So you’ve found yourself in need of credit repair services in Mobile, AL. Whether it’s a few late payments, high credit utilization, or a pesky old debt dragging down your score, you’re ready to take control and improve your creditworthiness. Luckily, Mobile is home to a range of professional credit repair services that can help you navigate the murky waters of credit report errors, disputes, and strategies to boost your credit score. With their expertise and dedication, you’ll soon be on your way to a healthier credit profile and the financial freedom you’ve been dreaming of.

What are credit repair services?

Understanding the basics

Credit repair services are professional assistance providers that help individuals in improving their credit scores and resolving credit-related issues. These services offer various strategies and techniques to address inaccuracies, errors, and negative items on credit reports, with the ultimate goal of improving creditworthiness.

How credit repair companies work

Credit repair companies typically start by reviewing your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion). They analyze the reports to identify any inaccuracies, errors, or derogatory information that may be negatively impacting your credit score. Once problematic items have been identified, the credit repair company will initiate the process of disputing the inaccurate information with the credit bureaus and the creditors involved.

Common misconceptions

There are a few common misconceptions about credit repair services. One common misconception is that credit repair companies can magically erase all negative items from your credit report. While they can help identify inaccuracies and dispute them, there is no guarantee that every negative item will be removed. Another misconception is that credit repair services are illegal or unethical. While there have been cases of fraudulent practices in the industry, legitimate credit repair companies operate within the confines of the law and follow ethical guidelines.

Benefits of credit repair services

Improving credit score

One of the primary benefits of credit repair services is the potential to improve your credit score. By identifying and disputing inaccurate information on your credit report, credit repair companies can help ensure that your credit history is accurately reflected. This, in turn, can lead to an increase in your credit score over time.

Increasing chances of loan approvals

A higher credit score can greatly increase your chances of getting approved for loans and other types of credit. Lenders often use credit scores as a primary factor in determining an individual’s creditworthiness. By improving your credit score through credit repair services, you can enhance your eligibility for loans with favorable terms and conditions.

Lowering interest rates

With a better credit score, you may also be able to negotiate lower interest rates on loans and credit cards. Higher credit scores are seen as an indicator of lower default risk, making you a more attractive borrower to lenders. This can result in lower interest rates, ultimately saving you money in the long run.

This image is property of res.cloudinary.com.

Factors to consider before choosing a credit repair service

Legitimacy and reputation

Before choosing a credit repair service, it is crucial to ensure that the company is legitimate and has a good reputation. Look for companies that are registered with the appropriate regulatory bodies and have positive reviews from past clients. Avoid companies that make unrealistic promises or charge exorbitant fees upfront.

Services offered

Different credit repair companies may offer varying services, so it is important to consider what specific assistance you need. Some companies may focus solely on disputing inaccurate information, while others may offer additional services like credit monitoring or financial counseling. Evaluate your needs and choose a company that aligns with your specific requirements.

Cost and affordability

Credit repair services typically charge fees for their services, so it is essential to consider the cost and affordability before making a decision. Some companies charge a one-time fee, while others may have a monthly fee structure. Compare the fees of different companies and ensure that the cost is within your budget. However, be cautious of companies that charge exorbitant fees without providing significant value.

Types of credit repair services

Self-help credit repair

Self-help credit repair involves individuals taking on the task of improving their credit scores on their own. This approach requires significant time, effort, and knowledge of the credit reporting system. It involves identifying inaccuracies, disputing them with credit bureaus and creditors, and monitoring progress. While self-help credit repair can be cost-effective, it may not be suitable for individuals who lack the knowledge or resources to navigate the credit repair process effectively.

Credit counseling

Credit counseling services provide guidance and advice on managing credit and improving credit scores. These services usually involve working with a credit counselor to assess your financial situation, develop a budget, and create a plan to pay off debts. While credit counseling does not directly dispute inaccuracies on credit reports, it can be a valuable resource for individuals struggling with debt management.

