Looking to buy a home in Gurnee but worried about your bad credit? Don’t fret! This article provides you with the best options for home loans that cater specifically to individuals with less-than-perfect credit scores. With these valuable insights, you’ll be able to secure the home loan you need in Gurnee, despite your credit challenges. So, read on and discover the possibilities that await you on your path to homeownership.

This image is property of www.refiguide.org.

1. Understanding Bad Credit

1.1 What is bad credit?

Bad credit refers to a low credit score that may result from a history of late payments, high credit utilization, or bankruptcy. When you have bad credit, it indicates to lenders that you are a high-risk borrower and may have difficulty fulfilling your financial obligations. This can make it challenging to obtain loans, including home loans, because lenders may view you as more likely to default on payments.

1.2 Factors that contribute to bad credit

There are several factors that can contribute to bad credit. Late or missed payments, high credit card balances, and collections or judgments can all negatively impact your credit score. Additionally, filing for bankruptcy or having a foreclosure on your record can significantly damage your creditworthiness. It’s important to understand how these factors can affect your credit score and take steps to improve your financial habits.

1.3 Impact of bad credit on home loan options

Having bad credit can limit your home loan options and make it more difficult to secure favorable terms. Traditional lenders may be hesitant to approve your loan application, or they may charge higher interest rates and fees due to the perceived risk. However, there are still options available for individuals with bad credit to obtain a home loan. Exploring these alternative options can help you achieve your goal of homeownership despite your credit challenges.

2. Types of Home Loans for Bad Credit

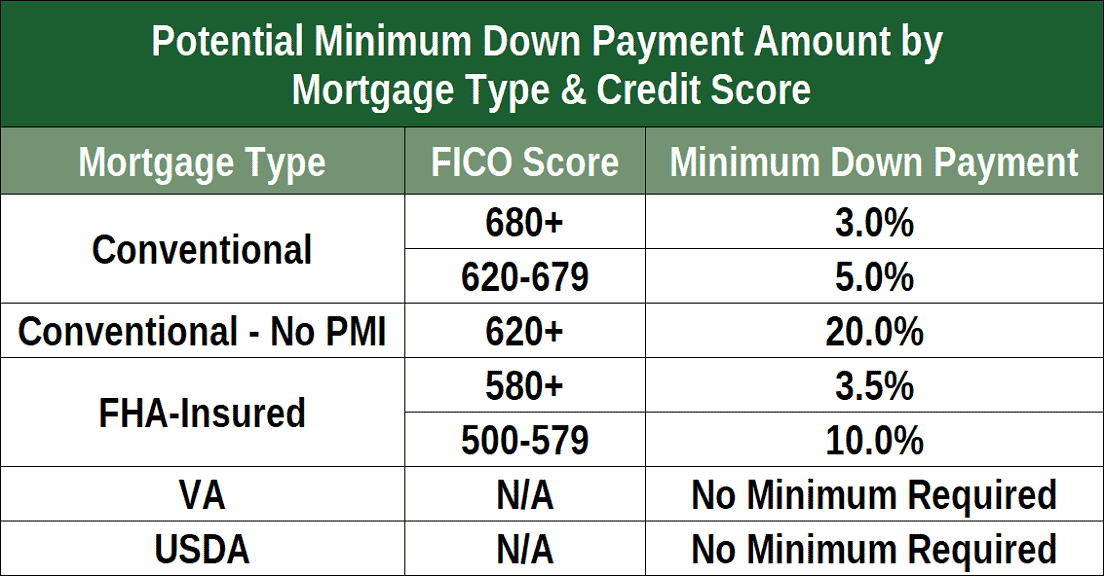

2.1 FHA loans

FHA loans, which are insured by the Federal Housing Administration, are a popular choice for borrowers with bad credit. These loans have less strict credit requirements compared to traditional mortgages, making them more accessible to individuals with low credit scores. FHA loans also offer competitive interest rates and require a lower down payment, usually around 3.5% of the home’s purchase price. This can make homeownership more attainable for those with bad credit.

