Are you wondering if credit repair services can assist you in removing legitimate negative marks from your credit report? It’s a common question, especially for those who may have encountered financial difficulties in the past. While credit repair services may claim to be able to help, it’s important to understand the potential limitations and considerations involved.

When it comes to legitimate negative marks on your credit report, such as late payments or accounts in collections, credit repair services can offer assistance in a few different ways. They may provide guidance on how to properly dispute inaccurate information or errors on your report, which can ultimately help improve your credit standing. However, it’s important to note that if the negative marks on your credit report are valid and accurately reflect your past financial history, credit repair services may not be able to remove them. In such cases, it’s crucial to focus on rebuilding your credit over time by consistently making on-time payments and using credit responsibly. Remember, while credit repair services can be a helpful resource, it’s essential to understand their limitations and approach your credit repair journey with realistic expectations.

This image is property of images.ctfassets.net.

Understanding Credit Repair Services

Credit repair services are companies that offer assistance to individuals in improving their credit scores by removing negative marks from their credit reports. These services aim to help individuals achieve better financial opportunities and access to credit by addressing inaccuracies and errors on their credit history.

What are credit repair services?

Credit repair services are organizations that specialize in analyzing credit reports, identifying negative marks, and working with credit bureaus to dispute and remove such marks. They often provide guidance and support in navigating the complex process of credit repair, offering strategies to improve credit scores and achieve financial stability.

How do credit repair services work?

Credit repair services typically start by obtaining a copy of your credit report from one or more credit bureaus. They then carefully review the report, searching for inaccuracies, incomplete information, or potential errors that may be negatively impacting your credit score.

Once the negative marks have been identified, the credit repair service will initiate the dispute process with the credit bureaus on your behalf. They will submit detailed arguments or provide supporting documentation to challenge the validity of the negative marks. The credit bureaus are then responsible for investigating these disputes and responding within a specific timeframe.

Can credit repair services remove legitimate negative marks?

While credit repair services can be effective in removing inaccurate or unverifiable negative marks, they may face limitations in dealing with legitimate negative marks. Legitimate negative marks, such as late payments, bankruptcies, or foreclosures, are typically a reflection of past financial missteps or challenges.

Credit repair services cannot guarantee the removal of legitimate negative marks because credit reporting agencies are required to report accurate and truthful information. However, they can assist in identifying any errors or discrepancies within the negative marks and help you address them appropriately.

Determining Legitimate Negative Marks

What qualifies as a legitimate negative mark?

Legitimate negative marks on your credit report are typically the result of actual failures to meet financial obligations, such as late payments, defaults, charge-offs, or collections. These negative marks can remain on your credit report for a defined period, depending on the type of mark and local regulations.

It’s important to distinguish between legitimate negative marks and inaccuracies or errors that may appear on your credit report. Inaccurate information can include incorrect payment histories, fraudulent accounts, or debts that do not belong to you. Credit repair services can assist in identifying and disputing these inaccuracies.

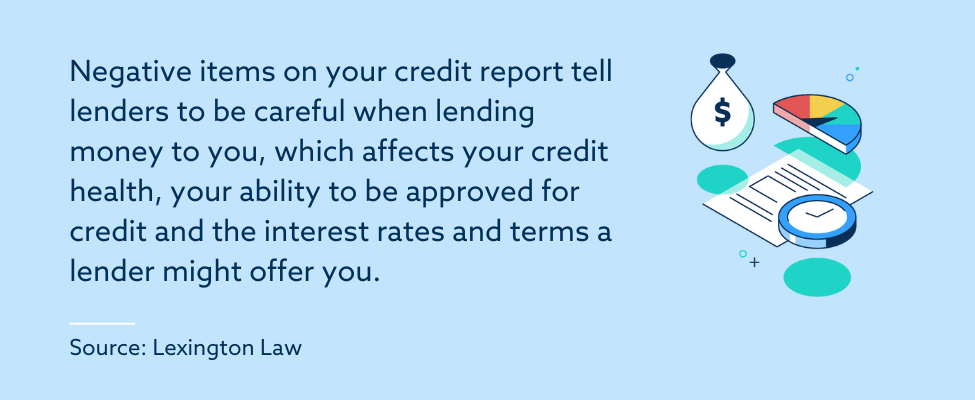

Why do negative marks appear on credit reports?

