So, you’ve found yourself in a bit of a credit pickle, huh? Don’t worry, we’ve got you covered. In this article, we’re going to dish out the scoop on the best loan options available for individuals with bad credit. Whether you’re looking to consolidate debt, cover unexpected expenses, or simply improve your credit score, we’ve scoured the internet and tapped into the wisdom of the Reddit community to bring you the most sought-after loan options out there. Get ready to discover some game-changing solutions that can help you navigate the world of lending, even with less-than-perfect credit. Hold on tight, because we’re about to show you a whole new range of possibilities that can turn your financial situation around.

This image is property of images.ctfassets.net.

1. Traditional Banks

Traditional banks are the oldest and most well-known option for obtaining a personal loan. They offer a variety of loan products, including personal loans and secured loans.

1.1 Personal Loans

Personal loans from traditional banks are typically unsecured, meaning you don’t need to put up any collateral to secure the loan. These loans can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. However, getting approved for a personal loan from a traditional bank can be challenging if you have bad credit, as they usually have strict credit requirements.

1.2 Secured Loans

Secured loans are another option offered by traditional banks. These loans require you to provide collateral, such as a car or home, to secure the loan. Secured loans can be a good option if you have bad credit, as the collateral provides additional security for the lender. However, keep in mind that if you fail to repay the loan, the lender can seize the collateral.

2. Credit Unions

Credit unions are member-owned financial cooperatives that offer similar services to traditional banks. They often have more flexible lending criteria and lower interest rates compared to traditional banks.

2.1 Personal Loans

Credit unions offer personal loans to their members, often with more relaxed credit requirements than traditional banks. They are more likely to consider factors beyond just your credit score, such as your relationship with the credit union and your overall financial situation.

2.2 Payday Alternative Loans (PALs)

Some credit unions also offer payday alternative loans (PALs) as an alternative to traditional payday loans. These loans typically have lower interest rates and more favorable repayment terms. PALs are designed to provide short-term financial assistance to individuals facing unexpected expenses or cash flow problems.

3. Online Lenders

Online lenders have gained popularity in recent years, offering convenient access to loans with varying terms and conditions. They may have more lenient credit requirements and faster approval processes compared to traditional banks.

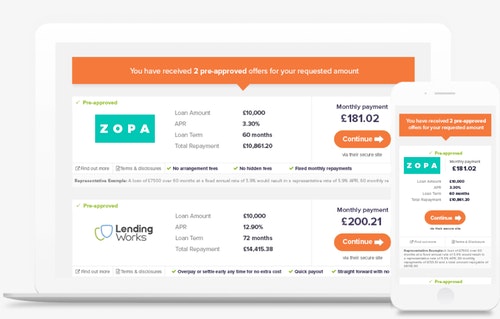

3.1 Peer-to-Peer (P2P) Lending

Peer-to-peer lending platforms connect borrowers directly with individual investors who are willing to fund their loan. These platforms often have less stringent credit requirements and can offer more flexible loan terms. However, interest rates may be higher compared to traditional loans.

3.2 Marketplace Lending

Marketplace lending platforms operate similarly to P2P lending but involve institutional investors rather than individual ones. They offer loans to individuals with bad credit by considering additional factors beyond credit scores. These platforms allow borrowers to access funds quickly and conveniently.

3.3 Payday Loans

Payday loans, while not the most desirable option, can be obtained from online lenders. However, it’s important to exercise caution with payday loans, as they typically come with high-interest rates and short repayment periods. They should only be used as a last resort in emergency situations.

3.4 Installment Loans

Installment loans are another type of loan offered by online lenders. These loans are repaid in fixed monthly installments over a specified period. Online lenders may be more willing to provide installment loans to individuals with bad credit, but it’s crucial to carefully review the interest rates and repayment terms before committing to such loans.

3.5 Bad Credit Loans

Many online lenders specialize in providing loans to individuals with bad credit. These loans often come with higher interest rates and fees as a result. However, they can provide a lifeline for individuals who have been struggling to secure loans from traditional sources.

4. Friends and Family

If you have a good relationship with someone willing to lend you money, borrowing from friends or family can be an option worth considering.

4.1 Informal Personal Loans

When borrowing from friends or family, you can negotiate an informal personal loan arrangement. This usually involves discussing the loan terms, such as repayment schedule and interest (if any), and documenting the agreement.

4.2 Documentation and Agreement

Although it may seem unnecessary, it’s important to draw up a written agreement outlining the loan terms and conditions. This not only protects both parties but also helps avoid any misunderstandings or conflicts that may arise in the future.

This image is property of images.deccanherald.com.

5. Home Equity Loans

If you own a home and have equity built up, a home equity loan can be an option to consider. However, it’s crucial to carefully weigh the risks and benefits before proceeding.

5.1 Secured Loans

Home equity loans are secured loans that allow you to borrow against the equity in your property. They typically have lower interest rates compared to unsecured loans. However, keep in mind that failing to repay the loan can result in the loss of your home.

5.2 High-Interest Rates

While home equity loans may offer lower interest rates compared to some other loan options, they can still come with higher rates compared to loans available to individuals with good credit. It’s important to carefully calculate the total cost of the loan, including interest, before proceeding.

