In this article, you will discover everything you need to know about the Credit Repair Contract. Whether you’re a curious individual looking to improve your credit score or someone seeking professional assistance, this informative piece will guide you through the ins and outs of credit repair contracts. From understanding the terms and conditions to the benefits and potential pitfalls, you’ll gain a comprehensive understanding of how a credit repair contract can potentially help you in your credit journey. So, let’s get started and unlock the secrets to building a better credit future!

Understanding Credit Repair Contracts

Definition of a Credit Repair Contract

A credit repair contract is a legally binding agreement between a client and a credit repair company. It outlines the terms and conditions under which the credit repair company will provide services to improve the client’s credit history and credit score. This contract aims to establish clear expectations, protect the rights of both parties, and ensure that the credit repair process is carried out in a fair and legal manner.

Reasons for a Credit Repair Contract

A credit repair contract is necessary for several reasons. Firstly, it provides a written record of the services to be performed, the fees involved, and the expectations of both parties. This ensures that both the client and the credit repair company are on the same page and can refer back to the contract in case of any disputes or misunderstandings.

Secondly, a credit repair contract helps protect the client from unethical practices or scams. By clearly outlining the obligations and responsibilities of the credit repair company, it establishes a level of accountability and allows the client to take legal action if the terms of the contract are violated.

Fundamental Elements of a Credit Repair Contract

A comprehensive credit repair contract should include certain fundamental elements. These elements typically consist of the following:

-

Identifying Information of Parties Involved: This section should clearly state the name, address, contact information, and any relevant identification details of both the client and the credit repair company.

-

Detailed Statement of Services to be performed: It is crucial that the contract describes in detail the specific services the credit repair company will provide. This may include reviewing credit reports, disputing incorrect or outdated information, negotiating with creditors, and providing ongoing credit counseling.

-

Fee Structure and Payment Arrangements: The contract should clearly outline the fees to be charged by the credit repair company and the payment arrangements, such as whether it is a one-time fee or a recurring payment. It should also specify when payments are due and any penalties for late payments.

Legal Aspects of Credit Repair Contracts

Regulations Governing Credit Repair Contracts

Credit repair contracts are subject to specific regulations to protect consumers from fraudulent or deceptive practices. These regulations vary by country and jurisdiction but generally aim to ensure transparency, fairness, and honesty in the credit repair process.

In the United States, for example, the Credit Repair Organizations Act (CROA) is a federal law that governs credit repair contracts. It establishes certain requirements that credit repair companies must adhere to when providing services to consumers.

Consequences of Violating Contract Terms

If either the client or the credit repair company violates the terms of the credit repair contract, there can be several consequences. These may include financial penalties, legal action, damage to reputation, and potential cancellation of the contract. It is essential for both parties to understand their rights and obligations to avoid any breaches that could lead to unfavorable outcomes.

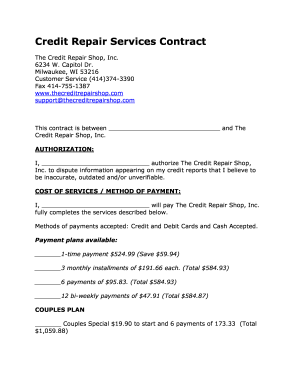

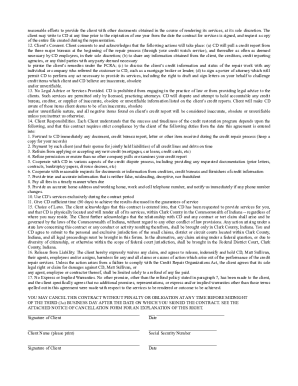

This image is property of www.pdffiller.com.

How to Draft a Credit Repair Contract

Identifying Information of Parties Involved

The first step in drafting a credit repair contract is to include the identifying information of both the client and the credit repair company. This information should include the full legal names, addresses, phone numbers, and any relevant identification numbers, such as social security or tax identification numbers.

