Are you struggling with your credit score and in need of assistance? Look no further! This article provides you with the contact information for the Credit Repair Customer Service Number, a reliable resource dedicated to helping individuals improve their credit. Whether you have inquiries, need guidance, or want to explore credit repair options, their friendly and professional customer service team is just a phone call away. Don’t let bad credit hold you back; reach out to the Credit Repair Customer Service Number today and take the first step towards a brighter financial future.

Understanding Credit Repair

Basics of credit repair

Credit repair is the process of improving and restoring an individual’s creditworthiness. It involves addressing and resolving any negative items on a person’s credit report, such as late payments, collections, or bankruptcy. By improving their credit, individuals can increase their chances of getting approved for loans, securing lower interest rates, and accessing better financial opportunities.

Importance of credit repair for financial health

A good credit score is essential for overall financial health. Lenders, employers, and even landlords often rely on credit reports to assess an individual’s reliability and trustworthiness. A poor credit score can limit access to loans, hinder job prospects, and even result in higher insurance premiums. By actively engaging in credit repair, individuals can take control of their financial well-being and open doors to more favorable financial opportunities.

Different methods to repair credit

There are several methods individuals can employ to repair their credit. One approach is to carefully review their credit reports and identify any errors or inaccuracies. By disputing these errors with the credit bureaus, individuals can have them corrected or removed. Another method is to establish positive credit habits, such as making payments on time, reducing credit utilization, and diversifying credit accounts. Additionally, individuals can seek the assistance of credit repair companies, who specialize in guiding individuals through the credit repair process.

Role of a Credit Repair Company

Services offered by credit repair companies

Credit repair companies provide a range of services to assist individuals in improving their credit. These services typically include credit report analysis, credit dispute assistance, and personalized credit improvement plans. Some credit repair companies may also offer debt negotiation services, credit monitoring, and financial planning advice. By leveraging their expertise and resources, credit repair companies can help individuals navigate the complex world of credit repair and achieve their financial goals.

How credit repair companies work

When individuals engage the services of a credit repair company, the first step is usually a comprehensive analysis of their credit reports. The credit repair company will closely examine the reports and identify any negative items or errors that need to be addressed. From there, they will guide the client through the process of disputing these items with the credit bureaus. Credit repair companies often have established relationships with the credit bureaus, which can facilitate more efficient and effective dispute resolution. Throughout the process, the credit repair company will provide ongoing support and guidance to ensure the client’s credit is being restored and improved.

Benefits of hiring credit repair companies

Hiring a credit repair company can offer several benefits to individuals seeking to repair their credit. Firstly, credit repair companies have specialized knowledge and experience in dealing with credit reporting agencies and understanding credit laws and regulations. This expertise allows them to navigate the complexities of the credit repair process more effectively. Additionally, credit repair companies can save individuals time and effort by handling the dispute process and negotiations on their behalf. They act as advocates for their clients, working to ensure their rights are protected and their credit reports are accurate and fair. Lastly, credit repair companies provide ongoing support and education to their clients, empowering them with the knowledge and tools to maintain good credit habits in the long term.

Importance of Good Customer Service in Credit Repair

Impacts of effective customer service

Effective customer service is a crucial component of the credit repair process as it directly impacts client satisfaction and overall success. Good customer service creates a positive and supportive experience for clients, fostering a sense of trust and confidence in the credit repair company. When clients feel heard, valued, and well taken care of, they are more likely to stay engaged in the credit repair process and work collaboratively with the credit repair company to achieve their credit goals.

Correlation between customer service and client satisfaction

Client satisfaction is deeply intertwined with the quality of customer service provided by credit repair companies. When clients receive prompt, accurate, and empathetic responses to their inquiries and concerns, they are more likely to have a positive perception of the company and the services it offers. On the other hand, poor customer service can lead to frustration, mistrust, and ultimately, client dissatisfaction. The way credit repair companies interact with their clients greatly impacts the overall success and reputation of their business.

How good customer service can improve the credit repair process

Good customer service plays a vital role in improving the credit repair process in several ways. Firstly, it ensures clear and effective communication between the credit repair company and the client, enabling both parties to stay informed and updated on the progress of the credit repair journey. Effective communication helps manage client expectations, address concerns promptly, and provide valuable guidance. Secondly, good customer service fosters a collaborative relationship between the credit repair company and the client. By building rapport and trust, the credit repair company can better understand the client’s unique circumstances and tailor their services to meet the client’s specific needs. Finally, good customer service can provide clients with the necessary tools, resources, and education to make informed credit decisions and maintain good credit habits in the future.

