So, you’re thinking about buying a home? Well, before you dive into the world of real estate and start searching for your dream house, it’s crucial to understand the five basics of home loans. Whether you’re a first-time buyer or looking to refinance, this article will break down the essential information you need to know. And don’t worry if you have bad credit because we’ll also discuss a mortgage option specifically designed for those with less-than-perfect credit scores. Get ready to embark on your homeownership journey armed with knowledge and confidence.

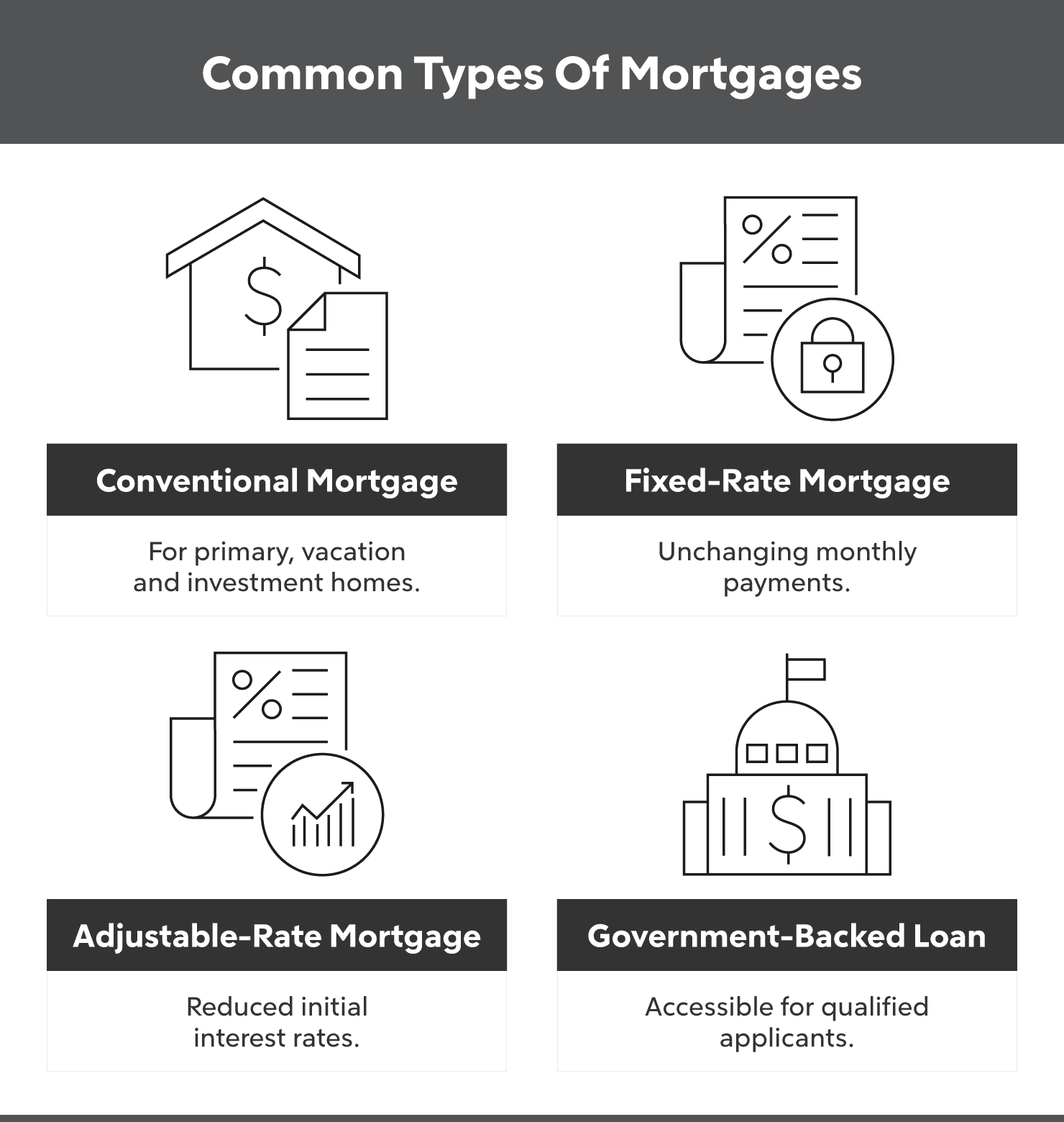

Types of Home Loans

When it comes to purchasing a home, there are several types of home loans available to you. Each type has its own set of criteria and benefits, so it’s important to understand them before making a decision.

