In this article, you will learn about the importance of credit repair when going through a divorce and how to untangle your finances effectively. Divorce can have a major impact on your credit score and overall financial well-being, so it’s crucial to take the necessary steps to repair and rebuild your credit during this time. Whether you’re dealing with joint debts, late payments, or other credit issues, this article will provide you with valuable information and tips to navigate the challenges of credit repair and divorce.

Firstly, it’s important to understand the impact that divorce can have on your credit. Joint debts, such as mortgages, loans, and credit cards, can become a major concern if they are not addressed properly in the divorce settlement. Late payments and missed payments can also negatively affect your credit score, making it more difficult to obtain future loans or credit. The article will guide you through the process of separating your finances, closing joint accounts, and establishing individual credit. It will also provide advice on how to address any existing credit issues and rebuild your credit after a divorce. By following these steps, you can take control of your financial situation and move forward with confidence.

Understanding Credit Scores

Basics of credit scores

Credit scores are a crucial aspect of our financial lives. They are a numerical representation of our creditworthiness, serving as a measure of our ability to manage and repay debts. Lenders, landlords, and even potential employers often rely on credit scores to assess the level of risk involved in extending credit or entering into financial agreements with individuals.

Your credit score is determined based on several factors, including your payment history, credit utilization, length of credit history, types of credit you have, and recent credit inquiries. These factors are used by credit bureaus, such as Experian, TransUnion, and Equifax, to calculate your credit score.

Debunking credit score myths

There are many misconceptions surrounding credit scores, and it’s important to separate fact from fiction. One common myth is that checking your credit score will negatively impact it. In reality, checking your own credit score, known as a “soft inquiry,” does not have any negative impact on your score. It’s when lenders or creditors make a “hard inquiry” into your credit history that can slightly lower your score.

Another myth is that carrying a small balance on your credit cards will help improve your credit score. While having a low credit utilization ratio is beneficial, there is no need to carry a balance and pay unnecessary interest charges. Instead, aim to pay your credit card balances in full and on time each month to demonstrate responsible credit management.

Importance of creditworthiness

Having a good credit score is crucial for various reasons. It not only determines your eligibility for loans and credit cards but also affects the interest rates you receive. A higher credit score can lead to lower interest rates, saving you money in the long run.

Additionally, your creditworthiness can impact other aspects of your life, such as renting an apartment or even landing a job. Landlords often run credit checks to assess whether potential tenants are likely to pay rent on time, while some employers may consider credit scores when evaluating a candidate’s financial responsibility.

Identifying and Fixing Errors

Common errors in credit reports

It’s not uncommon for credit reports to contain errors, and these inaccuracies can have a negative impact on your credit score. Common errors include incorrect personal information, duplicate accounts, inaccurate payment history, and accounts mistakenly attributed to you.

To identify any errors, it’s important to regularly review your credit reports from all three major credit bureaus. By law, you are entitled to one free credit report from each bureau per year, which you can access through AnnualCreditReport.com.

Disputing inaccuracies with credit bureaus

If you find any errors on your credit reports, it’s crucial to take immediate action to correct them. Start by contacting the credit bureau that issued the report containing the error. Provide them with detailed information about the inaccuracy and any supporting documentation.

The credit bureau is then responsible for investigating the dispute within a specified timeframe, typically 30 days. If they find the information to be inaccurate, they will update your credit report accordingly. It’s important to request a free copy of your updated credit report to ensure the changes have been made.

Working with creditors to resolve errors

In some cases, errors may be the result of miscommunication between the credit bureaus and your creditors. If you believe an error is due to a mistake made by a creditor, reach out to them directly to address the issue.

Provide the creditor with documentation supporting your claim and request that they report the accurate information to the credit bureaus. It’s important to maintain communication with both the credit bureaus and your creditors throughout the dispute resolution process to ensure all inaccuracies are corrected.

This image is property of images.squarespace-cdn.com.

Rebuilding Credit After Divorce

Impact of divorce on credit scores

Divorce can have a significant impact on your credit score, especially if joint debts were involved. When couples separate, joint accounts and debts must often be divided or closed, which can result in changes to each individual’s credit history.

If your ex-spouse fails to make timely payments on joint accounts, it can negatively affect your credit score. Additionally, the process of dividing joint debts can lead to a higher individual credit utilization ratio, which can also lower your credit score.

