So you’ve found yourself in a situation where your credit score isn’t exactly stellar, and now you’re left wondering what options you have for obtaining a loan. Look no further than Yahoo Answers – the online platform where internet users gather to seek advice from strangers. In this article, we’ll take a closer look at how people on Yahoo Answers explain loans for bad credit. From anecdotes to expert advice (or maybe not so expert), get ready to be enlightened on this unorthodox, yet surprisingly helpful, source of information.

Understanding Loans for Bad Credit: Yahoo Answers Explained

Are you facing financial difficulties due to a bad credit history? Don’t worry, you’re not alone. Many individuals find themselves in this situation, and it can be overwhelming to navigate the world of loans for bad credit. Thankfully, there are resources available to help you understand your options and guide you through the process. One such resource is Yahoo Answers, a popular online platform where individuals can ask questions and receive answers from the community. In this article, we will explore loans for bad credit, the importance of credit scores, types of loans available, common reasons for bad credit, how to check your credit score, finding loans for bad credit, using Yahoo Answers for loan advice, the pros and cons of using Yahoo Answers, tips for using the platform effectively, and alternative sources for loan information.

What is Bad Credit?

Before we delve into the world of loans for bad credit, let’s first understand what bad credit actually means. Bad credit refers to a low credit score, which is typically a result of a history of late payments, defaults, or other negative financial behaviors. Lenders use credit scores as a measure of risk when considering whether to approve a loan application. A low credit score indicates a higher risk, making it more challenging to obtain a loan with favorable terms.

Importance of Credit Score

Your credit score is a crucial factor in determining your financial health. It not only affects your ability to secure loans but can also impact other areas of your life, such as renting an apartment or obtaining insurance. A good credit score shows lenders that you are responsible with your finances and make timely payments. On the other hand, a bad credit score signals potential financial instability and may make lenders hesitant to offer you loans or credit.

This image is property of s.yimg.com.

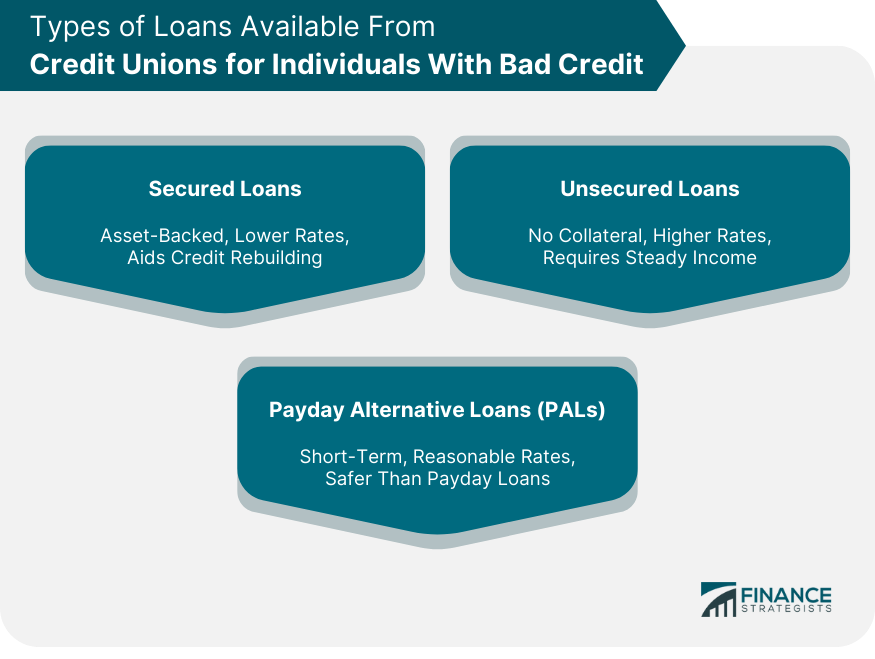

Types of Loans for Bad Credit

Despite having bad credit, there are still options available for obtaining loans. These loans are specifically designed for individuals with low credit scores, giving them an opportunity to improve their financial situation. Some common types of loans for bad credit include payday loans, installment loans, secured loans, and personal loans. Each type of loan has its own set of requirements and repayment terms, so it’s important to understand the options and choose the one that best suits your needs.