Detailed Statement of Services to be performed

The contract must clearly outline the specific services that the credit repair company will provide. This may include a detailed description of credit analysis, disputing erroneous information, negotiating with creditors, and providing educational resources for improving credit habits. The statement of services should be comprehensive to avoid any confusion or misunderstandings later on.

Fee Structure and Payment Arrangements

The contract should include a well-defined fee structure that outlines the costs associated with the credit repair services. This may include an initial setup fee, monthly fees, or fees tied to specific milestones or outcomes. Payment arrangements should specify how and when the fees are to be paid, including any accepted forms of payment, due dates, and potential late payment penalties.

Rights and Obligations in a Credit Repair Contract

Rights of the Client

A credit repair contract should explicitly state the rights of the client. These rights typically include:

-

Access to Information: The client has the right to access all information related to their credit repair process, including credit reports, dispute letters, and any other relevant documentation.

-

Timely Updates: The client should receive regular updates from the credit repair company regarding the status of their credit repair process and any progress made.

-

Privacy and Confidentiality: The client’s personal and financial information should be treated with strict confidentiality and not shared with any unauthorized parties.

Obligations of the Credit Repair Company

The credit repair contract should also specify the obligations of the credit repair company. These obligations often include:

-

Honesty and Transparency: The credit repair company must provide accurate and truthful information regarding the services they offer and the expected outcomes of the credit repair process.

-

Compliance with Laws and Regulations: The credit repair company should adhere to all applicable laws and regulations governing credit repair services, including the CROA in the United States.

-

Timely Performance of Services: The credit repair company must perform the agreed-upon services in a timely manner and provide regular updates to the client on the progress made.

Breach of Contract and Remedies

If either party breaches the credit repair contract, there are various remedies available. These may include mediation, arbitration, or litigation to resolve disputes. The contract should outline the specific process to be followed in the event of a breach and the potential consequences for the breaching party.

