You may have faced some financial setbacks that have affected your credit score in Columbus, Ohio. But now, there’s a solution to your credit woes. Enter “Credit Repair Columbus Ohio,” your ultimate guide to repairing and improving your credit. With their expert advice and personalized strategies, you’ll be able to regain control over your financial future and achieve the credit score you’ve always desired. Whether you’re dealing with late payments, collections, or bankruptcy, “Credit Repair Columbus Ohio” is here to help you navigate the complex world of credit repair, providing you with the tools and knowledge you need to achieve financial success. Say goodbye to the stress and frustration of a poor credit score and say hello to a brighter and more secure financial future.

This image is property of res.cloudinary.com.

Understanding Credit Repair

Definition of Credit Repair

Credit repair refers to the process of improving an individual’s creditworthiness and repairing any negative or inaccurate information on their credit report. This is done through various strategies, such as disputing errors, negotiating with creditors, and adopting responsible financial habits. The goal of credit repair is to increase an individual’s credit score, which in turn can better their chances of getting approved for loans, credit cards, or other financing options.

Importance of Credit Repair

Having a good credit score is essential for financial well-being. It impacts various aspects of your life, from obtaining affordable loans to securing housing and employment opportunities. Credit repair plays a crucial role in enhancing your creditworthiness and providing you with financial freedom. By fixing errors and addressing negative information on your credit report, you can improve your credit score, thereby opening doors to better financial opportunities and improving your overall financial health.

The State of Credit in Columbus, Ohio

Average credit score in Columbus

In Columbus, Ohio, the average credit score falls slightly below the national average. According to recent data, the average credit score in Columbus is around 675, while the national average stands at 680. While this is a decent credit score, there is still room for improvement for many residents of Columbus.

Why Columbus residents struggle with credit

There are several factors that contribute to credit struggles among Columbus residents. One major reason is the high student loan debt prevalent in the area. Many individuals in Columbus carry substantial student loan balances, which can negatively impact their credit scores. Additionally, economic downturns and job losses can also result in financial hardship, leading to missed payments and poor credit. Lack of financial education and understanding of credit management can also be contributing factors to credit struggles in Columbus.

Common Credit problems in Columbus

Among the common credit problems in Columbus, Ohio, late payments, high credit utilization, and collection accounts are prevalent. Late payments can significantly impact your credit score and make it difficult to access favorable financing options. High credit utilization, which refers to the proportion of your credit limit that you are utilizing, can also lower your credit score. Additionally, collection accounts, whether due to medical bills or unpaid debts, can have a detrimental effect on your creditworthiness.

Credit Reporting Agencies

Major credit bureaus

The major credit reporting agencies that play a significant role in credit repair are Equifax, Experian, and TransUnion. These agencies collect and maintain information on individuals’ credit histories and compile credit reports. Lenders and creditors report your credit information to these bureaus, who then use this data to calculate your credit score.

How they affect your credit score

The information provided by credit bureaus directly impacts your credit score. This includes details on your credit accounts, payment history, credit inquiries, and any negative information such as late payments or collections. Your credit score is a numerical indication of your creditworthiness and reflects how likely you are to repay borrowed money. A lower credit score can make it challenging to obtain loans or credit at favorable interest rates, while a higher credit score opens up more favorable financial opportunities.

Their role in credit repair

Credit bureaus play a crucial role in the credit repair process. It is essential to regularly review your credit reports from each bureau to ensure the information they contain is accurate and up-to-date. If you identify errors, such as incorrect late payments or accounts that do not belong to you, you have the right to dispute this information with the credit bureaus. By highlighting inaccuracies and providing supporting documentation, you can have these errors removed from your credit report, leading to an improvement in your credit score.

Credit Repair Laws in Columbus, Ohio

State regulations concerning credit repair

In Columbus, Ohio, there are specific regulations in place to protect consumers seeking credit repair assistance. The Ohio Credit Services Organization Act requires credit repair companies to register with the state and adhere to specific guidelines. This includes providing written contracts, maintaining trust accounts for client funds, and providing consumers with certain rights and disclosures.