Professional credit repair services

Professional credit repair services are organizations specifically dedicated to helping individuals improve their credit scores. These companies have expertise in credit report analysis, dispute letter writing, and negotiation with creditors. They take on the responsibility of addressing inaccuracies and derogatory items on behalf of their clients. Professional credit repair services can provide guidance, support, and expedited resolution for credit-related issues.

This image is property of static.wixstatic.com.

Understanding the credit repair process

Initial consultation and analysis

The credit repair process typically begins with an initial consultation and analysis. During this stage, the credit repair company will gather information about your credit history, review your credit reports, and assess your specific needs and goals. This information will help them develop a personalized strategy to address inaccuracies and improve your credit score.

Disputing inaccurate information

Once the inaccurate information on your credit report has been identified, the credit repair company will initiate the process of disputing the information with the credit bureaus. This involves sending letters and supporting documentation to the credit bureaus, requesting that they investigate and correct the inaccuracies. The credit repair company will handle the correspondence and keep you updated on the progress.

Negotiation and settlement

In some cases, credit repair services may engage in negotiation and settlement with creditors on your behalf. This typically occurs when there are outstanding debts or negative items that can be resolved through negotiation. The credit repair company will work with your creditors to negotiate favorable payment terms or settlements, helping you resolve outstanding issues and improve your credit standing.

Common techniques used by credit repair services

Credit report analysis

Credit repair services employ professionals who are skilled in analyzing credit reports. They thoroughly review your credit reports to identify inaccuracies, errors, and negative items that may be impacting your credit score. This analysis plays a crucial role in developing a targeted strategy for addressing problematic items on your credit report.

Dispute letter writing

Dispute letters are a key component of the credit repair process. Credit repair services often handle the task of writing and sending dispute letters to the credit bureaus on behalf of their clients. These letters outline the inaccuracies or errors on the credit report and request an investigation and correction of the information. The credit repair company will ensure that the letters are properly formatted and include any supporting documentation.

Goodwill letters and debt validation

Goodwill letters are another technique used by credit repair services to address negative items on credit reports. These letters are written to creditors, requesting that they remove or modify negative information as a gesture of goodwill. Debt validation is the process of requesting that creditors provide verification of debts and prove that they have the legal right to collect them. These techniques can help in resolving outstanding issues and improving your credit standing.

This image is property of static.wixstatic.com.

Risks and limitations of credit repair services

No guarantee of success

While credit repair services can assist in the process of improving your credit, there is no guarantee of success. The credit bureaus and creditors ultimately have the final say in whether to remove or modify negative items on your credit report. It is important to understand that credit repair is a complex and time-consuming process, and results may vary depending on individual circumstances.

Potential scams and frauds

The credit repair industry has its share of scams and fraudulent practices. Some companies may make false promises or engage in unethical practices to deceive consumers. It is crucial to research and choose reputable credit repair services to avoid falling victim to scams. Look for companies with a track record of success and positive reviews from customers.

Legal repercussions

Credit repair services operate within the boundaries of the law, but it is important to be aware of potential legal risks. Engaging in fraudulent or deceptive practices can result in legal repercussions, both for the credit repair company and the consumer. It is important to work with legitimate credit repair services and stay informed of your rights and responsibilities as a consumer.

Determining the best credit repair service for you

Researching multiple options

Before choosing a credit repair service, it is important to research and compare multiple options. Look for companies that offer transparent information about their services, pricing, and success rates. Consider their experience, reputation, and customer reviews. Taking the time to research and compare will help you make an informed decision.

