In the bustling city of Philadelphia, where financial aspirations blend with urban ambition, the need for effective credit repair companies has become increasingly apparent. Guiding individuals through the labyrinthine world of credit scores and reports, these companies offer their expertise and tailored solutions to those seeking to improve their financial standing. The article at hand examines the landscape of credit repair services in Philadelphia, highlighting the key players in the industry and shedding light on the techniques and strategies employed to bring about positive credit outcomes.

Services Provided by Credit Repair Companies

Credit report review

Credit repair companies offer a comprehensive review of your credit reports from the major credit bureaus, including Experian, TransUnion, and Equifax. They analyze your credit history and identify any errors, inaccuracies, or negative information that might be affecting your credit score.

Credit score improvement

One of the primary services provided by credit repair companies is to help you improve your credit score. They work with you to develop a personalized strategy to address the factors that are negatively impacting your credit score. This may involve guidance on paying off debts, reducing credit utilization, and managing credit inquiries.

Disputing inaccuracies in credit reports

Credit repair companies assist you in disputing any inaccuracies or errors that they identify in your credit reports. They handle the entire dispute process on your behalf, including gathering supporting documentation, drafting dispute letters, and following up with the credit bureaus to ensure a prompt resolution.

Settlement negotiations

If you have outstanding debts or accounts in collections, credit repair companies can negotiate with your creditors or collection agencies on your behalf. They aim to reach a settlement agreement that is favorable to you, such as a reduced payment or the removal of negative marks from your credit report.

Debt management and consolidation

Credit repair companies can also provide guidance and assistance with debt management and consolidation. They help you develop a plan to pay off your debts more efficiently, potentially through debt consolidation loans or negotiation with creditors to reduce interest rates or monthly payments.

Identity theft protection

In light of the increasing prevalence of identity theft, credit repair companies can provide services to help protect your identity. This includes monitoring your credit reports for any signs of fraudulent activity, assisting with identity theft resolution if you become a victim, and offering resources and advice on how to safeguard your personal information.

This image is property of philadelphiaweekly.com.

Benefits of Hiring a Credit Repair Company

Expertise and Knowledge

One of the major benefits of hiring a credit repair company is gaining access to their expertise and knowledge. These companies specialize in understanding the complexities of credit reporting and credit scoring systems. They stay updated on the latest regulations and industry best practices, allowing them to navigate the credit repair process more effectively on your behalf.

Time-Saving

Repairing your credit can be a time-consuming process, involving gathering documentation, writing dispute letters, and following up with credit bureaus and creditors. By outsourcing this work to a credit repair company, you save valuable time that can be dedicated to other important aspects of your life.

Legal Protection

Credit repair companies are well-versed in consumer protection laws, such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA). By working with a reputable credit repair company, you have the assurance that your rights as a consumer are being protected throughout the credit repair process.

Improved Credit Score

The ultimate goal of hiring a credit repair company is to improve your credit score. By addressing negative marks, resolving inaccuracies, and implementing strategies to improve your creditworthiness, these companies can help you achieve a higher credit score. A better credit score can lead to improved access to credit, lower interest rates, and more favorable loan terms.

Access to Resources and Tools

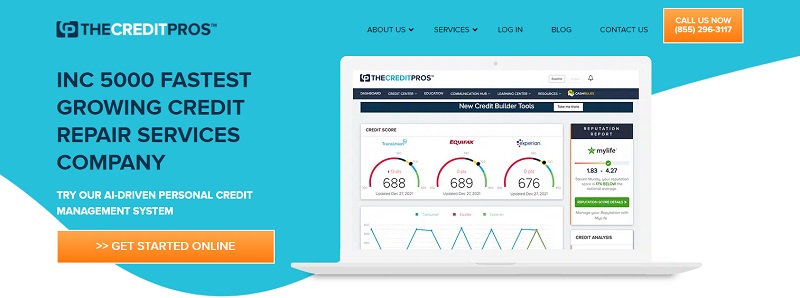

Credit repair companies have access to resources and tools that can further enhance the effectiveness of their credit repair services. They utilize advanced software and technology to review credit reports, identify potential errors or inconsistencies, and monitor progress towards achieving credit goals. Additionally, they may have partnerships with lenders or financial institutions that can provide specialized services or benefits to their clients.

This image is property of res.cloudinary.com.

Factors to Consider When Choosing a Credit Repair Company

Experience and Reputation

When selecting a credit repair company, it is essential to consider their experience and reputation in the industry. Look for a company that has been in operation for a significant period and has a proven track record of success in helping clients improve their credit. Research their online presence, read client testimonials, and check for any complaints filed against them with consumer protection agencies.

Transparency and Process

Credit repair companies should be transparent about their processes and provide clear explanations of how they will assist you in repairing your credit. Look for a company that offers a detailed roadmap of their credit repair process, including the specific actions they will take, the expected timeline, and the potential outcomes. Avoid companies that make promises that seem too good to be true or fail to disclose important information.

Fees and Payment Structure

Credit repair companies typically charge fees for their services, and it is crucial to understand their pricing structure before engaging their services. Be wary of companies that require upfront fees or ask for payment before they have delivered any results. Look for a company that offers a clear breakdown of their fees and provides options for payment, such as monthly installments or a pay-for-performance model.

Customer Reviews and Testimonials

Checking customer reviews and testimonials can provide valuable insights into the experiences of previous clients with a credit repair company. Look for reviews from reputable sources and pay attention to any recurring themes or patterns. Positive reviews that highlight successful outcomes and excellent customer service can be indicative of a reliable credit repair company.