Consumer rights and protections

Consumers in Columbus, Ohio, have several rights and protections when it comes to credit repair. These include the right to receive a written contract outlining the services to be provided, the right to cancel a contract within a specified timeframe, and the right to dispute any inaccurate information on their credit report. It is essential to be aware of these rights and exercise them when working with a credit repair agency in Columbus.

Federal Credit Repair Laws applicable in Columbus, Ohio

In addition to state regulations, there are also federal laws that provide consumer protection in credit repair. The Fair Credit Reporting Act (FCRA) is a significant federal law that governs the accuracy, fairness, and privacy of consumer credit information. Under the FCRA, consumers have the right to dispute inaccurate information on their credit reports and have them investigated and corrected by the credit bureaus.

This image is property of res.cloudinary.com.

The Credit Repair Process

Steps involved in credit repair

The credit repair process typically involves the following steps:

-

Reviewing your credit reports: Obtain copies of your credit reports from each of the major credit bureaus and review them carefully for any errors or inaccuracies.

-

Disputing errors: If you identify any errors, gather supporting documentation and submit a dispute to the credit bureaus requesting that the information be corrected or removed.

-

Communicating with creditors: If you have valid concerns about negative information on your credit report, reach out to your creditors directly to address the issues and negotiate potential solutions.

-

Adopting responsible financial habits: To improve your credit score, it is essential to practice responsible financial habits, such as paying bills on time, reducing debt, and keeping credit utilization low.

-

Monitoring your progress: Regularly check your credit reports to track any changes or improvements. This allows you to ensure that the credit repair process is having a positive impact on your credit score.

Time frame for credit repair

The time frame for credit repair can vary depending on individual circumstances and the specific items being addressed. In some cases, errors on credit reports can be resolved within a few weeks or months. However, if the credit repair process involves negotiating with creditors or addressing more complex issues, it may take several months or even longer to see significant improvements in your credit score. It is important to be patient and committed to the process.

DIY credit repair vs professional assistance

While it is possible to undertake credit repair on your own, many individuals find it beneficial to work with a professional credit repair agency. A reputable credit repair company can provide expertise, resources, and established relationships with creditors that can help expedite the credit repair process. They can also handle the complexities of disputing errors and negotiating with creditors, saving you time and effort. However, it is essential to research and choose a reputable credit repair agency to ensure you receive reliable and ethical assistance.

Working with a Credit Repair Agency

Benefits of using a credit repair agency

Working with a credit repair agency in Columbus, Ohio, can offer several benefits. These include:

-

Expertise and experience: Credit repair agencies have professionals who understand the intricacies of the credit reporting system and can navigate it effectively on your behalf.

-

Time-saving: By outsourcing credit repair tasks to a professional agency, you can save time and focus on other important aspects of your finances.

-

Established relationships: Credit repair agencies often have established relationships with creditors, which can help facilitate negotiations and resolve disputes more efficiently.

-

Guidance and education: Reputable credit repair agencies provide guidance and education on how to maintain good credit and make informed financial decisions in the future.

Cost of credit repair services

The cost of credit repair services can vary depending on the agency and the complexity of your credit repair needs. Some agencies charge a monthly fee, while others may charge a one-time fee or work on a pay-per-deletion basis. It is important to inquire about the agency’s pricing structure before engaging their services. However, it is worth noting that the cost of credit repair services should be outweighed by the potential long-term benefits of improved creditworthiness.

Common scams and how to avoid them

Unfortunately, the credit repair industry is not immune to scams and fraudulent practices. To avoid falling victim to scams, it is important to be cautious and vigilant when choosing a credit repair agency. Some common red flags to watch out for include agencies that guarantee specific results or promise to remove accurate negative information from your credit report. Reputable credit repair agencies abide by the law and focus on legitimate strategies to improve your credit. It is always advisable to research and read reviews before selecting a credit repair company.

