You’ve always dreamed of owning a beautiful home in the heart of New York City, but the state of your credit score has been holding you back. Thankfully, with the help of “New York’s Credit Journey: Exceptional Repair Services,” you can finally take control of your financial future. This article will provide you with an in-depth look at the exceptional repair services offered by this New York-based company, and how they can assist you in improving your credit score and achieving your dreams. So get ready to embark on a transformative credit journey that will open doors you never thought possible.

Understanding Credit Scores

Basics of Credit Scores

Credit scores play a crucial role in your financial life. They are a numerical representation of your creditworthiness and are used by lenders, landlords, employers, and insurance companies to assess the level of risk involved in any financial transaction. Credit scores generally range from 300 to 850, with higher scores indicating a lower credit risk. By understanding how credit scores work, you can take steps to improve your score and enhance your financial opportunities.

Factors Influencing Credit Scores

Several factors influence your credit score. These include your payment history, the amount of debt you owe, the length of your credit history, new credit applications, and the types of credit you use. Payment history is the most significant factor, accounting for about 35% of your credit score. Late payments, bankruptcies, and foreclosures can seriously damage your credit score, while timely payments and responsible credit usage can improve it.

Understanding Credit Reports

Credit scores are derived from the information in your credit report. Your credit report includes details about your credit accounts, payment history, outstanding debts, and public records such as judgments or bankruptcies. It’s essential to review your credit report regularly to ensure its accuracy. You can obtain a free copy of your credit report once a year from each of the three major credit bureaus – Experian, TransUnion, and Equifax. By understanding your credit report, you can identify any errors or issues that may be negatively impacting your credit score.

Importance of Good Credit in New York

Roles of Credit Scores in Everyday Life

In New York, as in other parts of the country, credit scores play a significant role in everyday life. A good credit score opens doors to various financial opportunities. It can help you secure better interest rates on loans and credit cards, negotiate lower insurance premiums, and even increase your chances of landing a job. Credit scores are a measure of your financial responsibility, and maintaining a good score is crucial for navigating the financial landscape in New York.

The Impact of Credit Scores in Mortgage and Rental Situations

When it comes to housing in New York, credit scores can greatly impact your options. Most landlords and property management companies use credit scores to evaluate potential tenants’ reliability in paying rent on time. A good credit score can increase your chances of securing a desirable rental property. Similarly, when applying for a mortgage, lenders use credit scores to determine your eligibility and interest rates. A higher credit score can save you thousands of dollars over the life of your mortgage.

Effects of Credit Scores on Employment Opportunities

Employers in New York often review credit scores during the hiring process, especially for positions that involve financial responsibilities. While credit checks are subject to strict regulations, your credit score can still influence an employer’s perception of your financial stability and trustworthiness. A lower credit score may lead to missed job opportunities. Therefore, maintaining a good credit score can help you stand out from other job applicants and increase your chances of securing desirable employment.

Credit Scores and Insurance Premiums

In New York, as in other states, credit scores can impact your insurance premiums. Insurance companies use credit scores as one of the factors in determining your risk level as a policyholder. A higher credit score is often associated with a lower likelihood of filing insurance claims, resulting in lower premiums. Being aware of your credit score and taking steps to improve it can lead to significant cost savings on your insurance policies.

Average Credit Scores in New York

Credit Distribution in New York

Credit scores in New York, like in other states, follow a distribution pattern. The majority of individuals have credit scores that fall within the range of 600 to 750. However, there is still a significant percentage of individuals with lower credit scores, indicating room for improvement. It’s essential to know where you stand compared to the average credit score in New York to understand the financial landscape better.

Comparison: New York’s Average Credit Score and the National Average

New York’s average credit score is higher than the national average, reflecting the generally higher income levels and financial opportunities available in the state. While the national average credit score hovers around 680, New York’s average credit score is closer to 700. However, this does not mean that individuals in New York should relax and assume their credit is excellent. It’s always important to strive for a higher credit score to take advantage of various financial opportunities.

Understanding the Credit Health of New Yorkers

To assess the credit health of New Yorkers, it is not enough to look only at the average credit score. Factors such as overall debt levels, credit utilization rates, and the presence of delinquencies or bankruptcies also influence credit health. While New York’s average credit score is relatively high, it’s crucial to dig deeper into individuals’ credit profiles to understand the specific challenges they may face. By understanding the credit health of New Yorkers, we can identify areas of improvement and help individuals navigate the credit repair process effectively.

Common Credit Mistakes New Yorkers Make

Common Factors Leading to Damaged Credit

In New York, as in any other state, there are several common factors that can lead to damaged credit. These include late payments, high credit card utilization, maxing out credit limits, bankruptcy, foreclosure, and identity theft. It’s essential to be aware of these factors and take steps to avoid them to maintain a healthy credit score.

Effects of Bankruptcy on Credit Score and Rebuilding Process

Bankruptcy is a significant event that can severely impact your credit score. A bankruptcy filing can stay on your credit report for up to ten years, making it challenging to obtain credit or secure favorable interest rates. However, it’s important to note that bankruptcy is not the end of your credit journey. With time and responsible financial habits, you can rebuild your credit and work towards improving your credit score.

