You thought your credit repair problems were over, but brace yourself because there is a storm brewing. The “Fes Credit Repair Lawsuit” has sent shockwaves throughout the industry, exposing the shady practices of the well-known credit repair company. With allegations of misleading claims, hidden fees, and negligible results, this lawsuit uncovers the dark truth behind Fes Credit Repair’s facade of credibility. Get ready to discover the shocking details that have led to this legal battle, leaving consumers furious and seeking justice against this deceitful company.

Background of the FES Credit Repair Lawsuit

Origins of the lawsuit

The FES Credit Repair Lawsuit originated from a series of complaints filed by numerous consumers who had utilized the services of FES Credit Repair. These consumers alleged that they had been misled and deceived by the company’s marketing tactics, false promises, and unauthorized charges. As a result of these allegations, a lawsuit was subsequently filed against FES Credit Repair, seeking compensation for the damages incurred by the aggrieved customers.

The parties involved in the lawsuit

The parties involved in the FES Credit Repair Lawsuit include the plaintiffs, who are the consumers who have brought forth the allegations against FES Credit Repair, and the defendant, FES Credit Repair itself. Additionally, the case also involves legal representation for both parties, including the plaintiffs’ attorneys and FES Credit Repair’s defense counsel. The court plays a pivotal role in overseeing the proceedings and ensuring a fair and just resolution to the conflict.

Issues leading to the lawsuit

The issues leading to the FES Credit Repair Lawsuit primarily revolve around the alleged deceptive marketing tactics employed by the company. Consumers have claimed that FES Credit Repair used misleading advertising and misrepresented their ability to improve credit scores. Moreover, there have been incidents of unauthorized charges made by FES Credit Repair, causing further frustration and discontent among affected customers. These issues, when combined, have resulted in significant dissatisfaction and ultimately led to the initiation of the lawsuit.

Specifics of the Lawsuit

Nature of the alleged violation

The alleged violation in the FES Credit Repair Lawsuit centers around deceptive practices and fraudulent conduct on the part of FES Credit Repair. Customers claim that they were lured into signing up for the company’s services based on false promises and guarantees of improving their credit scores swiftly. Additionally, there have been numerous reports of unauthorized charges made by FES Credit Repair, further exacerbating the alleged violation and breaching the trust of the affected consumers.

Impact on FES Credit Repair Services

The FES Credit Repair Lawsuit has had a significant impact on the reputation and operations of FES Credit Repair. With the public nature of the lawsuit and the allegations made against the company, consumer trust and confidence in its services have been severely eroded. This has resulted in a decline in customer subscriptions, damage to the company’s brand image, and potential financial repercussions for FES Credit Repair. Moreover, the lawsuit has also prompted regulatory scrutiny and increased oversight of the company’s practices.

Responses from the different parties involved

In response to the allegations made in the lawsuit, FES Credit Repair has vehemently denied any wrongdoing. The company claims that its marketing tactics are neither deceptive nor fraudulent and that it has always operated with the best interests of its customers in mind. FES Credit Repair has sought to counter the accusations by presenting legal arguments and evidence to support its defense. The plaintiffs, on the other hand, are resolute in their claims and are actively pursuing compensation for the damages they allege to have suffered due to FES Credit Repair’s actions.

This image is property of i.ytimg.com.

Legal Framework Surrounding Credit Repair

Regulations governing credit repair entities

Credit repair entities, including companies like FES Credit Repair, are subject to various regulations and requirements set forth by governing bodies. These regulations are intended to protect consumers from deceptive practices and ensure fair treatment. For instance, the Credit Repair Organizations Act (CROA) establishes guidelines that credit repair companies must adhere to, including providing clear and accurate information to consumers, refraining from making false promises, and prohibiting the collection of fees before services are rendered. Violations of these regulations can lead to legal action and potential penalties.

