In this article, you will learn about credit counseling agencies in Fort Wayne and how they can help you improve your financial situation. These agencies specialize in providing education and guidance to individuals who are struggling with debt or managing their finances. By working with a credit counseling agency, you can gain a better understanding of your financial situation and develop a plan to get back on track.

One of the main services provided by credit counseling agencies in Fort Wayne is debt management. If you are overwhelmed by credit card debt or other unsecured debts, a credit counselor can work with your creditors to negotiate a manageable payment plan. They can also help lower your interest rates and fees, making it easier to pay off your debts over time. Additionally, credit counseling agencies can provide budgeting assistance, helping you create a realistic budget and develop a plan to save money and reduce expenses. Overall, working with a credit counseling agency can provide you with the tools and knowledge you need to take control of your finances and work towards a debt-free future.

This image is property of waynethecreditguy.com.

What is Credit Counseling?

Understanding the concept of credit counseling

Credit counseling is a service provided by reputable agencies to help individuals and families who are struggling with debt. These agencies offer guidance and support to help people manage their financial situations more effectively and work towards becoming debt-free. Credit counseling is often sought by individuals who are facing financial difficulties, such as overwhelming debt, late payments, and high-interest rates.

Role of credit counseling agencies in Fort Wayne

Credit counseling agencies in Fort Wayne play a crucial role in assisting individuals and families in navigating their financial challenges. These agencies offer a wide range of services, including financial education, debt management plans, and negotiation with creditors. The goal is to provide clients with the tools and knowledge they need to regain control of their finances and work towards a more secure financial future.

The Benefits of Credit Counseling

Improving financial literacy and knowledge

One of the key benefits of credit counseling is the opportunity to improve your financial literacy and knowledge. Credit counselors are trained professionals who understand the intricacies of personal finance. They can provide valuable insights into budgeting, managing debt, and building savings. By participating in credit counseling sessions, you can gain a better understanding of your financial situation and develop the necessary skills to make informed decisions about your money.

Developing personalized debt management plans

Credit counseling agencies in Fort Wayne can help you develop personalized debt management plans tailored to your specific needs. These plans take into account your income, expenses, and debt obligations, and provide a roadmap for repaying your debts in a manageable and effective manner. With a debt management plan in place, you can consolidate your debts, negotiate with your creditors for lower interest rates and fees, and create a realistic timeline for becoming debt-free.

Providing guidance and support throughout the debt repayment process

Dealing with debt can be overwhelming and stressful. Credit counseling agencies in Fort Wayne offer much-needed guidance and support throughout the debt repayment process. They can help you navigate through complex financial issues, provide emotional support, and offer strategies for staying motivated and on track. Whether you need assistance with creating a budget, negotiating with creditors, or managing unexpected expenses, credit counselors are there to help you every step of the way.

Finding a Reputable Credit Counseling Agency

Researching and checking credentials

When searching for a reputable credit counseling agency in Fort Wayne, it’s important to do thorough research and check their credentials. Look for agencies that are accredited by recognized organizations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These accreditations ensure that the agency meets certain quality standards and adheres to ethical practices.

Reading reviews and testimonials

Reading reviews and testimonials from past clients can also be helpful in finding a reputable credit counseling agency. Look for positive feedback and success stories from individuals who have sought credit counseling services. This will give you an idea of the agency’s track record and the level of satisfaction among its clients.

Contacting local consumer protection agencies for recommendations

Another way to find a reputable credit counseling agency in Fort Wayne is by contacting local consumer protection agencies for recommendations. They can provide insights into agencies that have a good reputation and a history of providing quality services. Additionally, these agencies can also inform you of any complaints or issues that have been filed against specific credit counseling agencies.

The Credit Counseling Process

Initial consultation and assessment of financial situation

The credit counseling process typically starts with an initial consultation, during which you will meet with a credit counselor to discuss your financial situation. You will be asked to provide details about your income, expenses, debts, and financial goals. The counselor will then assess your financial situation and provide recommendations based on your specific needs.

Creation of a personalized budget and spending plan

Once your financial situation has been assessed, the credit counselor will work with you to create a personalized budget and spending plan. This plan will outline your income, expenses, and debt obligations, and will help you allocate your resources effectively. The goal is to help you prioritize your financial goals and identify areas where you can cut back on expenses to free up additional funds for debt repayment.

Negotiation with creditors to lower interest rates and fees

Another important aspect of credit counseling is negotiating with creditors to lower interest rates and fees. Credit counselors have established relationships with many creditors and can often secure lower interest rates or fee waivers for their clients. This can help you save money in the long run and make your debt more manageable.

This image is property of lifeworks-counseling.org.

Debt Management Strategies

Exploring debt consolidation options

Debt consolidation is a debt management strategy that involves combining multiple debts into a single loan with a lower interest rate. This can make repayment more manageable and simplify your financial situation. Credit counseling agencies in Fort Wayne can help you explore debt consolidation options and determine if it is the right strategy for you.

Implementing a debt snowball or debt avalanche method

The debt snowball and debt avalanche methods are two popular strategies for repaying debt. The debt snowball method involves paying off debts from smallest to largest, regardless of interest rates. This method provides a sense of accomplishment and motivation as you see your debts being paid off one by one. The debt avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first. This method saves you more money in interest over the long term.

Creating a realistic repayment timeline

Creating a realistic repayment timeline is essential for successfully managing your debts. A credit counseling agency can help you evaluate your financial situation, income, and expenses, and determine a timeline that works for you. This timeline will take into account your current debts, interest rates, and available funds to create a repayment plan that is realistic and achievable.