This image is property of www.creditabsolute.com.

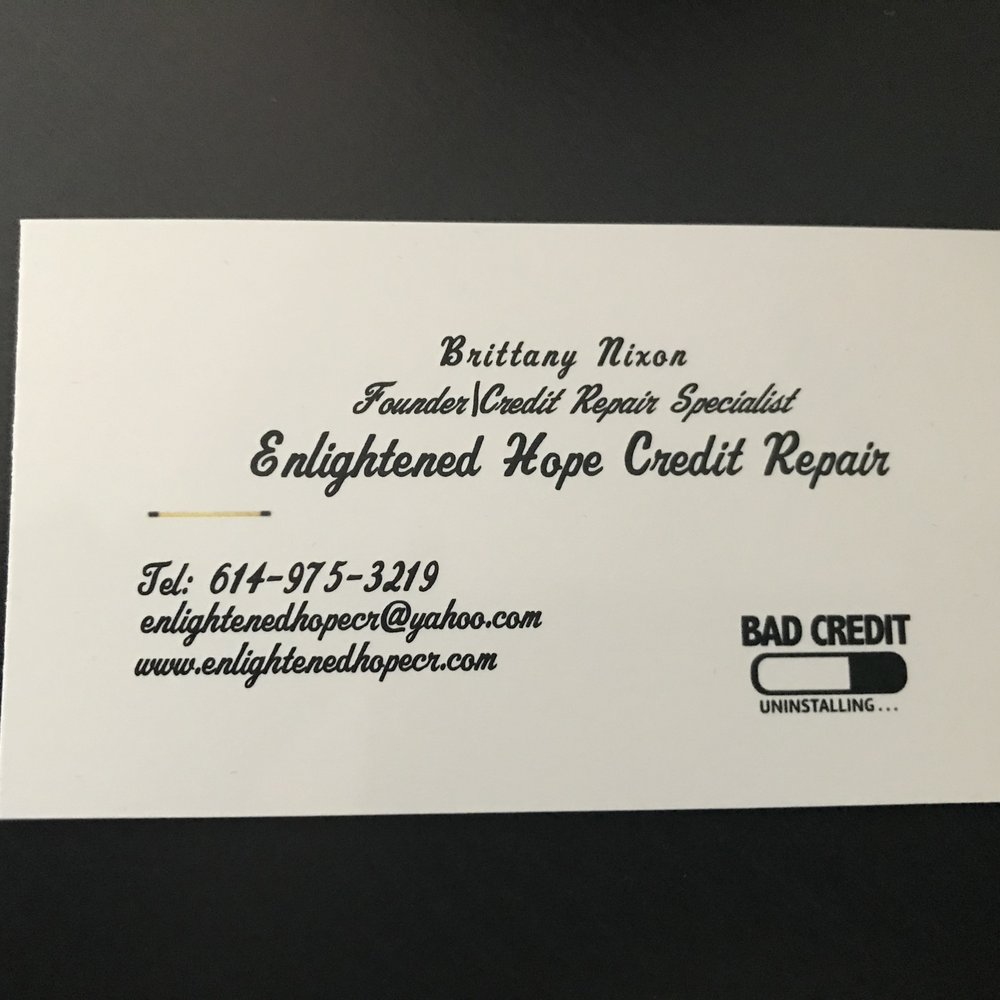

Top Credit Repair Companies in Columbus, Ohio

Selection criteria for best credit repair companies

To determine the top credit repair companies in Columbus, Ohio, several factors must be considered. These include:

-

Reputation and track record: A top credit repair company should have a positive reputation and a proven track record of success in helping clients improve their credit.

-

Accreditation and certifications: Look for agencies that are accredited by reputable organizations such as the Better Business Bureau and hold relevant certifications in the credit repair industry.