Role of Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in overseeing the operations of credit repair entities and ensuring compliance with relevant regulations. The CFPB is responsible for enforcing federal consumer financial laws and has the authority to take action against companies engaged in deceptive or fraudulent practices. The bureau conducts investigations, collects consumer complaints, and collaborates with other regulatory bodies to address issues within the credit repair industry.

Definition of fraudulent practices

Fraudulent practices within the credit repair industry encompass a broad range of activities aimed at deceiving consumers for financial gain. Examples of such practices include misrepresenting the effectiveness of credit repair services, promising guaranteed results, and charging unauthorized fees. The legal definition of fraud varies by jurisdiction but often involves elements of misrepresentation, intent to deceive, and harm caused to the victim. It is important for credit repair companies to operate within the boundaries of the law and abstain from engaging in fraudulent practices to protect consumers and maintain the integrity of the industry.

Accusations Leveled Against FES Credit

Alleged deceptive marketing tactics

Consumers involved in the FES Credit Repair Lawsuit accuse the company of employing deceptive marketing tactics to attract customers. Claims have been made that FES Credit Repair misrepresented the effectiveness of their services, exaggerating their ability to improve credit scores and resolve negative financial situations. Allegedly, customers were enticed into purchasing the services under false pretenses, leading to disappointment and financial loss.

Claims of false promises and guarantees

One of the primary accusations made against FES Credit Repair is the offering of false promises and guarantees to customers. It is alleged that the company assured clients of significant improvements in their credit scores within a short period. However, customers who availed of FES Credit Repair’s services reported little to no improvement, raising concerns about the credibility of the company’s claims and the veracity of their guarantees.

Incidents of unauthorized charges

A particularly concerning aspect of the FES Credit Repair Lawsuit involves incidents of unauthorized charges made by FES Credit Repair. Consumers have reported instances where fees were charged without their consent or knowledge, leading to unexpected financial burdens. These unauthorized charges have added fuel to the allegations against the company, suggesting a lack of transparency and potentially fraudulent practices.

This image is property of socialsellingnews-prod.s3.us-east-2.amazonaws.com.

Defence from FES Credit

FES Credit’s response to the accusations

FES Credit Repair has vehemently denied the allegations leveled against them. The company maintains that its marketing tactics are not deceptive and that all claims made about their services are accurate. FES Credit Repair asserts that they have worked diligently to assist customers in improving their credit scores and resolving their financial issues. The company contends that any dissatisfaction experienced by customers is not a result of their actions but rather the inherent challenges of the credit repair process.

Legal arguments presented by FES Credit

In defense of the accusations, FES Credit Repair has presented legal arguments supporting their position. They assert that their marketing materials and advertising campaigns comply with applicable regulations and industry standards. FES Credit Repair argues that they have operated in good faith, providing legitimate services to consumers looking to repair their credit. The company also asserts that any unauthorized charges are a result of administrative errors, and they have taken steps to rectify those instances promptly.

Public statements and communication from FES Credit

Throughout the duration of the lawsuit, FES Credit Repair has sought to maintain transparency and communicate their position to the public. They have released public statements addressing the allegations and emphasizing their commitment to their customers. FES Credit Repair has expressed their dedication to resolving any concerns and providing satisfactory outcomes for their clientele. They have vowed to continue improving their services and overcoming the challenges presented by the lawsuit.

Role of the Court in the Lawsuit

Procedure followed in the lawsuit

The FES Credit Repair Lawsuit has followed the standard legal procedures for such civil cases. The court received the initial complaint from the plaintiffs, which outlined the allegations against FES Credit Repair. Subsequently, the defendant, FES Credit Repair, was served with the lawsuit and given an opportunity to respond. The court then scheduled hearings and proceedings to review and analyze the evidence presented by both parties. Following this process, the court will proceed to make rulings and decisions based on the merits of the case.