2.2 VA loans

VA loans are specifically available to veterans, active-duty military members, and their eligible spouses. These loans are guaranteed by the Department of Veterans Affairs and often have more lenient credit requirements than conventional mortgages. Even if you have bad credit, you may still qualify for a VA loan if you meet the eligibility criteria. VA loans often require no down payment, making them an attractive option for those with limited funds.

2.3 USDA loans

USDA loans, backed by the United States Department of Agriculture, are designed to help low-income borrowers in rural areas purchase a home. These loans have flexible credit requirements and often allow for lower down payments compared to traditional mortgages. If you have bad credit and are interested in buying a home in a qualifying rural area, a USDA loan may be a viable option for you.

2.4 Subprime loans

Subprime loans are specifically tailored for borrowers with bad credit. They are offered by specialized lenders who are willing to take on higher-risk borrowers. While subprime loans may come with higher interest rates and fees, they provide an opportunity for individuals with bad credit to obtain a home loan when traditional lenders may not be willing to extend credit.

2.5 Home equity loans

If you already own a home and have built up equity, a home equity loan may be an option worth considering. Home equity loans allow you to borrow against the value of your property, using your home as collateral. Since these loans are secured by your property, lenders may be more willing to extend credit to individuals with bad credit. However, it’s important to note that defaulting on a home equity loan can result in foreclosure, so careful consideration should be given before pursuing this option.

2.6 Rent-to-own programs

Rent-to-own programs offer an alternative path to homeownership for individuals with bad credit. With these programs, you enter into a lease agreement with the option to purchase the property at a later date. A portion of your monthly rent goes towards building equity, which can be used towards a down payment when you exercise the purchase option. While rent-to-own programs can be an attractive option, it’s important to carefully review the terms of the agreement and ensure it aligns with your long-term financial goals.

3. FHA Loans

3.1 Overview of FHA loans

FHA loans are backed by the Federal Housing Administration and are designed to help individuals who may not qualify for conventional mortgages. These loans have less strict credit requirements and offer more flexible eligibility criteria, making them an excellent choice for borrowers with bad credit. FHA loans are available for primary residences, and borrowers can often secure competitive interest rates and down payment assistance.

3.2 Benefits of FHA loans for bad credit borrowers

One of the primary benefits of FHA loans for borrowers with bad credit is their lenient credit requirements. While traditional lenders may require a credit score of 620 or higher, FHA loans may be available to individuals with credit scores as low as 500, provided they make a larger down payment. FHA loans also offer competitive interest rates, making them an affordable option for homebuyers with bad credit.

3.3 Requirements for FHA loans in Gurnee

To qualify for an FHA loan in Gurnee, you will need to meet certain criteria. The minimum credit score requirement for an FHA loan is typically 500, but some lenders may require a higher score. You will also need to provide proof of stable employment and income to demonstrate your ability to repay the loan. Additionally, you must have a debt-to-income ratio below the maximum threshold set by the FHA, which is generally around 43%. Meeting these requirements can increase your chances of being approved for an FHA loan in Gurnee.

4. VA Loans

4.1 Overview of VA loans

VA loans are designed to help veterans, active-duty military members, and their eligible spouses become homeowners. These loans are backed by the Department of Veterans Affairs and offer several benefits, including flexible credit requirements and no down payment. VA loans are available for primary residences, making them a popular choice for military personnel and their families.

4.2 Benefits of VA loans for bad credit borrowers

One of the significant benefits of VA loans for bad credit borrowers is that they do not have a minimum credit score requirement set by the Department of Veterans Affairs. While individual lenders may have their own credit score requirements, VA loans generally offer more flexibility in terms of credit eligibility compared to traditional mortgages. Additionally, VA loans do not require a down payment, making homeownership more accessible for individuals with bad credit and limited funds.

4.3 Requirements for VA loans in Gurnee

To qualify for a VA loan in Gurnee, you must meet specific eligibility criteria set by the Department of Veterans Affairs. This includes having a valid Certificate of Eligibility, which is obtained through the VA. The property you intend to purchase must also meet the VA’s requirements for safety and livability. While there is no minimum credit score requirement, individual lenders may have their own standards, so it’s important to work with a reputable VA-approved lender in Gurnee to navigate the loan application process successfully.

