Are you struggling with a low credit score and feeling overwhelmed by the process of repairing it? Look no further than “60 Day Credit Repair” – the ultimate solution to your credit woes. This comprehensive program is designed to help you rebuild your credit in just 60 days, providing you with the tools and guidance you need to improve your financial standing. Say goodbye to the frustration of denied loan applications and hello to a brighter financial future with “60 Day Credit Repair”.

Understanding Credit Repair

Basics of credit repair

credit repair is the process of improving your credit score and repairing any negative marks on your credit report. It involves taking steps to address errors, dispute inaccurate information, and develop good credit habits. By doing so, you can increase your chances of being approved for loans, getting better interest rates, and overall enjoying a healthier financial position. Understanding the basics of credit repair is crucial in order to take control of your credit and improve your financial future.

Why credit repair is necessary

Credit repair is necessary because your credit score plays a significant role in your financial life. It is a numeric representation of your creditworthiness and it affects your ability to obtain credit, get approved for rental applications, and even secure employment or insurance. If you have a low credit score due to errors or negative marks on your credit report, it can be challenging to achieve your financial goals. By repairing your credit, you can enhance your creditworthiness and open doors to better financial opportunities.

How credit repair works

Credit repair works by systematically addressing issues that are negatively impacting your credit score. This can involve several steps, such as reviewing your credit report for errors, disputing inaccurate information with credit bureaus, and establishing positive credit habits. It’s important to note that credit repair is not an overnight process, but by committing to a well-thought-out plan, you can gradually and consistently improve your credit score. With patience, persistence, and the right strategies, you can successfully repair your credit and achieve better financial stability.

Evaluating Your Credit Score

How to check your credit score

Before embarking on the credit repair journey, it’s important to check your credit score to understand where you stand. There are several ways you can access your credit score, including through free credit score services, your credit card companies, or credit monitoring services. Once you have access to your credit score, take the time to review it thoroughly and make note of any negative or inaccurate information.

Interpreting your credit score

Understanding how to interpret your credit score is essential in evaluating your creditworthiness. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. A score above 700 is generally considered good, while a score below 600 may be categorized as poor. Different lenders may have different criteria for what they consider a good credit score, so it’s important to be aware of the specific requirements of the loans or credit you are seeking.

Factors affecting your credit score

Several factors contribute to determining your credit score. These include your payment history, credit utilization ratio, length of credit history, credit mix, and new credit applications. Payment history carries the most weight, accounting for approximately 35% of your credit score. Late payments, defaults, or collections can significantly impact your score. Credit utilization ratio, which is the percentage of your available credit that you are using, also plays a crucial role. It is recommended to keep your credit utilization below 30% to maintain a healthy score. Understanding the factors that affect your credit score will help you identify areas for improvement and prioritize your credit repair efforts.

Identifying Credit Report Errors

Understanding a credit report

A credit report is a detailed record of your credit history and financial activities. It includes information about your credit accounts, payment history, outstanding debts, and any negative marks such as collections or bankruptcies. It is essential to understand the layout and contents of your credit report as it serves as the basis for your credit score. Reviewing your credit report regularly will allow you to spot any errors or inaccuracies that need to be addressed during the credit repair process.

Common credit report errors

Credit report errors are more common than you might think, and they can significantly impact your credit score. Some common errors include incorrect personal information, accounts that do not belong to you, inaccurate payment history, and outdated or duplicate accounts. These errors might be due to mistaken identity, outdated information, or even identity theft. Identifying these errors is crucial to ensure that your credit report is an accurate reflection of your financial history.

How to spot errors in your credit report

To spot errors in your credit report, you need to carefully review each section and compare the information with your own records. Look for any discrepancies in account balances, payment history, or personal details. Pay close attention to any outstanding debts that have been paid off or incorrect dates of late payments. If you come across any discrepancies, make a note of them and gather any supporting documentation that can help you in the dispute process. Being thorough in reviewing your credit report is vital to ensure that any errors are promptly addressed and corrected.

