Do you find yourself drowning in credit card debt in South Bend? Don’t worry, help is here! This article provides you with valuable tips on how to manage your credit card debt responsibly. Whether you’re a student struggling with expenses or a working professional trying to stay afloat, these tips will guide you towards financial freedom. Say goodbye to sleepless nights and hello to a brighter financial future. So, grab a cup of coffee and let’s get started on your journey to managing credit card debt responsibly in South Bend!

Creating a Budget

Creating a budget is an essential step in managing credit card debt responsibly. By tracking your expenses, you can gain a clear understanding of where your money is going and identify areas where you can cut back. This will allow you to allocate funds specifically for debt repayment and stay on top of your financial obligations.

Track Your Expenses

The first step in creating a budget is to track your expenses. This means keeping a record of every dollar you spend, from your monthly bills to your morning coffee. There are various methods you can use to track your expenses, whether it’s through a spreadsheet, a budgeting app, or simply pen and paper. By tracking your expenses, you can identify any unnecessary or impulsive purchases that contribute to your credit card debt.

Identify Areas to Cut Back

Once you have a clear picture of your expenses, it’s time to identify areas where you can cut back. This requires a careful analysis of your spending habits and a willingness to make adjustments to your lifestyle. Look for non-essential expenses that can be reduced or eliminated, such as dining out, entertainment subscriptions, or shopping sprees. Cutting back in these areas will free up more money to put towards your credit card debt.

Allocate Funds for Debt Repayment

After tracking your expenses and identifying areas to cut back, it’s important to allocate funds specifically for debt repayment. This means setting aside a portion of your income each month solely for paying off your credit card debt. By prioritizing debt repayment in your budget, you ensure that you are consistently making progress towards becoming debt-free. Consider setting up a separate savings account or utilizing the envelope system to keep your allocated funds separate from your day-to-day spending.

Pay On Time

Paying your bills on time is crucial for managing credit card debt responsibly. Late payments not only incur hefty fees and penalty interest rates, but they also negatively impact your credit score. To avoid these consequences, it’s important to understand the due dates of your credit card payments, set up automatic payments, and utilize payment reminders.

Understand Due Dates

Make sure you are aware of the due dates for your credit card payments and understand the consequences of paying late. Some credit card issuers may impose late fees and increase your interest rate, which can further compound your debt. To avoid these additional charges, mark your due dates on a calendar or set reminders on your phone.

