So you’ve found yourself in a bit of a financial bind and your credit score has taken a hit. Don’t worry, because Credit Repair Milwaukee is here to help. With their expert team of credit repair specialists, they are dedicated to assisting you in improving and restoring your credit. Whether you need assistance with removing inaccurate information, resolving past bankruptcies or foreclosures, or simply need guidance on how to rebuild your credit, Credit Repair Milwaukee has the knowledge and experience to get you back on track to financial success. Say goodbye to the stress and frustration of bad credit and say hello to a brighter financial future with Credit Repair Milwaukee.

Understanding Credit Repair

Definition of Credit Repair

Credit repair refers to the process of improving an individual’s creditworthiness by addressing and resolving negative or inaccurate information on their credit report. This may involve disputing errors, negotiating with creditors, and implementing strategies to rebuild credit. The overall goal of credit repair is to enhance one’s credit score and financial profile, which can result in better loan terms, lower interest rates, and increased access to credit.

Why Credit Repair is Important

Having a good credit score is crucial in today’s financial landscape. Your credit score serves as a numerical representation of your creditworthiness, indicating to lenders how likely you are to repay borrowed money. A higher credit score can lead to better financial opportunities, such as securing loans, renting an apartment, and even landing certain job positions. On the other hand, a poor credit score can limit your options and result in higher interest rates or outright loan denials. Credit repair is important because it allows individuals to rectify past mistakes, resolve inaccuracies, and ultimately improve their creditworthiness.

Common Misconceptions about Credit Repair

There are several misconceptions surrounding credit repair that can often lead individuals astray. One common misconception is that credit repair agencies can magically erase negative information from your credit report. While credit repair agencies can indeed help you dispute inaccurate items, they cannot guarantee the removal of legitimate negative marks, such as missed payments or bankruptcies. It’s important to recognize that credit repair is not an overnight fix and requires time, patience, and ongoing financial responsibility. Additionally, some individuals believe that they can’t repair their credit on their own and need to rely on expensive credit repair agencies. While hiring an agency can be beneficial in certain situations, there are also effective do-it-yourself (DIY) strategies that can be employed to improve your credit score.

Credit Situation in Milwaukee

Average Credit Score in Milwaukee

The credit situation in Milwaukee mirrors the national trend, with an average credit score of around 665. While this score falls within the “fair” range, there is still room for improvement. Many factors contribute to this average, including late payments, high credit utilization, and instances of bankruptcy. It’s essential for individuals in Milwaukee to understand the importance of credit repair and take proactive measures to enhance their credit profiles.

Common Credit Issues in Milwaukee

Milwaukee faces several prevalent credit issues that can hinder individuals’ financial success. One of the primary challenges is the occurrence of late payments. Late payments can have a significant negative impact on credit scores and may result from financial hardship, poor money management, or simply forgetting due dates. Additionally, bankruptcies are another common credit concern in Milwaukee. Unexpected life events, medical bills, or job loss can lead to overwhelming debt and, ultimately, bankruptcy filings. Lastly, identity theft and fraudulent activities can also wreak havoc on credit reports, causing substantial damage to an individual’s financial reputation.

State Legislation Affecting Credit in Milwaukee

It’s important to note that state legislation can play a role in credit repair practices and consumers’ rights in Milwaukee. The State of Wisconsin has enacted laws that regulate credit reporting agencies and protect consumers from unfair practices, such as inaccurate reporting. Familiarizing yourself with these laws, such as the Wisconsin Consumer Act, can empower you to take action and ensure that your rights are upheld during the credit repair process.

This image is property of www.whitejacobs.com.

Hiring a Credit Repair Agency in Milwaukee

When and Why to Hire a Credit Repair Agency

While DIY credit repair is feasible and effective for many individuals, there are situations where hiring a credit repair agency may be beneficial. If you find yourself overwhelmed by the complexities of credit repair, lack the time or expertise to navigate the process, or have significant inaccuracies on your credit report, it may be wise to enlist professional help. Credit repair agencies specialize in the intricacies of credit reporting and can handle disputes, negotiations, and other critical tasks on your behalf. They can also provide guidance and personalized strategies to help you improve your credit score efficiently.