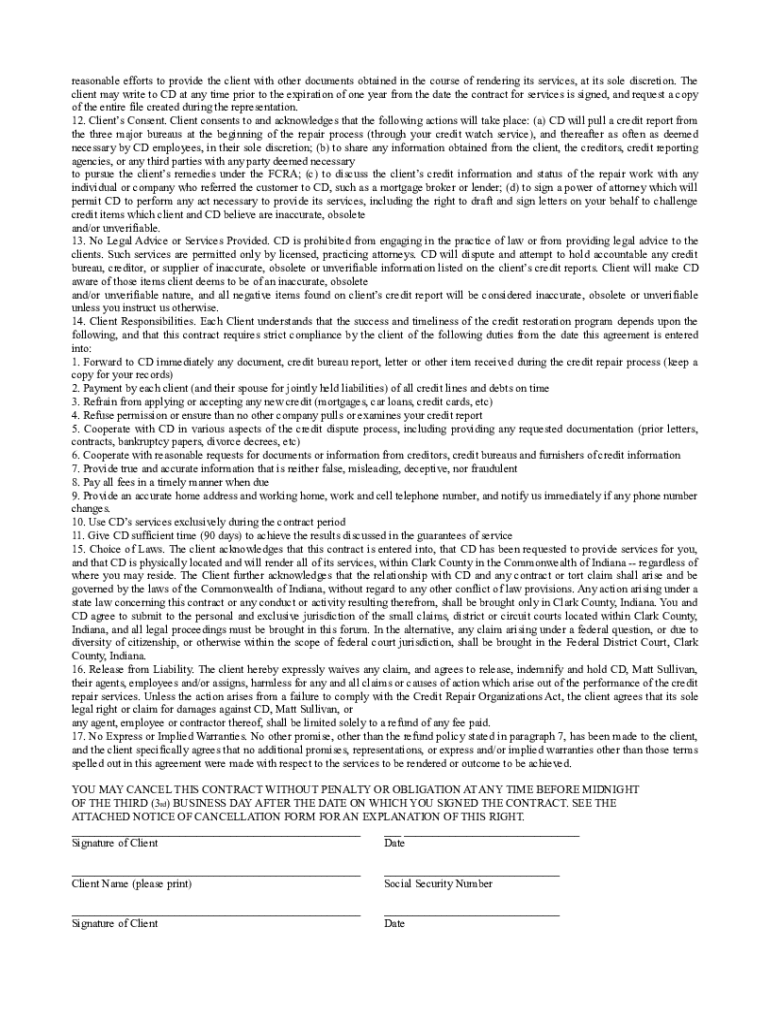

This image is property of www.pdffiller.com.

Importance of The Credit Repair Organizations Act (CROA)

Basic Provisions of the CROA

The Credit Repair Organizations Act (CROA) is a crucial law enacted in the United States to protect consumers from deceptive or unfair practices by credit repair companies. Some basic provisions of the CROA include:

-

Written Contracts: The CROA mandates that credit repair companies must provide clients with a written contract that discloses various details, including the services to be performed, the duration of the contract, and any guarantees or outcomes promised.

-

Prohibited Practices: The CROA prohibits credit repair companies from engaging in certain unfair practices, such as false claims or guarantees, charging fees before services are rendered, and advising clients to create new identities to evade their credit histories.

How CROA protects consumers in Credit Repair Contracts

The CROA plays a crucial role in protecting consumers in credit repair contracts. By requiring written contracts and prohibiting unfair practices, it promotes transparency, accountability, and ethical behavior within the credit repair industry. The law gives consumers the right to dispute any inaccurate or incomplete information on their credit reports and seek remedies if credit repair companies fail to fulfill their obligations.

Precautions while Signing a Credit Repair Contract

Reading and Understanding the Contract Thoroughly

Before signing a credit repair contract, it is crucial to thoroughly read and understand all the terms and conditions. Pay attention to the scope of services, fees, obligations of both parties, and any clauses regarding cancellation or termination of the contract. If there are any unclear or ambiguous terms, seek clarification from the credit repair company before proceeding.

Recognizing Red Flags

When signing a credit repair contract, be vigilant for any red flags that may indicate a potential scam or fraudulent activity. Some red flags to watch out for include:

-

Unrealistic Guarantees: Be cautious of any credit repair company that promises guaranteed results or the removal of accurate negative information from your credit report. Improving credit takes time and effort, and no company can guarantee specific outcomes.

-

Upfront Payment Demands: Legitimate credit repair companies typically charge fees after services have been rendered, not before. Avoid companies that demand upfront payment or charge exorbitant fees without clearly explaining what services will be provided.

Seeking Legal Advice

If you have concerns or questions about a credit repair contract, it is advisable to seek legal advice from a qualified attorney specializing in consumer protection or contract law. A legal professional can review the contract, ensure your rights are protected, and provide guidance on the best course of action.