Identifying a Good Credit Repair Customer Service

Traits of a good credit repair customer service

A good credit repair customer service possesses several key traits that set them apart. Firstly, they are knowledgeable and well-informed about credit repair laws, regulations, and best practices. This expertise allows them to provide accurate and reliable information to clients, guiding them through the credit repair process confidently. Secondly, good credit repair customer service is proactive and responsive. They promptly address client inquiries, concerns, and disputes with efficiency and professionalism. Thirdly, good credit repair customer service is empathetic and understanding. They recognize that credit repair is a personal and sensitive matter for clients and approach each interaction with compassion and respect.

Key performance indicators for credit repair customer service

Credit repair customer service can be evaluated based on several key performance indicators. First and foremost, response time is an essential metric to monitor. Prompt responses to client inquiries and concerns demonstrate the company’s commitment to excellent customer service. Additionally, client satisfaction surveys or feedback can provide valuable insights into how well the credit repair customer service is meeting client expectations and needs. Lastly, the resolution rate of client issues is a critical indicator of the effectiveness of credit repair customer service. Timely and satisfactory resolution of disputes and concerns reflects the dedication and expertise of the customer service team.

How to evaluate a credit repair customer service

To evaluate a credit repair customer service, individuals can consider several factors. Firstly, they can assess the company’s reputation and track record by researching reviews, testimonials, and ratings from previous clients. Positive feedback and success stories can indicate the quality of the customer service provided. Additionally, individuals can directly interact with the customer service team by reaching out with inquiries or concerns. This direct interaction allows individuals to gauge the professionalism, knowledge, and responsiveness of the customer service representatives. Lastly, individuals can evaluate the company’s transparency and accessibility in providing educational resources, credit counseling, and ongoing support to clients.

Value of a Credit Repair Customer Service Number

Rationale for having a dedicated customer service number

A dedicated credit repair customer service number provides a direct and convenient channel for clients to reach out to the credit repair company. It allows for real-time communication, enabling clients to seek immediate assistance for any inquiries, concerns, or issues they may have. By having a dedicated customer service number, credit repair companies can demonstrate their commitment to providing accessible and reliable support to their clients.

Advantages of a credit repair customer service number

There are several advantages to having a credit repair customer service number. Firstly, it offers personalized and human interaction, providing clients with the assurance that their concerns are being heard and addressed by a real person. This personal touch can significantly enhance the overall customer experience and satisfaction. Secondly, a dedicated customer service number allows for efficient and focused problem-solving. It enables credit repair companies to gather all necessary information from the client and provide tailored solutions or guidance promptly. Lastly, a credit repair customer service number allows for documentation and tracking of client interactions, ensuring that no inquiries or concerns slip through the cracks and providing a clear record of the client’s credit repair journey.

Elements of a good customer service number system

A good credit repair customer service number system should have several key elements. Firstly, it should offer extended operating hours to accommodate the diverse needs and schedules of clients. This ensures that individuals can reach out for support at their convenience. Secondly, the system should prioritize call routing and call waiting times to minimize client frustration and ensure efficient handling of inquiries and concerns. Additionally, the system should have a well-trained and knowledgeable customer service team who can effectively address client needs. Lastly, the customer service number system should be integrated with the company’s overall customer service framework, ensuring seamless coordination and follow-up actions.