5.3 Risk of Losing Your Home

One of the significant risks associated with home equity loans is the potential loss of your home if you fail to repay the loan. If you’re unable to make the required payments, the lender may foreclose on your property. It’s essential to consider this risk and ensure you have a solid repayment plan in place.

6. Co-Signer Loans

If you’re unable to qualify for a loan on your own due to bad credit, finding a co-signer can increase your chances of approval.

6.1 Finding a Co-Signer

A co-signer is someone with good credit who agrees to take on the responsibility of repaying the loan if you fail to do so. Finding a co-signer can be challenging, as it requires someone who trusts your ability to repay the loan and is willing to assume potential risks.

6.2 Responsibility and Risks

It’s crucial to remember that if you fail to make loan payments, not only will your credit suffer, but your co-signer’s credit will also be negatively affected. Moreover, if the loan goes into default, the lender can pursue legal action against both you and your co-signer to collect the outstanding balance.

6.3 Building Credit

One of the potential benefits of co-signer loans is the opportunity to improve your creditworthiness. By making timely loan payments, you can demonstrate responsible financial behavior and gradually rebuild your credit history. This can open up more borrowing options for you in the future.

This image is property of globalhealthcommunication.org.

7. Government Assistance Programs and Grants

Government assistance programs and grants can provide financial support to individuals facing challenging circumstances, including those with bad credit.

7.1 Personal Grants

Personal grants are financial assistance provided by organizations or government agencies that do not need to be repaid. These grants can help individuals cover various expenses, such as education, housing, or medical bills. Researching and applying for grants relevant to your situation can provide much-needed financial relief.

7.2 Government Loans

In addition to grants, some government programs offer loans specifically designed for individuals with bad credit. These loans often have more lenient credit requirements and lower interest rates compared to loans from traditional lenders. Exploring government loan options can be a viable solution for individuals in need of financial assistance.

7.3 Nonprofit Organizations

Nonprofit organizations often provide financial assistance programs aimed at helping individuals with bad credit. These programs may include low-interest loans, financial counseling, or other forms of support. Researching and reaching out to nonprofit organizations in your community can provide valuable resources and assistance.

8. 0% APR Credit Cards

While primarily used for making purchases, credit cards with introductory 0% APR (Annual Percentage Rate) offers can also be utilized as a short-term loan option.

8.1 Introductory Periods

Many credit card issuers offer promotional introductory periods with 0% APR, typically ranging from six months to eighteen months. During this time, you can utilize the credit card for purchases or even balance transfers without incurring any interest charges.

8.2 Balance Transfers

If you have higher-interest debt from other sources, such as credit cards or personal loans, you can consider transferring the balances to a 0% APR credit card. This can help consolidate and potentially reduce your interest payments, giving you some breathing room to pay off the debt.

8.3 Late Payments and High Fees

It’s important to carefully manage 0% APR credit cards to avoid late payments or high fees. If you fail to make timely payments or go over your credit limit, the promotional period may come to an end, and interest charges or penalties may apply. Responsible credit card management is essential to maximize the benefits of these offers.

This image is property of images.deccanherald.com.

9. Payday Loan Alternatives

While payday loans should generally be avoided due to their high costs, there are alternative options that can provide short-term financial assistance.

9.1 Salary Advances

Some employers offer salary advances or emergency payroll loans to their employees as a benefit. These programs allow you to borrow a portion of your upcoming paycheck in advance, typically without any interest charges. Salary advances can be an option for individuals facing immediate financial needs.

9.2 Credit Card Cash Advances

Although not the most cost-effective option, credit card cash advances can provide quick access to cash in emergency situations. Cash advances work by withdrawing money from your credit card’s available credit limit. However, keep in mind that these advances often come with high-interest rates and fees, so it’s crucial to pay off the balance as soon as possible.

9.3 Borrowing from Retirement Funds

If you have a retirement savings account, such as a 401(k) or an IRA, you may be able to borrow against the balance. The terms and conditions for borrowing from retirement funds vary, but it’s important to carefully review the options and potential implications before proceeding. Withdrawing funds from retirement accounts should generally be a last resort due to the potential long-term consequences.

10. Secured Loans

Secured loans offer another avenue for obtaining funds, particularly for individuals with bad credit. However, they come with their own set of risks and considerations.

10.1 Car Title Loans

Car title loans involve using your vehicle as collateral to secure the loan. These loans can be obtained relatively quickly, but they often come with high-interest rates and the risk of losing your vehicle if you default on the loan. It’s crucial to carefully consider the affordability and potential consequences before pursuing a car title loan.

10.2 Pawnshop Loans

Pawnshop loans are secured loans where you provide an item of value (such as jewelry or electronics) as collateral. The pawnshop assesses the value of the item and provides a loan based on that value. If you fail to repay the loan, the pawnshop can sell your item to recoup the loan amount. Like other secured loans, pawnshop loans often come with high-interest rates and should be approached with caution.

In conclusion, individuals with bad credit have various loan options available to them. From traditional banks to online lenders, credit unions, and government assistance programs, it’s important to carefully consider the pros and cons of each option. By exploring different avenues and understanding the risks involved, you can find the best loan solution for your specific financial situation. Remember, responsible borrowing and timely repayments are crucial to improving your creditworthiness in the long run.

This image is property of bsmedia.business-standard.com.