So, you find yourself in a bit of a financial bind, huh? Don’t fret, because we’ve got you covered. In this article, we’re going to reveal the best places to find emergency loans for individuals with bad credit. Whether it’s unexpected medical bills, car repairs, or any other unexpected expenses that life throws your way, we’ll guide you towards the resources you need to get back on your feet. No judgment, no hassle. Let’s get started.

Credit Unions

Local Credit Unions

Local credit unions are financial institutions that are owned and operated by members of a particular community or group. These institutions offer a wide range of financial services, including emergency loans for individuals with bad credit. Credit unions typically have more flexible eligibility criteria and lower interest rates compared to traditional banks, making them a great option for those in need of emergency funds. To access these loans, you will need to become a member of the credit union, which usually involves meeting certain residency or employment requirements.

Online Credit Unions

In addition to brick-and-mortar credit unions, there are also online credit unions that provide emergency loans for individuals with bad credit. These online institutions offer convenience and accessibility, as you can apply for a loan from the comfort of your own home. Online credit unions often have competitive interest rates and loan terms that cater to individuals with varying credit scores. By exploring the options available from online credit unions, you can find the emergency loan that best suits your needs.

Online Lenders

Payday Lenders

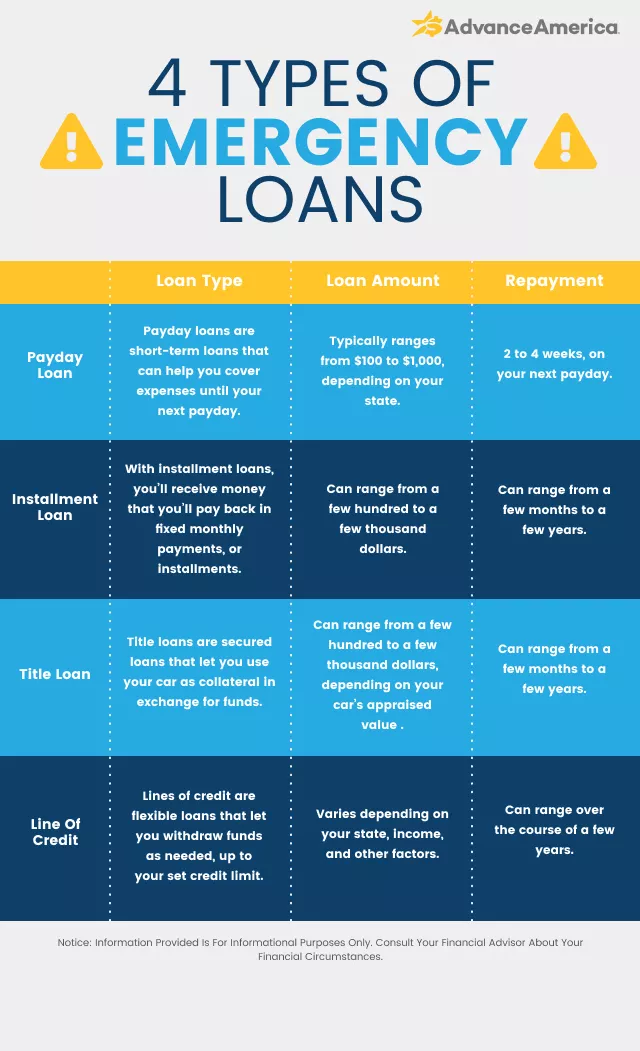

Payday lenders are another option for obtaining emergency loans with bad credit. These lenders typically offer short-term loans that are intended to be repaid with your next paycheck. While payday loans can be an accessible source of quick funds, it is important to exercise caution when considering this option. Payday loans often come with extremely high interest rates and fees, which can make it difficult to repay the loan on time. If you are unable to repay the loan within the specified time frame, you may find yourself trapped in a cycle of debt.

Installment Lenders

Installment lenders provide emergency loans for individuals with bad credit in larger amounts than payday lenders. These loans are repaid in fixed monthly installments over a defined period. While installment loans may be a more manageable option for some, it is crucial to carefully review the terms and conditions of the loan. Interest rates and fees can vary significantly among installment lenders, and it is essential to choose a reputable lender that offers reasonable rates and repayment terms.

Peer-to-peer Lenders

Peer-to-peer lending platforms connect borrowers with individual investors who are willing to lend money. These platforms allow individuals with bad credit to access emergency loans by presenting their loan request to potential lenders. Peer-to-peer loans often have competitive interest rates and flexible repayment options, making them an attractive alternative to traditional lending institutions. However, as with any lending arrangement, it is important to carefully read and understand the terms and conditions before entering into a loan agreement.

This image is property of cdn.advanceamerica.net.

Government Assistance Programs

Grants and Loans from Local Government Agencies

Local government agencies often provide financial assistance in the form of grants or loans to individuals in need. These programs may have specific eligibility requirements, but they can be a valuable resource for individuals with bad credit who require emergency funds. Contact your local government agencies, such as the housing authority or social services department, to inquire about any available assistance programs and their application process.

