If you’re looking for a reliable and efficient credit repair service, look no further than “Total Control Credit Reviews.” With their expertise and dedication, they have gained a reputation for delivering exceptional results and helping individuals take control of their credit scores. Through this article, you will gain valuable insights into the experiences of their satisfied customers, highlighting the effectiveness of Total Control Credit Reviews in transforming financial lives.

Understanding Total Control Credit

Definition of Total Control Credit

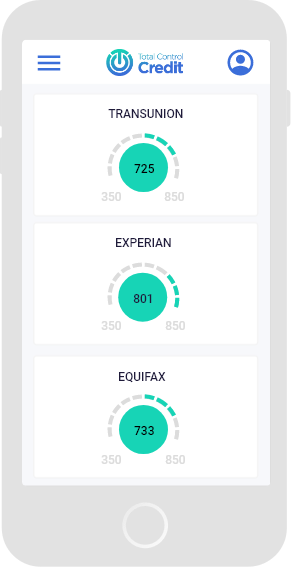

Total Control Credit is a credit monitoring service that provides individuals with tools and resources to manage their credit effectively. It allows you to monitor your credit score, track changes, and detect any suspicious activity that may indicate identity theft.

Features of Total Control Credit

Total Control Credit offers several features to help you stay on top of your credit. These include credit score tracking, identity theft protection, convenient account management, and up-to-date credit reports. With these features, you can have peace of mind knowing that your credit is being monitored and that you have access to important information about your financial standing.

How Total Control Credit Operates

Total Control Credit operates by connecting with credit bureaus and gathering information about your credit history. It analyzes this data and provides you with insights and alerts regarding any changes or potential issues. Through its user-friendly interface, you can access detailed reports, track your credit score over time, and take necessary actions to improve your credit.

Benefits of Total Control Credit

Helps in Credit Score Tracking

One of the primary benefits of Total Control Credit is its ability to track your credit score. By monitoring your credit score regularly, you can quickly identify any significant changes and take appropriate steps to address them. This feature is valuable, as it enables you to maintain a good credit score, which is essential for securing loans, obtaining favorable interest rates, and even potential employment opportunities.

Offers Identity Theft Protection

In today’s digital world, the risk of identity theft is a constant concern. Total Control Credit helps protect you from identity theft by monitoring your credit for any suspicious activity. If it detects any unusual transactions or changes to your credit report, it will notify you immediately so that you can take action to prevent further damage. This proactive approach to identity theft protection can save you time, money, and stress.

Convenient Account Management

Total Control Credit provides users with convenient account management tools. You can easily access and view your credit reports, track your credit score progress, and update personal information. Additionally, you can set up alerts for specific events, such as when your credit score reaches a certain threshold or when a new account is opened in your name. These convenient features empower you to take control of your credit and make informed decisions.

Provides Updated Credit Reports

With Total Control Credit, you have access to updated credit reports on a regular basis. This allows you to stay informed about the status of your credit and ensures that you have the most up-to-date information when making financial decisions. Having accurate credit reports is crucial, as they help you understand your creditworthiness and identify any errors or discrepancies that may need to be corrected.

Drawbacks of Total Control Credit

Can Be Expensive

One potential drawback of Total Control Credit is that it can be expensive compared to other credit monitoring services. While the price may vary depending on the plan you choose, the cost can add up over time. It’s important to consider your budget and compare Total Control Credit with other options to ensure that you are getting the best value for your money.

Limited Support Availability

Another drawback of Total Control Credit is the limited availability of customer support. Some users have reported difficulties in reaching a representative, which can be frustrating, especially when you need immediate assistance. Improved support availability and response times would enhance the overall user experience.

May Have Difficult Navigation On The Website

A common complaint from users is the difficulty in navigating the Total Control Credit website. Some users have found it challenging to find specific features or access their credit reports easily. Enhancements to the website’s user interface and navigation system would greatly improve the overall usability and customer experience.

Insights into User Reviews

General Sentiment from Users

Overall, user reviews of Total Control Credit are mixed. While some users have praised its credit monitoring capabilities and user-friendly interface, others have expressed frustration with the pricing and customer support. It’s important to consider these varying perspectives when making a decision about whether Total Control Credit is the right credit monitoring service for you.

Common Praises in Reviews

Users who have had positive experiences with Total Control Credit often commend its convenience and effectiveness in monitoring their credit scores. They appreciate the timely alerts and updates that provide them with valuable insights. Many also highlight the ease of use and the convenience of accessing their credit reports and managing their accounts.

Common Complaints in Reviews

Common complaints in user reviews revolve around the expensive pricing, limited availability of customer support, and difficulty in navigating the website. Some users feel that the cost of Total Control Credit does not justify the features and services it offers. Others express frustration with delays in receiving help from customer support or the inability to reach a representative when needed. The challenging website navigation has also been a source of frustration for users.

Pricing and Plans

Monthly Subscription Costs

Total Control Credit offers different subscription plans with varying costs. The prices typically range from $X to $Y per month, depending on the level of credit monitoring and additional features included in the plan. It’s important to carefully consider your budget and the specific features you require before selecting a plan.

