In today’s world, financial challenges can sometimes lead to bankruptcy, leaving individuals feeling trapped and overwhelmed. However, there is a glimmer of hope in the form of companies that specialize in removing bankruptcies from credit reports. These companies offer a lifeline to those seeking a fresh start, assisting individuals in repairing their credit and regaining control over their financial future. By working with these professionals, you can unlock opportunities that seemed out of reach and rebuild your creditworthiness with confidence. Discover the power of companies that remove bankruptcies and open the door to a brighter financial tomorrow.

Understanding Bankruptcy Removal

Bankruptcy removal refers to the process of removing bankruptcies from credit reports. When someone files for bankruptcy, it is recorded on their credit report, which can have a significant negative impact on their creditworthiness. The process of bankruptcy removal involves legally disputing the accuracy of the bankruptcy information and having it removed from the credit report. This can help individuals improve their credit scores and financial standing.

Importance of removing bankruptcies from credit reports

Removing bankruptcies from credit reports is crucial for several reasons. Firstly, bankruptcies have a long-lasting negative impact on credit scores. They can severely limit the individual’s ability to secure loans, mortgages, or credit cards. By removing bankruptcies from the credit report, individuals can have a fresh start and rebuild their creditworthiness.

Additionally, most lenders and financial institutions consider bankruptcies on credit reports as a red flag. It may lead to higher interest rates, stricter terms, or even denials when applying for credit. By removing bankruptcies, individuals can enhance their chances of obtaining favorable loan and credit terms in the future.

Furthermore, bankruptcies can create a stigma in financial matters. Potential employers, landlords, and even insurance providers may review credit reports as part of their decision-making process. Removing bankruptcies can help individuals present a more positive financial image, opening doors to better opportunities and reduced discrimination.

The role of credit repair companies in bankruptcy removal

Credit repair companies play a crucial role in assisting individuals with bankruptcy removal. These companies are specialized in understanding the intricacies of credit reports and the legal framework surrounding them. They provide expertise, guidance, and representation to individuals seeking to have bankruptcies removed from their credit reports.

Credit repair companies have a deep understanding of the Fair Credit Reporting Act (FCRA), the legal foundation governing credit reporting agencies. They leverage their knowledge of consumer rights, credit dispute processes, and legal requirements to navigate the complexities of bankruptcy removal. By partnering with credit repair companies, individuals can increase their chances of successful bankruptcy removal and improve their financial future.

Legal Rights Pertaining to Bankruptcy Removal

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the activities of credit reporting agencies (CRAs) and promotes fair and accurate credit reporting. Under the FCRA, individuals have the right to dispute inaccurate or incomplete information on their credit reports, including bankruptcies. This includes the right to have the bankruptcies completely removed if they are proven to be inaccurate or misleading.

Rights of consumers under FCRA

Consumers have several rights under the FCRA when it comes to bankruptcy removal. They have the right to receive a free copy of their credit report annually from each of the major credit reporting agencies. This provides individuals with the opportunity to review their credit reports for inaccuracies or outdated information.

If bankruptcies are found to be inaccurate or incomplete, consumers have the right to dispute them with the credit reporting agency. The agency then has a legal obligation to investigate the disputed information and correct or remove it if necessary. Consumers also have the right to add a statement to their credit report explaining any disputes or inaccuracies.

How FCRA affects bankruptcy removal

The FCRA provides a legal framework for individuals to challenge bankruptcies on their credit reports. It ensures that credit reporting agencies are accountable for the accuracy and fairness of the information they report. Through the FCRA, individuals can exercise their rights to dispute bankruptcies, which can lead to their removal if successfully proven to be inaccurate.

Credit repair companies, well-versed in the FCRA, can assist individuals in understanding their rights and navigating the legal requirements involved in bankruptcy removal. They can help individuals prepare the necessary documentation, communicate with credit reporting agencies, and advocate for their rights throughout the process.

The Process of Bankruptcy Removal

Preliminary evaluation of credit report

The first step in the process of bankruptcy removal is to conduct a thorough evaluation of the individual’s credit report. This involves reviewing the credit report for inaccuracies, outdated information, or any discrepancies related to the bankruptcy filing. It is important to ensure that all the information included in the bankruptcy record is consistent and correct.