This image is property of www.rocketmortgage.com.

Conventional Loans

Conventional loans are the most common type of home loan and are not insured or guaranteed by any government agency. These loans typically require a higher credit score and a larger down payment compared to other loan types. However, they often offer the most competitive interest rates and flexible terms.

FHA Loans

FHA loans are backed by the Federal Housing Administration (FHA) and are designed to help first-time homebuyers or those with a lower credit score. These loans have more lenient credit requirements, lower down payment options, and competitive interest rates. FHA loans also allow for higher debt-to-income ratios, making it easier to qualify for a loan.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and surviving spouses. These loans are guaranteed by the Department of Veterans Affairs (VA) and offer attractive benefits such as no down payment requirement, competitive interest rates, and no mortgage insurance. VA loans also have flexible credit requirements and the ability to finance closing costs.

USDA Loans

USDA loans, also known as Rural Development loans, are designed to help low and moderate-income borrowers in rural areas. These loans are guaranteed by the U.S. Department of Agriculture (USDA) and offer 100% financing, no down payment requirement, and competitive interest rates. USDA loans also have low mortgage insurance rates and flexible credit requirements.

Jumbo Loans

Jumbo loans are used to finance properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans are typically used for higher-priced properties and require a larger down payment compared to other loan types. Jumbo loans have stricter credit requirements and may have higher interest rates, but they provide the flexibility to finance a larger loan amount.

Qualifying for a Home Loan

Before applying for a home loan, it’s important to understand the qualification criteria set by lenders. Meeting these requirements will increase your chances of securing a loan and getting the best terms.

