So you’ve found yourself in a situation where you need some extra cash, but your credit score is less than stellar. Don’t worry, because there are quick and easy bad credit loans available in Alberta to help you out. Whether you need funds for unexpected expenses, home renovations, or debt consolidation, these loans are designed to provide financial assistance, even if your credit history is less than perfect. In this article, we will explore the options available for bad credit loans in Alberta, empowering you with the knowledge to make informed decisions and get the financial support you need.

This image is property of depositmycashnow.ca.

What are Bad Credit Loans?

Bad credit loans are financial products specifically designed for individuals with poor credit. These loans provide an opportunity for those who have experienced financial difficulties in the past to access the funds they need. Whether it’s for emergency expenses, debt consolidation, or other personal financial needs, bad credit loans can be a lifeline for individuals who have been turned away by traditional lenders due to their credit history.

Definition of Bad Credit Loans

Bad credit loans, also known as subprime loans, are loans offered to individuals with low credit scores or negative credit histories. These loans are typically provided by lenders who specialize in working with borrowers with less-than-perfect credit. Unlike traditional loans, where creditworthiness is a crucial determining factor, bad credit loans focus more on other factors such as income, employment stability, and the ability to repay the loan.

Benefits of Bad Credit Loans

One of the main advantages of bad credit loans is their accessibility. These loans provide individuals with poor credit the opportunity to secure the funding they need, which may otherwise be difficult or impossible through traditional lending channels. Bad credit loans also offer a chance to rebuild credit by making consistent, on-time payments, improving the borrower’s overall creditworthiness over time.

Another benefit of bad credit loans is their flexibility. Unlike certain types of loans that have strict usage restrictions, bad credit loans can be used for various purposes, including medical expenses, home repairs, education expenses, or even debt consolidation. The borrower has the freedom to utilize the funds as needed, providing a valuable solution to their financial challenges.

How Bad Credit Loans Work

When applying for a bad credit loan, the borrower typically needs to provide basic information such as proof of income, employment details, and identification documents. The lender will assess the borrower’s financial situation to determine the loan amount, interest rates, and repayment terms. Bad credit loans can be secured or unsecured, with the decision dependent on the borrower’s specific circumstances and preferences.

After approval, the borrower receives the loan funds and begins making regular payments based on the agreed-upon schedule. It’s crucial for borrowers to make their payments on time as stipulated in the loan agreement to avoid further damage to their credit score. With responsible repayment, borrowers can potentially improve their credit history and become eligible for more favorable loan terms in the future.

Getting Bad Credit Loans in Alberta

If you reside in Alberta and have bad credit, there are specific steps you can take to obtain a bad credit loan. Understanding the requirements, choosing the right lender, and completing the loan application accurately are key aspects of the process.

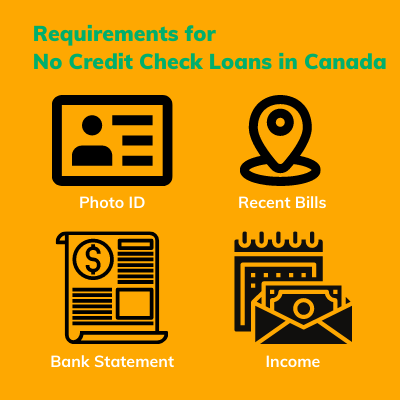

Requirements for Bad Credit Loans

While the specific requirements may vary among lenders, some common criteria for bad credit loans in Alberta include proof of identity, proof of employment and income, a valid bank account, and a minimum age requirement (typically 18 or 19 years old). Lenders will also consider factors such as your debt-to-income ratio and any outstanding debts when evaluating your loan application.

Choosing the Right Lender

When seeking a bad credit loan in Alberta, it’s essential to choose a reputable lender who understands the unique challenges faced by individuals with poor credit. Conducting thorough research, reading customer reviews, and checking the lender’s credentials can help ensure a reliable and trustworthy lending experience.

It’s also important to compare the interest rates, repayment terms, and fees offered by different lenders to find the best loan option for your needs. While bad credit loans generally come with higher interest rates, careful consideration of the terms and repayment conditions can help minimize the financial burden.