Filing for credit dispute

Once potential inaccuracies or inconsistencies related to the bankruptcy filing are identified, the next step is to file a credit dispute with the credit reporting agency. This can be done online, by mail, or through the credit repair company acting on behalf of the individual. The dispute should include detailed documentation and evidence that supports the claim of inaccuracy or incorrect information.

The credit reporting agency then has a legal obligation to investigate the dispute within a specific timeframe, usually 30 days. During the investigation, the agency will reach out to the relevant creditors and legal entities involved in the bankruptcy to verify the accuracy of the information. If the information cannot be verified, the agency is obligated to correct or remove it from the credit report.

The time frame for bankruptcy removal

The time frame for bankruptcy removal varies depending on the complexity of the case and the responsiveness of the credit reporting agency. Typically, the investigation and resolution process can take anywhere from 30 to 90 days. It is important to note that the credit reporting agency may require additional documentation or evidence to support the dispute, which could extend the timeline.

During the process, it is crucial to maintain open communication with the credit reporting agency and ensure all requested information is promptly provided. Individuals should also keep track of all correspondence and document any relevant interactions or updates throughout the bankruptcy removal process.

Companies That Specialize in Bankruptcy Removal

Overview of credit repair companies

Credit repair companies are organizations that specialize in assisting individuals in improving their credit scores and resolving credit report issues. They work closely with individuals to identify and dispute inaccuracies, including bankruptcies, on their credit reports. Credit repair companies often have expertise in navigating the legal frameworks, such as the FCRA, and have established relationships with credit reporting agencies.

Specialization in bankruptcy removal

Many credit repair companies offer specialized services in bankruptcy removal. They have in-depth knowledge of the specific laws, regulations, and procedures involved in challenging bankruptcies on credit reports. These companies understand how to gather the necessary evidence, prepare legal documentation, and effectively communicate with credit reporting agencies to advocate for their clients.

When selecting a credit repair company for bankruptcy removal, it is essential to choose one that has a proven track record in successfully removing bankruptcies. Researching the company’s reputation and success rates in bankruptcy removal cases is crucial in ensuring the best possible outcome.

Services offered by these companies

Credit repair companies offer a range of services to assist individuals with bankruptcy removal. These services typically include a comprehensive evaluation of the individual’s credit report, identification of inaccuracies or discrepancies, and the preparation and filing of credit disputes. The companies utilize their expertise and knowledge of the FCRA to navigate the complexities of the process.

Additionally, credit repair companies often provide ongoing support and guidance throughout the bankruptcy removal process. They help individuals gather the necessary documentation, respond to credit reporting agency inquiries, and track the progress of the dispute. Some companies may also offer educational resources and tools to help individuals understand credit management and engage in proactive financial planning.

Evaluating the Credibility of Bankruptcy Removal Companies

Credentials and accreditation

When considering a credit repair company for bankruptcy removal, it is important to evaluate their credentials and accreditation. Reputable companies often have credentials from recognized industry associations, such as the National Association of Credit Services Organizations (NACSO) or the Ethical Credit Repair Alliance (ECRA). These credentials indicate that the company adheres to ethical standards and best practices in credit repair.

Additionally, it is advisable to research the company’s history, including how long they have been in operation and any notable achievements or recognitions they have received. Reading online reviews, testimonials, or client feedback can also provide insights into the credibility and reliability of the company.

Service reviews and consumer feedback

Feedback from previous clients is a valuable resource for evaluating the credibility of bankruptcy removal companies. Reading reviews and testimonials can provide an understanding of the company’s success rates, customer satisfaction levels, and the overall experience of working with them. Positive reviews and recommendations from clients who have successfully had bankruptcies removed can indicate the company’s effectiveness and trustworthiness.

It is important to consider both positive and negative reviews and weigh them against each other. Some negative reviews may be isolated incidents, while others may reveal patterns or recurring issues. Taking the time to thoroughly research and evaluate consumer feedback can help individuals make an informed decision when selecting a bankruptcy removal company.

Comparison with other credit repair companies

Comparing different bankruptcy removal companies can offer insights into their credibility and effectiveness. It is beneficial to research multiple companies, considering factors such as their success rates in bankruptcy removal, the expertise of their staff, their pricing structure, and the level of customer support they provide. Comparing the features, services, and reputation of different companies can help individuals make a well-informed decision.

It is crucial to remember that each individual’s situation is unique, and what works for one person may not work for another. Finding a bankruptcy removal company that aligns with the individual’s specific needs and goals is key to achieving the best possible outcome.