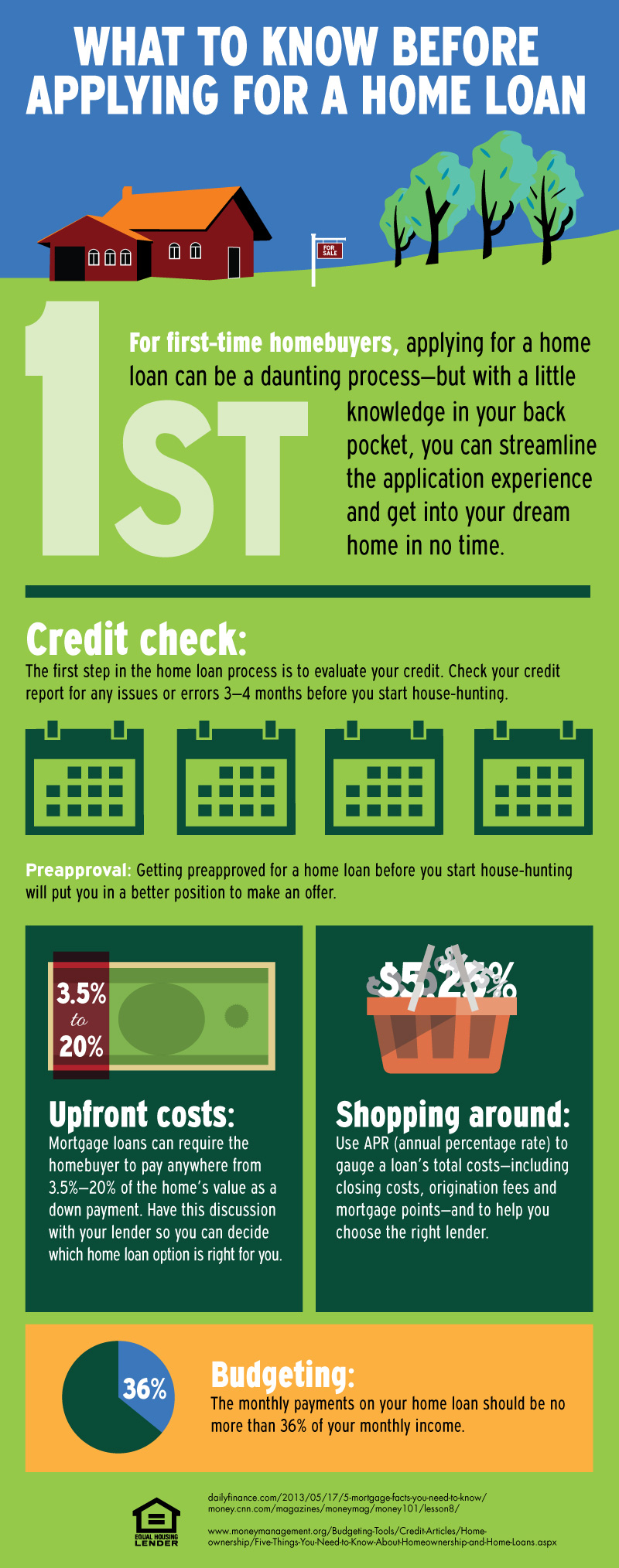

Credit Score

Your credit score plays a crucial role in determining your eligibility for a home loan. Lenders use credit scores to assess your creditworthiness and determine the interest rate you will qualify for. Having a higher credit score will not only increase your chances of getting approved but also help you secure better loan terms. It’s important to review your credit report, identify and resolve any errors, and take steps to improve your credit score if needed.

Income and Employment

Lenders will review your income and employment history to ensure that you have a stable source of income to repay the loan. They will typically ask for pay stubs, tax returns, and employment verification to assess your ability to make monthly mortgage payments. It’s important to have a steady employment history and sufficient income to meet the lender’s requirements.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a measure of your monthly debt payments relative to your gross monthly income. Lenders use this ratio to assess your ability to manage your debt and make mortgage payments. It’s important to keep your DTI ratio below the lender’s maximum threshold, typically around 43%. Lower DTI ratios demonstrate a lower level of risk to the lender and increase your chances of getting approved for a loan.

Down Payment

The down payment is a percentage of the home’s purchase price that you must pay upfront. The amount required varies depending on the loan type and lender. Conventional loans typically require a down payment of at least 3%, while FHA loans may require as little as 3.5% and VA loans offer the benefit of no down payment requirement. Saving for a down payment can be a significant financial commitment, but it can help reduce your monthly mortgage payments and potentially lower your interest rate.

Property Appraisal

Before approving a loan, lenders will require a property appraisal to determine its value. This step is crucial to ensure that the property’s value aligns with the loan amount. The appraisal is typically conducted by a licensed appraiser who will visit the property, assess its condition, and compare it to recently sold properties in the area. A favorable appraisal is essential as it protects both you and the lender from overpaying for the property.

Interest Rates and Fees

Understanding interest rates and fees is essential when comparing loan options. These factors can significantly impact the overall cost of your mortgage.

Fixed-Rate Loans

A fixed-rate loan has an interest rate that stays the same throughout the entire loan term. This means that your monthly mortgage payments will also remain constant. Fixed-rate loans provide stability and predictability, allowing you to plan your budget effectively. These loans are ideal if you prefer consistency and do not want to be affected by potential interest rate fluctuations.

Adjustable-Rate Loans

Unlike fixed-rate loans, adjustable-rate loans (ARMs) have interest rates that can change over time. The initial interest rate is typically lower than that of a fixed-rate loan, but it can change periodically based on market conditions. ARMs usually have an initial fixed-rate period, after which the interest rate adjusts annually or semi-annually. These loans are suitable if you plan to sell or refinance the property before the rate adjustment period begins.

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is a broader measurement of the cost of borrowing, including both the interest rate and any applicable fees or closing costs. The APR represents the true cost of the loan over its term and allows you to compare offers from different lenders accurately. When comparing loan options, it’s important to consider both the interest rate and the APR to fully understand the cost of borrowing.

Loan Origination Fees

Loan origination fees are charged by lenders to cover the cost of processing and underwriting the loan. These fees are usually a percentage of the total loan amount and are added to the closing costs. It’s important to consider loan origination fees when comparing loan offers, as they can vary significantly between lenders. Some lenders may offer lower interest rates but offset that with higher origination fees, so it’s crucial to evaluate the overall cost of the loan.

This image is property of www.jefferson-bank.com.

