Are you wondering if credit repair services can assist you in removing legitimate negative marks from your credit report? It’s a common concern for many people who are actively trying to improve their credit history. The answer to this question is not a straightforward yes or no, as it depends on various factors.

Credit repair services can indeed be beneficial for individuals who have inaccurate or fraudulent negative marks on their credit reports. These services specialize in identifying errors and disputing them on your behalf. However, when it comes to legitimate negative marks, such as late payments or defaults, the outcome may not be as promising. While credit repair services can assist in communicating with creditors and negotiating settlements, they cannot guarantee the removal of accurate negative marks.

It’s important to approach credit repair services with realistic expectations and be aware of the limitations they may have. In some cases, working directly with the creditors and taking proactive steps to improve your financial management may be more effective in the long run. Ultimately, the decision to enlist the help of credit repair services should be based on a thorough understanding of your specific credit situation and the potential outcomes they can realistically achieve.

Understanding Credit Repair Services

This image is property of images.ctfassets.net.

What are credit repair services?

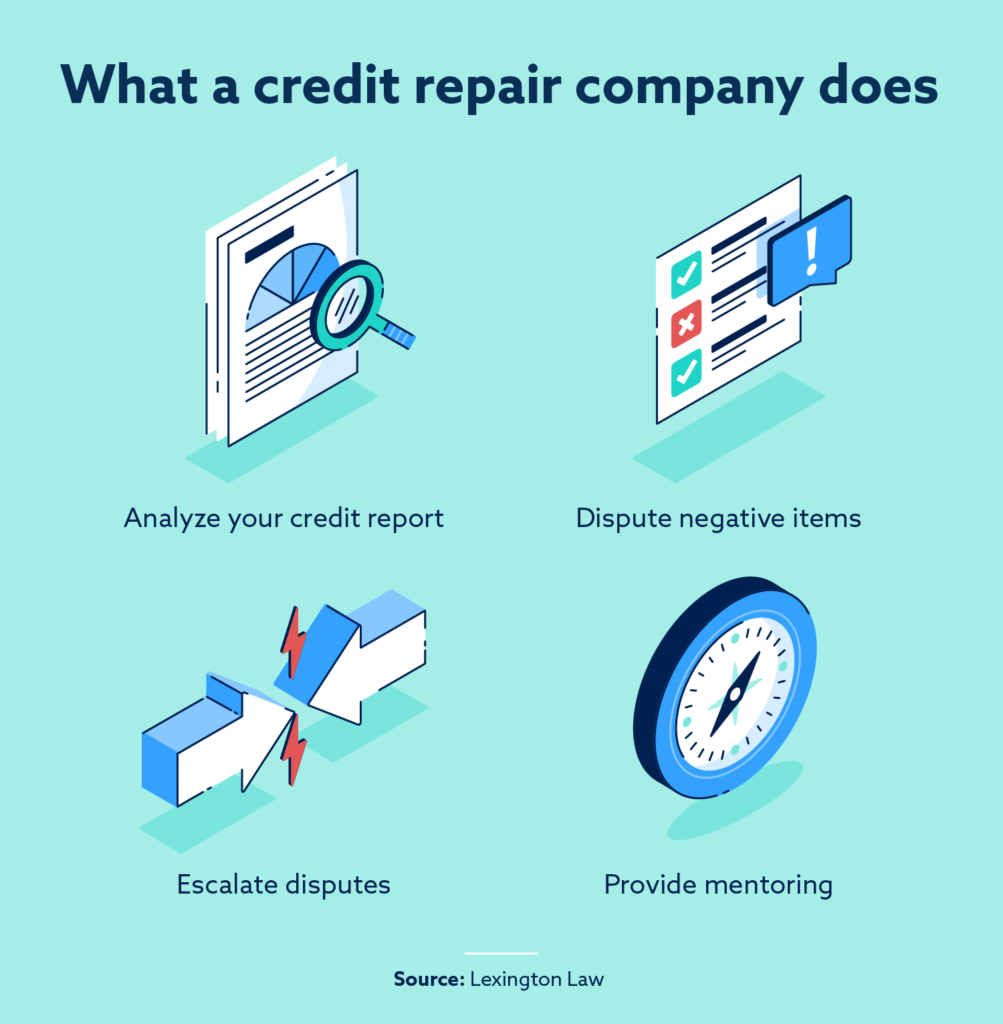

Credit repair services are companies that offer assistance to individuals in improving their credit scores and repairing their credit history. These services claim to have the expertise and resources to help individuals handle issues related to negative marks on their credit reports, such as late payments, bankruptcies, and collections. The purpose of credit repair services is to identify and dispute inaccuracies and errors on credit reports, potentially leading to their removal and subsequent improvement in credit scores.