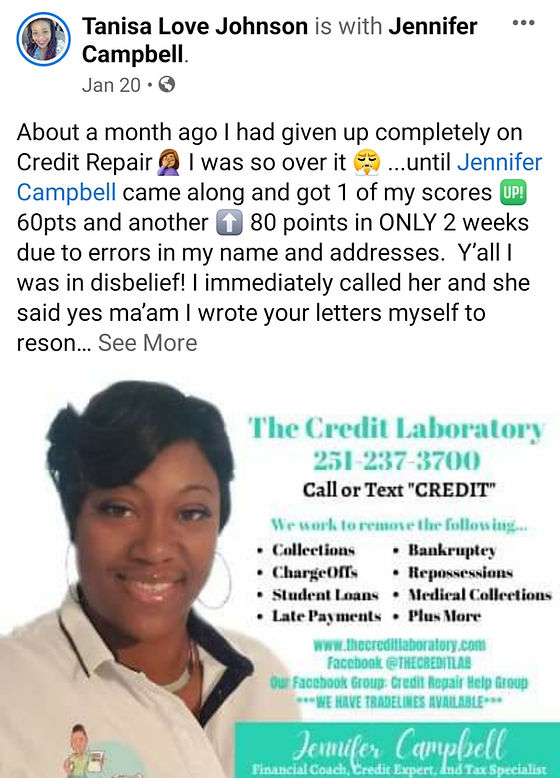

Reading customer reviews and testimonials

Customer reviews and testimonials can provide valuable insights into the effectiveness and reliability of a credit repair service. Look for reviews from customers who have had similar credit issues or goals. Reading about the experiences and outcomes of other clients can give you a better idea of what to expect from a particular company.

Consulting with financial professionals

If you are unsure about which credit repair service to choose or need additional guidance, consider consulting with financial professionals such as credit counselors or financial advisors. These professionals can provide personalized advice based on your specific financial situation and goals. They may have recommendations or insights that can help you make an informed decision.

This image is property of static.wixstatic.com.

Credit repair services vs. DIY credit repair

Pros and cons of hiring professionals

Hiring credit repair professionals can save you time and effort, as they have expertise in navigating the credit repair process. They can effectively handle the communication with credit bureaus and creditors and have a better understanding of the strategies needed to improve your credit score. However, the cost of hiring professionals can be a con, especially for individuals on a tight budget.

Time and effort required for self-help

Self-help credit repair requires significant time and effort on your part. You would need to educate yourself about credit repair laws, dispute procedures, and negotiation techniques. You would also need to devote time to analyze your credit reports, draft dispute letters, and monitor progress. While self-help credit repair can be cost-effective, it may not be suitable for individuals with limited time or resources.

Educational resources for DIY credit repair

If you choose to engage in DIY credit repair, there are various educational resources available to help you navigate the process. You can find books, online articles, and video tutorials that provide step-by-step guidance on improving your credit score. These resources can help you understand the credit repair process and empower you to take control of your credit.

Choosing a credit repair service in Mobile, AL

Local options and availability

If you are specifically looking for a credit repair service in Mobile, AL, there are several local options available. Conduct a search online or ask for recommendations from friends, family, or local financial professionals. Check the websites and reviews of local credit repair services to understand their services, pricing, and success rates.

Comparing services and pricing

When choosing a credit repair service in Mobile, AL, it is important to compare the services and pricing offered by different companies. Consider the specific services each company provides, such as credit report analysis, dispute letter writing, or negotiation with creditors. Compare the fees charged by different companies and ensure that they are within your budget.

Client success stories and satisfaction

Client success stories and satisfaction are good indicators of the effectiveness and reliability of a credit repair service. Look for testimonials or case studies on the websites of credit repair services in Mobile, AL. Reading about the experiences of other clients can give you an idea of the potential outcomes and the level of satisfaction you can expect.

In conclusion, credit repair services can be valuable resources for individuals looking to improve their credit scores and resolve credit-related issues. Understanding the basics of credit repair, weighing the benefits and risks, and considering factors such as legitimacy, services offered, and cost are all crucial steps in choosing the right credit repair service for you. Whether you decide to hire professionals or pursue DIY credit repair, the ultimate goal is to enhance your creditworthiness and achieve financial freedom.

This image is property of s3-media0.fl.yelpcdn.com.