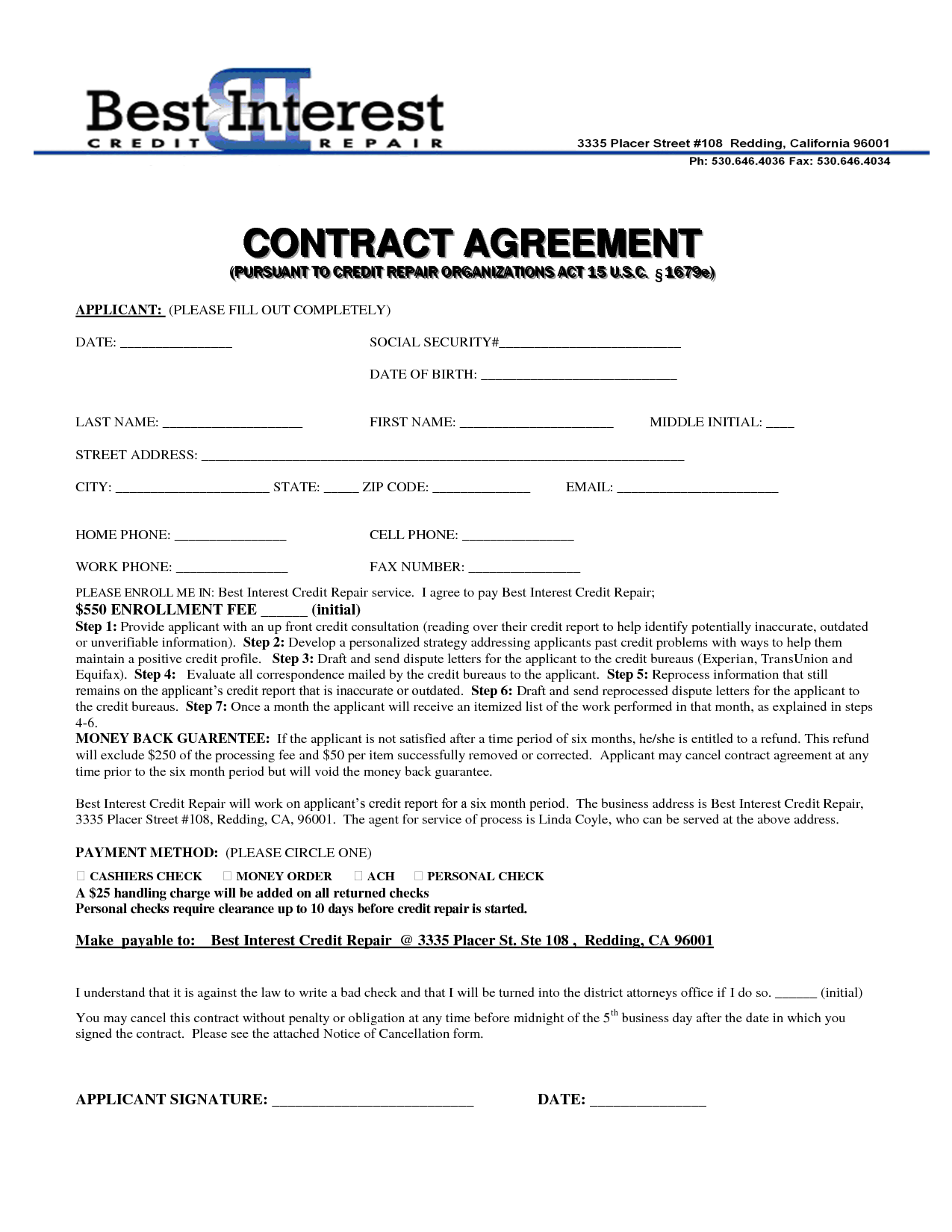

This image is property of i.pinimg.com.

Disputes and Resolutions in Credit Repair Contracts

Common Disputes in Credit Repair Contracts

Disputes can arise in credit repair contracts for various reasons. Some common disputes include:

-

Unsatisfactory Results: If the credit repair company fails to deliver the promised results or does not make any progress in improving the client’s credit, it may lead to a dispute regarding the quality of service provided.

-

Billing and Payment Issues: Disputes may arise if there are discrepancies in the fees charged, late payment penalties, or any unexpected charges not outlined in the contract.

Effective Dispute Resolution Strategies

To effectively resolve disputes in credit repair contracts, it is advisable to:

-

Communication: Start by addressing the issue directly with the credit repair company. Clearly communicate your concerns and expectations, and try to reach a mutually agreeable solution.

-

Mediation or Arbitration: If direct communication does not resolve the dispute, consider engaging in mediation or arbitration. These alternative dispute resolution methods can help parties reach a resolution without resorting to litigation.

Role of Agencies and Courts

In cases where disputes cannot be resolved through mediation or arbitration, parties may choose to pursue legal action. Consumer protection agencies and courts play a vital role in resolving these disputes. They ensure that credit repair companies adhere to the law and provide a fair and impartial forum for resolving conflicts.