This image is property of images.ctfassets.net.

5. USDA Loans

5.1 Overview of USDA loans

USDA loans are backed by the United States Department of Agriculture and are designed to assist low-income borrowers in purchasing homes in rural areas. These loans offer competitive interest rates and low or no down payment options, making them an attractive choice for individuals with bad credit who meet the income and location requirements. USDA loans are available for primary residences and offer flexible credit guidelines.

5.2 Benefits of USDA loans for bad credit borrowers

One of the significant benefits of USDA loans for bad credit borrowers is the availability of low or no down payment options. This can be particularly helpful for individuals with limited funds who are looking to purchase a home. USDA loans also have more flexible credit requirements compared to traditional mortgages, making them accessible to borrowers with bad credit. Additionally, USDA loans offer competitive interest rates, further enhancing the affordability of homeownership.

5.3 Requirements for USDA loans in Gurnee

To be eligible for a USDA loan in Gurnee, you must meet specific income and location requirements. The property you intend to purchase must be located in a qualifying rural area as defined by the USDA. Additionally, your household income must fall within the USDA’s limits for low or moderate-income borrowers. While there is no specific credit score requirement set by the USDA, individual lenders may have their own standards, so it’s essential to work with a reputable USDA-approved lender in Gurnee.

6. Subprime Loans

6.1 Overview of subprime loans

Subprime loans are specifically designed for borrowers with bad credit. These loans are offered by lenders who specialize in providing credit to individuals who may not qualify for traditional mortgages. Subprime loans often come with higher interest rates and fees to offset the lender’s perceived risk. While they may be more costly compared to other loan options, subprime loans can provide borrowers with bad credit an opportunity to purchase a home when traditional lenders are less willing to extend credit.

6.2 Benefits of subprime loans for bad credit borrowers

One of the key benefits of subprime loans for bad credit borrowers is the opportunity for homeownership. Subprime lenders are more lenient in their credit requirements compared to traditional lenders, making it easier for individuals with bad credit to be approved for a loan. While subprime loans may have higher costs, they provide an avenue for borrowers who may not qualify for other loan options to achieve their goal of homeownership.

6.3 Requirements for subprime loans in Gurnee

The specific requirements for subprime loans in Gurnee may vary depending on the lender. Since subprime loans are offered by specialized lenders, they often have their own eligibility criteria, including minimum credit score requirements, debt-to-income ratio limits, and down payment requirements. Working with a reputable subprime lender in Gurnee can help guide you through the loan application process and ensure you are aware of the specific requirements for obtaining a subprime loan.

This image is property of i.insider.com.

7. Home Equity Loans

7.1 Overview of home equity loans

Home equity loans allow homeowners to borrow against the equity they have built up in their property. These loans are secured by the value of the home and can be an option for individuals with bad credit who already own a home. Home equity loans provide borrowers with access to funds that can be used for various purposes, including home improvements, debt consolidation, or other financial needs.

7.2 Benefits of home equity loans for bad credit borrowers

One of the primary benefits of home equity loans for bad credit borrowers is the use of collateral. Since these loans are secured by the value of the property, lenders may be more willing to extend credit to individuals with bad credit. This can provide an opportunity to access funds at a lower interest rate compared to other loan options available to individuals with bad credit. However, it’s important to carefully consider the risks associated with using your home as collateral.

7.3 Requirements for home equity loans in Gurnee

The requirements for home equity loans in Gurnee may vary depending on the lender. Generally, lenders will consider factors such as the amount of equity in your home, your credit score, and your ability to repay the loan. It’s essential to work with a reputable lender in Gurnee who can guide you through the process and help you understand the specific requirements for obtaining a home equity loan.

8. Rent-to-Own Programs

8.1 Overview of rent-to-own programs

Rent-to-own programs offer an alternative path to homeownership for individuals with bad credit. These programs allow you to enter into a lease agreement with the option to purchase the property at a later date. A portion of your monthly rent goes towards building equity, which can be used towards a down payment when you exercise the purchase option. Rent-to-own programs can provide an opportunity to improve your credit while working towards homeownership.