Rulings and decisions of the court

As the FES Credit Repair Lawsuit is ongoing, the court has not yet issued final judgments or decisions. However, interim rulings and decisions may have been made, such as the approval of class certification or the granting of procedural motions. These rulings guide the course of the lawsuit and indicate the court’s stance on various aspects of the case. The final rulings and decisions of the court will determine the outcome of the lawsuit, including potential damages or settlements.

Implications of the court’s decisions

The court’s decisions in the FES Credit Repair Lawsuit will have far-reaching implications for both the plaintiffs and FES Credit Repair. If the court finds in favor of the plaintiffs and substantiates the allegations against FES Credit Repair, the company may be held responsible for compensating the affected consumers. This could have significant financial ramifications and potentially impact FES Credit Repair’s ability to continue operating. Conversely, if the court rules in favor of FES Credit Repair, it will bolster the company’s defense and potentially restore some level of trust and credibility in their services.

This image is property of getoutofdebt.org.

Impacts of the Lawsuit on Consumers

Changes in services for existing customers

The FES Credit Repair Lawsuit has resulted in changes in the services provided to existing customers. As a direct response to the allegations and increased scrutiny, FES Credit Repair has implemented modifications to its programs and procedures. These changes aim to address the concerns raised by consumers, enhance transparency, and ensure compliance with applicable regulations. While these modifications may benefit existing customers, the impact on desired outcomes and credit repair effectiveness remains to be seen.

Impact on customers’ credit scores and financial futures

The FES Credit Repair Lawsuit has had a considerable impact on the credit scores and financial futures of affected customers. Many consumers who sought the services of FES Credit Repair did so with the expectation of improving their creditworthiness and securing better financial opportunities. However, the alleged misleading practices and ineffective results have dashed these hopes and potentially worsened the financial situations of these individuals. The lawsuit, therefore, represents not only a legal battle for compensation but a significant setback for the affected customers’ financial well-being.

Consumer rights under the Credit Repair Organizations Act

The Credit Repair Organizations Act (CROA) grants certain rights to consumers seeking credit repair services. This legislation aims to protect consumers from deceptive practices and ensure fair treatment within the credit repair industry. Under CROA, consumers have the right to receive a clear, written contract detailing the terms and conditions of the services provided by credit repair companies. Additionally, consumers have the right to cancel their contract within a specific timeframe without incurring penalties. The FES Credit Repair Lawsuit highlights the importance of consumer rights in the context of credit repair and the potential consequences of their violation.

Comparison with Past Lawsuits in Credit Repair Industry

Similarities and differences with previous lawsuits

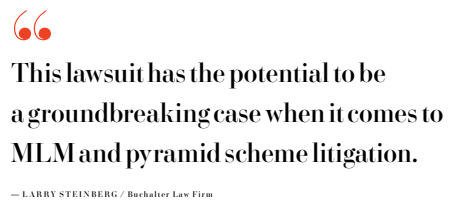

The FES Credit Repair Lawsuit shares several similarities with past litigation in the credit repair industry. Like previous lawsuits, it involves allegations of deceptive marketing tactics, false promises, and unauthorized charges. However, the FES Credit Repair Lawsuit stands out due to its scale and the potential impact on a large number of consumers. Additionally, while past lawsuits have resulted in settlements or judgments against credit repair companies, the ultimate outcome of the FES Credit Repair Lawsuit remains to be seen.

Precedents set in past lawsuits

Past lawsuits in the credit repair industry have set essential precedents for consumer protection and regulatory enforcement. These cases have highlighted the significance of accurate advertising, truthful claims, and transparent practices within the credit repair sector. Court rulings have reinforced the need for credit repair companies to operate in compliance with applicable laws and regulations, clearly defining the boundaries of permissible conduct. The FES Credit Repair Lawsuit will contribute further to the evolving body of case law and may shape future legal battles within the industry.