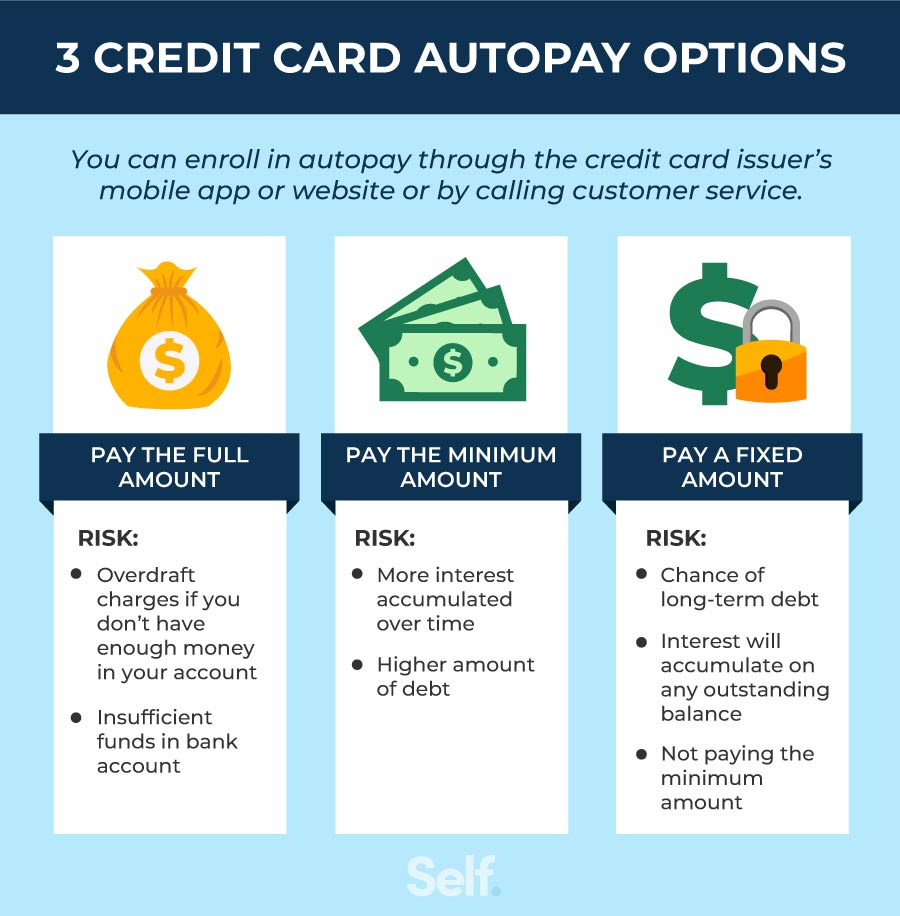

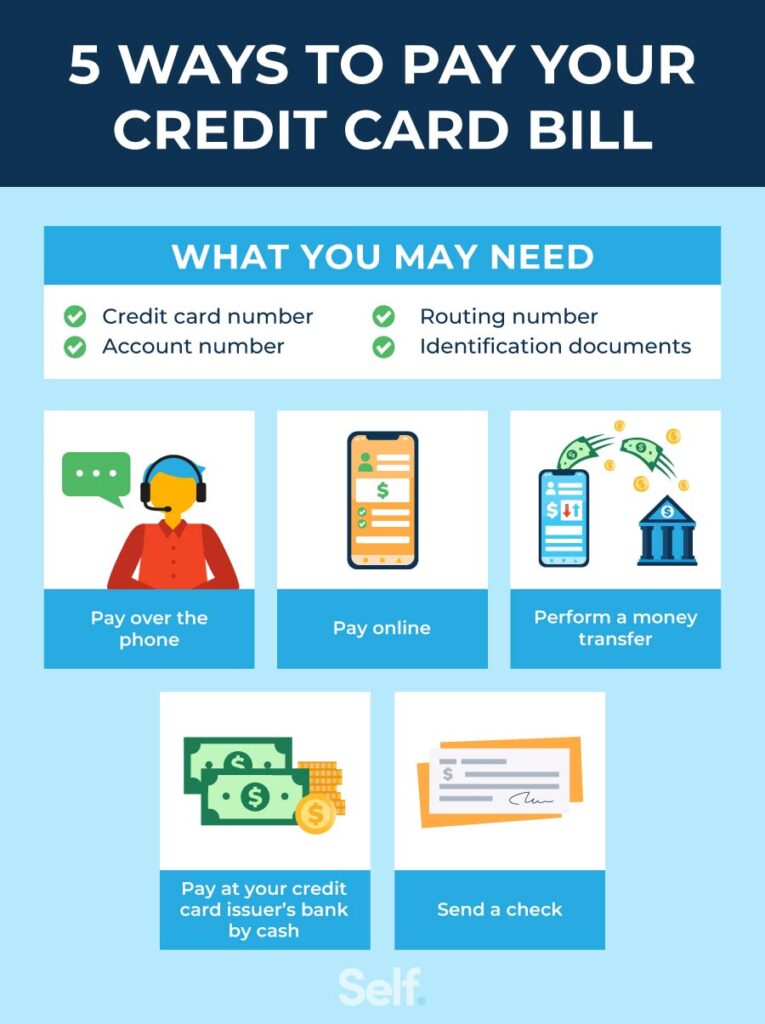

Set Up Automatic Payments

To ensure you never miss a payment, consider setting up automatic payments for your credit card bills. This way, the minimum payment or a specified amount will be automatically deducted from your bank account on the due date. However, it’s important to regularly review your credit card statements to ensure the correct amount is being deducted and to verify that there are no fraudulent charges.