Cost of Service for Bankruptcy Removal

Pricing structure of bankruptcy removal

The cost of bankruptcy removal services varies among credit repair companies. The pricing structure may involve an initial setup fee, followed by monthly fees for the duration of the services. Some companies may charge a flat fee for the entire process, while others offer tiered pricing based on the complexity of the case or the desired level of service.

It is important for individuals to inquire about the pricing structure upfront and understand what is included in the fees. Transparent credit repair companies will provide a breakdown of the costs and clearly explain what services are covered. It is advisable to compare the pricing structures of different companies to ensure a fair and competitive price for bankruptcy removal services.

Financial commitment and value for money

When considering the cost of bankruptcy removal services, individuals should assess the financial commitment required and weigh it against the potential benefits. While there is a cost associated with professional assistance, successfully removing bankruptcies from credit reports can have a significant positive impact on creditworthiness and financial opportunities.

Individuals should evaluate their financial situation, future goals, and the potential savings or advantages gained from improved credit scores. A carefully considered financial investment in bankruptcy removal services can be a worthwhile long-term strategy for achieving financial stability and accessing favorable lending terms.

Payment options available

Credit repair companies often offer various payment options to accommodate individual preferences. Depending on the company, individuals may have the option to pay the fees upfront or in installments. Some companies may offer flexible financing options, and others may provide discounts for paying in full or for referring new clients.

It is recommended that individuals discuss and clarify the payment options with the bankruptcy removal company before making a decision. Clear communication regarding payment terms and any potential additional charges is crucial to ensure a smooth and transparent financial arrangement.