Negative marks appear on credit reports as a way to reflect an individual’s creditworthiness and their past financial behavior. Lenders and credit reporting agencies use this information to assess the level of risk associated with extending credit or offering loans.

When individuals fail to make timely payments, default on loans, or experience financial hardships, it can negatively impact their credit history. These negative marks serve as a record of past difficulties and can affect their credit scores and ability to access credit in the future.

Identifying errors in negative marks

Even legitimate negative marks can contain errors or discrepancies that credit repair services can assist in resolving. It’s crucial to carefully review each negative mark for accuracy and consistency. Look for any incorrect reporting of dates, amounts owed, or other relevant details that may impact the validity of the negative mark.

Credit repair services can help investigate these discrepancies and work with credit bureaus to rectify any errors. By addressing inaccuracies within legitimate negative marks, you can ensure that your credit report more accurately reflects your financial history.

This image is property of img.money.com.

The Impact of Legitimate Negative Marks

How negative marks affect your credit score

Legitimate negative marks, such as late payments or defaults, can significantly impact your credit score. Credit scoring models take into account various factors when determining your score, including payment history, credit utilization, length of credit history, types of credit, and new credit.

Negative marks, particularly recent ones, can lower your credit score and make it more challenging to obtain favorable credit terms or secure loans with competitive interest rates. Higher interest rates, reduced credit limits, and even rejection of credit applications are potential consequences of having legitimate negative marks on your credit report.

Effects on borrowing and financial opportunities

Having legitimate negative marks on your credit report can limit your borrowing and financial opportunities. Lenders, employers, landlords, and insurance companies often review credit reports to assess applicants’ financial responsibility and stability.

A history of legitimate negative marks may result in higher insurance premiums, difficulty securing favorable rental agreements, or even potential challenges in finding employment. These limitations highlight the importance of addressing negative marks and working towards a healthier credit profile.

This image is property of www.forbes.com.

Evaluating the Effectiveness of Credit Repair Services

Success rates of credit repair services

The success rates of credit repair services vary depending on several factors, such as the individual’s unique credit situation, the diligence of the credit repair service, and the accuracy of the negative marks being disputed. While credit repair services can be successful in removing inaccurate information, the removal of legitimate negative marks may present more significant challenges.

It is crucial to work with reputable credit repair services that have a track record of assisting individuals in resolving credit reporting discrepancies and improving credit scores. Research and reviews can provide insights into the effectiveness of different credit repair services before making a decision.

