So you’re curious about credit repair services and whether they can help you remove those pesky legitimate negative marks from your credit report, huh? Well, let’s address that question. Credit repair services are often marketed as a solution to improving your credit score by removing negative marks from your report. But here’s the thing – they can’t magically erase legitimate negative items from your credit history.

While credit repair services may be able to help with inaccuracies or errors on your credit report, they typically can’t do much when it comes to legitimate negative marks. Legitimate negative marks, like missed payments or defaulted loans, are accurate records of your credit history and therefore can’t be simply removed. It’s important to keep in mind that credit repair services aren’t authorized or regulated by the government, and some may even engage in unethical practices. So, it’s crucial to tread carefully and do your research before considering their services.

Ultimately, the best way to improve your credit is by taking proactive steps such as paying your bills on time, reducing your debt, and managing your finances responsibly. While credit repair services may have limitations, remember that time and responsible financial habits can help rebuild your credit over the long run.

This image is property of images.ctfassets.net.

Understanding Credit Repair Services

Defining credit repair services

Credit repair services are companies or organizations that offer assistance to individuals who are looking to improve their credit scores and repair their credit reports. These services typically involve analyzing credit reports, identifying negative marks, and working towards their removal or resolution.

How credit repair services work

Credit repair services work by first obtaining a copy of your credit report from one or more of the major credit bureaus. They will then analyze the report to identify any negative marks, such as late payments, collections, or bankruptcy. Once these negative marks are identified, the credit repair service will develop a personalized plan to address them.

The credit repair service will then initiate a process of disputing the negative marks on your behalf. They will communicate with the credit bureaus and the entities that reported the negative information, such as lenders or creditors. The goal is to have any inaccurate or unverifiable negative marks removed from your credit report, which can potentially improve your credit score.

Types of credit repair services

There are various types of credit repair services available, ranging from do-it-yourself software to professional credit repair companies. Some common types include:

-

Do-it-yourself software: This option provides you with software or online tools that guide you through the process of repairing your credit. These tools often include credit report analysis, dispute letter templates, and educational resources.

-

Credit repair agencies: These are companies that specialize in credit repair and have experience dealing with credit bureaus and creditors. They typically charge a fee for their services and handle most of the credit repair process on your behalf.

-

Credit counseling agencies: These agencies provide guidance and advice on credit repair and financial management. They can help you create a budget, negotiate with creditors, and develop a plan to improve your credit.

-

Law firms: Some law firms offer credit repair services as part of their overall legal services. They can provide legal expertise and representation if necessary.

Negative Marks on Credit Reports

What are negative marks on credit reports?

Negative marks on credit reports are pieces of information that indicate a history of financial struggles or irresponsible credit behavior. These marks can have a negative impact on your credit score and can make it more difficult to obtain credit in the future. Some common negative marks include late payments, collections, bankruptcies, foreclosures, and tax liens.

Types of negative marks

Negative marks on credit reports can vary in severity and duration. Some examples include:

-

Late payments: When you fail to make a payment by the due date, your creditor may report it as a late payment. The severity of the impact depends on the number and frequency of late payments.

-

Collections: If you fail to repay a debt, it may be sold to a collection agency. The collection agency can then report the debt as a collection on your credit report, which can significantly impact your credit score.

-

Bankruptcies: Bankruptcies can have a long-lasting negative impact on your credit. They generally stay on your credit report for several years and can make it difficult to obtain credit in the future.

-

Foreclosures and repossessions: If you have defaulted on a mortgage or an auto loan, it may result in a foreclosure or repossession. These negative marks can have a significant impact on your credit score.

Understanding legitimate negative marks

Not all negative marks on your credit report can be removed or disputed. Legitimate negative marks include accurate records of late payments, collections, bankruptcies, and other negative events. These negative marks are a reflection of your credit history and cannot be removed through credit repair services. It’s important to distinguish between legitimate negative marks and inaccurate or unverifiable information.

Laws and Regulations

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer credit information. It establishes the rights of consumers regarding their credit reports and provides guidelines for credit reporting agencies, creditors, and consumers. The FCRA allows consumers to dispute inaccurate information on their credit reports and imposes obligations on credit reporting agencies to investigate and correct such information.

Credit Repair Organizations Act (CROA)

The Credit Repair Organizations Act (CROA) is a federal law that governs the conduct of credit repair organizations. It sets out certain requirements and prohibits unfair and deceptive practices in the credit repair industry. The CROA mandates that credit repair organizations provide consumers with a written contract, disclose certain information, and refrain from making false claims about their services.