Free Trial Possibilities

Total Control Credit occasionally offers free trial periods for new users. These trials allow individuals to experience the service and its features before committing to a subscription. Keep an eye out for any promotional offers or free trial periods to take advantage of this opportunity.

Cancellation Policies

Total Control Credit has specific cancellation policies in place. It’s important to review these policies before signing up for a subscription to understand the terms and conditions regarding cancellation and any associated fees. Being aware of the cancellation process can help you make an informed decision and avoid any unwanted charges in the future.

Customer Support

Availability of Customer Support

Total Control Credit offers customer support through various channels, including phone, email, and online chat. However, some users have reported difficulties in reaching a representative and experiencing delays in receiving assistance. It is essential to consider the availability and responsiveness of customer support when evaluating Total Control Credit as a credit monitoring service.

Quality of Customer Support

The quality of customer support provided by Total Control Credit has received mixed reviews. While some users have reported satisfactory experiences and prompt resolutions to their queries, others have expressed frustration with delayed responses and unhelpful support. The inconsistency in customer support quality is an aspect that Total Control Credit may need to address to improve overall customer satisfaction.

User Feedback on Customer Support

User feedback on customer support has varied. Some users have praised the knowledge and helpfulness of the support representatives they interacted with, while others have expressed disappointment with the response times and effectiveness of the support provided. It’s important to consider user feedback and reviews when assessing the level of customer support you can expect from Total Control Credit.

Security Measures

Data Protection Policies

Total Control Credit has strict data protection policies in place to safeguard your personal and financial information. These policies ensure that your data is handled securely and in compliance with applicable privacy laws. Understanding the data protection policies of a credit monitoring service is crucial for your peace of mind and the confidentiality of your information.

Safety of Personal Information

Total Control Credit prioritizes the safety of your personal information by implementing advanced security measures. These measures may include encryption, firewalls, and other protocols to protect your data from unauthorized access. While no system is entirely foolproof, Total Control Credit strives to maintain a high level of security to protect your personal information.

Instances of Data Breaches

There have been no reported instances of data breaches associated with Total Control Credit. This is a positive indication of the service’s commitment to maintaining the security and integrity of user data. However, it is always crucial to remain vigilant and take necessary precautions to protect your personal information.

Comparison with Other Credit Monitoring Services

How it Fares Against Competitors

Total Control Credit performs well when compared to other credit monitoring services, but it may not be the best option for everyone. Its features and functionality, along with its pricing, should be compared to those of its competitors to determine which service aligns best with your needs and preferences.

Unique Selling Points

Total Control Credit’s unique selling points include its user-friendly interface, credit score tracking features, and identity theft protection capabilities. These features, combined with timely alerts and convenient account management tools, set Total Control Credit apart from some of its competitors. Considering these unique selling points can help you determine whether Total Control Credit is the right choice for you.

Areas for Improvement Relative to Market Leaders

While Total Control Credit has several positive aspects, there are areas where it may need improvement relative to market leaders. Some of these areas include pricing transparency, customer support availability, and website navigation. Addressing these concerns would enable Total Control Credit to compete more effectively with market leaders and improve overall customer satisfaction.

The Sign-up Process

Step-by-Step Guide to Signing Up

The sign-up process for Total Control Credit is straightforward and typically involves the following steps:

- Visit the Total Control Credit website.

- Select the subscription plan that best suits your needs.

- Provide the necessary personal and financial information for account creation.

- Review and agree to the terms and conditions.

- Complete the payment process for your subscription.

- Access your Total Control Credit account and start monitoring your credit score.

Requirements for Account Creation

To create a Total Control Credit account, you will need to provide basic personal and financial information, such as your name, address, social security number, and payment details. This information is necessary to authenticate your identity and establish your account for credit monitoring purposes. It is crucial to ensure that the information provided is accurate and up to date.

Trial and Activation Process

If a free trial is available, you may be required to provide your payment information to activate the trial period. Once your trial period expires, your subscription will automatically be activated, and regular payments will commence. It’s important to review the trial and activation process to understand the terms and conditions associated with it.

Final Verdict on Total Control Credit

Is it Worth the Investment?

Determining whether Total Control Credit is worth the investment depends on your individual needs and preferences. If you value convenient credit score tracking, identity theft protection, and comprehensive credit reports, Total Control Credit may be worth considering. However, you should also take into account the pricing, availability of customer support, and user reviews before making a decision.

Who is it Best Suited For?

Total Control Credit is best suited for individuals who value convenience, simplicity, and comprehensive credit monitoring. If you are actively working on improving your credit score, staying informed about potential identity theft, or simply want to have a better understanding of your financial standing, Total Control Credit can be a valuable tool.

Summary of Strengths and Weaknesses

Total Control Credit offers several strengths, including credit score tracking, identity theft protection, convenient account management, and up-to-date credit reports. However, it does have weaknesses, such as potential high costs, limited customer support availability, and challenges with website navigation. Comparing its strengths and weaknesses against your specific needs will help you determine whether Total Control Credit is the right credit monitoring service for you.