In this article, you will learn about the typical timeline for credit repair and when you can expect to see results. When it comes to credit repair, there is no set timeframe as it can vary depending on your individual situation. However, on average, it can take anywhere from a few months to a year to see noticeable improvements in your credit score. This timeline is influenced by factors such as the severity of your credit issues, the accuracy of the negative information on your credit report, and the effectiveness of your credit repair efforts.

The process of credit repair involves identifying and disputing any inaccuracies or errors on your credit report, as well as taking steps to improve your creditworthiness, such as paying down debts and making on-time payments. It is important to remember that credit repair is not a quick fix, and it requires patience and persistence. While you may start seeing some improvements within a few months, it can take longer for significant changes to occur. It is essential to stay committed to the process and continue working towards improving your credit over time.

This image is property of images.ctfassets.net.

Understanding Credit Repair

What is credit repair?

Credit repair refers to the process of improving an individual’s creditworthiness by removing negative items from their credit report and establishing positive credit habits. This is done through various strategies such as disputing errors, negotiating with creditors, and adopting responsible financial behavior.

Why is credit repair important?

Having a good credit score is crucial in today’s financial landscape. It determines your ability to access credit, secure loans, and get favorable interest rates. Poor credit can hinder your financial goals and limit your options. Therefore, credit repair is essential for anyone looking to improve their financial standing and increase their borrowing power.

How does credit repair work?

Credit repair involves a series of steps aimed at identifying and rectifying errors or inaccuracies on your credit report. First, you need to obtain copies of your credit reports from the three major credit bureaus – Equifax, Experian, and TransUnion. Review these reports thoroughly and identify any negative items or errors that may be impacting your credit score.

Next, you will need to dispute these items with the credit bureaus, providing supporting documentation to back up your claims. The credit bureaus have 30 days to investigate your disputes and either remove the negative items or provide a valid explanation for their presence on your report.

Once the negative items are removed, you can focus on building positive credit by establishing good payment habits, keeping balances low, and diversifying your credit portfolio. It’s important to note that credit repair is not a quick fix, and it requires time and effort to see significant improvements in your credit score.

Factors Affecting Credit Repair Timeline

Extent of credit damage

The extent of credit damage plays a significant role in determining how long credit repair will take. If you have a few minor negative items on your credit report, the repair process may be relatively quick. However, if you’re dealing with multiple collections, charge-offs, or bankruptcies, it may take longer to repair your credit.

Types of negative items

Different types of negative items on your credit report may have varying impacts on your credit repair timeline. For example, late payments or collections may be easier to remove or resolve compared to more severe items such as bankruptcies or foreclosures. The complexity and severity of these negative items can affect the amount of time it takes to address and repair them.

Efforts put into credit repair

Credit repair is not a one-time activity but an ongoing process that requires consistent effort. The more time and effort you dedicate to disputing errors, negotiating with creditors, and establishing responsible financial habits, the faster you will see results. It’s important to be proactive and take action to expedite the credit repair process.

Average Timeframes for Credit Repair

Short-term credit repair

In some cases, you may start seeing minor improvements in your credit score within a few weeks or months. This is especially true if you’re able to successfully dispute and remove inaccuracies or errors from your credit report. However, significant improvements in your credit score may take longer, typically ranging from six months to a year.

Medium-term credit repair

If you’re dealing with more complex negative items or damaged credit, it may take several months to a year to see substantial improvements in your credit score. This timeframe accounts for the time it takes to address and resolve these issues, as well as the time required for positive credit behaviors to have a noticeable impact.

Long-term credit repair

For individuals with severe credit damage such as bankruptcies or multiple foreclosures, the credit repair process may take several years to complete. These cases require significant efforts and patience to repair credit and rebuild a positive credit history. It’s important to set realistic expectations and understand that credit repair is a gradual process.

Key Steps in the Credit Repair Process

Obtaining credit reports

The first step in the credit repair process is to obtain copies of your credit reports from Equifax, Experian, and TransUnion. You are entitled to a free copy of your credit report from each bureau annually. Review these reports for errors, inaccuracies, or negative items that may be dragging down your credit score.

Identifying and disputing errors

Carefully review your credit reports for any errors, such as incorrect personal information, unauthorized accounts, or inaccurate credit limits. If you find any inaccuracies, you have the right to dispute them with the credit bureaus. Provide supporting documentation to back up your claims and initiate the dispute process.

Negotiating with creditors

If you have legitimate negative items on your credit report, such as late payments or collections, you can try negotiating with the creditors or collection agencies. Often, they are willing to work with you to resolve outstanding debts. Negotiating payment plans or settlements and obtaining documentation of these arrangements can help improve your credit.

