Picture this: you find yourself drowning in a sea of financial troubles, desperately in need of a lifeboat to bring you back to shore. As you embark on your search for help, you come across two terms that seem promising – credit repair and credit counseling services. But, confusion sets in. What exactly are the differences between the two? And which one is suited for your specific situation?

In this article, we will dive deep into the realms of credit repair and credit counseling services, unraveling their distinctive features and shedding light on how they can potentially rescue you from the choppy waters of bad credit. By the time you reach the end, you will not only have a crystal clear understanding of the disparities between these two services, but you will also be equipped with the knowledge to make an informed decision about which one is best for you. So, let’s untangle the complexities of credit repair and credit counseling services, and pave the way towards a brighter financial future.

This image is property of i.ytimg.com.

Credit Repair vs Credit Counseling Services

Can you explain the difference between credit repair and credit counseling services? If you’re feeling confused about these terms and how they differ, don’t worry – you’re not alone. They both deal with improving your credit situation, but they approach it from different angles. In this article, we will explore the definitions, objectives, processes, providers, and costs of both credit repair and credit counseling services, so you can have a clear understanding of each.

What is Credit Repair?

Definition of Credit Repair

Credit repair is a service designed to help individuals improve their credit scores by addressing negative marks on their credit reports. These negative marks may include late payments, collections, charge-offs, bankruptcies, or any other factors that can negatively impact your creditworthiness.

Objective of Credit Repair

The primary objective of credit repair is to increase your credit score, as a higher credit score opens up more opportunities for securing loans, mortgages, credit cards, and favorable interest rates. A better credit score can also improve your chances of getting approved for apartment rentals or employment.

Legitimacy of Credit Repair Services

It is important to note that not all credit repair services are legitimate or effective. While there are reputable companies that have the knowledge and expertise to assist you, there are also scams and fraudulent organizations that prey on vulnerable individuals. It is essential to do your due diligence and research any credit repair organization before enlisting their services, ensuring they have a solid track record and positive customer reviews.

What is Credit Counseling?

Definition of Credit Counseling

Credit counseling is a service that provides expert guidance and advice on personal finance and credit management. It typically involves a thorough review of your financial situation, including your income, expenses, assets, and debts, with the goal of creating a personalized plan to address your financial challenges.

Objective of Credit Counseling

The primary objective of credit counseling is to help individuals understand and improve their financial habits, develop budgeting skills, and provide education on responsible money management. It aims to assist you in gaining control over your finances, reducing debt, and achieving long-term financial stability.

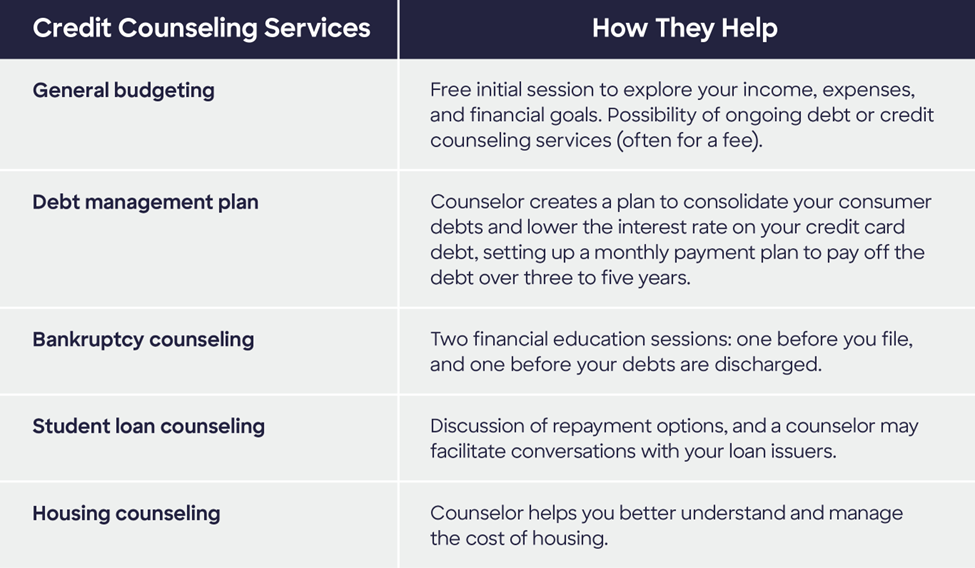

Types of Credit Counseling

There are various types of credit counseling services available, depending on your specific needs. These may include debt management counseling, budgeting and financial education, student loan counseling, and bankruptcy counseling. Each type focuses on different aspects of personal finance, providing tailored guidance and solutions.