Other relevant laws and regulations

In addition to the FCRA and the CROA, there may be state-specific laws and regulations that govern credit repair services. It’s important to be aware of the legal landscape in your state to ensure compliance with applicable laws and to protect against scams and unethical practices.

Potential Benefits of Credit Repair Services

Improvement in credit score

One of the main benefits of credit repair services is the potential improvement in your credit score. By identifying and addressing negative marks on your credit report, credit repair services can help boost your creditworthiness. This, in turn, can increase your chances of obtaining credit at favorable terms and interest rates.

Removal of inaccurate information

Credit repair services can assist in identifying and disputing inaccurate or unverifiable information on your credit report. If the credit repair service is successful in having the inaccurate information removed, it can help paint a more accurate picture of your creditworthiness to potential lenders.

Professional assistance and expertise

Credit repair services have experience and expertise in dealing with credit bureaus, creditors, and the dispute process. They can provide guidance and assistance throughout the credit repair journey, helping you navigate the complexities of credit reporting and improving your chances of success.

This image is property of img.money.com.

Limitations of Credit Repair Services

Cannot remove legitimate negative marks

It’s important to note that credit repair services cannot remove legitimate negative marks from your credit report. Legitimate negative marks, such as accurate records of late payments or bankruptcy, are a reflection of your credit history and cannot be removed through the dispute process. It’s essential to have realistic expectations when engaging credit repair services.

Time-consuming process

Credit repair is not an overnight solution. Resolving negative marks and improving your credit score can be a time-consuming process. It requires consistent effort and ongoing communication with credit bureaus and creditors. It’s important to be patient and committed to the credit repair journey.

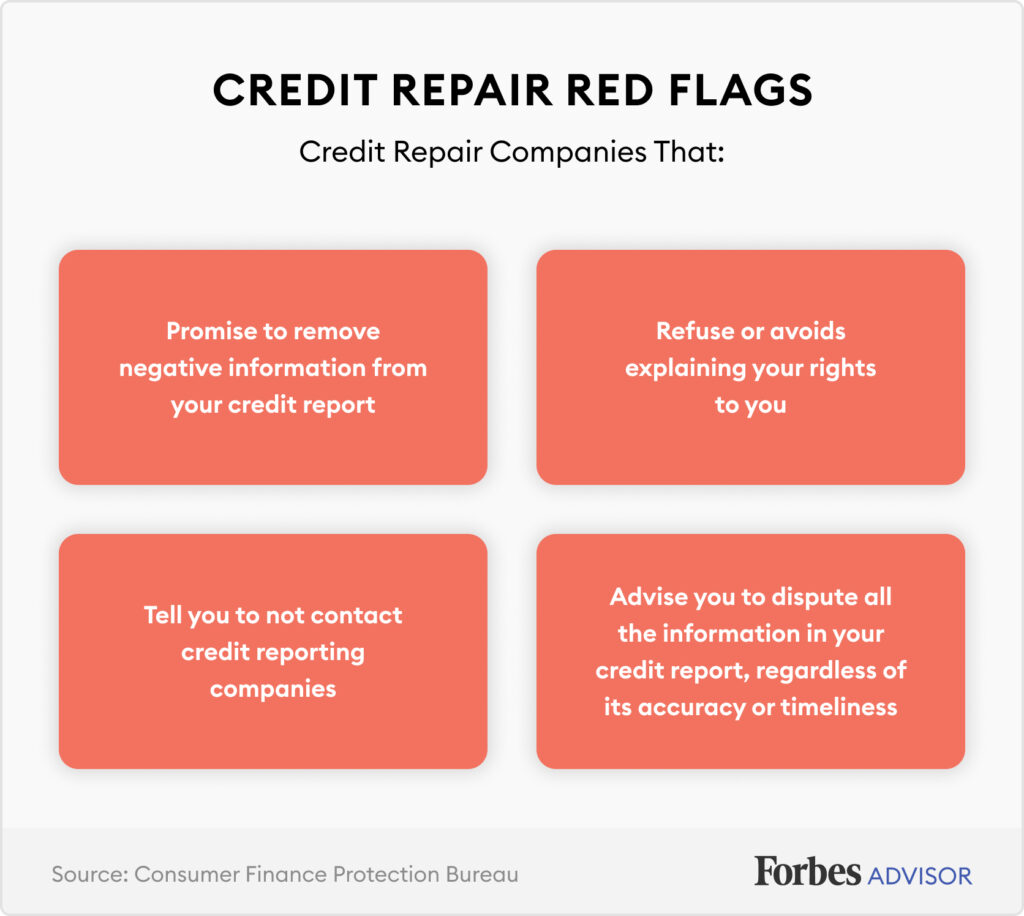

Possible scams and unethical practices

Unfortunately, the credit repair industry has its share of scams and unethical practices. Some credit repair services may make false promises or engage in fraudulent activities. It’s crucial to research and choose reputable and accredited credit repair services to protect yourself from scams.