Utilize Payment Reminders

If you prefer not to set up automatic payments, another effective way to stay on top of your credit card payments is by utilizing payment reminders. Many credit card issuers offer email or text notifications that alert you when your payment is due. Take advantage of these reminders to stay organized and avoid late payments.

This image is property of images.ctfassets.net.

Prioritizing Repayment

When managing credit card debt, it’s crucial to have a clear strategy for repayment. Two popular methods are the snowball method and the debt avalanche method. Additionally, you may also consider balance transfers to reduce interest rates and streamline your repayment process.

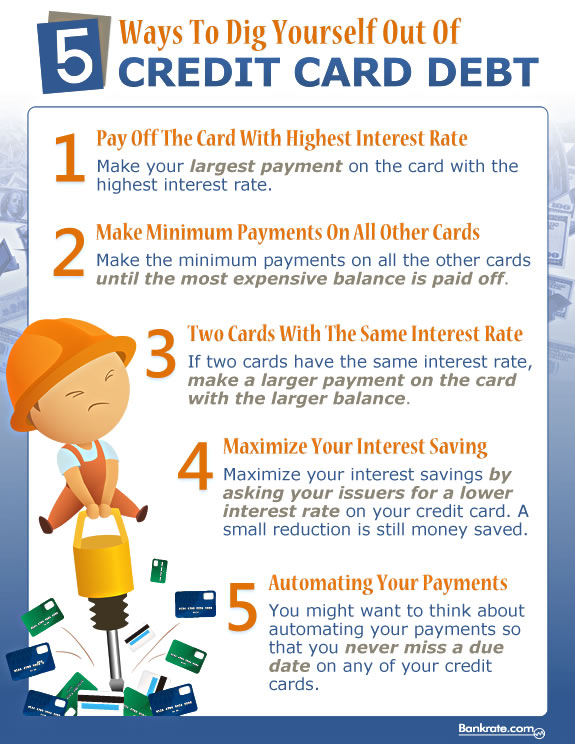

Snowball Method

The snowball method involves tackling your smallest credit card debt first while making minimum payments on all other debts. Once the smallest debt is paid off, you take the money you were using for that payment and apply it to the next smallest debt. This method can provide a psychological boost as you experience small wins along the way, helping to stay motivated and focused on your debt repayment journey.

Debt Avalanche Method

The debt avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first. By targeting high-interest debts, you minimize the overall interest you will pay over time. Start by making minimum payments on all debts and allocate any extra funds towards the debt with the highest interest rate. Once that debt is fully paid, move on to the next highest interest rate debt.

Consider Balance Transfer

If you have multiple credit cards with high interest rates, you may want to consider a balance transfer. This involves transferring your existing credit card balances to a new credit card with a lower interest rate. By consolidating your debts onto one card, you can save money on interest and streamline your repayment process. However, it’s important to read the terms and conditions carefully before proceeding with a balance transfer to ensure that it is a financially sound decision.

Negotiating with Creditors

When faced with overwhelming credit card debt, it’s important to communicate with your creditors and explore options for debt relief. By contacting your creditors directly, exploring debt consolidation, or seeking professional advice, you can potentially negotiate better terms and create a manageable repayment plan.

Contacting Creditors

If you are struggling to make your credit card payments, it’s essential to reach out to your creditors and explain your financial situation. Many creditors have hardship programs or alternative payment arrangements that can help you manage your debt more effectively. They may be willing to lower your interest rate, reduce your minimum payment, or offer a temporary forbearance. It’s important to communicate openly and honestly with your creditors to find a solution that works for both parties.

Exploring Debt Consolidation

Debt consolidation is another option to consider when negotiating with creditors. This involves combining multiple debts into a single loan or credit card with a lower interest rate. By consolidating your debts, you simplify your repayment process and potentially save money on interest. However, it’s important to weigh the pros and cons and carefully consider your ability to repay the consolidated debt before proceeding.

