather necessary documentation, and guide them through the loan application process. While their primary focus is on evaluating loan applications rather than repairing credit, Loan Officers require an understanding of credit and financial management principles to make informed lending decisions.

Conclusion

A career as a Credit Repair Specialist offers a promising career path with a competitive salary range. These professionals play a vital role in helping individuals and businesses improve their credit scores, navigate credit laws and regulations, and ultimately achieve their financial goals. By possessing the necessary education, skills, and qualities, individuals can embark on a fulfilling journey in the credit repair industry, with opportunities for growth, advancement, and financial success.

This image is property of www.ziprecruiter.com.