Federal Assistance Programs

The federal government also offers various assistance programs designed to help individuals facing financial difficulties. These programs may include grants, loans, or other forms of support. Examples of federal assistance programs include the Low Income Home Energy Assistance Program (LIHEAP) and the Supplemental Nutrition Assistance Program (SNAP). These programs have specific eligibility criteria, and it is advisable to check the official government websites or contact relevant agencies for more information on how to apply.

Nonprofit Organizations

Community Development Financial Institutions

Community development financial institutions (CDFIs) are nonprofit organizations that provide financial services to underserved communities. These institutions often offer emergency loans to individuals with bad credit, with a focus on promoting economic development and financial inclusion. CDFIs typically have more flexible lending criteria and may prioritize helping individuals who have been turned down by traditional lenders. Research local CDFIs in your area to explore their emergency loan options.

Charitable Organizations

Charitable organizations can also be a valuable resource for emergency loans for individuals with bad credit. Many nonprofit organizations offer assistance programs that provide financial support to those in need. These organizations may provide emergency loans or grants to help cover essential expenses during challenging times. Reach out to local charities or research national organizations to inquire about any available emergency loan programs.

This image is property of cdn.advanceamerica.net.

Family and Friends

Informal Loans from Friends or Relatives

One option for obtaining emergency funds with bad credit is seeking assistance from family or friends. Informal loans from trusted individuals can be a more flexible and forgiving alternative to traditional loans. Before approaching someone for financial help, it is important to have a clear plan for repayment and to discuss expectations openly. It is essential to treat informal loans professionally and ensure both parties are comfortable with the arrangement to maintain positive relationships.

Credit Cards

Secured Credit Cards

Secured credit cards can be a useful tool for obtaining emergency funds for individuals with bad credit. With a secured credit card, you are required to provide a security deposit that serves as collateral for your credit limit. These cards often have lower credit requirements and can help you build or rebuild your credit history over time. By using a secured credit card responsibly and making timely payments, you can improve your credit score and potentially qualify for more favorable loan options in the future.

Prepaid Credit Cards

Prepaid credit cards can also be a viable option for emergency funds for individuals with bad credit. These cards are not linked to a traditional credit line but instead require you to load funds onto the card before use. While prepaid cards do not directly contribute to building credit, they can provide a convenient and accessible payment method for emergency expenses. Prepaid cards can be obtained without a credit check, making them an appealing option for those with bad credit.

This image is property of ewscripps.brightspotcdn.com.

Home Equity Loans

Borrow Against Home Equity

If you own a home, you may be eligible for a home equity loan or line of credit. These loans allow you to borrow against the equity you have built in your home. Home equity loans often come with lower interest rates and more lenient credit requirements compared to other types of loans. However, it is crucial to consider the potential risks associated with home equity loans. Defaulting on this type of loan can result in foreclosure, so it is important to carefully assess your ability to repay before taking on this financial commitment.

Retirement Accounts

Borrow from a 401(k)

If you have a 401(k) retirement account with your employer, you may be able to borrow funds from it in the form of a 401(k) loan. This type of loan allows you to borrow up to a certain percentage of your vested balance and repay it over a specified period. While borrowing from a 401(k) can provide access to emergency funds, it is crucial to understand the potential long-term consequences. Failure to repay the loan within the designated timeframe may result in penalties, taxes, and a depletion of your retirement savings.

Borrow from an IRA

Individual Retirement Accounts (IRAs) may also offer the option to take out a loan against your savings. Similar to a 401(k) loan, borrowing from an IRA can provide immediate funds to address emergencies. However, it is essential to consult with a financial advisor and carefully consider the implications of withdrawing from your retirement savings. Early withdrawals from an IRA can lead to taxes, penalties, and the loss of potential growth on your investments.

This image is property of ewscripps.brightspotcdn.com.

Advance Pay from Employer

Request an Advance on Salary

In certain situations, it may be possible to request an advance on your salary from your employer. This option provides access to funds that you have already earned but have not yet received. If you find yourself in a financial emergency, it is worth discussing the possibility of receiving an advance on your paycheck with your employer. While this option may not be available to everyone, it can be a helpful solution for immediate financial needs.

Military Assistance

Emergency Relief Programs for Military Personnel

If you are a member of the military or a veteran, there are specific emergency relief programs available to assist you during financial hardships. These programs are designed to provide financial support to military personnel and their families during challenging times. Organizations such as the Army Emergency Relief (AER) and the Navy-Marine Corps Relief Society (NMCRS) offer grants and interest-free loans to help with emergency expenses. Contact your local military installation or visit the official websites of these organizations to learn more about the assistance programs available to you.

In conclusion, there are multiple avenues to explore when seeking emergency loans for individuals with bad credit. From credit unions to online lenders, government assistance programs to nonprofit organizations, and even support from family and friends, each option comes with its own set of considerations. It is important to carefully assess your financial situation, research different lenders and programs, and choose the option that best suits your needs. Remember, when seeking an emergency loan, it is crucial to borrow only what you need and ensure you have a plan for repayment to maintain your financial stability.

This image is property of ewscripps.brightspotcdn.com.