Seeking Professional Advice

If you are overwhelmed by your credit card debt and unsure of how to proceed, seeking professional advice can be beneficial. Nonprofit credit counseling agencies can provide guidance and assistance in managing your debts, negotiating with creditors, and creating a sustainable repayment plan. These agencies typically offer counseling services free of charge and can provide valuable insights and resources to help you regain control of your finances.

This image is property of images.ctfassets.net.

Avoiding Additional Debt

As you work towards managing and paying off your credit card debt responsibly, it’s important to avoid accumulating additional debt. By limiting credit card usage, building an emergency fund, and considering lifestyle adjustments, you can prevent further financial hardship.

Limit Credit Card Usage

One of the most effective ways to avoid accumulating more credit card debt is to limit your credit card usage. Consider leaving your credit cards at home and using cash or a debit card for your day-to-day expenses. By keeping credit card usage to a minimum, you reduce the temptation to overspend and accumulate more debt.

Build an Emergency Fund

Having an emergency fund is crucial for financial stability and can prevent you from relying on credit cards in times of unexpected expenses. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This way, you can cover unexpected costs without resorting to credit card debt.

Consider Lifestyle Adjustments

If your credit card debt is becoming unmanageable, it may be necessary to consider lifestyle adjustments to free up more funds for debt repayment. This could involve downsizing your living arrangements, cutting back on dining out or entertainment expenses, or finding ways to increase your income through a side gig or part-time job. By making intentional changes to your lifestyle, you can prioritize debt repayment and achieve financial stability.

Seeking Financial Assistance

If you find yourself in a situation where credit card debt is overwhelming and you need additional support, there are various resources available in the South Bend area. From local assistance programs to nonprofit credit counseling agencies, these resources can provide guidance and assistance tailored to your specific financial situation.

Local Resources

Explore local resources in South Bend that offer financial assistance programs. These programs may provide temporary relief, such as financial counseling, budgeting workshops, or even financial assistance grants for those facing extreme hardship. Reach out to local government offices, community organizations, and churches to inquire about available resources.

Nonprofit Credit Counseling

Nonprofit credit counseling agencies can also be a valuable resource for managing credit card debt responsibly. These organizations offer free or low-cost financial counseling services and can help you create a personalized action plan for managing your debt. They often have relationships with creditors and can negotiate reduced interest rates or more favorable repayment terms on your behalf.

Government Assistance Programs

Additionally, there may be government assistance programs available to South Bend residents who are struggling with credit card debt. These programs may provide financial assistance for basic needs, such as housing, utilities, and food. Explore local, state, and federal resources to determine if you qualify for any assistance programs that can alleviate the financial burden of credit card debt.

This image is property of yoursuperiorfinance.com.

Monitoring Credit Reports

Regularly monitoring your credit reports is an important aspect of managing credit card debt responsibly. By checking your reports, disputing errors, and protecting your personal information, you can ensure the accuracy of your credit information and safeguard against identity theft.

Check Regularly

It’s essential to check your credit reports regularly to monitor any changes or discrepancies. You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. Take advantage of this opportunity to review your credit reports for any inaccuracies, such as fraudulent accounts or incorrect personal information.

Dispute Errors

If you identify any errors on your credit reports, it’s important to dispute them promptly. Contact the credit bureau in writing, providing detailed evidence and documentation to support your claim. The credit bureau is required to investigate the disputed information and correct any errors within a reasonable time frame.

Protecting Personal Information

To minimize the risk of identity theft and fraud, it’s crucial to protect your personal information. Safeguard your social security number, banking details, and credit card information. Be cautious when sharing personal information online or with unknown individuals. Regularly monitor your financial statements for any suspicious activity or unauthorized charges. By taking proactive steps to protect your personal information, you can reduce the risk of falling victim to identity theft and the ensuing financial consequences.

Understanding Interest Rates

Understanding the interest rates associated with your credit cards is essential for managing credit card debt responsibly. By reading the credit card terms, negotiating lower rates, and considering debt consolidation loans, you can make informed decisions and potentially save money on interest.