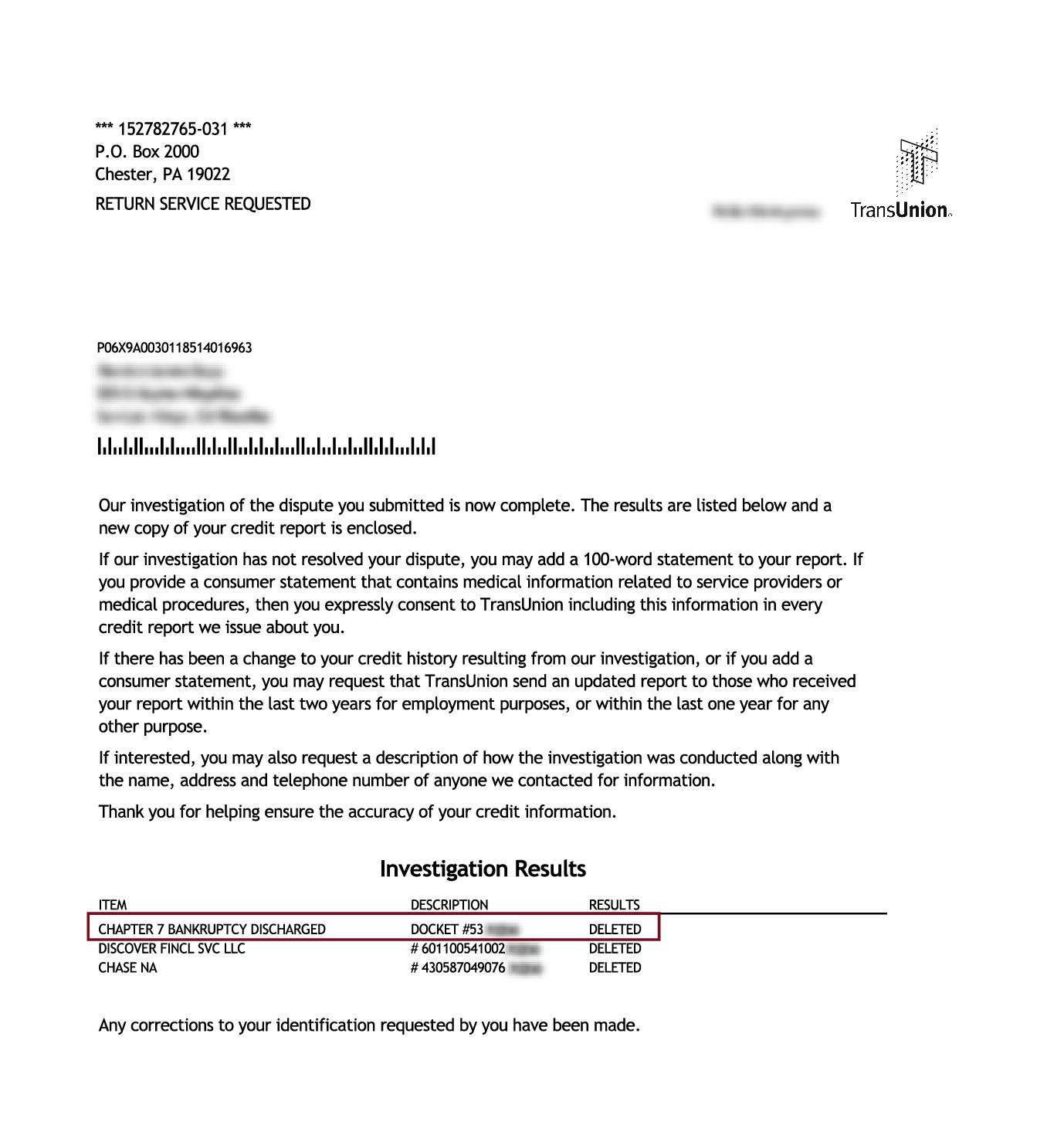

Case Studies of Successful Bankruptcy Removal

Presenting real-life experiences

Examining real-life case studies can provide valuable insights into the effectiveness and impact of bankruptcy removal. Case studies offer concrete examples of individuals who have successfully navigated the bankruptcy removal process with the assistance of credit repair companies. These stories can illustrate the potential outcomes and benefits of pursuing bankruptcy removal.

By presenting case studies, individuals can understand different scenarios, challenges, and successes in bankruptcy removal. Case studies also illustrate the potential improvements in credit scores and the long-term financial impact of successfully removing bankruptcies.

Impact on credit scores after bankruptcy removal

Removing bankruptcies from credit reports can have a positive impact on credit scores. Bankruptcies are one of the most damaging entries on a credit report and can significantly lower credit scores. By eliminating bankruptcies, individuals can improve their credit utilization ratio, reduce the negative effect on payment history, and enhance their overall creditworthiness.

The extent of the impact on credit scores may vary depending on the individual’s overall credit history and the presence of other negative marks on the credit report. However, removing bankruptcies provides a solid foundation for rebuilding credit and improving credit scores over time.

Timeline of credit score recovery

Recovering credit scores after bankruptcy removal is a gradual process that requires time, disciplined financial behavior, and positive credit usage. While bankruptcy removal can immediately improve credit scores by eliminating the negative impact of the bankruptcies, it is important to continue practicing responsible credit management.

With consistent and responsible credit habits, individuals can see a gradual increase in their credit scores over time. This may include making timely payments, keeping credit utilization low, diversifying credit types, and regularly reviewing credit reports for inaccuracies or discrepancies. The timeline for credit score recovery varies depending on individual circumstances and credit management practices.

Consequences of Failing to Remove Bankruptcies

Potential difficulties in securing loans

Failing to remove bankruptcies from credit reports can result in significant difficulties when seeking loans or credit. Lenders and financial institutions often view bankruptcies as a high risk factor, which can lead to denials or higher interest rates. The presence of a bankruptcy on a credit report can indicate a history of financial instability, making lenders hesitant to extend credit.

By not addressing bankruptcies, individuals may find it challenging to secure loans for major purchases such as a home or a vehicle. Even if approval is granted, individuals may face unfavorable terms and conditions, resulting in higher costs over time. Removing bankruptcies can strengthen financial eligibility and increase the chances of obtaining favorable loan terms.

Long-term effects on creditworthiness

Bankruptcies can have long-term effects on creditworthiness if they are not removed from credit reports. They can stay on credit reports for up to 10 years, depending on the type of bankruptcy filed. During that time, the bankruptcies continue to impact credit scores and financial opportunities.

The long-term effects of bankruptcies can result in limited access to credit, reduced credit limits, and higher interest rates. This can hinder individuals’ ability to achieve financial goals such as purchasing a home, starting a business, or accessing competitive rates for insurance. Removing bankruptcies is crucial in improving creditworthiness and enabling individuals to pursue their financial aspirations.