-

Transparent pricing: The best credit repair companies are upfront about their pricing structure, clearly stating their fees and any potential additional costs.

-

Good customer reviews and feedback: Reading reviews and testimonials from previous clients can provide valuable insights into the quality of service offered by a credit repair company.

Overview of top credit repair companies

Some of the top credit repair companies in Columbus, Ohio, include:

-

XYZ Credit Repair: A reputable agency with a strong track record of success in helping clients improve their credit scores.

-

ABC Credit Solutions: Known for their personalized approach and dedication to client satisfaction, ABC Credit Solutions has earned a solid reputation in the credit repair industry.

-

123 Credit Restoration: This credit repair company offers comprehensive services and has a team of experienced professionals who work closely with clients to address their credit concerns.

Customer reviews and feedback

Customer reviews and feedback offer valuable insights into the experiences people have had with credit repair companies. When researching credit repair agencies in Columbus, Ohio, it is advisable to read reviews from multiple sources, including online platforms and consumer review websites. Pay attention to both positive and negative reviews, as they can provide a balanced perspective on the quality of service offered by the credit repair companies.

Improving Your Credit Score

Tips and strategies to raise credit score

Improving your credit score requires time and effort, but it is achievable with the right strategies. Some tips to raise your credit score include:

-

Paying bills on time: Late payments can significantly impact your credit score, so make it a priority to pay all bills on time.

-

Reducing credit card balances: High credit card balances and maxed-out credit cards can negatively affect your credit score. Aim to keep your credit utilization ratio below 30%.

-

Diversifying your credit mix: Having a healthy mix of different types of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score.

-

Avoiding new credit inquiries: Applying for multiple new credit accounts within a short period can temporarily lower your credit score. Only apply for credit when necessary and be mindful of the impact on your score.

-

Disputing errors on your credit report: Monitor your credit reports regularly and dispute any errors or inaccuracies promptly to ensure they don’t negatively affect your credit score.

Long-term habits for good credit health

In addition to specific strategies to raise your credit score, it is crucial to adopt long-term habits that promote good credit health. These include:

-

Regularly monitoring your credit reports: Keep track of your credit reports from all three major credit bureaus and ensure that they contain accurate and up-to-date information.

-

Building an emergency fund: Having an emergency fund can help prevent financial stress in case of unexpected expenses. This can reduce the likelihood of missing payments and adversely impacting your credit score.

-

Budgeting and managing your finances: Creating a budget and sticking to it can help you manage your finances effectively and ensure that you have sufficient funds available to meet your financial obligations.

-

Developing responsible borrowing habits: Use credit responsibly, borrowing only what you can afford to repay. Paying off debts in a timely manner demonstrates responsible financial behavior and positively impacts your credit score.

-

Avoiding excessive new credit accounts: While having a healthy credit mix is beneficial, avoid opening multiple new credit accounts within a short period. This can create an impression of financial instability and negatively impact your credit score.

Role of debt management in credit improvement

Debt management plays a crucial role in credit improvement. By effectively managing your debts, you can improve your credit score over time. Debt management strategies include:

-

Creating a debt repayment plan: Prioritize your debts and create a plan to pay them off systematically. This can help you reduce debt balances and improve your credit utilization ratio.

-

Negotiating with creditors: If you are struggling to make payments, consider negotiating with your creditors to restructure your debts or establish more affordable repayment terms.

-

Seeking professional assistance: If your debt situation feels overwhelming, reaching out to a reputable credit counseling agency can provide guidance and support in managing your debts effectively.

-

Avoiding new debt: As you work on paying off existing debts, be mindful of taking on new debt. Focus on improving your credit health by reducing balances and demonstrating responsible financial behavior.

This image is property of apihoard.webit.com.