Scoping Out Fraud in Credit Repair Contracts

Recognizing Credit Repair Scams

It is essential to be aware of the warning signs that may indicate a credit repair scam. Some common indicators of fraudulent credit repair companies include:

-

Unsolicited Offers: Be cautious of credit repair companies that contact you out of the blue without any prior interaction or request for their services.

-

Request for Advanced Payment: Legitimate credit repair companies do not demand advanced payment before rendering services. If a company insists on upfront payment, it may be a red flag.

Steps to Take if Scammed

If you believe you have been scammed by a credit repair company, it is important to act swiftly. Take the following steps:

-

Gather Evidence: Collect any documents, emails, or communication related to the credit repair company’s services and promises made.

-

File a Complaint: Report the scam to your local consumer protection agency, the Better Business Bureau, and any relevant regulatory authorities. Provide them with all the evidence you have collected.

Reporting to the Relevant Authorities

Reporting credit repair scams to the relevant authorities is crucial to protect yourself and others from falling victim. Contact your local consumer protection agency, state attorney general’s office, and the Federal Trade Commission (FTC) to report the fraudulent activities. These agencies have the authority to investigate and take legal action against scammers.

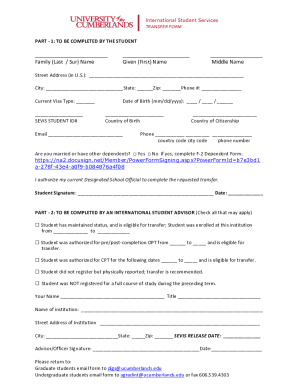

This image is property of www.pdffiller.com.

Maintaining Transparency in Credit Repair Contracts

Transparency in Terms and Conditions

Transparency in credit repair contracts is essential to ensure all parties involved have a clear understanding of their rights and obligations. The terms and conditions should be written in clear and concise language, avoiding complex legal jargon. This helps prevent misunderstandings and promotes a fair and transparent credit repair process.

Transparency in Fees Charged

Credit repair companies should clearly outline the fees they charge for their services in the contract. This includes the amount of each fee, the frequency of payment, and any circumstances that may lead to additional charges. Transparent fee structures promote trust and enable clients to make informed decisions about the services they are paying for.

Transparency in Results Guaranteed

While credit repair companies cannot guarantee specific outcomes, they should be transparent about the success rates of their services and the typical results they have achieved for previous clients. This allows potential clients to have realistic expectations and make informed choices about whether to engage their services.

Review and Ending of Credit Repair Contracts

Regular Review of the Contract

It is advisable to regularly review the credit repair contract throughout the duration of the agreement. This helps ensure that both parties are fulfilling their obligations and that any necessary adjustments or amendments can be made if needed. Regular reviews also allow for open communication and prevent misunderstandings.

Grounds for Terminating the Contract

Credit repair contracts may be terminated under various circumstances. Some common grounds for termination include:

-

Completion of Services: The contract can be terminated once all the agreed-upon services have been successfully completed.

-

Violation of Contract Terms: If either party violates the terms of the contract, the other party may have the right to terminate the agreement.

Procedure for Ending the Contract

The credit repair contract should outline the procedure for ending the agreement. This may include giving written notice to the other party, specifying the reasons for termination, and any additional steps that need to be followed, such as returning or destroying confidential information.

In conclusion, credit repair contracts play a crucial role in ensuring a fair and transparent credit repair process. By understanding the definition, legal aspects, and fundamental elements of these contracts, and taking necessary precautions while signing them, individuals can protect themselves from scams and fraudulent practices. It is important to maintain open communication, review the contract regularly, and seek legal advice if needed. With transparency, adherence to applicable laws, and respect for consumer rights, credit repair contracts can effectively help individuals improve their credit history and reach their financial goals.

This image is property of www.pdffiller.com.