Stigmatization in financial matters

Bankruptcies on credit reports can subject individuals to stigmatization in financial matters. Potential employers, landlords, and insurance providers may review credit reports as part of their evaluation process. The presence of bankruptcies can create a perception of financial irresponsibility, leading to potential disadvantages or discrimination.

By removing bankruptcies, individuals can present a more positive financial image and mitigate the stigma associated with bankruptcies. This can lead to greater opportunities in employment, housing, and insurance, as it demonstrates a commitment to financial responsibility and rebuilding creditworthiness.

Do-It-Yourself Versus Hiring a Professional Company

Pros and cons of doing it yourself

Removing bankruptcies from credit reports can be done by individuals themselves, but it requires a deep understanding of credit reporting laws, dispute processes, and the nuances of credit reports. Some individuals may choose the DIY approach to save costs or gain a better understanding of credit management.

The main advantage of DIY bankruptcy removal is the potential cost savings. Individuals can dispute bankruptcies directly with credit reporting agencies and have control over the process. However, it is important to note that without professional expertise and guidance, individuals may face challenges in gathering supporting evidence, navigating legal requirements, and effectively advocating their case.

Advantages of leveraging on professional expertise

Hiring a professional credit repair company offers several advantages when it comes to bankruptcy removal. These companies have a deep understanding of credit reporting laws, dispute processes, and the nuances of credit reports. They can leverage their expertise to handle the complexities of bankruptcy removal and increase the chances of successful outcomes.

Professional companies also provide guidance and support throughout the entire process. They offer a level of experience and knowledge that can expedite the removal process and ensure compliance with legal requirements. Additionally, credit repair companies often have established relationships and direct lines of communication with credit reporting agencies, facilitating smoother interactions and resolutions.

Considerations before making a decision

Before deciding whether to pursue DIY bankruptcy removal or hire a professional company, individuals should carefully consider their expertise, available time, and desired outcomes. DIY removal may be suitable for individuals who feel confident in navigating the credit reporting system and have the time and resources to dedicate to the process.

On the other hand, hiring a professional credit repair company may be the best option for individuals who want professional expertise, guidance, and convenience. It is important to research and select a reputable company that specializes in bankruptcy removal, assess the potential costs, and consider the potential benefits and impact on creditworthiness.

Future Prospects After Bankruptcy Removal

Rebuilding credit score post-bankruptcy removal

After successful bankruptcy removal, individuals have the opportunity to rebuild their credit scores gradually. By practicing responsible credit management, they can establish a positive credit history and improve their creditworthiness over time. This may involve making timely payments, keeping credit utilization low, and refraining from taking on excessive debt.

It is important to remember that credit score improvement is a gradual process. It requires patience, discipline, and continued positive credit habits. By focusing on sound financial management practices and leveraging the lessons learned from past experiences, individuals can steadily rebuild their credit scores and regain financial stability.

Maintaining a clean credit report

Maintaining a clean credit report is crucial even after bankruptcy removal. Regularly reviewing credit reports for inaccuracies, monitoring credit activity, and promptly addressing any issues that arise is essential in preventing future negative marks. By staying proactive and vigilant, individuals can ensure the accuracy and integrity of their credit reports.

Additionally, it is beneficial to engage in responsible credit behavior and avoid the factors that led to bankruptcy in the first place. This may include living within means, budgeting effectively, and seeking financial advice when needed. By maintaining a clean credit report and practicing responsible financial habits, individuals can enhance their long-term financial prospects.

Financial planning for a bankruptcy-free future

Bankruptcy removal provides individuals with a fresh start and an opportunity to create a bankruptcy-free future. It is essential to engage in comprehensive financial planning to avoid future financial hardships and minimize the chances of facing similar circumstances. This may involve creating a budget, establishing emergency funds, and seeking guidance from financial professionals or credit counselors.

Financial planning should also include setting realistic goals, tracking progress, and continuously reassessing and adapting financial strategies as circumstances change. By taking proactive steps and making informed financial decisions, individuals can build a secure and stable financial future, free from the burden of bankruptcy.

In conclusion, understanding bankruptcy removal is crucial for individuals seeking to improve their creditworthiness and achieve financial stability. Removing bankruptcies from credit reports involves careful evaluation, engaging the services of credit repair companies, and leveraging legal rights such as those granted by the Fair Credit Reporting Act. By working with reputable companies, individuals can navigate the complexities of bankruptcy removal, rebuild their credit scores, and plan for a promising future.