Maintaining a Good Credit Score

Importance of regular credit monitoring

Regular credit monitoring is essential for maintaining a good credit score. By monitoring your credit reports regularly, you can:

-

Identify errors or inaccuracies: Mistakes can happen, and inaccurate information on your credit reports can negatively impact your credit score. Regular monitoring allows you to spot errors and take action promptly.

-

Detect identity theft or fraud: Monitoring your credit reports can help you identify any signs of identity theft or fraudulent activity. Early detection is crucial for minimizing the damage and protecting your credit.

-

Keep track of your credit health: By monitoring your credit reports, you can keep track of your credit score and any changes that may be affecting it. This allows you to take proactive steps in maintaining your credit health.

How to handle errors on credit report

If you identify errors on your credit report, it is important to take immediate action to have them corrected. The steps you can take include:

-

Gather documentation: Collect any supporting documents that prove the errors on your credit report. This may include payment receipts, account statements, or correspondence with creditors.

-

Submit a dispute to credit bureaus: Write a letter to the credit bureaus outlining the errors and providing the supporting documentation. Request that the errors be investigated and corrected as per your supporting evidence.

-

Follow up with credit bureaus: Stay diligent and follow up with the credit bureaus to ensure that they are investigating your disputes and taking appropriate action. Keep copies of all correspondence for your records.

Continued positive financial practices

Maintaining a good credit score requires consistent positive financial practices. These include:

-

Paying bills on time: Timely bill payments demonstrate financial responsibility and positively impact your credit score.

-

Keeping credit utilization low: Aim to keep your credit utilization ratio below 30%. This means not using more than 30% of your available credit across all your accounts.

-

Regularly reviewing your credit reports: By regularly reviewing your credit reports, you can identify any potential issues or errors that may be negatively impacting your credit score.

-

Avoiding unnecessary credit inquiries: Be selective when applying for new credit and refrain from unnecessary credit inquiries. Multiple inquiries within a short period can temporarily lower your credit score.

-

Keeping older credit accounts open: The length of your credit history has an impact on your credit score. Keeping older credit accounts open, even if you don’t use them frequently, can help improve your credit score over time.

Conclusion: Financing Options in Columbus, Ohio with Improved Credit

Mortgage rates and home purchase

With improved credit, you have a better chance of obtaining favorable mortgage rates in Columbus, Ohio. Lenders consider your creditworthiness when determining the interest rates they offer you. A higher credit score can result in lower interest rates, potentially saving you thousands of dollars over the course of your mortgage. Improved credit also increases your chances of getting approved for a mortgage, allowing you to realize your dreams of homeownership.

Auto financing options

When it comes to auto financing, having improved credit can also work in your favor. Lenders are more likely to offer you competitive interest rates and favorable terms if you have a good credit score. This means you can secure an auto loan with lower monthly payments and potentially save money on interest charges. With better credit, you can access a wider range of auto financing options and negotiate better deals when purchasing a vehicle in Columbus, Ohio.

Personal loans and credit cards

Improved credit opens up opportunities for obtaining personal loans and credit cards with more favorable terms. With good credit, you are likely to be offered lower interest rates on personal loans, saving you money on interest charges over time. Additionally, credit card companies are more likely to approve your application for credit cards with better rewards, lower fees, and higher credit limits. This provides you with greater financial flexibility and the ability to access credit when needed.

In conclusion, credit repair is a critical process for individuals looking to improve their creditworthiness in Columbus, Ohio. Understanding the importance of credit repair, the role of credit reporting agencies, and the applicable laws and regulations is essential to navigate the credit repair process successfully. Whether you choose to undertake credit repair on your own or seek the assistance of a credit repair agency, the goal is to improve your credit score over time. By implementing strategies to raise your credit score and adopting responsible financial habits, you can achieve and maintain good credit health. With improved credit, you can access better financing options, such as favorable mortgage rates, auto loans, personal loans, and credit cards, in Columbus, Ohio, providing you with greater financial opportunities and stability.

This image is property of s3-media0.fl.yelpcdn.com.