Benefits of Hiring a Credit Repair Agency

Hiring a credit repair agency in Milwaukee can offer several advantages. Firstly, these agencies have extensive knowledge of credit reporting laws and regulations, ensuring that your rights are protected throughout the credit repair process. They can also leverage their experience and relationships with creditors to negotiate on your behalf, potentially resulting in the removal of negative items or favorable repayment terms. Additionally, credit repair agencies can provide ongoing support and education, equipping you with the necessary tools and knowledge to maintain a healthy credit profile long after their services have ended.

How to Choose the Right Agency

When selecting a credit repair agency in Milwaukee, it’s crucial to conduct thorough research and due diligence. Look for agencies with a proven track record, positive customer reviews, and transparent pricing structures. Avoid agencies that make lofty promises or charge exorbitant upfront fees, as these may be indicators of potential scams. Additionally, consider agencies that offer personalized attention, clear communication channels, and a commitment to educating their clients. Finally, request a consultation or initial assessment to gauge the agency’s professionalism, expertise, and compatibility with your specific credit repair needs.

DIY Credit Repair in Milwaukee

Pros and Cons of DIY Credit Repair

For those who prefer a hands-on approach and have the time and dedication to tackle credit repair themselves, DIY credit repair can be a viable option. One of the significant advantages of DIY credit repair is the cost savings compared to hiring a credit repair agency. Rather than incurring fees for professional assistance, you can allocate those funds toward paying off debts or building an emergency savings fund. DIY credit repair also allows you to have complete control over the process, ensuring that you’re fully aware of every action taken on your credit report.

However, there are also potential drawbacks to DIY credit repair. The complex nature of credit reporting and the legalities involved can be overwhelming, especially for individuals with minimal knowledge or experience. Navigating the dispute process and negotiating with creditors can be time-consuming and require persistent follow-ups. There’s also a risk of making mistakes or inadvertently harming your credit further if you’re unaware of best practices. It’s essential to weigh these pros and cons before deciding whether DIY credit repair is the right path for you.

Steps of DIY Credit Repair

If you decide to pursue DIY credit repair in Milwaukee, there are several key steps you should follow. The first step is to obtain copies of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Carefully review your reports, paying close attention to any inaccuracies, incomplete information, or signs of identity theft. The next step is to dispute any errors or discrepancies you find. This can be done through a written dispute letter or online through the credit bureaus’ websites. Be sure to include supporting documentation and clearly explain the nature of the dispute.

Once your disputes are filed, the credit bureaus have a specific period to investigate and respond. If the inaccurate information is not corrected or removed, you can escalate the dispute to the Consumer Financial Protection Bureau (CFPB) or consider seeking legal assistance. Simultaneously, it’s important to adopt healthy financial habits, such as paying bills on time, reducing debt, and not opening unnecessary new credit accounts. Over time, these proactive measures can contribute to a better credit score and overall financial well-being.

Resources for DIY Credit Repair

Embarking on the journey of DIY credit repair in Milwaukee doesn’t mean you have to do it alone. There are several resources available to assist you every step of the way. Online guides, reputable blogs, and educational websites can provide comprehensive information on credit repair strategies, dispute processes, and credit management techniques. The Federal Trade Commission (FTC) website is an excellent resource for learning about your rights as a consumer and understanding the legalities surrounding credit repair. Additionally, financial literacy organizations, community centers, and local libraries may offer workshops or classes on credit repair and financial wellness.

This image is property of res.cloudinary.com.

Understanding Your Credit Report

Components of a Credit Report

To fully comprehend the information presented on your credit report, it’s essential to understand its core components. A credit report consists of various sections, including personal identifying information, credit account details, public records, and inquiries. Personal identifying information includes your name, address, Social Security number, and employment history. Credit account details provide an overview of your credit accounts, such as credit cards, loans, and mortgages. This section includes information on the account balance, payment history, credit limit, and any negative or positive remarks. Public records encompass bankruptcies, tax liens, and civil judgments. Lastly, the inquiry section lists entities that have recently accessed your credit report, typically when considering your credit application.