Accreditations and Associations

Accreditations and associations can serve as indicators of a credit repair company’s commitment to industry standards and ethical practices. Look for credit repair companies that are affiliated with reputable organizations, such as the National Association of Credit Services Organizations (NACSO) or the Better Business Bureau (BBB). These affiliations demonstrate a commitment to upholding high standards of professionalism and customer service.

This image is property of res.cloudinary.com.

Top Credit Repair Companies in Philadelphia

Company A

Services Provided

Company A offers a comprehensive range of credit repair services, including credit report review, credit score improvement, dispute resolution, debt management, and identity theft protection. They provide personalized strategies tailored to each client’s unique credit situation.

Pricing Structure

Company A offers competitive pricing options for their services. They offer different packages based on the level of assistance required and the complexity of the credit repair process. Their fees are transparent, and they provide a breakdown of the costs associated with each package.

Customer Reviews

Customer reviews for Company A are overwhelmingly positive. Clients have praised their professionalism, efficiency, and effectiveness in helping them achieve significant improvements in their credit scores. Many have reported successfully resolving disputes and seeing positive changes in their credit reports.

Company B

Services Provided

Company B specializes in credit report review, credit score improvement, and settlement negotiations. They analyze credit reports, identify errors and discrepancies, and work with clients to develop strategies to address negative items.

Pricing Structure

Company B offers a straightforward pricing structure with different pricing tiers based on the scope of the credit repair services required. They provide detailed explanations of the fees associated with each package and offer flexible payment options.

Customer Reviews

Customers who have worked with Company B have praised their expertise and commitment to achieving positive results. They have received positive feedback for their professionalism, communication, and ability to negotiate favorable settlements with creditors.

Company C

Services Provided

Company C offers a comprehensive suite of credit repair services, including credit report review, credit score improvement, and identity theft protection. They also provide guidance on debt management and consolidation strategies.

Pricing Structure

Company C offers tiered pricing options tailored to the specific needs of their clients. They disclose their fees upfront, providing transparency and clarity regarding the costs associated with their services.

Customer Reviews

Customers who have used Company C’s services have expressed satisfaction with the outcomes of their credit repair journeys. They have praised the company for its attention to detail, clear communication, and ability to deliver positive results within a reasonable timeframe.

Company D

Services Provided

Company D specializes in credit report review, credit score improvement, and debt management. They offer personalized strategies to address negative items on credit reports and provide guidance on managing and reducing debt.

Pricing Structure

Company D offers transparent pricing and provides clients with a breakdown of the costs associated with their services. They offer different pricing options based on the level of assistance required.

Customer Reviews

Customers who have utilized Company D’s services have expressed appreciation for their knowledgeable and dedicated team. Clients have reported significant improvements in their credit scores and credit reports, attributing their success to the services provided by Company D.

Company E

Services Provided

Company E offers a range of credit repair services, including credit report review, credit score improvement, and settlement negotiations. They work closely with clients to address inaccurate information and negotiate with creditors to improve creditworthiness.

Pricing Structure

Company E provides clients with transparent pricing options and comprehensive explanations of the costs involved. They offer flexible payment plans to accommodate varying budgets and financial situations.

Customer Reviews

Clients who have worked with Company E have praised their professionalism, attention to detail, and commitment to delivering favorable outcomes. They have highlighted the positive impact on their credit scores and expressed satisfaction with the level of support provided.

This image is property of philadelphiaweekly.com.

How to Improve Your Credit Score on Your Own

Pay Your Bills on Time

One of the most crucial factors affecting your credit score is your payment history. Consistently paying your bills on time demonstrates good financial responsibility and can result in a positive impact on your credit score. Set up automatic payments or use reminders to ensure timely payments.

Maintain Low Credit Utilization Ratio

Your credit utilization ratio, which measures the amount of available credit you are using, plays a significant role in determining your credit score. Aim to keep your credit utilization below 30% of your available credit to maintain a healthy ratio. Paying off balances and being mindful of your spending can help achieve this goal.

Regularly Check Your Credit Reports

Monitor your credit reports regularly to identify any errors or discrepancies that may be negatively impacting your credit score. You are entitled to a free credit report from each of the major credit bureaus annually. Review these reports for accuracy, and promptly dispute any inaccuracies you find.

Correct Any Inaccurate Information

If you identify inaccuracies or errors on your credit reports, take steps to correct them. This can involve contacting the credit bureau and providing supporting documentation to support your dispute. Be persistent in following up to ensure the inaccuracies are resolved.

Keep Old Accounts Open

Closing old credit card accounts can negatively impact your credit history, as it reduces the average age of your accounts. Instead, keep these accounts open and use them occasionally to maintain an active credit history. Be sure to make timely payments and keep the balances low to demonstrate responsible credit usage.

Diversify Your Credit Mix

A diverse credit mix that includes different types of credit, such as credit cards, loans, and a mortgage, can positively impact your credit score. Having a mix of revolving accounts (e.g., credit cards) and installment accounts (e.g., loans) demonstrates your ability to manage different types of credit responsibly.

In conclusion, credit repair companies in Philadelphia offer a range of services aimed at improving your credit score, disputing inaccuracies, and providing guidance on debt management and identity theft protection. When choosing a credit repair company, consider factors such as their experience, reputation, pricing structure, and customer reviews. Additionally, there are strategies that you can implement on your own to improve your credit score, including paying bills on time, maintaining a low credit utilization ratio, regularly checking your credit reports, and correcting any inaccuracies. By making informed choices and taking proactive steps, you can work towards achieving a healthier credit profile and a higher credit score.

This image is property of philadelphia-pa-credit-repair.creditfirm.net.