Factors Influencing Credit Repair Success

Severity of negative marks

The severity of the negative marks on your credit report can influence the success of credit repair efforts. Generally, less severe negative marks, such as a single late payment, may be easier to dispute and remove. More severe negative marks, such as bankruptcies or foreclosures, may be more challenging to address.

Documentation and evidence

Having proper documentation and evidence to support your dispute is crucial for credit repair success. This may include receipts, correspondence, and other relevant documents that prove the inaccuracies or mistakes on your credit report. The more comprehensive and compelling your evidence, the higher the chances of success.

Communication with credit bureaus

Effective communication with credit bureaus is essential throughout the credit repair process. Clear and concise dispute letters, timely follow-ups, and accurate documentation can help facilitate the resolution of inaccuracies on your credit report. Open and honest communication is key to achieving credit repair success.

This image is property of images.ctfassets.net.

Alternative Approaches to Credit Repair

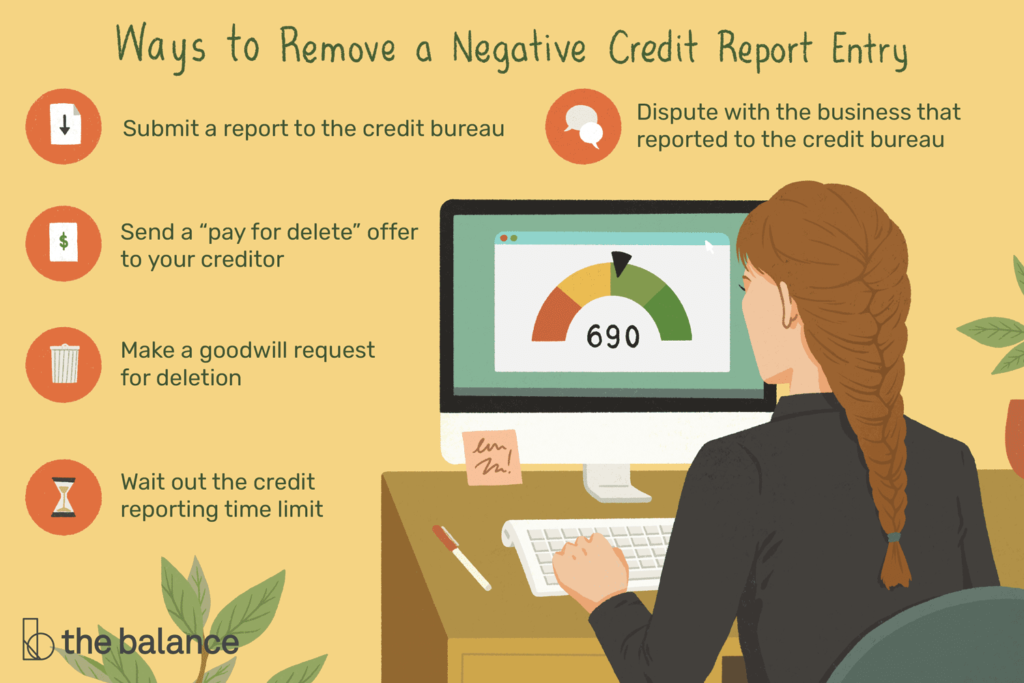

Working directly with creditors

Instead of engaging credit repair services, you may choose to work directly with your creditors to address negative marks on your credit report. Communicating with your creditors and negotiating payment plans or settlements may help resolve certain negative marks. This can be an effective approach if the negative marks are due to temporary financial setbacks or errors.

Building positive credit history

An alternative approach to credit repair is to focus on building positive credit history. This involves making timely payments, keeping credit card balances low, and avoiding new debt. Over time, responsible credit behavior can help outweigh the impact of negative marks and improve your credit score.

Seeking legal assistance

In some cases, seeking legal assistance may be necessary, especially if you believe your rights have been violated or if you are dealing with complex legal issues. Consulting with an attorney who specializes in credit and consumer law can provide valuable guidance and representation.

Choosing the Right Credit Repair Service

Research and due diligence

When choosing a credit repair service, it’s important to conduct thorough research and due diligence. Look for reviews, testimonials, and ratings from reputable sources. Consider the company’s reputation, track record, and years of experience in the industry.