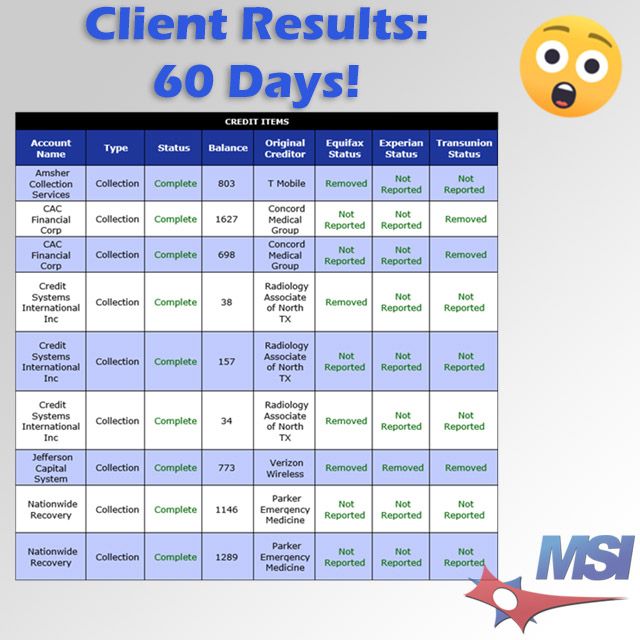

Disputing Credit Report Errors

Filing a dispute with credit bureaus

Once you have identified errors in your credit report, the next step is to file a dispute with the credit bureaus. You can initiate a dispute online, by mail, or through phone depending on the credit bureau’s preferred method. When filing a dispute, clearly state the errors you discovered and provide supporting documentation to back up your claims. The credit bureaus are required to investigate the disputed item within 30 days and inform you of the resolution.

What to do if the dispute is not resolved

If the dispute is not resolved to your satisfaction, you have the right to escalate the issue. You can send a follow-up letter to the credit bureau, including any additional evidence or explaining why you believe the resolution is incorrect. If you have evidence that proves the disputed item is inaccurate, consider reaching out to the data furnisher, such as a creditor or collection agency, to request that they update the information with the credit bureau. It’s important to persist in your efforts until the issue is resolved, as it can have a significant impact on your credit score and overall financial well-being.

Following up on credit dispute

After filing a dispute, it is essential to follow up on the progress and ensure that the credit bureaus have made the necessary corrections. Review your credit report regularly to confirm that the errors have been rectified. Keep copies of all correspondence and document any changes made to your credit report. By diligently following up on credit disputes, you can ensure that your credit report accurately reflects your financial history and maximize your chances of achieving a better credit score.

Building a 60 Day Plan

Creating a credit repair schedule

Building a 60-day plan is instrumental in helping you stay organized and focused on improving your credit. Start by creating a schedule that outlines specific tasks and goals for each day or week. Allocate time to review your credit report, identify errors, gather necessary documentation, file disputes, and monitor progress. Breaking down the process into smaller, manageable steps will make it less overwhelming and increase your chances of successfully repairing your credit within the 60-day timeframe.

Setting realistic goals

When building a 60-day credit repair plan, it’s important to set realistic goals. Understand that credit repair is a gradual process and improvements may not happen overnight. Instead of aiming for a perfect credit score within 60 days, focus on achievable goals such as resolving specific errors, paying off outstanding debts, or improving your credit utilization ratio. By setting small, attainable goals, you can build momentum and maintain motivation throughout the credit repair journey.

Monitoring progress

Consistently monitoring your progress is essential to gauge the effectiveness of your credit repair efforts. Keep track of any changes made to your credit report, such as corrected errors, increased credit limits, or decreased outstanding balances. Utilize credit monitoring services or regularly check your credit score to get a clear picture of how your credit is improving over time. By monitoring your progress, you can stay motivated and make necessary adjustments to your credit repair plan if needed.