Impact of Late Payments and High Credit Card Utilization

Late payments and high credit card utilization are two common mistakes that can quickly damage your credit. Late payments, even if only a few days overdue, can leave a lasting negative impact on your credit score. Similarly, maxing out your credit card limits or utilizing a significant percentage of your available credit can harm your credit score. It’s crucial to make payments on time and keep your credit utilization low to maintain a healthy credit score.

Identifying Credit Repair Needs

Signs You Need Credit Repair

There are several signs that indicate you may need credit repair. These include consistently being denied credit, receiving high-interest rates and unfavorable terms on loans or credit cards, and having a low credit score. If you encounter any of these signs, it’s essential to take action to repair and rebuild your credit.

Consequences of Neglecting Credit Repair

Neglecting credit repair can have severe consequences. A low credit score can limit your financial opportunities, resulting in higher interest rates, difficulty securing loans, and missed chances for desirable housing or employment opportunities. Ignoring credit repair needs can prolong the negative impact on your finances and delay your journey to achieving financial stability.

Role of Credit Counseling in Identifying Repair Needs

Credit counseling services can be a valuable resource in identifying your credit repair needs. A credit counselor can analyze your credit report, assess your financial situation, and provide guidance on improving your credit. They can also help you create a personalized action plan to address any credit repair needs you may have. Consulting with a credit counselor can be a proactive step towards improving your credit health.

Navigating the Credit Repair Process

Overview of the Credit Repair Process

The credit repair process involves several steps aimed at improving your credit health. It starts with obtaining a copy of your credit report and identifying any errors or inaccuracies. You then need to dispute these errors with the credit bureaus and provide supporting documentation, if necessary. Additionally, it’s essential to implement responsible financial habits such as making payments on time, reducing debt, and avoiding new credit applications.

DIY Credit Repair vs. Professional Services

When it comes to credit repair, you have the option of pursuing a do-it-yourself approach or seeking professional assistance. DIY credit repair involves directly disputing errors on your credit report, implementing financial habits on your own, and monitoring your progress. Alternatively, professional credit repair services can handle the entire process for you, including communicating with credit bureaus, analyzing your credit report, and providing guidance. The choice between DIY credit repair and professional services depends on your comfort level, time availability, and complexity of your credit repair needs.

Dealing with Credit Bureaus during the Repair Process

Interacting with credit bureaus is a crucial part of the credit repair process. It involves submitting dispute letters to address any errors or inaccuracies on your credit report. When dealing with credit bureaus, it’s important to follow their specific procedures and provide supporting documentation to support your dispute. Patience and persistence are key during this process, as it may take time to receive responses and see changes reflected on your credit report.

New York’s Credit Repair Services

Overview of Credit Repair Companies in New York

New York has a wide range of credit repair companies that offer services to individuals seeking assistance in improving their credit. These companies typically have experienced professionals who specialize in credit repair and have a deep understanding of the financial landscape in New York. When selecting a credit repair company in New York, it’s essential to research their reputation, track record, and the services they offer.

Types of Services Offered by Credit Repair Firms

Credit repair firms in New York offer various services to help individuals improve their credit. These services may include credit report analysis, dispute letter preparation and submission, credit counseling, budgeting assistance, and credit education. The specific services offered may vary depending on the credit repair company. It’s crucial to choose a company that provides the services that align with your credit repair needs.

Understanding the Costs of Credit Repair Services

Credit repair services in New York typically involve costs. These costs can include an initial setup fee, monthly fees, and fees for specific services provided. The costs can vary depending on the credit repair company and the level of service you require. It’s important to review and compare the costs of different credit repair services in New York to ensure that they align with your budget and expected outcomes.

Choosing the Right Credit Repair Service

Criteria for Choosing a Credit Repair Company

When selecting a credit repair company, several criteria should be considered. These include the company’s reputation, track record, customer reviews, certifications, and accreditations. It’s important to choose a reputable and trustworthy credit repair company that has a proven history of delivering results for their clients. Additionally, consider the company’s level of transparency, communication, and the specific services they offer.

Reviewing the Best Credit Repair Services in New York

To make your search for the right credit repair service easier, it’s helpful to review and compare some of the best credit repair services in New York. Look for companies that have a strong reputation, positive customer reviews, and a track record of success. Consider their specific areas of expertise, the comprehensiveness of their services, and their approach to credit repair.