Finding the Credit Repair Customer Service Number

Common places to find the customer service number

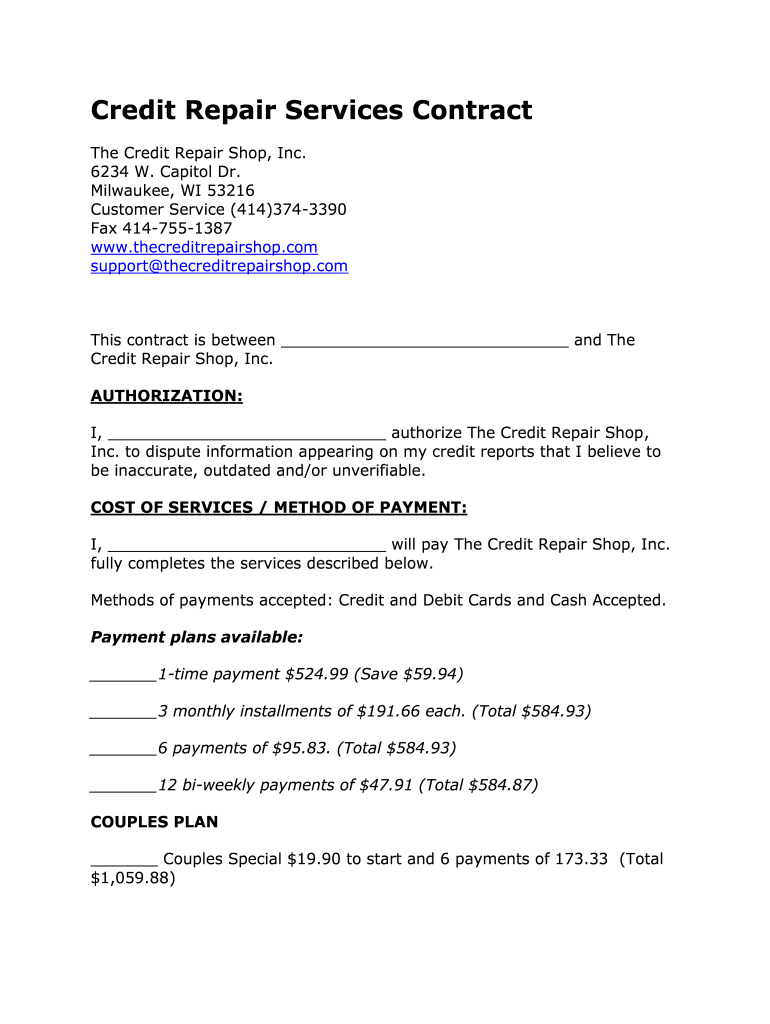

Credit repair customer service numbers can typically be found in several common places. Firstly, they are often prominently displayed on the credit repair company’s official website. Individuals can navigate to the “Contact Us” or “Support” section of the website to find the customer service number. Secondly, the customer service number may be included in any correspondence or documentation provided by the credit repair company, such as welcome emails or client contracts. Individuals can search their email inbox or physical files for any relevant information. Lastly, individuals can also reach out to the credit repair company directly via email or online chat to inquire about the customer service number.

Responsible use of the customer service number

While the credit repair customer service number provides a valuable resource for individuals seeking assistance, it is essential to use it responsibly. Individuals should ensure that their inquiries or concerns are relevant to their credit repair journey and directly related to the services provided by the credit repair company. Unnecessary or excessive use of the customer service number can strain the resources and capabilities of the customer service team. By using the customer service number responsibly, individuals can help ensure that all clients can access the support they need in a timely and efficient manner.

Privacy and security considerations when using the service number

When contacting a credit repair customer service number, individuals should be mindful of privacy and security concerns. It is essential to verify the authenticity of the customer service number and ensure you are contacting the legitimate credit repair company. Individuals should also avoid sharing sensitive personal information or financial details over the phone unless they are certain of the legitimacy and security of the communication. By taking appropriate precautions, individuals can protect their privacy and avoid falling victim to scams or fraudulent activities.

Using the Credit Repair Customer Service Number

Best practices when calling the customer service number

When calling a credit repair customer service number, it is helpful to follow some best practices to ensure a smooth and productive experience. Firstly, individuals should have their relevant documents, such as credit reports or dispute letters, readily available before making the call. This ensures that all necessary information is at hand for the customer service representative to assist effectively. Secondly, individuals should be clear and concise when explaining their inquiries or concerns. Providing specific details and any relevant supporting documentation can help the customer service representative better understand the situation and offer appropriate guidance. Lastly, individuals should maintain a friendly and polite demeanor throughout the call, recognizing that the customer service representative is there to assist and support them.

What information to prepare before calling

Before calling a credit repair customer service number, individuals should gather and prepare the following information:

- Personal identification information

- Details of any specific credit items or issues they would like to discuss

- Relevant documentation, such as credit reports or dispute letters

- Recent correspondence or communication with the credit repair company

- A clear and concise summary of their inquiries or concerns

By having this information readily available, individuals can streamline the conversation and ensure that all necessary details are communicated effectively.

Understanding the customer service call process

The customer service call process typically follows a structured and standardized approach. When calling a credit repair customer service number, individuals can expect to be greeted by an automated system that may provide several menu options to direct their call. Following this, the call will be routed to a customer service representative who will introduce themselves and verify the caller’s identity. The individual can then proceed to explain their inquiries or concerns while the customer service representative listens attentively and asks probing questions for clarification. Based on this information, the customer service representative will provide the necessary guidance, answer questions, or escalate the inquiry or concern to the appropriate department if needed. The call will conclude with a summary of the discussion and any follow-up actions that may be required.

Resolving Issues via the Credit Repair Customer Service Number

Common issues faced by credit repair clients

Credit repair clients may encounter several common issues throughout the credit repair process. One common issue is the presence of inaccurate or outdated information on their credit reports. This can include items that do not belong to the client or items that have been resolved but are still being reported as negative. Another common issue is the lack of progress or slow response from the credit reporting agencies in resolving disputes or inaccuracies. Excessive delays in the resolution process can be frustrating and hinder the client’s credit repair journey. Additionally, clients may have questions or concerns regarding specific credit items, such as how to handle collections or negotiate with creditors.