Strategies for rebuilding credit post-divorce

Rebuilding your credit after a divorce may seem daunting, but it’s entirely possible with the right strategies. Start by reviewing your credit reports and addressing any errors or inaccuracies, as mentioned earlier. This will ensure that your credit history is as accurate and up-to-date as possible.

Next, focus on building positive credit history. This can be done by making all payments on time, keeping your credit utilization ratio low, and avoiding opening too many new accounts at once. Over time, these responsible credit habits will help improve your credit score.

Utilizing credit wisely during the divorce process

While going through a divorce, it’s essential to manage your credit wisely to prevent further damage. It’s important to keep a close eye on joint accounts and ensure that payments are made on time. Consider closing joint accounts if it is feasible to do so without negatively impacting your credit.

Additionally, it’s crucial to communicate with your ex-spouse throughout the process to ensure that both parties are aware of their responsibilities regarding joint debts. By working together and maintaining open lines of communication, you can minimize any potential negative effects on your credit.

Managing Debt and Divorce

Handling joint debts during divorce

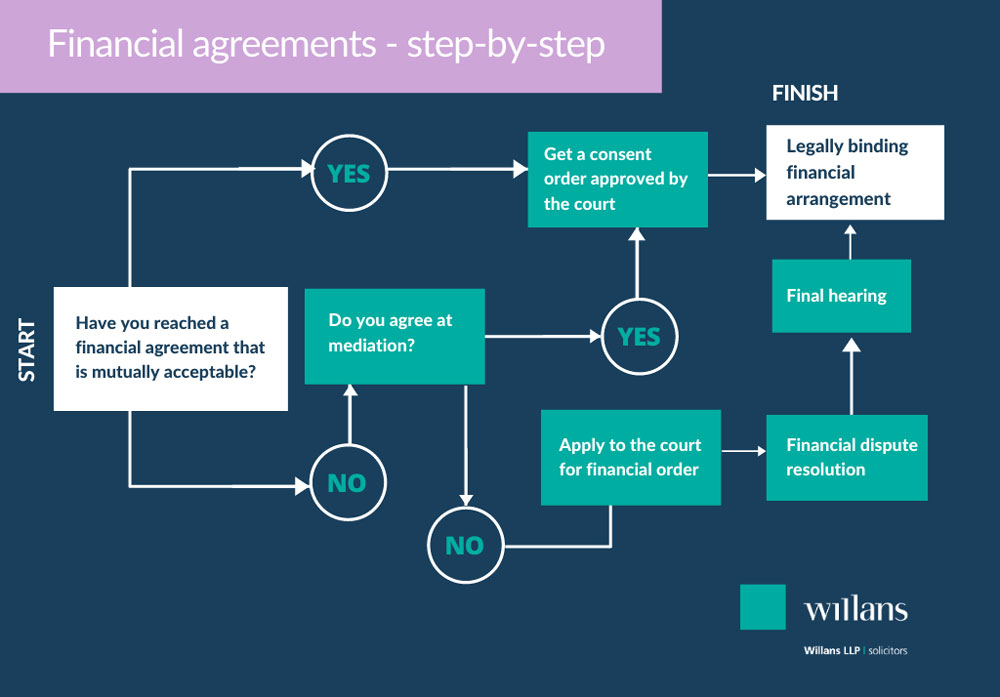

Divorce often involves the division of assets and liabilities, including joint debts. It’s important to address these debts during the divorce process to avoid any potential financial pitfalls in the future.

Start by taking stock of all joint debts and creating a plan for how they will be divided. Consider options such as paying off the debts jointly or transferring them to individual accounts. It may be necessary to work with legal professionals or financial advisors to navigate the complexities of dividing joint debts effectively.

Negotiating with creditors for debt settlements

During a divorce, it’s not uncommon to negotiate with creditors for debt settlements or modified payment options. Divorce can result in financial strain, and creditors may be willing to work with you to find a solution that meets everyone’s needs.

If you’re struggling to make payments on joint debts, it’s important to proactively reach out to your creditors. Explain the situation, provide any necessary documentation, and inquire about possible options for debt settlement or payment plan modifications. By taking this proactive approach, you can potentially alleviate some of the financial burden associated with joint debts.

Utilizing debt relief options

If you find yourself overwhelmed with debt after a divorce, it may be worth considering debt relief options. These options can help you manage your debt and work towards a more stable financial future.

Debt consolidation, for example, involves combining multiple debts into one loan with a lower interest rate. This can simplify debt repayment and potentially save you money on interest charges. Another option is debt management, where a credit counseling agency works with you to create a repayment plan and negotiate with creditors on your behalf.