Read Credit Card Terms

When you apply for a credit card, it’s important to read the terms and conditions carefully. Pay attention to the interest rates, including the annual percentage rate (APR) for purchases, balance transfers, and cash advances. Understand any introductory offers or promotional periods, as the interest rates may change after these periods expire. Knowing these terms will help you make informed decisions about your credit card usage and repayment strategy.

Negotiate Lower Rates

If you have good payment history and a strong credit score, you may be able to negotiate lower interest rates with your credit card issuer. Reach out to your credit card company and inquire about potential rate reductions. Emphasize your commitment to responsible financial management and mention any competitive offers you have received from other credit card companies. While there’s no guarantee that your request will be granted, it’s worth exploring the possibility of lowering your interest rates to save money on your credit card debt.

Consider Debt Consolidation Loans

Debt consolidation loans are another option to consider when aiming to manage credit card debt responsibly. These loans involve taking out a new loan to pay off your existing credit card debt. By consolidating your debts into one loan, you may be able to secure a lower interest rate and simplify your repayment process. However, it’s important to carefully evaluate the terms and fees associated with the consolidation loan to ensure it’s a financially beneficial option for you.

This image is property of images.ctfassets.net.

Managing Multiple Credit Cards

If you have multiple credit cards, managing them effectively is crucial for responsible credit card debt management. By consolidating your cards, strategically allocating payments, and avoiding opening new accounts, you can simplify your finances and minimize the risk of accumulating more debt.

Consolidation Options

If you have multiple credit cards with outstanding balances, consider consolidating them into one credit card or a debt consolidation loan. This will streamline your repayment process and potentially reduce interest rates. By consolidating your credit cards, you can minimize the temptation of using multiple cards and keep a better track of your overall debt.

Strategize Payment Allocation

When managing multiple credit cards, it’s important to strategically allocate your payments. Consider prioritizing cards with the highest interest rates or the largest outstanding balances. Make minimum payments on all cards, but allocate any additional funds towards the card you are targeting for repayment. As you pay off one card, move those funds towards the next card on your priority list. By strategically allocating your payments, you can accelerate your debt repayment and save money on interest.

Avoid Opening New Accounts

While it may be tempting to open new credit card accounts to manage existing debt, it’s generally advisable to avoid doing so. Opening new accounts may increase your overall debt burden and potentially harm your credit score. Focus on responsibly managing your existing credit cards instead of adding more cards to the mix. Only consider opening new accounts if it aligns with your overall financial goals and if you are confident in your ability to use them responsibly.

Staying Motivated and Disciplined

Managing credit card debt responsibly requires discipline and motivation. By setting achievable goals, rewarding yourself along the way, and staying focused on your long-term financial health, you can stay motivated and on track to becoming debt-free.

Set Achievable Goals

Start by setting achievable goals for yourself. These goals should be specific, measurable, attainable, realistic, and time-bound (SMART). For example, you could aim to pay off a specific credit card balance within a certain timeframe. Breaking down your larger debt into smaller, more manageable goals will allow you to experience a sense of accomplishment as you make progress. Celebrate each milestone reached and use it as motivation to continue your journey towards financial freedom.

Reward Yourself

Rewarding yourself along the way can help you stay motivated and committed to your debt repayment plan. Acknowledge your progress and treat yourself when you achieve certain milestones. However, it’s important to choose rewards that do not contradict your financial goals. Opt for low-cost or free rewards, such as a relaxing evening at home, a walk in the park, or a small indulgence that won’t derail your budget.

Stay Focused on Long-Term Financial Health

Finally, it’s crucial to stay focused on your long-term financial health throughout your credit card debt management journey. Remember that responsible debt management is not only about paying off your current debts but also about avoiding future debt and building a strong financial foundation. Make financial education a priority, continue to monitor your spending habits, and constantly evaluate your progress towards your financial goals. By staying focused on the bigger picture, you can create a sustainable and debt-free future for yourself.

This image is property of cd3138f368a5fb150fb4-4d58d1bf06f71055f353fb77fdd92dfe.ssl.cf5.rackcdn.com.