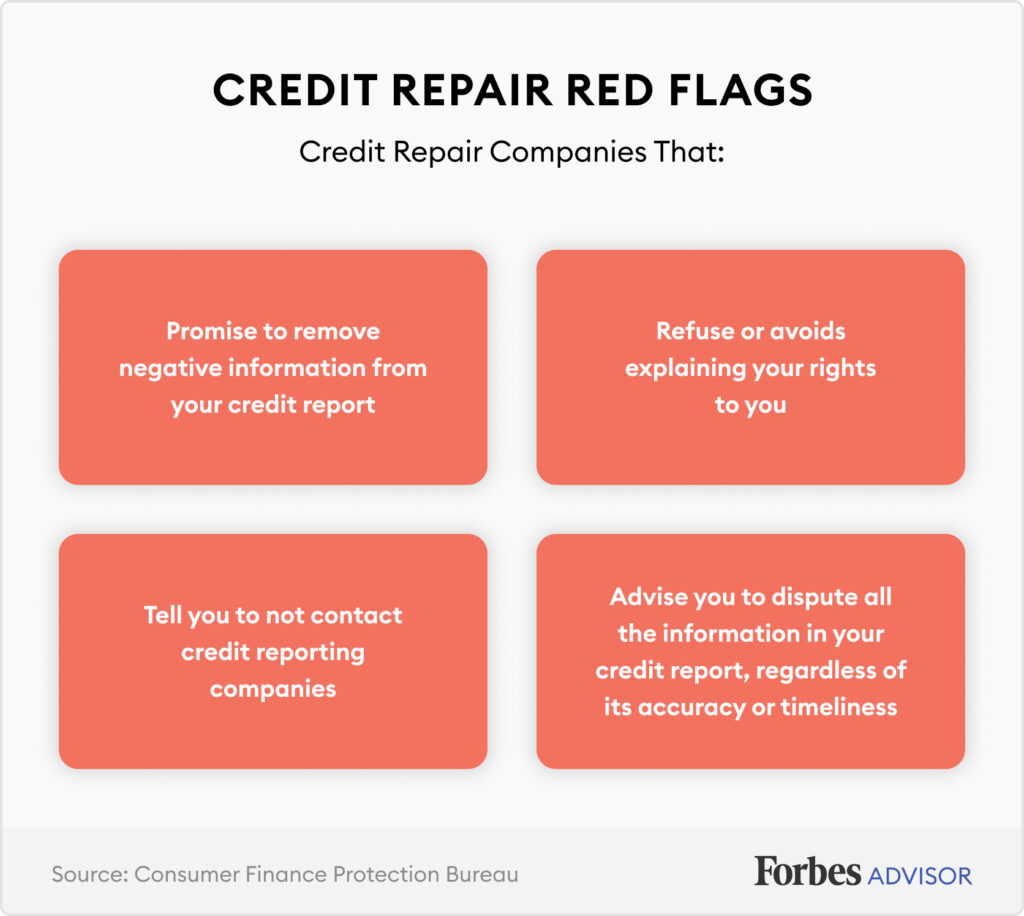

Legal limitations of credit repair services

Credit repair services operate within legal boundaries and must comply with consumer protection laws, such as the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA). These laws regulate how credit repair services can operate and protect individuals from fraudulent or unethical practices.

Credit repair services cannot make false promises or guarantees regarding the removal of legitimate negative marks. They must also provide transparent information about their services, fees, and the rights consumers have throughout the credit repair process.

Factors influencing the removal of negative marks

The removal of negative marks is influenced by various factors, including the type of negative mark, age of the mark, supporting evidence, and the credit reporting agency’s response. Credit bureaus are required to investigate disputes within a specific timeframe and make necessary updates to credit reports.

Credit repair services can work with individuals to ensure they provide clear and compelling arguments or evidence to support disputes. Timely communication and persistence are often vital in achieving positive outcomes and effectively addressing legitimate negative marks on credit reports.

This image is property of www.lexingtonlaw.com.

Alternatives to Credit Repair Services

Managing negative marks through direct communication

While credit repair services can provide valuable guidance and support, individuals can also take certain actions on their own to address negative marks. Directly contacting creditors or collection agencies can provide an opportunity to negotiate payment arrangements, settle accounts, or request goodwill adjustments.

Open communication and demonstrating a commitment to resolving outstanding debts may lead to more favorable outcomes and potentially the removal or improvement of negative marks. Taking proactive steps to rectify financial challenges can demonstrate responsibility and increase the likelihood of positive changes in credit profiles.

Rebuilding credit through responsible financial habits

Another alternative to credit repair services is rebuilding credit through responsible financial habits. This involves consistently making on-time payments, keeping credit utilization low, and managing credit responsibly.

By practicing good credit habits over time, individuals can gradually improve their credit scores and mitigate the impact of past negative marks. Establishing a positive payment history, limiting new credit applications, and diversifying credit types can contribute to a healthier credit profile and better financial opportunities.

In conclusion, credit repair services can be helpful in identifying and disputing inaccuracies or errors in credit reports. While they may face limitations in removing legitimate negative marks, they play a significant role in assisting individuals in working towards healthier credit profiles. Understanding the impact of negative marks and exploring alternative strategies can empower individuals to take control of their financial futures and achieve long-term credit wellness.

This image is property of images.ctfassets.net.