How do credit repair services work?

Credit repair services typically begin by obtaining a copy of the client’s credit report from the major credit bureaus. These reports are then thoroughly reviewed to identify any incorrect or misleading information that may be negatively affecting the individual’s credit score. Once the erroneous items are identified, credit repair services will initiate the dispute process with the credit bureaus, requesting the removal or correction of the inaccurate information. They may also engage with creditors on the client’s behalf to resolve any outstanding issues.

The legality of credit repair services

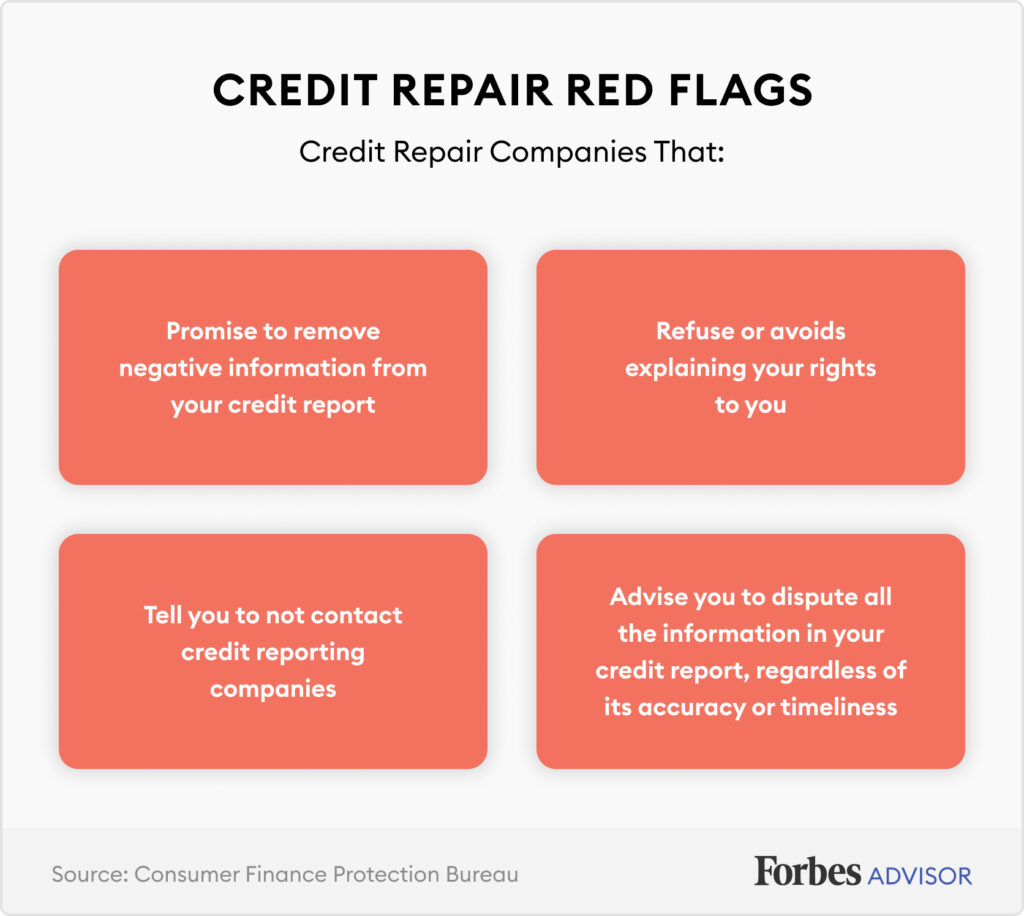

The legality of credit repair services may vary depending on the jurisdiction. In many countries, credit repair services are legal and regulated, as long as they adhere to certain laws and regulations. However, it is important to note that not all credit repair services operate ethically or lawfully. Some may engage in fraudulent or deceptive practices, promising instant credit improvement or the removal of accurate negative marks. It is crucial for individuals seeking credit repair services to research and select reputable companies that comply with applicable laws and regulations.