Completing the Loan Application

When applying for a bad credit loan in Alberta, it is crucial to provide accurate and up-to-date information on the loan application. Incomplete or false information can lead to delays in the approval process or even result in the application being denied. Ensure that all required documents are submitted and any supporting documentation, such as bank statements or pay stubs, are included for verification purposes.

Approval Process and Timelines

Once the loan application is submitted, lenders will typically conduct a thorough review of the borrower’s financial information to assess their creditworthiness. Depending on the lender and the complexity of the application, the approval process can vary in duration. Some lenders may offer fast approval times and provide funds within a few business days, while others may take longer to evaluate the application.

It’s important to keep in mind that even if you are approved for a bad credit loan, the lender may still impose certain conditions or require collateral, depending on the loan type and amount. Therefore, it is essential to carefully review and understand the terms and conditions before accepting the loan offer.

Types of Bad Credit Loans in Alberta

In Alberta, various types of bad credit loans are available to borrowers with poor credit. Understanding the different options can help you choose the one that best suits your financial needs and goals.

Secured Loans

Secured bad credit loans require the borrower to provide collateral, such as a vehicle or property, which serves as a form of security for the lender. This collateral reduces the lender’s risk and allows borrowers with bad credit to access larger loan amounts or secure more favorable interest rates or terms. Failure to repay a secured loan may result in the loss of the collateral.

Unsecured Loans

Unsecured bad credit loans, on the other hand, do not require collateral. These loans are typically smaller in amount and come with higher interest rates due to the increased risk for the lender. Unsecured loans may be a suitable option for individuals who do not possess valuable assets to use as collateral.

Payday Loans

Payday loans are short-term loans designed to provide immediate financial relief until the borrower’s next payday. These loans are typically unsecured and are offered in smaller amounts. Payday loans can be convenient for individuals facing emergency expenses or unexpected bills but should be used sparingly as they often come with high-interest rates and fees.

Installment Loans

Installment loans allow borrowers to repay the loan amount, along with interest and fees, over a predetermined period through equal monthly installments. These loans offer a more affordable repayment structure compared to payday loans, making them a viable option for individuals who require more extended repayment terms.

Guarantor Loans

Guarantor loans involve a third-party individual, known as the guarantor, who co-signs the loan agreement and takes on the responsibility of repayment if the borrower defaults. Having a guarantor with good credit can increase the chances of loan approval and potentially lead to better interest rates and terms. Guarantor loans can be an option for individuals who have bad credit but have someone willing to vouch for their creditworthiness.

Secured Bad Credit Loans

Secured bad credit loans can be an attractive option for individuals looking to access larger loan amounts or secure better interest rates and repayment terms. Understanding how secured loans work and the requirements involved is crucial when considering this type of loan.

Collateral for Secured Loans

Collateral is an essential component of secured loans. It serves as a form of security for the lender, reducing their risk in case the borrower fails to repay the loan. Common forms of collateral include vehicles, real estate, or other valuable assets that hold sufficient value based on the loan amount requested. The lender will assess the value of the collateral and determine the loan amount accordingly.

Advantages and Disadvantages of Secured Loans

Secured loans offer certain advantages for borrowers with bad credit. They generally come with more lenient eligibility criteria and can provide access to larger loan amounts. Additionally, secured loans often have lower interest rates compared to unsecured loans due to the reduced risk for the lender.

However, there are also disadvantages to consider. The primary disadvantage of secured loans is the potential loss of collateral if the borrower defaults on the loan. This risk can be significant, particularly if the collateral is a valuable asset such as a vehicle or property.

How to Apply for a Secured Loan in Alberta

To apply for a secured bad credit loan in Alberta, you will need to provide proof of ownership for the collateral, such as vehicle registration documents or property deeds. The lender will assess the value of the collateral along with other factors, such as income and employment stability, to determine the loan amount and interest rates. It is important to carefully review the terms and conditions of the loan agreement before accepting the offer to ensure you understand your responsibilities and the potential risks involved.

This image is property of spring-prod-cms.s3.us-west-2.amazonaws.com.

Unsecured Bad Credit Loans

Unsecured bad credit loans provide individuals with poor credit the opportunity to access funds without the need for collateral. These loans can be helpful for those who do not possess valuable assets but still require financial assistance.