Trends in legal issues within the credit repair industry

Legal issues within the credit repair industry have been a recurring theme in recent years. The rise of misleading marketing techniques, unscrupulous practices, and unauthorized charges has resulted in heightened scrutiny from regulators and increased legal action. This trend reflects the importance of vigilant consumer protection measures and emphasizes the need for robust oversight to maintain the integrity of the credit repair industry. The FES Credit Repair Lawsuit is an example of the ongoing legal battles faced by credit repair companies and the urgency for industry-wide reform.

This image is property of fernandinaobserver.com.

Resolution and Outcome of the Lawsuit

Settlement terms

Given that the FES Credit Repair Lawsuit is ongoing, a final resolution has not yet been reached. However, settlements are a common outcome in such cases, as they provide a compromise for both parties involved. Settlement terms may include financial compensation for affected consumers, changes in business practices for FES Credit Repair, and potential penalties. The specific settlement terms will ultimately depend on the evidence presented, the court’s rulings, and negotiations between the parties.

Impact on FES Credit Repair’s business operations

The outcome of the FES Credit Repair Lawsuit will undoubtedly have a significant impact on the company’s business operations. If the court rules against FES Credit Repair, the financial implications of potential damages and settlements may severely hamper the company’s ability to continue operations as usual. Moreover, the damage to the company’s reputation and consumer trust may result in reduced customer subscriptions and limited expansion opportunities. Conversely, a favorable outcome for FES Credit Repair could help restore confidence and mitigate the negative impacts of the lawsuit on their business operations.

Lessons learnt for the credit repair industry

The FES Credit Repair Lawsuit serves as an important lesson for the credit repair industry as a whole. It highlights the consequences of deceptive practices and the need for transparency and accountability in providing credit repair services. Companies operating within the industry must recognize the potential legal and financial risks associated with misleading advertising, false promises, and unauthorized charges. By learning from the mistakes made in the context of the FES Credit Repair Lawsuit, credit repair companies can work towards rebuilding trust and prioritizing consumer protection.

Future Implications of the Lawsuit on Credit Repair Industry

Changes in regulations and oversight following the lawsuit

The FES Credit Repair Lawsuit is likely to result in changes to regulations and oversight within the credit repair industry. Regulatory bodies, such as the CFPB, may revise existing guidelines or introduce new ones to strengthen consumer protection measures. Increased scrutiny and enforcement actions are also anticipated, with regulators closely monitoring credit repair companies to ensure compliance. The lawsuit could serve as a catalyst for stricter regulations and a more comprehensive oversight framework within the industry.

Impacts on other credit repair companies

The FES Credit Repair Lawsuit is expected to have a ripple effect on other credit repair companies, particularly those with similar business practices. The outcome of the lawsuit and any resulting settlements or judgments will serve as a precedent for future cases and may shape legal expectations for the industry. Competitors will need to take note of the issues raised in the lawsuit and proactively address any shortcomings in their own practices to avoid similar legal entanglements.

Implications for consumers seeking credit repair services

The FES Credit Repair Lawsuit will likely lead to increased awareness among consumers seeking credit repair services. The publicity surrounding the case and the allegations made against FES Credit Repair may prompt potential customers to exercise caution and conduct thorough research before engaging with any credit repair company. Consumers are likely to be more vigilant about false promises, deceptive advertising, and unauthorized fees, and demand greater transparency and accountability from credit repair service providers. Ultimately, the FES Credit Repair Lawsuit may empower consumers and enhance industry standards for the benefit of all stakeholders.

In conclusion, the FES Credit Repair Lawsuit has brought to light significant issues within the credit repair industry. The allegations of deceptive marketing tactics, false promises, and unauthorized charges have raised concerns about the integrity of companies like FES Credit Repair. As the lawsuit progresses, the court’s rulings and decisions will determine the outcome and potential damages or settlements. Regardless of the final judgment, the lawsuit will have far-reaching implications for consumers seeking credit repair services, other credit repair companies, and the industry as a whole. The lessons learned from this lawsuit will hopefully contribute to enhanced regulations, better consumer protection, and increased transparency in the credit repair industry.

This image is property of www.directsellingnews.com.