Check for accreditation and certifications

Accreditation and certifications can provide reassurance that the credit repair service adheres to ethical standards and best practices. Look for certifications such as those from the National Association of Credit Services Organizations (NACSO) or the National Association of Certified Credit Counselors (NACCC).

Read reviews and testimonials

Reading reviews and testimonials from previous clients can provide insights into the effectiveness and credibility of a credit repair service. Look for unbiased reviews from reputable sources to get an accurate picture of other consumers’ experiences.

This image is property of www.forbes.com.

Steps to Take Before Engaging Credit Repair Services

Requesting and reviewing credit reports

Before engaging any credit repair services, it’s important to obtain copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). Review the reports carefully and make note of any inaccuracies or negative marks that you believe are legitimate and can be disputed.

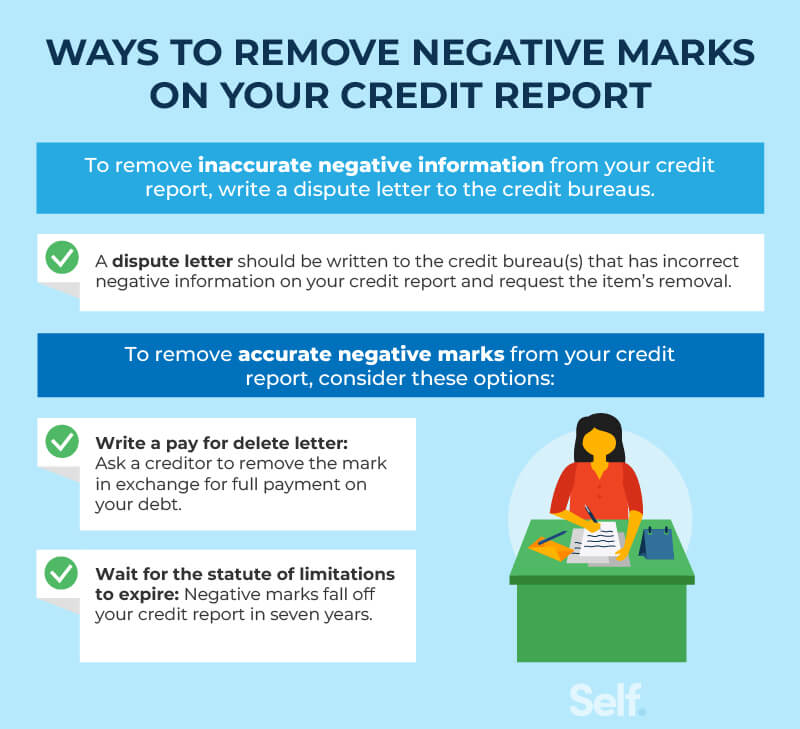

Identifying and disputing inaccuracies

Once you have identified inaccuracies on your credit reports, you can begin the process of disputing them. This typically involves writing a dispute letter to the credit bureaus, clearly identifying the inaccurate information and providing any supporting documentation. Keep records of all correspondence and follow up regularly to ensure progress is being made.

Creating a budget and improving financial habits

Credit repair is not just about disputing negative marks; it’s also about improving your overall financial health. Create a budget that allows you to pay bills on time and reduce debt. Develop good financial habits, such as tracking expenses, saving money, and avoiding unnecessary debt. These steps can help you establish a solid foundation for long-term credit repair and financial stability.

Considering the Costs

Upfront fees and monthly charges

Credit repair services often charge upfront fees and may have monthly charges for their services. It’s important to understand the costs associated with credit repair services and ensure they align with your budget and financial goals. Compare different credit repair service providers to find the most cost-effective option.

Cost-benefit analysis

Before engaging credit repair services, it’s vital to conduct a cost-benefit analysis. Consider the potential benefits of credit repair, such as an improvement in your credit score and increased access to credit, against the costs associated with the service. Assess whether the potential benefits outweigh the expenses.

Importance of understanding terms and agreements

When engaging credit repair services, it’s crucial to thoroughly read and understand the terms and agreements. Pay attention to any cancellation or refund policies, as well as any guarantees or promises made by the credit repair service. Protect yourself by being aware of your rights and responsibilities as a consumer.

In conclusion, credit repair services can offer assistance and guidance in improving your credit score and repairing your credit reports. They work by identifying and addressing negative marks, disputing inaccuracies, and providing professional expertise. However, it’s important to understand the limitations of credit repair services and consider alternative approaches. Conduct research, evaluate costs, and take steps to improve your financial habits before engaging credit repair services. With realistic expectations and a proactive approach, credit repair services can be a helpful tool in your journey towards healthy credit.

This image is property of www.thebalancemoney.com.