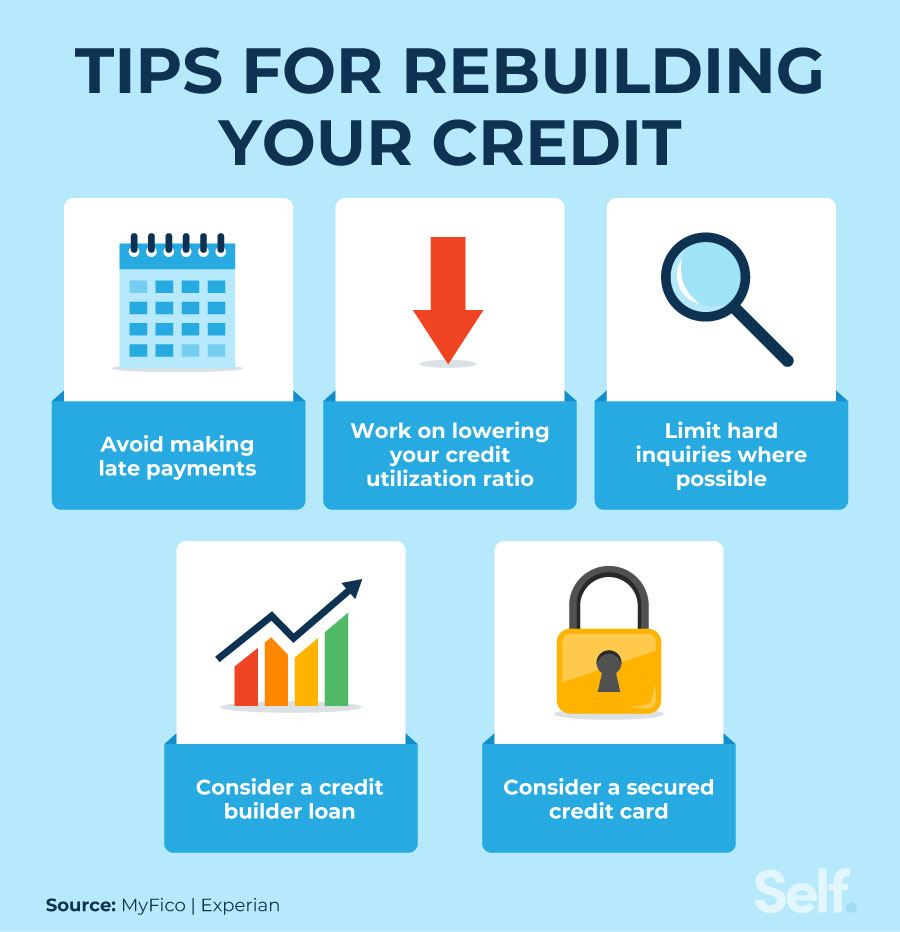

Establishing positive credit habits

While working on disputing errors and addressing negative items, it’s crucial to establish positive credit habits to rebuild your credit. This includes making timely payments on existing accounts, keeping credit card balances low, and diversifying your credit by opening new accounts responsibly. These actions demonstrate responsible financial behavior and contribute to improving your credit score over time.

This image is property of images.ctfassets.net.

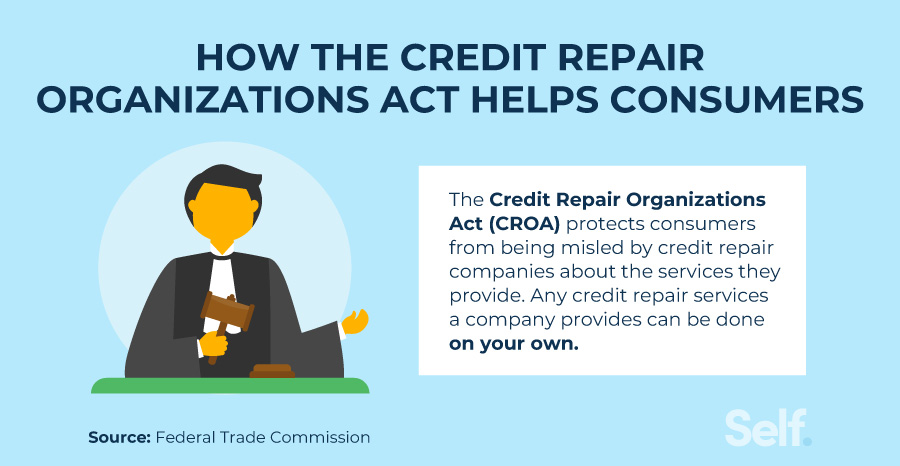

Hiring a Credit Repair Company

Pros and cons of hiring a credit repair company

Hiring a credit repair company can be beneficial if you’re overwhelmed by the credit repair process or lack the time and expertise to handle it yourself. These companies have experience in dealing with credit bureaus and creditors, and they can navigate the intricate process on your behalf. However, it’s important to be cautious and research credit repair companies thoroughly, as there are reputable organizations and scams operating in the industry.