Closing Costs

Closing costs are the fees and expenses associated with finalizing the home purchase and securing the loan. These costs can include appraisal fees, title insurance, attorney fees, and prepaid property taxes and insurance. Closing costs typically range from 2% to 5% of the loan amount, so it’s important to budget for these expenses in addition to the down payment. Some lenders may offer to cover a portion of the closing costs, while others may allow you to roll them into the loan amount.

Loan Term Options

Choosing the right loan term is essential as it determines the length of time it will take to pay off your mortgage and affects your monthly payments and interest costs.

15-Year Mortgage

A 15-year mortgage offers a shorter loan term compared to a traditional 30-year mortgage. With a 15-year term, your monthly payments will be higher, but you’ll be able to pay off the loan in a shorter amount of time. These mortgages typically come with lower interest rates, which can result in significant interest savings over the life of the loan. 15-year mortgages are ideal if you can comfortably afford higher monthly payments and want to build equity faster.

30-Year Mortgage

A 30-year mortgage is the most common loan term option. With a 30-year term, your payments are spread out over a longer period, resulting in lower monthly payments compared to a 15-year mortgage. However, you’ll pay more in interest over the life of the loan. 30-year mortgages are popular among buyers who prioritize affordability and prefer lower monthly payments.

Biweekly Mortgage

A biweekly mortgage payment plan allows you to make half of your monthly mortgage payment every two weeks instead of making a full payment once a month. This results in 26 half payments per year, which is equivalent to 13 full payments. By making an extra payment each year, you can build equity faster and potentially pay off your mortgage ahead of schedule. Biweekly mortgages are a good option if you want to accelerate your mortgage payoff and save on interest.

Interest-Only Loan

Interest-only loans allow you to make smaller monthly payments by only paying the interest portion of the loan for a specified period, typically 5 to 10 years. After the interest-only period ends, your payments will increase to cover both principal and interest, resulting in higher monthly payments. Interest-only loans are suitable if you have a short-term plan for the property or if you expect your income to increase in the future.

Balloon Mortgage

A balloon mortgage offers lower monthly payments for an initial fixed-term, typically 5 to 7 years, but requires a large lump sum payment (the balloon payment) at the end of the term. Balloon mortgages are suitable if you plan to sell or refinance the property before the balloon payment is due. These loans can provide short-term affordability but require careful planning to ensure you can make the balloon payment when it comes due.

Loan Pre-Approval Process

Getting pre-approved for a home loan is an important step in the homebuying process. It helps you understand your budget, narrow down your options, and strengthens your offer when making an offer on a property.

Gathering Financial Documents

To start the loan pre-approval process, you’ll need to gather important financial documents. This typically includes recent pay stubs, W-2 forms, tax returns, bank statements, and any other documentation that verifies your income, assets, and debts. Having these documents ready will expedite the pre-approval process and allow lenders to assess your financial situation accurately.

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

This image is property of www.investopedia.com.

Completing a Loan Application

Once you’ve gathered all the necessary financial documents, you’ll need to complete a loan application. This application will require you to provide information about yourself, your employment history, your income, and the property you intend to purchase. It’s important to be thorough and provide accurate information to ensure a smooth loan pre-approval process.

Credit Check

During the loan pre-approval process, lenders will conduct a credit check to review your credit history, credit scores, and any outstanding debts. This allows them to assess your creditworthiness and determine the interest rate and loan terms you qualify for. It’s important to review your credit report beforehand and address any errors or issues to ensure a favorable credit check.

Pre-Approval Letter

After the lender reviews your financial documents and credit check, they will provide you with a pre-approval letter. This letter states the loan amount you are pre-approved for, the maximum purchase price you can afford, and any specific conditions or requirements. A pre-approval letter demonstrates to sellers that you are a serious buyer and strengthens your offer when competing with other buyers.

Shopping for Homes

With a pre-approval letter in hand, you can confidently start shopping for homes within your budget. It’s important to work closely with a real estate agent to find properties that meet your criteria and align with your financial goals. Having a pre-approval letter will make the process smoother as sellers will know you’re a qualified buyer and ready to move forward with the purchase.

Choosing the Right Lender

Choosing the right lender is crucial as they will be your partner throughout the home loan process. Taking the time to research and compare lenders will help ensure you find the right fit for your needs.