No Collateral Required

One of the primary advantages of unsecured bad credit loans is that they do not require collateral. This eliminates the risk of losing valuable assets in case of loan default. Instead, lenders evaluate the borrower’s creditworthiness based on factors such as income, employment stability, and current financial obligations.

Interest Rates and Terms

As unsecured loans pose a higher risk for lenders, they often come with higher interest rates compared to secured loans. The interest rates and repayment terms may vary depending on the lender and the borrower’s creditworthiness. Before accepting an unsecured loan offer, it is crucial to carefully review the interest rates, fees, and repayment schedule to ensure you can afford the loan and understand the associated costs.

Applying for an Unsecured Loan in Alberta

To apply for an unsecured bad credit loan in Alberta, you will typically need to provide proof of identity, proof of income, and bank statements. Lenders will evaluate your financial situation to determine your eligibility for the loan and to establish the loan amount, interest rates, and repayment terms. It is important to provide accurate and up-to-date information on the loan application to avoid delays or potential rejection.

Payday Loans for Bad Credit

Payday loans offer a short-term financial solution for individuals facing immediate cash needs between paychecks. These loans are known for their quick approval process and ease of access but come with certain drawbacks that borrowers should be aware of.

Overview of Payday Loans

Payday loans are typically small-dollar loans designed to be repaid in full, along with interest and fees, on the borrower’s next payday. These loans are often unsecured and do not require extensive credit checks, making them accessible to individuals with bad credit. The application process is usually straightforward and can be completed online or in person at a payday loan storefront.

Benefits and Drawbacks of Payday Loans

One of the main benefits of payday loans is their fast approval process, with funds often disbursed on the same day or within a few business days. This makes them a suitable option for individuals facing urgent financial needs. Additionally, payday loans do not require collateral, eliminating the risk of losing valuable assets in case of loan default.

However, payday loans come with higher interest rates and fees compared to other types of loans. The short repayment term and high-cost structure may result in a cycle of debt if borrowers are unable to repay the loan in full by the due date. It is essential to carefully consider the financial implications and only opt for payday loans when other alternatives are not feasible.

How to Apply for a Payday Loan in Alberta

To apply for a payday loan in Alberta, you will typically need to provide proof of employment, a valid bank account, and identification documents. Lenders will evaluate your income and current financial obligations to determine your loan eligibility. It’s important to remember that payday loans are meant to be a short-term solution, so borrowing responsibly and within your means is crucial to avoid falling into a cycle of debt.

This image is property of www.fatcatloans.ca.

Installment Loans for Bad Credit

Installment loans provide borrowers with bad credit the opportunity to repay their loan over a specific period through regular monthly installments. These loans offer a more flexible and affordable repayment option compared to payday loans.

Repayment Terms and Schedule

Unlike payday loans that require full repayment on the borrower’s next payday, installment loans are repaid over a predetermined period. The repayment terms and schedule are agreed upon between the borrower and the lender during the application process. Each installment includes a portion of the principal loan amount, interest, and any applicable fees.

The length of the repayment period can vary depending on the loan amount and the terms agreed upon. Longer repayment periods may result in smaller monthly installments but may also lead to higher overall interest costs. It’s important to choose a repayment schedule that fits your financial situation and allows you to comfortably make the payments without compromising your other financial obligations.

Advantages and Disadvantages of Installment Loans

One of the main advantages of installment loans is their structured repayment plan, which allows borrowers to budget and plan their finances accordingly. The fixed monthly payments make it easier to manage and ensure timely repayment. Additionally, installment loans often come with lower interest rates compared to payday loans, making them a more affordable option for individuals with bad credit.

However, installment loans may still come with higher interest rates compared to traditional loans for borrowers with good credit. The longer repayment period can also result in higher overall interest costs. It’s crucial to carefully review the loan terms, including the interest rates and fees, before accepting an installment loan offer.

Steps to Obtain an Installment Loan in Alberta

To obtain an installment loan in Alberta, you will typically need to provide proof of identity, proof of income, and sometimes bank statements. The lender will assess your financial situation to determine your eligibility for the loan and establish the loan amount, interest rates, and repayment terms. It is important to provide accurate and up-to-date information on the loan application and to review the loan agreement carefully before accepting the offer.