Common Reasons for Bad Credit

There are various reasons why someone may have bad credit. Life is unpredictable, and even the most financially responsible individuals can face unexpected challenges. Some common reasons for bad credit include job loss, medical emergencies, divorce, excessive debt, or simply a lack of knowledge about managing finances effectively. It’s important to remember that having bad credit doesn’t define you as a person, and there are ways to improve your financial situation over time.

This image is property of s.yimg.com.

How to Check Your Credit Score

Knowing your credit score is crucial when applying for loans or seeking ways to improve your financial standing. Fortunately, checking your credit score has become easier than ever. There are several credit bureaus that provide free credit reports annually, such as Experian, Equifax, and TransUnion. Additionally, many online platforms offer free credit score checks, helping you stay informed about your financial health.

Finding Loans for Bad Credit

When searching for loans for bad credit, it’s important to do your research and explore various options. Traditional lenders may be hesitant to offer loans to individuals with bad credit, but there are alternative lending institutions that specialize in such situations. Online lenders, credit unions, and peer-to-peer lending platforms are some options worth considering. Additionally, seeking advice from financial advisors or credit counseling agencies can provide valuable insights.

This image is property of www.financestrategists.com.

Using Yahoo Answers for Loan Advice

Yahoo Answers is a popular online platform where users can ask questions and receive answers from the community. It can be a helpful resource for individuals seeking loan advice, especially for those with bad credit. Users can ask specific questions related to loans for bad credit, and others who have faced similar situations can provide guidance based on their experiences. It’s important to note that while Yahoo Answers can provide insights, it’s always recommended to verify information from multiple sources and consult with professionals before making any financial decisions.

Pros and Cons of Using Yahoo Answers

As with any online platform, Yahoo Answers has its pros and cons when it comes to seeking loan advice. One advantage is the vast community of users who can provide a range of perspectives and personal experiences. It can offer a sense of support and reassurance knowing that others have gone through similar situations. However, it’s important to be cautious and critical of the information received. Anyone can answer questions on Yahoo Answers, and the accuracy of the responses may vary. Additionally, information provided may not be up-to-date or relevant to your specific situation.

This image is property of www.financestrategists.com.

Tips for Using Yahoo Answers

If you decide to use Yahoo Answers for loan advice, here are some tips to help you make the most of the platform:

- Be specific: When asking a question, provide as much detail as possible to receive more precise and relevant answers.

- Research: Before accepting any advice, cross-reference the information with reputable sources to ensure accuracy.

- Consider multiple responses: Don’t rely solely on one answer. Look for patterns in the responses and draw your conclusions.

- Trust your judgment: Ultimately, you know your financial situation best. Use the information provided as a guide but make decisions based on your own understanding and needs.

- Be aware of scams: Unfortunately, online platforms are not immune to scams. Exercise caution and be skeptical of any requests for personal or financial information.

Alternative Sources for Loan Information

While Yahoo Answers can be a helpful resource, it’s always essential to gather information from multiple sources. Reputable financial websites, government resources, and credit counseling agencies are reliable sources of loan information. They can provide valuable guidance tailored to your specific situation, backed by professional expertise.

In conclusion, loans for bad credit can provide individuals with the means to improve their financial situation. Understanding the intricacies of bad credit, the importance of credit scores, and the different types of loans available is crucial. Utilizing resources like Yahoo Answers can offer insights from a community of individuals who have experienced similar challenges. However, it’s important to be cautious, verify information from multiple sources, and consult with professionals when making financial decisions. By arming yourself with knowledge and exploring alternative sources for loan information, you can navigate the world of loans for bad credit with confidence.

This image is property of www.financestrategists.com.