Comparing Interest Rates

One of the most important factors to consider when choosing a lender is the interest rate they offer. Small differences in interest rates can have a significant impact on your monthly payments and the overall cost of your loan. It’s important to compare rates from different lenders to ensure you’re getting the best possible rate for your loan.

Loan Terms and Conditions

In addition to interest rates, it’s important to review and compare the loan terms and conditions offered by different lenders. This includes the length of the loan, any prepayment penalties, and any other terms that may affect your loan. Taking the time to understand the terms and conditions will help you choose a lender that offers favorable terms for your specific needs.

Customer Reviews

Reading customer reviews and testimonials can provide valuable insights into the lender’s level of service and customer satisfaction. Look for lenders with positive reviews and a good reputation in the industry. Online resources and review platforms can be a great place to start when researching lenders.

:max_bytes(150000):strip_icc()/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)

This image is property of www.thebalancemoney.com.

Accessibility and Communication

Having easy access to your lender and effective communication throughout the loan process is crucial. Consider how accessible and responsive the lender is to your inquiries and concerns. A lender who is readily available and attentive to your needs can make the loan process less stressful and more efficient.

Loan Officer Experience

The experience and expertise of your loan officer can make a significant difference in the loan process. A knowledgeable loan officer can guide you through the various loan options, help you make informed decisions, and address any concerns or questions you may have. It’s important to choose a lender with experienced loan officers who have a deep understanding of home loans and the local real estate market.

Down Payment Assistance Programs

If you’re struggling to come up with a down payment, there are various down payment assistance programs available to help make homeownership more affordable.

First-Time Homebuyer Programs

Many states and local governments offer first-time homebuyer programs that provide down payment assistance, closing cost assistance, or favorable loan terms for qualified buyers. These programs are designed to help individuals and families who may not have enough savings for a down payment. Researching and exploring these programs can provide valuable resources and financial support for first-time homebuyers.

State and Local Government Grants

State and local governments often offer grants or forgivable loans to assist with down payment or closing costs. These grants do not require repayment if certain criteria are met, such as living in the home for a specific period. It’s important to research the grants and programs available in your area to see if you qualify.

Employer Assistance Programs

Some employers offer down payment assistance or home buying programs as part of their employee benefits packages. These programs can provide financial assistance or favorable loan terms to employees who meet certain eligibility criteria. It’s worth checking with your employer to see if they offer any assistance programs that can help you with your down payment.

Nonprofit Organizations

There are various nonprofit organizations that offer down payment assistance programs. These organizations aim to promote affordable homeownership and provide financial support to individuals and families in need. Researching and reaching out to local nonprofit organizations can provide additional resources and options for down payment assistance.

Gift Funds

If you have family or friends who are willing and able to provide financial assistance, you may be able to use gift funds for your down payment. Lenders typically have specific guidelines for using gift funds, so it’s important to discuss this option with your lender and follow their requirements. Gift funds can provide an alternative source of down payment funds and help make homeownership more accessible.

Loan Documentation Requirements

When applying for a home loan, there are several documents you’ll need to provide to verify your financial situation and ensure a smooth loan process.

:max_bytes(150000):strip_icc()/what-most-important-c-five-cs-credit.asp_final-bad30a49d14a454fb0894b12e116aeca.png)

This image is property of www.investopedia.com.

Proof of Income

Lenders will typically require proof of income to verify your ability to make mortgage payments. This can include recent pay stubs, W-2 forms, or income tax returns if you are self-employed. Providing accurate and up-to-date proof of income is crucial to satisfy the lender’s requirements.

Tax Returns and W-2s

Your most recent tax returns and W-2 forms are important documents that lenders will typically request as part of the loan application process. These documents help verify your income, employment history, and any additional sources of income. It’s important to keep copies of your tax returns and W-2 forms readily available to provide to your lender.

Bank Statements

Lenders will request bank statements to review your savings, checking, and investment account balances. These statements help assess your financial stability and your ability to cover the down payment, closing costs, and other expenses. It’s important to provide complete and accurate bank statements to avoid any delays in the loan approval process.

Employment Verification

Lenders will verify your employment history and may contact your current and previous employers to confirm your income and employment status. It’s important to provide accurate contact information for your employers and be prepared for the lender to request employment verification.