Purpose of Credit Repair

Improving Credit Score

One of the main purposes of credit repair is to improve your credit score. By addressing negative entries on your credit report, such as errors or inaccuracies, late payments, or collections, credit repair aims to boost your creditworthiness and increase your score. A higher credit score demonstrates to lenders that you are a responsible borrower, making you more desirable for favorable loan terms and interest rates.

Removing Errors or Inaccuracies

Credit reports may sometimes contain errors or inaccuracies that lower your credit score. These errors can range from incorrect personal information to false negative marks on your credit history. Credit repair specialists work to identify these errors, dispute them with credit bureaus and creditors, and ensure their removal from your credit report.

Settling Outstanding Debts

Credit repair services may also negotiate with your creditors on your behalf to settle outstanding debts. This process involves working out payment plans, negotiating reduced amounts, or exploring options for debt forgiveness. By settling these debts, credit repair aims to eliminate negative entries on your credit report and improve your overall creditworthiness.

Increasing Creditworthiness

Ultimately, the purpose of credit repair is to enhance your creditworthiness and financial standing. By improving your credit score, removing errors, and settling debts, you are perceived as a more reliable borrower. This can lead to increased access to credit opportunities, better interest rates, and a stronger financial foundation.

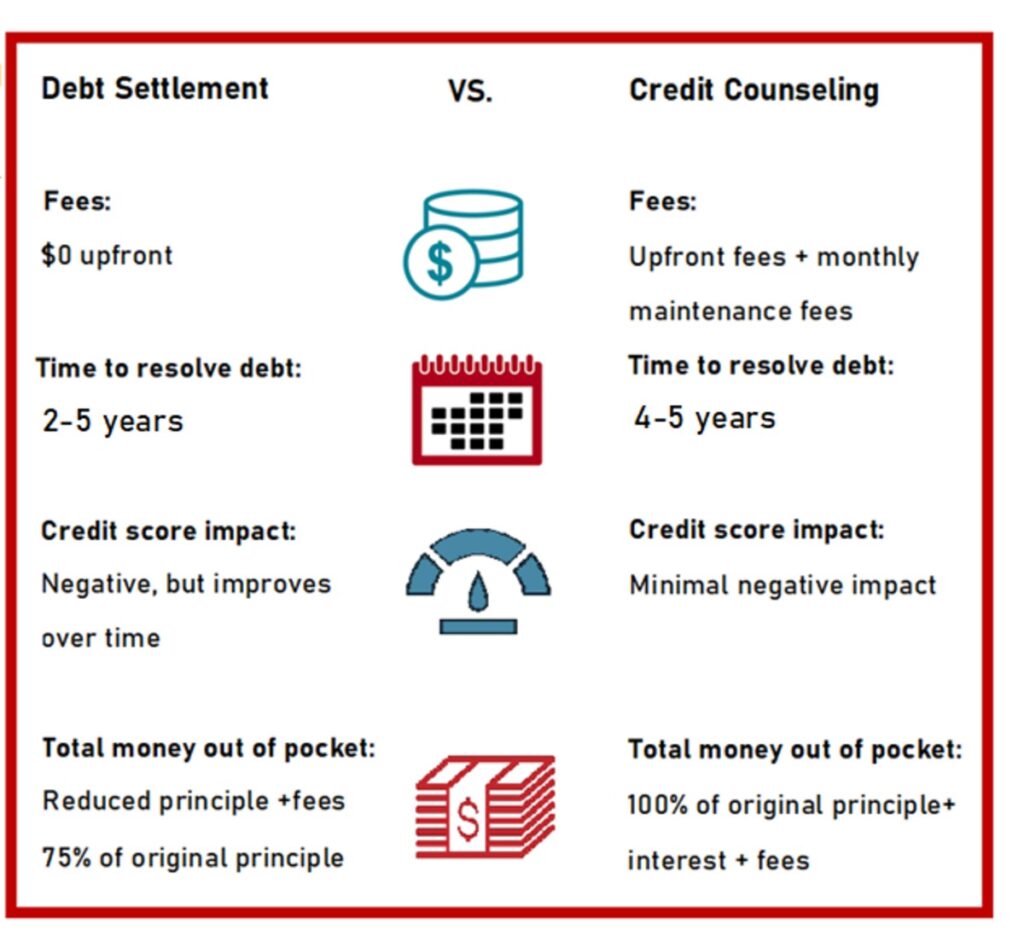

This image is property of www.clearoneadvantage.com.

Purpose of Credit Counseling

Debt Management

One of the key purposes of credit counseling is to assist individuals in managing their debts effectively. Credit counselors work closely with clients to understand their financial situation, evaluate their debts, and develop personalized debt management plans. These plans often involve consolidating debts, negotiating with creditors for lower interest rates or reduced payments, and providing guidance on strategies to pay off debts more efficiently.

Budgeting and Financial Education

Credit counseling services also aim to educate individuals on proper budgeting and financial management. Credit counselors can provide guidance on creating a realistic budget, tracking expenses, and establishing healthy financial habits. By understanding how to manage your money effectively, you can avoid future debt problems and work towards achieving your financial goals.

Student Loan Counseling