Choosing a reputable credit repair company

When selecting a credit repair company, it’s essential to do your due diligence and choose a reputable organization. Look for companies with a track record of success, positive customer reviews, and a transparent pricing structure. Avoid companies that make lofty promises or require upfront fees before providing any services.

DIY Credit Repair

Benefits of DIY credit repair

While hiring a credit repair company can be helpful, there are advantages to undertaking credit repair on your own. DIY credit repair allows you to have full control over the process, save money on professional fees, and gain a better understanding of your credit situation. It also enables you to actively participate and learn valuable financial skills along the way.

Useful resources and tools for DIY credit repair

There are several resources and tools available to aid in the DIY credit repair process. Online credit monitoring services such as Credit Karma or Credit Sesame can help you keep track of your credit scores and monitor changes. Additionally, numerous online guides and educational materials provide step-by-step instructions on disputing errors and improving credit.

This image is property of images.ctfassets.net.

Monitoring Progress and Expecting Results

Tracking credit score improvements

As you navigate the credit repair process, it’s important to monitor your credit score regularly. Keep track of your score to gauge the impact of your efforts and identify areas for improvement. Several credit monitoring services offer monthly score updates and provide insights into factors affecting your score.

Patience and realistic expectations

Credit repair is not an overnight process, and it requires patience. Understand that significant improvements in your credit score may take time, especially if you’re dealing with extensive credit damage. Set realistic expectations and focus on the progress you’re making rather than immediate results. With perseverance and dedication, you will eventually see positive changes in your creditworthiness.

Alternative Options for Credit Improvement

Credit counseling

Credit counseling is a service provided by nonprofit organizations that can help you develop a personalized plan to improve your credit. Credit counselors can offer guidance on budgeting, debt management, and negotiating with creditors. They can also provide educational resources and tools to enhance your financial literacy.

Debt consolidation

If you’re struggling with multiple debts, debt consolidation may be an option to consider. This involves combining multiple high-interest debts into a single loan with a lower interest rate. Debt consolidation can help simplify your repayment plan and potentially reduce your monthly payments, making it easier to manage your debt.

Secured credit cards

Secured credit cards are an excellent option for individuals looking to build or rebuild their credit. These cards require a cash deposit as collateral, and the credit limit is typically equal to the deposit. Responsible use of a secured credit card, such as making timely payments and keeping balances low, can help establish a positive credit history over time.

Developing a strict budget

One of the most effective ways to improve your credit is to develop a strict budget and stick to it. Analyze your income and expenses, prioritize your financial goals, and allocate funds accordingly. By consistently living within your means and avoiding unnecessary debt, you can build a solid financial foundation and improve your creditworthiness.

This image is property of eddyballe.com.

Maintaining a Healthy Credit Profile

Regular credit monitoring

Even after repairing your credit, it’s crucial to maintain good credit habits and regularly monitor your credit. Monitor your credit reports for any new errors or inaccuracies that may arise and promptly address them. Regularly check your credit score to ensure it remains healthy and take steps to address any issues that may arise.

Paying bills on time

One of the most significant factors in maintaining good credit is making timely payments on your bills and debts. Late payments can have a detrimental impact on your credit score, so it’s crucial to prioritize payment due dates and ensure you pay your bills on time. Set up payment reminders or automatic payments to avoid missing any deadlines.

Managing credit utilization

Credit utilization refers to the amount of credit you’re currently using compared to your available credit limits. To maintain a healthy credit profile, it’s recommended to keep your credit utilization below 30% of your available credit. High credit utilization can negatively impact your credit score, so it’s important to regularly review and manage your credit card balances.

Conclusion

In conclusion, credit repair is a process that can take varying amounts of time depending on the extent of credit damage, types of negative items, and efforts put into repairing credit. Short-term credit repair may yield minor improvements within weeks or months, while more complex cases may take months to a year for noticeable improvements. Severe credit damage may require several years to fully repair.

Key steps in the credit repair process include obtaining credit reports, identifying and disputing errors, negotiating with creditors, and establishing positive credit habits. While hiring a credit repair company can be beneficial, there are also advantages to undertaking credit repair on your own through resources and tools available online.

Monitoring progress and having realistic expectations are important aspects of the credit repair journey. Alternative options for credit improvement include credit counseling, debt consolidation, secured credit cards, and developing a strict budget.

Maintaining a healthy credit profile involves regular credit monitoring, timely bill payments, and managing credit utilization. By taking action, being proactive, and practicing responsible financial behavior, you can improve your creditworthiness and achieve your financial goals.

This image is property of www.i1.creditdonkey.com.