Asset Documentation

If you have additional assets such as stocks, bonds, or retirement accounts, lenders may request documentation to verify their existence and value. Providing accurate asset documentation will help lenders assess your financial situation more accurately and determine your eligibility for the loan.

Mortgage Insurance

Mortgage insurance is a form of protection for lenders in case borrowers default on their loans. The type of mortgage insurance required will depend on the loan program and the down payment amount.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is typically required for conventional loans with a down payment of less than 20%. PMI protects the lender in case of default and allows borrowers to secure a loan with a smaller down payment. The cost of PMI is typically added to the monthly mortgage payments. Once the loan-to-value ratio reaches 80%, borrowers may be able to request cancellation of PMI.

FHA Mortgage Insurance Premium (MIP)

FHA loans require borrowers to pay a Mortgage Insurance Premium (MIP) to secure the loan. This insurance protects the lender against losses in case of default. FHA loans require both an upfront MIP payment and ongoing monthly MIP payments. The upfront payment is typically financed into the loan amount, while the monthly payments are added to the mortgage payments.

VA Funding Fee

VA loans require borrowers to pay a one-time funding fee that helps fund the VA loan program. The funding fee amount varies depending on factors such as service category, down payment amount, and whether it’s the borrower’s first VA loan. The funding fee can be paid upfront or rolled into the loan amount. VA loans do not require monthly mortgage insurance payments.

USDA Guarantee Fee

USDA loans require borrowers to pay a guarantee fee that helps fund the USDA loan program. The guarantee fee is similar to mortgage insurance and provides protection to the lender in case of default. The fee amount is determined by the loan amount and is typically financed into the loan. USDA loans do not require monthly mortgage insurance payments.

Canceling Mortgage Insurance

For borrowers who have PMI on conventional loans, mortgage insurance can be canceled once the loan-to-value ratio reaches 80% or less. This can be achieved by making additional principal payments or through appreciation of the property’s value. For government-backed loans such as FHA and USDA loans, mortgage insurance is typically required for the life of the loan, unless refinanced into a different loan program.

Loan Repayment Options

When it comes to repaying your home loan, there are several options to consider. It’s important to choose a repayment strategy that aligns with your financial goals and allows you to comfortably manage your mortgage payments.

Monthly Principal and Interest Payments

The most common repayment option is making monthly principal and interest payments over the loan term. This repayment strategy amortizes the loan over time, gradually paying down the principal balance while covering the interest charges. Monthly payments are typically fixed and do not change over the life of the loan, providing stability and predictability.

Biweekly Payments

Biweekly mortgage payments involve making half of your monthly mortgage payment every two weeks. This results in 26 half payments per year, which is equivalent to 13 full payments. By making an extra payment each year, you can pay off the loan sooner and save on interest. Biweekly payments can help you build equity faster and potentially shorten the loan term.

Additional Principal Payments

Making additional principal payments on your mortgage allows you to pay off the loan faster and reduces the total interest paid over the life of the loan. By allocating extra funds towards the principal balance, you can effectively shorten the loan term and potentially save thousands of dollars in interest. It’s important to check with your lender to ensure that there are no prepayment penalties or restrictions on making additional principal payments.

Loan Recasting

Loan recasting allows you to make a lump sum payment towards the principal balance of your loan, followed by a recalculation of your monthly payments. This option does not change the loan term or interest rate but can lower your monthly payments by spreading the remaining principal balance over the remaining term. Loan recasting can be beneficial if you have a large sum of money available to reduce your monthly payment burden.

Refinancing

Refinancing involves replacing your current mortgage with a new loan, often with better terms or to take advantage of lower interest rates. Refinancing can help reduce your monthly payments, shorten the loan term, or access equity in your home. However, it’s important to consider factors such as closing costs, loan fees, and the length of time you plan to stay in the home before deciding to refinance.

In conclusion, understanding the different types of home loans, the qualification requirements, interest rates and fees, loan term options, pre-approval process, choosing the right lender, down payment assistance programs, loan documentation requirements, mortgage insurance, and loan repayment options is essential when embarking on the homebuying journey. By familiarizing yourself with these key aspects, you can make informed decisions and navigate the loan process more confidently. Remember to consult with professionals in the industry, such as loan officers and real estate agents, to ensure you’re choosing the best options that align with your financial goals and circumstances.