How to Read a Credit Report

Reading and interpreting your credit report may seem daunting at first, but with some guidance, it can become more manageable. Start by carefully reviewing each section and ensuring that all personal identifying information is accurate. This includes confirming that your name is spelled correctly, your address is current, and there are no unfamiliar or fraudulent accounts listed under your name. Move on to the credit account details section and examine the payment history. Look for any late payments, collection accounts, or charge-offs that may be impacting your credit score negatively. Pay close attention to the credit limit utilization and strive to keep it to a minimum. The public records section should be scrutinized for any inaccuracies or outdated information, as these can heavily influence your creditworthiness.

Tips for Managing Your Credit Report

Once you understand how to read your credit report, it’s important to proactively manage it to maintain and improve your creditworthiness. Regularly monitor your credit report to stay informed about any changes or potential errors. You are entitled to a free annual credit report from each of the three major credit bureaus, allowing you to review your reports regularly. Additionally, consider enrolling in credit monitoring services that can provide real-time updates and alerts regarding changes to your credit report. Promptly address any inaccuracies or discrepancies you identify through the dispute process outlined earlier. Lastly, establish healthy financial habits, such as paying bills on time, reducing debt, and maintaining a diverse mix of credit accounts. These practices can contribute to a positive credit profile over time.

Common Causes of Bad Credit

Late Payments

Late payments are a leading cause of bad credit. Falling behind on credit card payments, loan installments, or utility bills can severely impact your credit score. Creditors typically report late payments to the credit bureaus, resulting in a negative mark on your credit report. It’s important to prioritize making timely payments and, if possible, set up automatic payments or reminders to avoid missing due dates.

Bankruptcies

Bankruptcies occur when individuals are overwhelmed by debt and are unable to repay their creditors. Filing for bankruptcy can provide debt relief, but it also leaves a lasting mark on your credit report. Bankruptcies can significantly lower your credit score and remain on your credit report for years, making it challenging to access credit or secure favorable terms. Avoiding bankruptcy is ideal, but if it becomes the only viable option, consult with a bankruptcy attorney to understand the implications fully.

Identity Theft

Identity theft is a prevalent problem that can wreak havoc on your credit. When someone obtains and misuses your personal information, they can open fraudulent accounts, make unauthorized purchases, and accumulate debt in your name. This can severely damage your credit, and it may take substantial time and effort to rectify the situation. To protect yourself from identity theft, regularly monitor your credit reports, be cautious with personal information, and consider utilizing identity theft protection services.