Guarantor Loans for Bad Credit

Guarantor loans provide individuals with bad credit the opportunity to secure a loan by having a third-party individual act as a guarantor. This type of loan can be beneficial for borrowers who do not meet the typical lending criteria but have someone willing to vouch for their creditworthiness.

Securing a Loan with a Guarantor

When applying for a guarantor loan, the borrower must find a suitable guarantor who meets the lender’s requirements. A guarantor is generally a person with good credit, stable income, and a willingness to take on the responsibility of loan repayment if the borrower defaults. The guarantor provides an additional layer of security for the lender, increasing the chances of loan approval and potentially securing more favorable interest rates and terms.

Responsibilities of a Guarantor

Being a guarantor for a loan is a significant commitment. If the borrower fails to repay the loan, the guarantor becomes responsible for fulfilling the financial obligation. It is crucial for the guarantor to carefully review and understand the terms and conditions of the loan agreement and assess their own financial situation before agreeing to act as a guarantor.

Assuming the role of a guarantor should not be taken lightly, as it can have potential financial implications. It’s important to have open communication between the borrower and the guarantor to ensure both parties are aware of their responsibilities and expectations.

Applying for a Guarantor Loan in Alberta

To apply for a guarantor loan in Alberta, both the borrower and the guarantor will need to provide proof of identity, proof of income, and may be required to submit other supporting documentation. The lender will evaluate the creditworthiness of both parties and assess the loan amount, interest rates, and repayment terms based on their combined financial situations. It is important for both the borrower and the guarantor to understand their obligations and responsibilities before proceeding with the loan application.

This image is property of www.finder.com.

Benefits of Bad Credit Loans in Alberta

Despite the challenges associated with bad credit, obtaining a bad credit loan in Alberta can offer various benefits for individuals in need of financial assistance.

Access to Funding for Individuals with Poor Credit

The primary benefit of bad credit loans is that they provide individuals with poor credit the opportunity to access funds when traditional lenders may turn them away due to their credit history. These loans offer a lifeline to those who may have limited options for securing the funds they need to cover urgent expenses or to consolidate debt.

Opportunity to Rebuild Credit

Another significant advantage of bad credit loans is the potential to rebuild credit. By consistently making on-time payments and demonstrating responsible financial behavior, borrowers can improve their credit scores over time. This can open doors to better borrowing options and lower interest rates in the future.

Flexible Repayment Options

Bad credit loans often come with flexible repayment options to accommodate individuals with different financial situations. Whether it’s through installment loans or longer-term options, borrowers can select a repayment plan that aligns with their income and ensures they can make timely payments.

Risks and Considerations

While bad credit loans can provide much-needed financial relief, it’s essential to be aware of the risks and considerations associated with these types of loans.

Higher Interest Rates

One significant downside of bad credit loans is the higher interest rates compared to loans offered to individuals with good credit. Lenders charge higher interest rates to compensate for the increased risk associated with lending to individuals with poor credit. It’s important to carefully consider the interest rates and ensure that the loan is affordable, taking into account your current financial situation.

Potential Impact on Credit Score

While bad credit loans can help improve credit scores over time, missed or late payments can have a negative impact on your credit score. It is crucial to make payments on time and ensure proper financial management to avoid further damage to your credit history.

Scams and Predatory Lending Practices

Borrowers with bad credit should be cautious of scams and predatory lending practices. It’s important to only work with reputable lenders and carefully review loan offers, ensuring transparency in terms of interest rates, fees, and repayment conditions. Avoid lenders that ask for upfront fees or engage in aggressive tactics.

Borrowing Responsibly and Within Your Means

It is crucial to borrow responsibly and within your means when considering a bad credit loan. Assess your financial situation, create a budget, and determine the loan amount and repayment terms that are feasible for you. Borrowing more than you can afford or taking on excessive debt can lead to further financial difficulties in the future.

In summary, bad credit loans in Alberta can be a valuable resource for individuals facing financial challenges, providing access to funds and an opportunity to rebuild credit. Understanding the different types of bad credit loans, their requirements, and the associated risks is crucial when considering these loan options. By selecting the right lender, responsibly managing your loan, and making timely payments, bad credit loans can serve as a stepping stone towards financial stability.

This image is property of smartcdn.gprod.postmedia.digital.