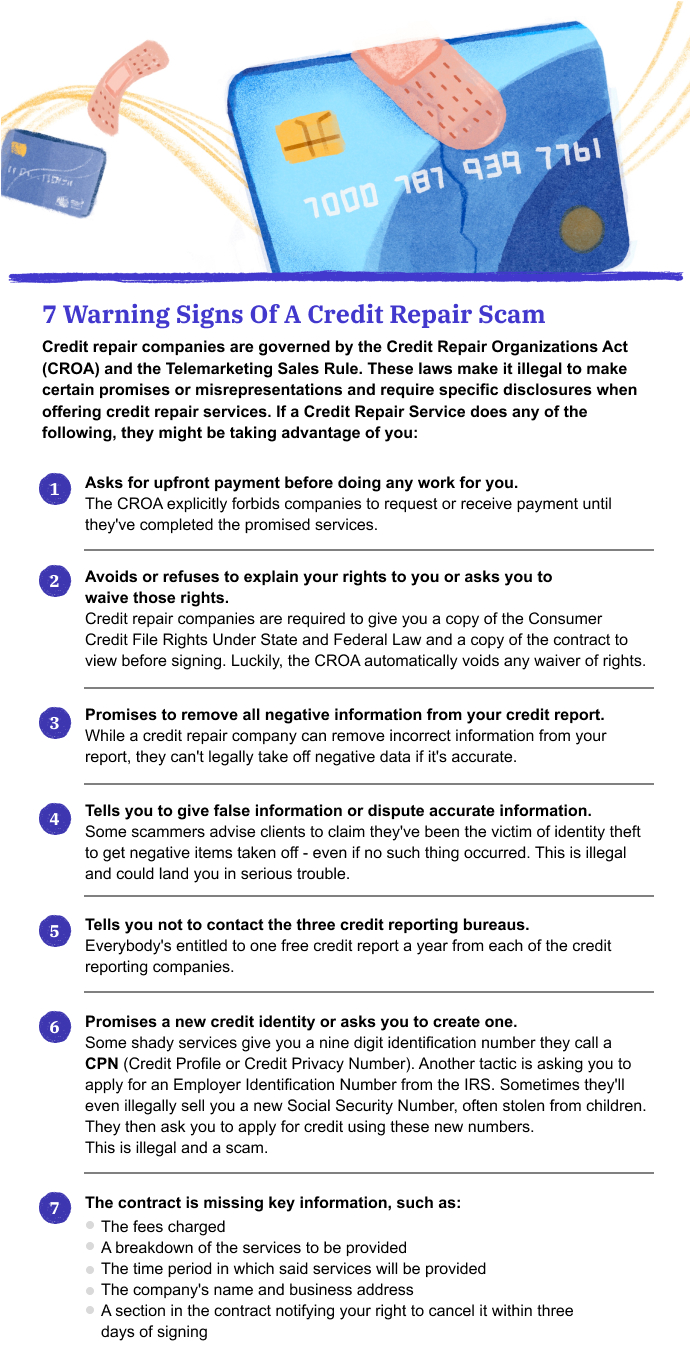

How to Avoid Credit Repair Scams

Unfortunately, there are fraudulent credit repair companies that prey on individuals seeking credit repair assistance. To avoid falling victim to credit repair scams, be cautious of any company that guarantees specific results, asks for payment upfront before providing services, or advises you to create a new identity. Additionally, research the company’s reputation, read customer reviews, and verify their certifications and accreditations. Being diligent and informed can help you avoid credit repair scams and protect your financial well-being.

Consumer Protection Laws for Credit Repair

Understanding New York State Credit Repair Laws

New York State has specific laws and regulations in place to protect consumers seeking credit repair services. The New York State Department of Financial Services oversees the credit repair industry and enforces compliance with these laws. It’s important to familiarize yourself with these laws to ensure that your rights are protected and that you are working with a legally compliant credit repair company.

Federal Credit Repair Regulations

In addition to state laws, there are federal regulations that govern the credit repair industry. The Credit Repair Organizations Act (CROA) is a federal law that sets guidelines and requirements for credit repair companies operating throughout the country. This law ensures that consumers are equipped with the necessary information and protections when seeking credit repair services. Understanding these federal regulations can help you make informed decisions when choosing a credit repair service.

Violations and Complaints Handling Processes in Credit Repair

When dealing with credit repair companies, it’s important to understand how violations and complaints are handled. If you believe a credit repair company has violated state or federal laws, you have the right to file a complaint with the appropriate regulatory authorities. The New York State Department of Financial Services and the Consumer Financial Protection Bureau are two organizations where you can report any potential violations or file complaints against credit repair companies.

The Road to Credit Recovery

Success Stories of Credit Repair in New York

Credit repair has helped countless individuals in New York recover from damaged credit and achieve financial stability. Success stories abound, with individuals seeing improvements in their credit scores, securing more favorable loan terms, and gaining access to better housing and employment opportunities. These success stories highlight the transformative power of credit repair and the positive impact it can have on an individual’s financial well-being.

Practicing Good Credit Habits Post-repair

While credit repair can significantly improve your credit health, it’s important to continue practicing good credit habits post-repair. This involves making payments on time, keeping credit utilization low, avoiding excessive debt, and regularly monitoring your credit report. By maintaining responsible financial habits, you can ensure that your credit remains healthy and continue to reap the benefits of a good credit score.

Maintaining and Monitoring Your Improved Credit

After going through the credit repair process and achieving improvements in your credit, it’s crucial to maintain and monitor your improved credit. Regularly reviewing your credit report for any errors or inaccuracies, monitoring your credit score, and updating your financial habits as needed will help you sustain the positive progress you have made. By staying vigilant and proactive, you can continue on the road to lasting credit recovery.