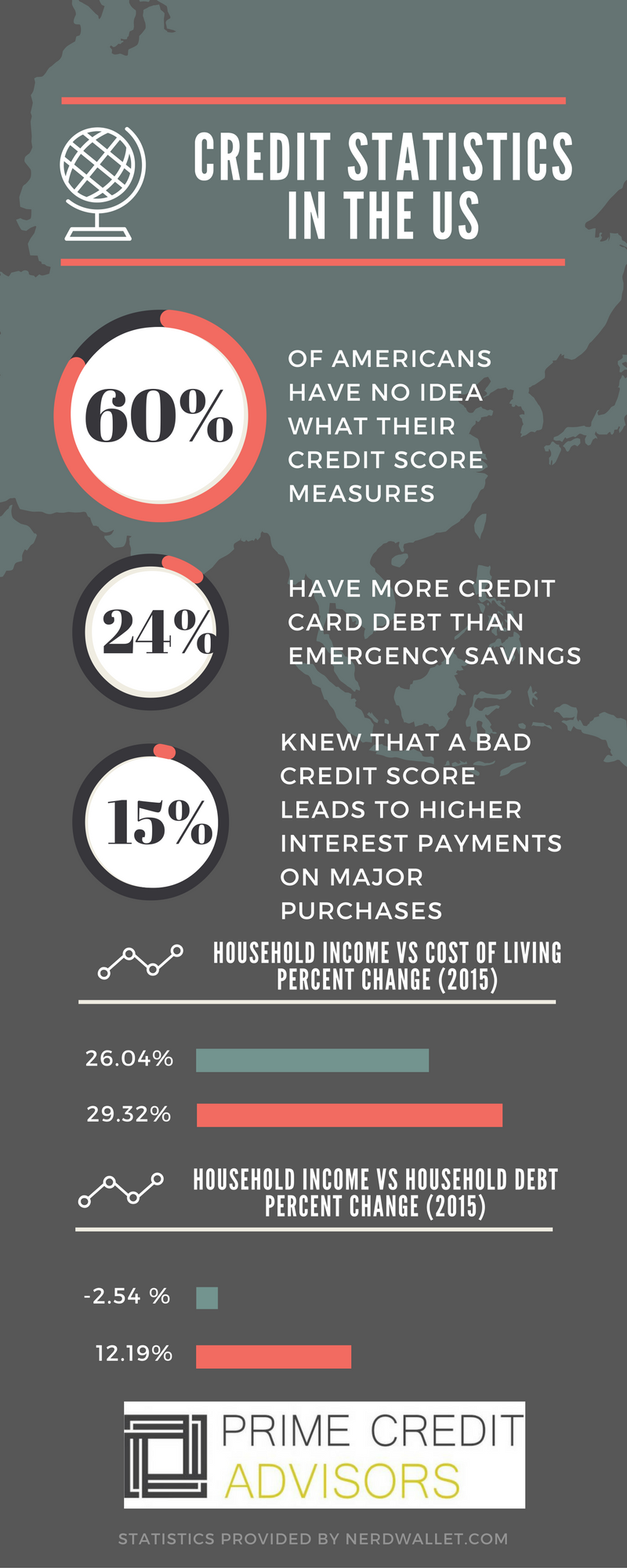

This image is property of www.primecreditadvisors.com.

Strategies for Improving Your Credit Score

Debt Consolidation

Debt consolidation is a strategy that involves combining multiple debts into a single loan or credit account. This can be beneficial because it allows you to streamline your debt and potentially secure a lower interest rate. By consolidating your debts, you may be able to make more manageable monthly payments, enabling you to stay current and reduce your overall debt load. However, it’s crucial to approach debt consolidation with caution and thoroughly research your options, as certain consolidation methods may have drawbacks or hidden fees.

Keep Credit Utilization Low

Credit utilization refers to the percentage of your available credit that you’re currently utilizing. Maintaining a low credit utilization ratio is crucial for improving your credit score. Ideally, you should aim to keep your credit utilization below 30%. This demonstrates responsible credit management and shows lenders that you’re not relying heavily on borrowed funds. To keep your credit utilization low, consider paying off balances in full each month, refraining from excessive spending, and avoiding maxing out credit cards.

Don’t Close Old Credit Cards

Closing old credit cards may seem like a logical step when trying to rebuild your credit, but it can actually have a negative impact. Older credit accounts contribute to the length of your credit history, which is an important factor in determining your credit score. If you close a long-standing credit card, it can shorten your credit history and potentially decrease your credit score. Instead, consider keeping old accounts open, especially if they have positive payment histories and low credit utilization. However, be mindful of any annual fees associated with the card and weigh the overall benefits against the costs.

Understanding Credit Repair Scams

Recognizing Credit Repair Scams

Unfortunately, the credit repair industry is not immune to scams or unethical practices. It’s crucial to be aware of red flags and recognize the signs of a credit repair scam. Some common warning signs include agencies guaranteeing to remove accurate negative information from your credit report, demanding upfront fees before providing any services, or pressuring you to provide false information when disputing items on your credit report. Additionally, be cautious of companies that operate under multiple names, lack proper accreditation or licensing, or fail to provide clear and transparent communication.

Protecting Yourself from Scams

Protecting yourself from credit repair scams starts with being well-informed and aware of your rights as a consumer. Educate yourself about the credit repair process, familiarize yourself with laws and regulations governing credit repair agencies, and research any potential agency or company before engaging their services. It’s also important to read contracts carefully, ensuring that they clearly outline the services provided, fees charged, and any guarantees or refund policies. When in doubt, consult reputable financial advisors or seek recommendations from friends, family, or trusted professionals who have experience with credit repair.