Legitimate Negative Marks on Credit Reports

What are legitimate negative marks?

Legitimate negative marks on credit reports are indications of credit-related events that have had a negative impact on an individual’s creditworthiness. These marks reflect the individual’s history of late or missed payments, defaults, foreclosures, repossessions, or other financial difficulties. Unlike erroneous or inaccurate information, legitimate negative marks are generally valid and based on actual credit-related incidents. Removing legitimate negative marks from a credit report can be challenging, as they represent accurate historical information.

Types of legitimate negative marks

There are various types of legitimate negative marks that may appear on a credit report. These include late payments, charge-offs, collections, bankruptcies, tax liens, and civil judgments, among others. Late payments occur when an individual fails to make timely payments on credit accounts or loans, whereas charge-offs indicate that a creditor has classified the debt as uncollectible. Collections arise when a delinquent account is transferred to a third-party debt collector. Bankruptcies, tax liens, and civil judgments are legal actions that demonstrate significant financial challenges.

The impact of legitimate negative marks on credit scores

Legitimate negative marks can have a significant impact on an individual’s credit scores. Credit scoring models, such as the FICO score or VantageScore, consider factors such as payment history, credit utilization, and the presence of negative marks when calculating credit scores. Legitimate negative marks often result in a lower credit score, making it more difficult for individuals to qualify for new credit or obtain favorable loan terms. It is important to recognize that credit repair services may have limited ability to remove legitimate negative marks, as they are accurate reflections of an individual’s credit history.

The Role of Credit Repair Services

This image is property of img.money.com.

Do credit repair services target legitimate negative marks?

Credit repair services primarily focus on disputing inaccurate or erroneous information on credit reports. While their goal is to remove negative items that are unfair or misleading, it is important to remember that they cannot guarantee the removal of legitimate negative marks. The primary purpose of credit repair services is to address inaccuracies, not to erase valid negative entries. However, some credit repair companies may still attempt to challenge the negative marks on a client’s behalf, even if the chances of success are limited.

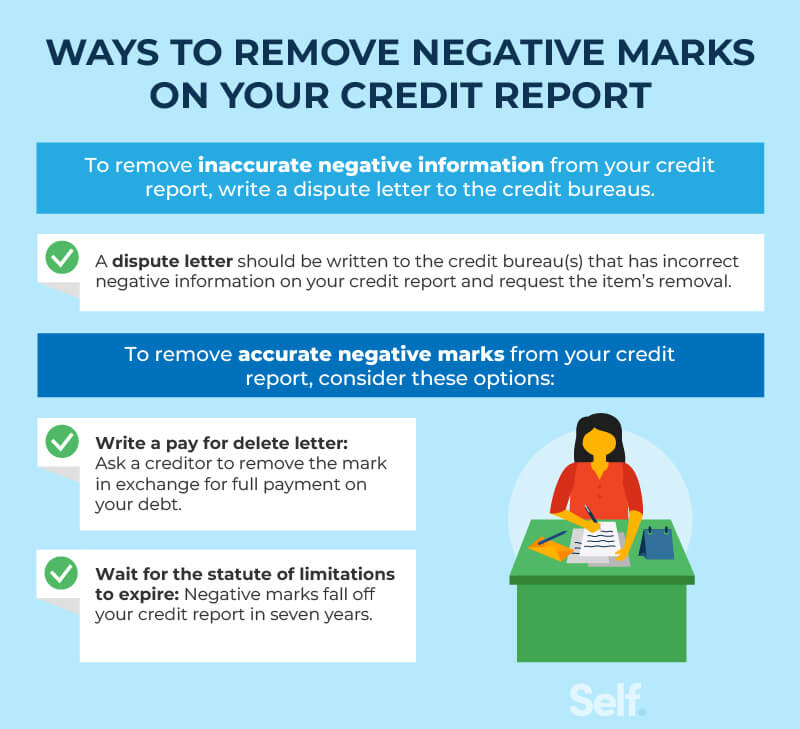

Methods used by credit repair services

Credit repair services employ various methods to address inaccuracies on credit reports. These methods typically involve sending dispute letters to the credit bureaus, requesting investigations into the accuracy of specific negative entries. The credit bureaus then have a designated period to verify the information or remove it from the credit report. Credit repair services may also engage in negotiation with creditors to settle delinquent accounts or arrange payment plans. Additionally, they may provide guidance on credit-building strategies and educate individuals on responsible financial habits.