How customer service can resolve these issues

Credit repair customer service plays a crucial role in resolving issues faced by clients. For inaccurate or outdated information on credit reports, the customer service representative can guide the client through the dispute process, ensuring that all necessary documentation and evidence are provided to the credit reporting agencies. They can also liaise with the credit reporting agencies to expedite the resolution process and ensure that any errors are corrected promptly. In cases of slow response or lack of progress, the customer service representative can follow up with the credit reporting agencies on behalf of the client, advocating for timely action and updates. When clients have questions or concerns regarding specific credit items, the customer service representative can provide advice, negotiate with creditors, or offer alternative solutions to resolve or manage the situation.

Tips for a successful resolution of issues

To increase the likelihood of a successful resolution of issues through the credit repair customer service number, individuals can follow these tips:

- Clearly articulate the issue: Provide a concise and specific explanation of the problem or concern, ensuring that all salient details are communicated clearly.

- Provide supporting evidence: When applicable, provide any relevant documentation or evidence to support your claim or request. This can include credit reports, payment records, or correspondence.

- Follow up regularly: If a resolution is not reached within a reasonable timeframe, follow up with the customer service representative for updates and escalate the issue if necessary.

- Be patient and persistent: Resolving credit issues can sometimes be a lengthy and complex process. Maintain patience and perseverance, knowing that the credit repair customer service team is working diligently on your behalf.

- Keep records of all communication: Maintain a record of all conversations, correspondence, and resolutions discussed with the customer service team. This documentation can serve as evidence and reference for future inquiries or disputes.

Improving the Credit Repair Customer Service Number Experience

Possible improvements in the customer service system

While the credit repair customer service number can be a valuable resource, there is always room for improvement to enhance the customer experience. One possible improvement is to reduce call waiting times by optimizing call routing and staffing levels. Implementing technology such as interactive voice response systems or chatbots can also provide clients with self-service options for common inquiries or status updates. Additionally, offering multichannel support, such as email or online chat, can provide alternative avenues for individuals to seek assistance, accommodating different communication preferences.

Role of feedback in improving the customer service experience

Feedback plays a critical role in identifying areas for improvement and enhancing the customer service experience. Credit repair companies should actively seek feedback from clients through surveys, reviews, or one-on-one discussions. By listening to client feedback, credit repair companies can identify areas that require attention, address specific concerns, and enhance the overall customer service strategy. Feedback also provides valuable insights into emerging trends and issues, allowing credit repair companies to stay responsive and adapt their services to meet evolving client needs.

Technologies that can enhance the customer service process

Several technologies can enhance the credit repair customer service process. Customer relationship management (CRM) systems can centralize client information, interactions, and history, enabling customer service representatives to provide more personalized and efficient support. Artificial intelligence (AI) tools can automate certain processes, such as dispute preparation or document collection, improving overall efficiency and turnaround times. Additionally, cloud-based communication platforms can facilitate seamless collaboration and information sharing among the customer service team, ensuring consistent and accurate support to clients.

Examples of Excellent Credit Repair Customer Service Practices

Case studies of good customer service in credit repair

Several credit repair companies have demonstrated excellent customer service practices. For example, XYZ Credit Repair Company stands out for its responsive and knowledgeable customer service representatives. Clients consistently report timely and accurate assistance in resolving disputes and addressing credit concerns. ABC Credit Solutions is praised for its personalized approach to customer service. They invest time and effort in understanding each client’s unique circumstances, providing tailored advice and guidance. Additionally, QRS Credit Repair excels in client education and ongoing support. They offer regular webinars, informative resources, and one-on-one sessions to empower clients with the knowledge and skills necessary to maintain good credit habits long after the credit repair process.

Lessons to be learned from these examples

These examples highlight several valuable lessons for other credit repair companies and businesses in general. Firstly, responsive and knowledgeable customer service representatives are essential for providing an excellent customer service experience. Investing in training and ongoing professional development can empower customer service representatives to deliver high-quality support. Secondly, personalization is key. Taking the time to understand each client’s unique situation and tailoring the support and guidance accordingly fosters a stronger client-provider relationship. Lastly, education and ongoing support are crucial. By offering resources, webinars, or personalized sessions, credit repair companies can empower clients to maintain good credit habits and make informed financial decisions in the future.

How to incorporate these practices into other businesses

Other businesses can incorporate these practices by prioritizing customer service training and development. Ensuring that customer service representatives are equipped with the necessary knowledge and skills to address client inquiries and concerns effectively is critical. Additionally, businesses can adopt a customer-centric approach by actively listening to client feedback, personalizing interactions, and continuously seeking opportunities to educate and support their customers. By taking inspiration from successful credit repair companies and applying these practices, businesses can cultivate a culture of excellent customer service and build long-lasting customer relationships.