What to Do If You Are Scammed

If you believe you have fallen victim to a credit repair scam in Milwaukee, it’s crucial to take immediate action to protect yourself. Start by gathering all relevant documentation, including any contracts, correspondence, or evidence of the scam. Report the incident to the Wisconsin Department of Financial Institutions, the Wisconsin Attorney General’s office, and the Federal Trade Commission (FTC). File a complaint with these organizations, providing as much detail as possible about the scam and the individuals or companies involved. Lastly, consider contacting a consumer protection attorney who can advise you on your legal rights and potential courses of action.

This image is property of res.cloudinary.com.

Understanding Credit Counseling

What is Credit Counseling

Credit counseling is a service designed to help individuals understand and manage their finances, particularly when it comes to debt and credit-related issues. Credit counselors are trained professionals who provide guidance, education, and personalized action plans to help individuals overcome financial challenges and achieve their financial goals. They can offer assistance in budgeting, debt management, credit building, and other areas of personal finance.

Benefits of Credit Counseling

Engaging in credit counseling can offer several benefits to individuals in Milwaukee who are struggling with their finances. Credit counselors can help you create a realistic budget tailored to your income and expenses. They can also negotiate with creditors on your behalf to establish affordable repayment plans or reduce interest rates. Credit counseling can provide valuable education on topics such as credit management, debt reduction strategies, and financial planning, empowering you to make informed decisions about your financial future. Additionally, credit counseling services are often affordable or even free, making them accessible to individuals from all walks of life.

Finding Credit Counseling in Milwaukee

Finding reputable credit counseling services in Milwaukee is essential to ensure that you receive reliable and professional assistance. Start by researching non-profit credit counseling agencies that have a solid reputation and excellent customer reviews. Look for agencies accredited by reputable organizations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These organizations have stringent standards and require agencies to adhere to ethical practices. It’s also advisable to schedule an initial consultation with a credit counselor to assess their expertise, communication style, and compatibility with your specific financial needs.

Maintaining Good Credit in Milwaukee

Developing Healthy Financial Habits

Maintaining good credit in Milwaukee requires the development and practice of healthy financial habits. Start by creating a realistic budget that accounts for all income, expenses, and savings goals. Stick to this budget as closely as possible, avoiding unnecessary spending and focusing on paying bills on time. Prioritize building an emergency fund to handle unexpected expenses, reducing the need for credit and potential debt accumulation. Regularly assess your financial goals, adjusting the budget accordingly and seeking ways to increase income or decrease expenses. By consistently practicing these habits, you’ll be able to maintain a stable financial situation and a positive credit profile.

Utilizing Financial Tools and Resources

In addition to healthy financial habits, utilizing financial tools and resources can help you maintain good credit in Milwaukee. Take advantage of free credit monitoring services to stay informed about changes to your credit report or any potential signs of identity theft. Many financial institutions or credit card companies offer these services as a benefit to their customers. Consider downloading mobile banking apps that allow you to monitor account balances, make payments, and track expenditures conveniently. Explore personal finance apps or online tools that provide budgeting assistance, investment guidance, and credit score tracking. Empowering yourself with these resources can facilitate effective credit management and financial planning.

Continuous Monitoring and Checkups

Maintaining good credit is an ongoing process that requires continuous monitoring and periodic checkups. Regularly review your credit reports from the three major credit bureaus to ensure that they are accurate and up to date. Reporting any errors or inaccuracies promptly is essential to prevent potential damage to your credit. Schedule regular checkups with a credit counselor, financial advisor, or other trusted professionals to assess your financial situation, receive guidance, and make any necessary adjustments to your strategies. It’s also beneficial to stay informed about changes in credit reporting laws or financial regulations that may impact your credit or financial planning. By staying proactive and engaged in the credit management process, you can consistently maintain good credit in Milwaukee.

In conclusion, understanding credit repair is crucial for individuals in Milwaukee who want to improve their creditworthiness and access better financial opportunities. Whether you choose to hire a credit repair agency or embark on a DIY credit repair journey, it’s important to be knowledgeable about the credit reporting process, your rights as a consumer, and the steps you can take to improve your credit score. By utilizing resources, practicing healthy financial habits, and seeking assistance when needed, you can navigate the credit repair process effectively and maintain good credit in Milwaukee. Remember, credit repair is a journey that requires patience, commitment, and continuous monitoring, but the rewards are well worth the effort.

This image is property of res.cloudinary.com.