8.2 Benefits of rent-to-own programs for bad credit borrowers

One of the significant benefits of rent-to-own programs for bad credit borrowers is the opportunity to improve your credit while renting. Making timely monthly payments and fulfilling the terms of the lease agreement can help demonstrate responsible financial behavior and improve your credit score over time. Additionally, rent-to-own programs often offer more flexible credit requirements compared to traditional mortgages, making them accessible for individuals with bad credit.

8.3 Requirements for rent-to-own programs in Gurnee

The specific requirements for rent-to-own programs in Gurnee may vary depending on the property owner or company administering the program. It’s important to carefully review the terms of the agreement, including any credit or income requirements, the length of the lease agreement, and the purchase terms. Working with a reputable rent-to-own program provider in Gurnee can ensure you have a clear understanding of the requirements and can navigate the process successfully.

This image is property of www.badcredit.org.

9. Alternative Options for Bad Credit Borrowers

9.1 Co-signer

One alternative option for bad credit borrowers is to have a co-signer on the loan. A co-signer is an individual who agrees to take responsibility for the loan if the primary borrower is unable to make the payments. Having a co-signer with good credit can increase your chances of being approved for a loan and may even result in more favorable terms. However, it’s important to consider the responsibility that comes with having a co-signer and the potential strain it may place on your relationship.

9.2 Improve credit score

Another alternative option for bad credit borrowers is to work on improving their credit score before applying for a home loan. This can involve paying down outstanding debts, making timely payments, and reducing credit card balances. Taking steps to improve your credit score can not only increase your chances of being approved for a loan but can also result in more favorable interest rates and terms. It’s important to be patient and diligent in the process of improving your credit score, as it may take time.

9.3 Save for a larger down payment

Saving for a larger down payment can also be an effective strategy for bad credit borrowers. A larger down payment can help offset the perceived risk associated with bad credit, making lenders more willing to extend credit. By saving for a larger down payment, you can potentially secure better interest rates and terms, which can result in significant savings over the life of your loan. It may require disciplined saving and budgeting, but the financial benefits can be well worth it.

10. Choosing the Best Home Loan Option

10.1 Assessing personal financial situation

When it comes to choosing the best home loan option, it’s essential to assess your personal financial situation carefully. Consider factors such as your credit score, income, debts, and long-term financial goals. Understanding your financial picture will help determine which loan options are realistically available to you.

10.2 Comparing interest rates and terms

Comparing interest rates and terms is crucial when evaluating home loan options. Different lenders may offer varying interest rates and loan terms, which can significantly impact the overall cost of your loan. Carefully compare and consider the interest rates, fees, and repayment terms of each option to determine which loan option is the most financially advantageous for your situation.

10.3 Researching lenders and their reputation

Researching lenders and their reputation is an important step in selecting the best home loan option. Look for lenders who specialize in working with bad credit borrowers and have a track record of providing quality service. Reading reviews and checking with reputable sources such as the Better Business Bureau can help you gauge the reliability and credibility of potential lenders.

10.4 Seeking assistance from a mortgage broker

If navigating the home loan options seems overwhelming, seeking assistance from a mortgage broker can be beneficial. Mortgage brokers are professionals who can help connect you with lenders that best fit your financial situation and objectives. They have in-depth knowledge of the loan market and can provide expert guidance throughout the loan application process.

10.5 Evaluating long-term financial goals

Lastly, when choosing the best home loan option, it’s important to evaluate your long-term financial goals. Consider how the loan you choose aligns with your plans for the future, such as when you want to pay off the mortgage or if you plan on refinancing. Evaluating your long-term financial goals will help ensure that the loan option you select is the most suitable for your overall financial well-being.

In conclusion, having bad credit does not mean that homeownership is out of reach. There are several home loan options available for individuals with bad credit, including FHA loans, VA loans, USDA loans, subprime loans, home equity loans, and rent-to-own programs. By understanding the requirements and benefits of each option and assessing your personal financial situation, you can choose the best home loan option for your needs. Remember, it’s important to improve your credit score over time, save for a larger down payment if possible, and research reputable lenders to make an informed decision. With determination and careful consideration, you can achieve your goal of homeownership despite bad credit.

This image is property of www.badcredit.org.