Can credit repair services legally remove legitimate negative marks?

The ability of credit repair services to legally remove legitimate negative marks from credit reports is a subject of debate. While credit repair services may attempt to dispute legitimate negative marks, the outcome is often uncertain. The credit bureaus and creditors have the legal right to verify the accuracy of the information and may reinstate it if it is found to be valid. Consequently, individuals should be cautious when engaging credit repair services promising the guaranteed removal of negative marks, as this may inherently contradict regulatory requirements.

Factors to Consider Before Hiring Credit Repair Services

This image is property of images.ctfassets.net.

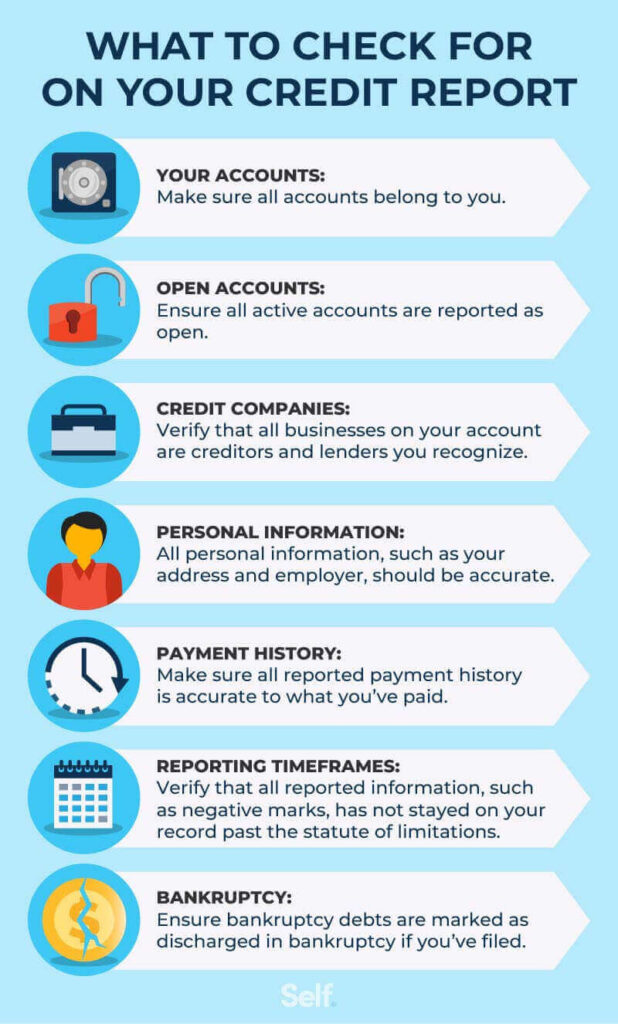

Reviewing your credit report

Before considering credit repair services, it is essential to obtain a copy of your credit report and carefully review its contents. Understanding the specific negative marks and assessing their accuracy can help you determine if credit repair services are necessary. If you find legitimate negative marks that accurately reflect your credit history, it may be challenging for credit repair services to produce favorable results. Identifying any inaccuracies or errors is crucial since these represent the primary target of credit repair efforts.

Understanding your rights as a consumer

As a consumer, it is important to familiarize yourself with your rights concerning credit repair services. In many jurisdictions, individuals have the right to receive truthful and accurate information, as well as the ability to challenge incorrect information on their credit reports. The Fair Credit Reporting Act (FCRA) and other consumer protection laws establish guidelines for credit repair services and provide safeguards against deceptive practices. Ensuring that the credit repair services you consider comply with these regulations can help protect your interests.

Alternatives to credit repair services

While credit repair services can be beneficial for addressing inaccuracies on credit reports, it is essential to consider alternative options. For individuals with legitimate negative marks, proactive financial management and responsible credit habits can gradually improve credit scores over time. This may involve making timely payments, reducing debt, and maintaining a low credit utilization ratio. Additionally, individuals can explore credit counseling services, which offer personalized guidance on improving creditworthiness and managing financial obligations.