However, it’s important to carefully consider the pros and cons of each debt relief option and seek professional advice before making any decisions. Beware of scams and organizations that offer quick-fix solutions but may only worsen your financial situation.

This image is property of s28126.pcdn.co.

Credit Repair vs. Debt Settlement

Understanding the differences between credit repair and debt settlement

Credit repair and debt settlement are two separate processes that aim to improve your financial situation but address different aspects of your overall credit profile.

Credit repair focuses on identifying and correcting errors on your credit report, as well as implementing strategies to improve your credit habits and build positive credit history. The goal is to increase your credit score over time by maintaining responsible financial behavior.

Debt settlement, on the other hand, involves negotiating with creditors to settle debts for less than the full amount owed. This can help individuals who are struggling to make payments or facing financial hardship. While debt settlement can provide temporary relief, it can also have a negative impact on your credit score.

Pros and cons of each approach

Credit repair offers a long-term solution for improving your credit score and overall financial well-being. By addressing errors on your credit report and implementing responsible credit habits, you can gradually rebuild your credit and open up opportunities for better financial terms in the future.

Debt settlement, on the other hand, can provide immediate relief by reducing the total amount of debt owed. However, it can also come with negative consequences, such as damaging your credit score and potentially facing tax implications for the forgiven debt.

It’s important to carefully evaluate your financial situation and goals before deciding on the best approach for you. Consulting with a financial advisor or credit repair professional can provide you with the guidance and support needed to make an informed decision.

Navigating Collections and Charge-Offs

Dealing with collection agencies

Collections can occur when a creditor or lender sells your delinquent debt to a third-party collection agency. Dealing with collection agencies can be intimidating, but it’s important to approach the situation proactively.

Start by requesting written verification of the debt from the collection agency. They are legally required to provide this information. Once you receive verification, review the details to ensure that the debt is indeed valid and belongs to you.

Next, consider negotiating a settlement with the collection agency. Many agencies are willing to accept a reduced payment amount or offer a payment plan arrangement. However, make sure to get any settlement agreements in writing before making any payments.

Paying off or settling charged-off accounts

A charged-off account occurs when a creditor writes off the debt as a loss and closes the account. However, this does not mean that you are no longer responsible for the debt. Charged-off accounts can still negatively impact your credit score and may still be pursued by collection agencies.

If you have a charged-off account, it’s important to address it as soon as possible. Consider negotiating a settlement with the original creditor or the collection agency that acquired the debt. Make sure to get any settlement agreements in writing and keep documentation of payments made.

Rebuilding credit after collections

Dealing with collections and charged-off accounts can be challenging, but it’s not the end of the road for your credit. With time and responsible credit management, you can rebuild your credit even after collection accounts.

Start by focusing on making all payments on time and keeping your credit utilization ratio low. It’s important to demonstrate responsible credit behavior and create positive credit history moving forward.

Consider opening a secured credit card, where you provide a deposit as collateral, to help rebuild your credit. Make small purchases and pay off the balance in full each month to show responsible credit usage. Over time, these efforts will help improve your credit score and allow you to move past the negative impact of collections.

This image is property of www.willans.co.uk.

Hiring Credit Repair Companies

Choosing a reputable credit repair company

If you’re considering hiring a credit repair company, it’s important to choose a reputable one. Research different companies and read reviews from past clients to get an idea of their reputation. Look for companies that are transparent about their process and offer clear pricing information.

Avoid companies that make unrealistic promises or ask for upfront fees before providing any services. Legitimate credit repair companies will not guarantee specific credit score improvements or charge fees before they have performed any work.

Understanding the services offered

Credit repair companies typically offer a range of services aimed at improving your credit profile. These services may include reviewing your credit reports, disputing inaccuracies, providing guidance on improving credit habits, and offering educational resources to help you maintain good credit in the future.

It’s important to have a clear understanding of the services being offered and how they align with your specific credit repair goals. Consult with the credit repair company to ensure they can address your unique needs and provide the level of support required.

Avoiding credit repair scams

Unfortunately, the credit repair industry is not immune to scams and fraudulent practices. It’s crucial to be vigilant and aware of warning signs when considering credit repair services.

Be cautious of companies that make bold claims, such as guaranteeing specific credit score improvements or removing accurate information from your credit reports. Legitimate credit repair companies cannot guarantee specific outcomes, as the process is dependent on many factors beyond their control.