Student loan counseling is another area of credit counseling that specifically addresses the challenges faced by individuals with student loan debt. Credit counselors can help you navigate through the complexities of student loans, provide information on available repayment options, and assist in developing a manageable plan for repayment. They can also offer guidance on loan forgiveness programs or other options that may alleviate the burden of student loan debt.

Bankruptcy Counseling

For individuals struggling with overwhelming debt and considering bankruptcy as a last resort, credit counseling services offer guidance and counseling on the bankruptcy process. Credit counselors can help you understand the different types of bankruptcy, their implications, and alternatives to bankruptcy. They can provide the necessary information and support to make an informed decision about your financial future.

Process of Credit Repair

Credit Report Analysis

The credit repair process typically begins with a detailed analysis of your credit report. Credit repair specialists review your credit history, identifying areas of concern, including negative entries, errors, or inaccuracies. This analysis helps determine the steps required to address these issues and improve your credit score.

Disputing Inaccuracies or Errors

Once identified, credit repair services initiate the process of disputing any inaccuracies or errors found in your credit report. They communicate with credit bureaus and creditors to challenge and request the removal of these items. This process may involve providing evidence or documentation to support your case.

Negotiating with Creditors

In cases where you have outstanding debts, credit repair services may negotiate with your creditors on your behalf. These negotiations aim to settle the debt by agreeing on a payment plan or potentially reducing the amount owed. The goal is to reach an agreement that satisfies both parties and eliminates the negative impact of the debt on your credit score.

Building Positive Credit History

Alongside disputing negative entries, credit repair services may also assist you in building positive credit history. This can involve guidance on responsible credit card usage, recommending suitable credit options, and providing strategies to establish a solid credit foundation. Building a positive credit history over time can further enhance your creditworthiness.

This image is property of 094618235d57f9f184ca-ffd24fd86f5b6c69fe5e6bc000cf6d5b.ssl.cf5.rackcdn.com.

Process of Credit Counseling

Credit and Financial Assessment

The credit counseling process begins with a comprehensive assessment of your credit and financial situation. Credit counselors gather information about your income, expenses, debts, assets, and liabilities to gain a holistic understanding of your financial health. This assessment helps identify key areas that need attention and provides the basis for developing a tailored plan.