Credit Counseling vs. Debt Settlement

Understanding the differences between credit counseling and debt settlement

Credit counseling and debt settlement are two different approaches to managing debt. While both can help you work towards becoming debt-free, they have distinct differences. Credit counseling focuses on education, budgeting, and developing manageable debt repayment plans. Debt settlement, on the other hand, involves negotiating with creditors to reduce the overall amount of debt owed. It’s important to understand the pros and cons of each approach and choose the one that aligns with your financial goals and circumstances.

Evaluating the pros and cons of each approach

Credit counseling offers many benefits, including financial education, personalized debt management plans, and ongoing support. It can help you become more financially literate, develop healthier financial habits, and repay your debts in a more manageable way. Debt settlement, on the other hand, may offer the possibility of reducing the overall amount of debt owed but can result in negative impacts on your credit score and may involve upfront fees. It’s important to carefully evaluate the pros and cons of each approach and choose the one that best suits your needs and financial situation.

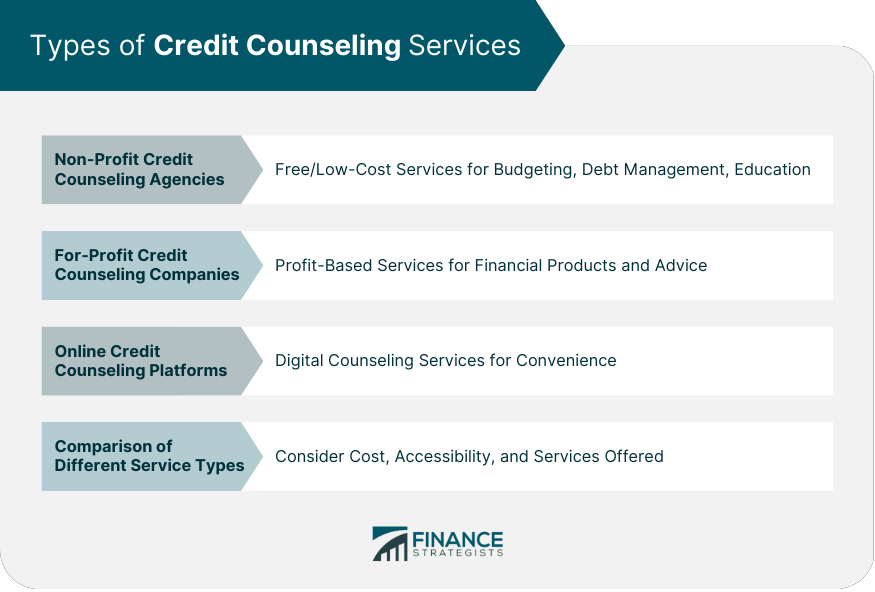

This image is property of www.financestrategists.com.

Credit Counseling and Credit Scores

Impact of credit counseling on credit scores

Participating in a credit counseling program typically does not directly impact your credit score. However, enrolling in a debt management plan, which is often a part of credit counseling, can have a temporary negative impact on your credit score. This is because creditors may report that you are on a debt management plan to credit reporting agencies. However, as you make consistent payments and successfully complete the program, your credit score can improve over time.

Rebuilding credit after completing a credit counseling program

After completing a credit counseling program, it’s important to focus on rebuilding your credit. This can be achieved by making timely payments on all your debts, keeping credit card balances low, and avoiding new debt. Over time, your credit score can improve, and you can work towards a healthier financial future.

Common Mistakes to Avoid in Credit Counseling

Falling for credit repair scams

When seeking credit counseling services, it’s essential to be aware of credit repair scams. These scams often promise quick fixes to improve your credit score or eliminate your debts. However, they usually require upfront fees and may not deliver on their promises. To avoid falling for credit repair scams, do thorough research, choose reputable credit counseling agencies, and consult with trusted financial advisors.

Not following the advice and recommendations of the credit counseling agency

To benefit fully from credit counseling, it’s important to follow the advice and recommendations provided by the credit counseling agency. This may include developing a realistic budget, sticking to a debt management plan, and making timely payments on your debts. By actively participating and implementing the strategies suggested by your credit counselor, you can increase your chances of successfully managing your debts and achieving your financial goals.

This image is property of www.financestrategists.com.

Working with Creditors and Collection Agencies

Understanding creditor negotiation tactics

Creditors and collection agencies often employ various negotiation tactics to recover outstanding debts. When working with a credit counseling agency, they may be more willing to negotiate lower interest rates, waive fees, or accept reduced payments. Credit counselors are skilled negotiators and can advocate on your behalf to help you reach more favorable terms with your creditors.

Dealing with collection calls and harassment

If you are receiving collection calls or experiencing harassment from creditors or collection agencies, credit counseling agencies in Fort Wayne can provide guidance and support. They can help you understand your rights as a consumer and advise you on how to handle these situations. By working with a credit counseling agency, you can regain control of your interactions with creditors and collection agencies.

Conclusion

Seeking credit counseling services can play a vital role in helping individuals and families in Fort Wayne regain control of their finances and work towards a debt-free future. Credit counseling agencies offer a range of benefits, including improving financial literacy, creating personalized debt management plans, and providing ongoing guidance and support. By researching and choosing reputable credit counseling agencies, individuals can access the tools and resources necessary to successfully navigate their financial challenges. By taking control of their financial situations and working towards a debt-free future, individuals in Fort Wayne can achieve financial freedom and peace of mind.

This image is property of images.squarespace-cdn.com.