Effectiveness of Credit Repair Services

This image is property of www.forbes.com.

Success rates of credit repair services

The success rates of credit repair services vary depending on several factors. Factors such as the accuracy of the information disputed, the quality of the supporting documentation, and the cooperation of the credit bureaus and creditors play a role in determining the outcomes. It is important to note that credit repair services cannot guarantee specific results, especially when it comes to the removal of legitimate negative marks. Genuine errors on credit reports tend to have a higher likelihood of removal compared to accurate negative entries.

Factors that may affect the outcome

Several factors can influence the outcome of credit repair services. These factors include the complexity of the credit issues, the responsiveness of credit bureaus and creditors, and the expertise and diligence of the credit repair company. Additionally, the credit reports and scores of individuals can also impact the effectiveness of credit repair services. Individuals with a long history of legitimate negative marks may face more significant challenges in achieving substantial improvements.

The importance of ongoing credit management

While credit repair services may provide temporary relief by addressing erroneous information, ongoing credit management is essential for long-term credit improvement. Individuals should develop responsible financial habits, such as timely bill payments, maintaining a low credit utilization ratio, and monitoring credit reports regularly. By practicing sound financial behaviors, individuals can gradually rebuild their credit and mitigate the negative impact of legitimate marks over time. Credit repair services should be viewed as a complementary tool, rather than a standalone solution.

Potential Risks and Scams

This image is property of www.lexingtonlaw.com.

Identifying fraudulent credit repair companies

Unfortunately, the credit repair industry is not immune to scams and fraudulent practices. To protect yourself, it is important to be aware of the red flags that may indicate a fraudulent credit repair company. These include promises of instant credit improvement, demands for upfront fees before providing services, and attempts to create a new identity or use illegal tactics to remove negative marks. Legitimate credit repair companies operate in accordance with applicable laws and regulations, and they do not engage in deceptive or illegal practices.

Common scams to watch out for

Scammers in the credit repair industry often exploit vulnerable individuals who are desperate for quick credit improvement. Common scams include identity theft, where perpetrators steal personal information to create false identities and deceive authorities. Additionally, some dishonest credit repair companies may prey on individuals with legitimate negative marks, promising their removal for a high fee, but ultimately failing to deliver results. It is essential to stay vigilant and carefully research credit repair companies before engaging their services.

Protecting yourself from credit repair scams

Protecting yourself from credit repair scams requires cautious decision-making and thorough research. Before hiring any credit repair company, verify their credentials, reputation, and compliance with regulatory requirements. Seek recommendations from trusted sources and read reviews or testimonies from previous clients. Avoid companies that demand upfront fees or make unrealistic promises. By educating yourself about credit repair scams and taking proactive measures to verify the legitimacy of companies, you can reduce the risk of falling victim to fraudulent practices.

Alternative Solutions for Removing Legitimate Negative Marks

Directly contacting creditors and bureaus

One alternative solution for addressing legitimate negative marks is to communicate directly with the creditors and credit bureaus involved. Contacting creditors and providing explanations or negotiating settlements may lead to a mutually beneficial resolution. In some cases, creditors may be willing to remove or modify negative entries if the individual demonstrates responsible credit behavior or resolves outstanding debts. Likewise, disputing inaccurate information directly with the credit bureaus can yield positive results without involving credit repair services.

Negotiating a settlement or payment plan

Negotiating a settlement or payment plan with creditors is another effective approach to managing legitimate negative marks. By engaging in open and transparent communication, individuals may reach agreements that alleviate the impact of negative information. This could involve negotiating reduced payments, refinancing options, or establishing structured payment plans. By demonstrating a genuine willingness to address past credit challenges, individuals can simultaneously work towards improving their creditworthiness and repairing their financial situation.

Rebuilding credit through responsible financial habits

Constantly improving credit can be achieved through responsible financial habits and strategic credit management. While it may take time, perseverance, and discipline, rebuilding credit provides long-term benefits. By consistently making timely payments, reducing debts, and refraining from excessive borrowing, individuals can gradually demonstrate creditworthiness and counteract the impact of legitimate negative marks. This approach focuses on proactive credit management rather than relying solely on external credit repair services, empowering individuals to take control of their financial well-being.