Additionally, be wary of companies that request upfront fees before providing any services. The Credit Repair Organizations Act prohibits credit repair companies from charging fees until they have performed the promised services.

DIY Credit Repair Tips

Steps to take for self-guided credit repair

If you prefer to take a DIY approach to credit repair, there are several steps you can take to improve your credit on your own.

First, start by reviewing your credit reports from all three major credit bureaus. Look for any errors or inaccuracies that may be dragging down your credit score. Dispute these errors with the credit bureaus, providing any necessary documentation to support your claims.

Next, focus on developing good credit habits. Make all payments on time, keep your credit utilization ratio low, and avoid opening too many new accounts at once. These responsible credit behaviors will help improve your credit score over time.

Utilize resources such as online educational materials, books, and reputable websites to educate yourself on best practices for credit repair. The more you know, the better equipped you will be to navigate the complexities of the credit system.

Improving credit through responsible financial habits

Improving your credit goes beyond simply disputing errors on your credit report. It requires developing and maintaining responsible financial habits.

Start by creating a budget to track your income and expenses. This will help you prioritize your payments and ensure that bills are paid on time. Consider setting up automatic payments to avoid any late or missed payments.

Focus on paying down existing debts, starting with those with the highest interest rates. As you make progress, you’ll gradually reduce your overall debt load and improve your credit utilization ratio.

Avoid opening new accounts unnecessarily. Each new credit inquiry can slightly lower your credit score, so only apply for credit when necessary and carefully consider the potential impact on your score.

Utilizing credit repair resources

There are numerous resources available to aid in your credit repair journey. Websites such as MyFICO.com, CreditKarma.com, and AnnualCreditReport.com offer valuable tools and information for improving your credit.

Consider seeking guidance from credit counseling agencies accredited by the National Foundation for Credit Counseling or the Financial Counseling Association of America. These organizations can offer personalized advice and assistance based on your individual financial circumstances.

Remember, credit repair is a journey that requires patience and perseverance. By utilizing the available resources and implementing responsible financial habits, you can take control of your credit and improve your financial well-being.

This image is property of s28126.pcdn.co.

Protecting Finances from Identity Theft

Recovering from identity theft

Identity theft can have devastating effects on your financial well-being, but there are steps you can take to recover if you become a victim.

Start by filing a police report and documenting any fraudulent activity. Contact the credit bureaus to place a fraud alert on your credit reports, which will make it more difficult for fraudsters to open new accounts in your name.

Next, close any accounts that have been compromised and open new ones with updated security measures. Review your credit reports regularly for any suspicious activity and address any inaccuracies immediately.

Consider enrolling in a credit monitoring service that alerts you of any changes or potential breaches in your credit files. These services can help detect and prevent future instances of identity theft.

Monitoring credit reports for suspicious activity

Regularly monitoring your credit reports is key to detecting any suspicious activity that may indicate identity theft. Review your reports from all three major credit bureaus, checking for any new accounts, inquiries, or changes to your personal information.

Look for any unfamiliar accounts or addresses that may indicate fraudulent activity. If you notice anything suspicious, contact the credit bureaus and the respective creditors to report the fraud and take appropriate actions to protect your identity and credit.

Preventing identity theft after divorce

During and after a divorce, it’s important to take steps to protect your finances from potential identity theft. Start by changing your passwords for all financial accounts, including bank accounts, credit cards, and online banking portals. Choose strong, unique passwords that include a combination of letters, numbers, and special characters.

Consider freezing your credit, which prevents creditors from accessing your credit files unless you give them permission. This can help prevent new accounts from being opened in your name without your knowledge or consent.

Be cautious when sharing personal information, both online and offline. Avoid giving out sensitive information unless necessary, and be wary of scams or phishing attempts that may attempt to trick you into divulging personal data.

Conclusion

In conclusion, untangling finances after a divorce can be a complex and challenging process. However, by understanding credit scores, addressing errors, and implementing responsible financial habits, you can rebuild your credit and take control of your financial well-being.

Whether you choose to hire a credit repair company or take a DIY approach, it’s important to be proactive and stay informed. Remember to protect your finances from identity theft and utilize available resources to support your credit repair journey.

By taking the necessary steps, you can overcome the challenges of divorce and achieve a strong credit profile that sets you on a path to financial success. Empower yourself to make informed decisions and prioritize your financial well-being.

This image is property of i.ytimg.com.