Developing a Repayment Plan

Based on the assessment, credit counselors work with you to create a personalized repayment plan. This plan takes into account your income, expenses, and debts, and aims to assist you in repaying your debts systematically and efficiently. It may involve negotiating with creditors for lower interest rates or reduced payments, consolidating debts, or prioritizing certain debts for repayment.

Debt Consolidation

As part of the credit counseling process, debt consolidation may be recommended in cases where you have multiple debts with varying interest rates. Credit counselors can help you consolidate your debts into a single loan or payment plan, simplifying your debt management and potentially reducing your overall interest expenses.

Negotiating with Creditors

Similar to credit repair, credit counseling services may also negotiate with your creditors to establish more favorable repayment terms. This can include negotiating lower interest rates, extended payment periods, or reduced monthly payments. These negotiations aim to make your debts more manageable and help you regain control of your financial situation.

Who Provides Credit Repair Services?

Credit Repair Companies

Credit repair services are commonly offered by specialized credit repair companies. These companies employ credit repair specialists who are well-versed in credit laws, regulations, and dispute processes. They have the expertise to analyze credit reports, identify issues, and navigate the credit repair process effectively.

Individual Credit Repair Specialists

In addition to credit repair companies, individual credit repair specialists offer their services independently. These specialists may have their own businesses or work as freelancers, providing credit repair assistance to individuals on a more personalized level. Their expertise and knowledge allow them to guide clients through the credit repair process.

Non-profit Organizations

Some non-profit organizations also offer credit repair services as part of their broader financial assistance programs. These organizations typically focus on helping individuals with limited financial resources and provide credit repair services at reduced or no cost. Non-profit credit repair services aim to assist those who may not be able to afford private credit repair assistance.

This image is property of www.cache2net.com.

Who Provides Credit Counseling Services?

Non-profit Credit Counseling Agencies

Non-profit credit counseling agencies are the most common providers of credit counseling services. These agencies are dedicated to assisting individuals in overcoming their financial challenges and achieving financial stability. They employ certified credit counselors who provide personalized guidance and support throughout the credit counseling process.

Government Agencies

Government agencies may also offer credit counseling services as part of their financial assistance programs. These agencies recognize the importance of financial education and counseling in promoting responsible money management. The services they provide are often free or available at a low cost, enabling individuals to access the support they need without a significant financial burden.

Certified Credit Counselors

Certified credit counselors, whether working for non-profit agencies or private firms, play a crucial role in providing credit counseling services. These counselors have undergone specialized training and certification programs to develop the necessary skills and knowledge to assist individuals with their financial challenges. Their expertise ensures that clients receive reliable and informed advice.

Cost of Credit Repair

Credit repair services are not free, and the cost can vary depending on the complexity of your credit situation and the provider you choose. Typically, credit repair companies charge an initial setup fee, followed by monthly fees for ongoing services. The setup fee can range from $50 to several hundred dollars, while monthly fees usually fall between $50 and $150. It’s important to review and compare the fees and services offered by various credit repair providers before making a decision.

This image is property of miro.medium.com.

Cost of Credit Counseling

The cost of credit counseling varies depending on the provider and the services rendered. Non-profit credit counseling agencies often offer initial counseling sessions free of charge. If you decide to enroll in a debt management plan, there may be a setup fee ranging from $25 to $50, accompanied by a monthly fee of around $20 to $75, depending on the complexity of your debts. However, it is worth noting that many non-profit organizations offer fee waivers or reduced fees for individuals with limited financial means. Government agencies that provide credit counseling services often offer free or low-cost options, ensuring that financial assistance is accessible to as many people as possible.

In conclusion, credit repair and credit counseling services have different objectives and processes, but both aim to improve your financial situation. Credit repair focuses on improving your credit score and addressing negative marks on your credit report, while credit counseling provides guidance and education on managing finances effectively and repaying debts. Understanding the differences between these services can help you choose the path that best suits your individual needs and goals. Remember to carefully research and select reputable providers, considering factors such as legitimacy, expertise, and cost, to ensure you receive the support you need to achieve your financial well-being.