Seeking Professional Advice

Consulting credit counselors or financial advisors

If you are unsure about the appropriate course of action, consulting credit counselors or financial advisors can provide valuable guidance and advice. These professionals have expertise in credit management, debt consolidation, and financial planning. They can assess your specific situation, evaluate the impact of legitimate negative marks, and provide personalized recommendations. Credit counselors and financial advisors may also suggest alternative solutions or assistance programs that can help address your credit challenges effectively.

Understanding the role of attorneys in credit repair

Attorneys specializing in credit repair can offer legal expertise and representation in credit-related matters. While their services may involve higher costs compared to credit repair companies, they possess extensive knowledge of consumer protection laws and regulations. Attorneys can provide guidance on navigating complex credit issues, protecting your rights, and escalating disputes, if necessary. It is important to note that legal intervention may be more suitable in cases where there are clear violations or where negotiation efforts with creditors or credit bureaus have been unsuccessful.

Considering the cost-benefit analysis

Before making a decision, it is crucial to conduct a cost-benefit analysis of engaging credit repair services, credit counselors, financial advisors, or attorneys. Evaluate the potential financial outcomes, the fees associated with each option, and the expected probability of success. Consider the value of time and effort required for each approach, as well as the potential impact on your credit and overall financial well-being. Making an informed decision involves weighing both the short-term benefits and the long-term implications of each available option.

Long-Term Strategies for Credit Improvement

Establishing a budget and financial goals

A strong foundation for credit improvement lies in effective budgeting and setting financial goals. Create a comprehensive budget that accurately reflects your income, expenses, and debt repayment obligations. Identify areas where you can cut back on spending and allocate surplus funds towards debt repayment. Establishing clear financial goals, such as reducing credit card balances, paying off loans, or saving for specific purposes, helps to maintain focus and motivation while working towards credit improvement.

Maintaining a positive credit history

Consistently maintaining a positive credit history is crucial for long-term credit improvement. Make payments on time for all credit obligations, including credit cards, loans, and utility bills. Avoid exceeding credit limits and aim to keep credit utilization below 30% of available credit. Regularly review your credit reports to ensure accuracy and identify any potential issues promptly. By developing responsible credit habits and keeping a clean credit history, individuals can gradually rebuild credit scores and reduce the impact of legitimate negative marks.

Monitoring your credit regularly

Regularly monitoring your credit is essential for staying informed about changes to your credit reports and scores. Numerous free online tools and services allow individuals to monitor their credit reports from all three major credit bureaus. Keep a close eye on any updates, inaccuracies, or new negative marks that may appear. Promptly addressing errors or inaccuracies is crucial to prevent them from negatively impacting creditworthiness. By actively monitoring your credit, you can ensure that legitimate negative marks do not go unnoticed or unresolved.

Final Thoughts on Credit Repair Services

Assessing your individual circumstances

When considering credit repair services, it is important to assess your individual circumstances and credit needs carefully. Evaluate the presence of legitimate negative marks on your credit report and consider the potential impact of their removal on your credit scores. Reflect upon your short-term and long-term financial goals, and consider alternative solutions that may be more suitable for your specific situation. Credit repair services should be seen as one of several available options, rather than a guarantee for complete credit restoration.

Weighing the pros and cons

Weighing the pros and cons of credit repair services is crucial in making an informed decision. While credit repair services can be beneficial for addressing inaccuracies, their ability to remove legitimate negative marks is limited. Consider the potential costs involved, both monetary and time-wise, as well as the likelihood of success. Assess the credibility and reputation of the credit repair companies you are considering and compare them against alternative strategies or resources available to you. By conducting thorough research and careful consideration, you can make a decision that aligns with your needs and financial objectives.

Making an informed decision

Ultimately, making an informed decision about using credit repair services requires a comprehensive understanding of your credit history, rights as a consumer, and available alternatives. Consider the potential risks and scams associated with the credit repair industry and seek professional advice when needed. Focus on long-term strategies for credit improvement, such as responsible financial habits and ongoing credit monitoring. By taking a proactive approach to credit management and exploring various options, you can navigate the credit repair landscape wisely and work towards achieving your financial goals.