Imagine having a comprehensive plan that not only helps you improve your credit score but also ensures financial success in every aspect of your life. Well, look no further as the Credit Firm Life Plan is here to bring you exactly that! This groundbreaking program is designed to not only repair and rebuild your credit, but also equip you with the tools and knowledge needed to achieve long-term financial stability. With the Credit Firm Life Plan, you can transform your credit and transform your life. Get ready to take control of your financial future like never before.

Understanding Credit Firm Life Plan

A Credit Firm Life Plan refers to a comprehensive financial strategy designed to help individuals and businesses effectively manage their finances, improve their credit score, and achieve their long-term financial goals. It involves working with professional credit firms who provide expert guidance and services tailored to individual needs. Understanding the importance of a Credit Firm Life Plan and its implications for individuals and businesses is crucial for making informed financial decisions and securing a stable financial future.

Definition of Credit Firm Life Plan

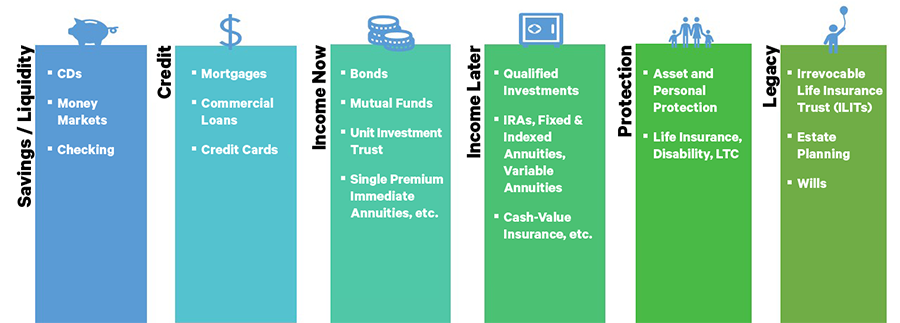

A Credit Firm Life Plan encompasses a range of services provided by credit firms to help individuals and businesses manage their finances. These services include financial advice, debt consolidation, credit repair, investment planning, and retirement planning. A Credit Firm Life Plan is essentially a roadmap that outlines financial goals, strategies for achieving those goals, and the steps individuals and businesses need to take to navigate their financial journey successfully.

Importance of Credit Firm Life Plan

A Credit Firm Life Plan holds significant importance for individuals and businesses for several reasons. Firstly, it helps in effective money management by providing a structured approach to budgeting, saving, and investing. With a well-constructed plan, individuals can prioritize their financial goals, track their expenses, and make informed decisions regarding their savings and investment choices.

Secondly, a Credit Firm Life Plan plays a vital role in improving credit scores. Credit firms assist in analyzing credit reports, identifying areas of improvement, and implementing strategies to enhance creditworthiness. This, in turn, opens up opportunities for individuals and businesses to access better loan terms, secure favorable interest rates, and expand their financial capabilities.

Thirdly, a Credit Firm Life Plan supports debt payment plans. Credit firms can help individuals and businesses consolidate their debts, negotiate with creditors, and establish a structured repayment plan. This relieves financial burdens and provides a clear path towards becoming debt-free.

Lastly, a Credit Firm Life Plan assists in savings and investment goals. By setting realistic financial goals and creating a tailored investment plan, individuals and businesses can work towards accumulating wealth and securing their future. Credit firms provide expert advice on investment opportunities, risk management, and asset allocation, ensuring that financial resources are allocated wisely.

Implications for individuals and businesses

For individuals, having a Credit Firm Life Plan can lead to improved financial stability, increased purchasing power, and a stronger credit profile. It enables them to take control of their finances, make informed decisions, and work towards achieving their long-term goals. With a solid plan in place, individuals can better navigate life events such as buying a home, starting a family, or planning for retirement.

For businesses, a Credit Firm Life Plan is equally important. It allows businesses to manage their finances effectively, handle debt obligations, and access capital for growth opportunities. By working closely with credit firms, businesses can optimize their financial resources, build a strong credit standing, and secure funding on favorable terms.

Factors Influencing Credit Firm Life Plan

Several factors influence the construction of a Credit Firm Life Plan. These factors must be carefully considered to ensure that the plan is tailored to individual circumstances and can effectively address specific financial challenges. Some of the key factors include:

Cost of living

The cost of living in a particular area significantly impacts an individual or business’s financial situation. Higher costs of living may require careful budgeting strategies and stricter financial management. Understanding the local cost of living is crucial when designing a Credit Firm Life Plan that aligns with financial goals.

Current credit score

An individual or business’s current credit score plays a crucial role in determining the available financial options and interest rates. Credit firms assess credit scores to develop a plan that can help individuals and businesses improve their creditworthiness. The current credit score sets the foundation for strengthening financial health and achieving long-term goals.

Prior financial commitments

Existing financial commitments, such as mortgages, loans, or credit card debts, influence the design of a Credit Firm Life Plan. Credit firms consider these commitments when creating a plan to ensure that individuals and businesses can effectively manage their debts, meet payment obligations, and work towards financial freedom.

Individual earning capacity

The level of income an individual or business generates influences the financial decisions and goals that can be realistically pursued. Credit firms take into account earning capacity when designing a Credit Firm Life Plan, ensuring that the plan aligns with the individual or business’s financial resources.

Starting Your Credit Firm Life Plan

Embarking on your Credit Firm Life Plan requires careful consideration and a systematic approach. The following steps can guide you in starting your plan:

Assessing financial situation

Begin by assessing your current financial situation. This includes evaluating income, expenses, debts, and assets. Understanding your financial standing provides a clear picture of your financial strengths, weaknesses, and areas that require attention.

Finding a credible credit firm

Research and choose a reputable credit firm to work with. Look for firms that have extensive experience, positive client testimonials, and a track record of delivering quality services. A credible credit firm will provide you with expert guidance, tailored solutions, and ongoing support throughout your financial journey.

Creating realistic financial goals

Identify and prioritize your financial goals. These goals may include saving for a down payment on a home, paying off debts, or building a retirement fund. Establishing realistic goals is essential to formulate a Credit Firm Life Plan that is achievable and aligned with your aspirations.

Benefits of Credit Firm Life Plan

A Credit Firm Life Plan offers numerous benefits that can have a significant positive impact on your financial health. Some of the key advantages include:

Helps in effective money management

Having a structured financial plan provides a framework for managing your money effectively. It allows you to track your expenses, set budgets, and make smart financial decisions. By having a clear understanding of your financial situation, you can allocate funds appropriately and avoid unnecessary expenses.

Improves credit score

One of the primary benefits of a Credit Firm Life Plan is its potential to improve your credit score. Credit firms analyze your credit report, identify areas for improvement, and help implement strategies to enhance your creditworthiness. This, in turn, improves your chances of securing favorable loan terms, lower interest rates, and access to credit when needed.

Supports debt payment plans

With a Credit Firm Life Plan, you can receive professional assistance in handling your debts. Credit firms provide debt consolidation services, negotiate with creditors on your behalf, and develop a structured repayment plan that aligns with your financial capabilities. This support relieves financial stress and helps you stay on track towards becoming debt-free.

Assists in savings and investment goals

A Credit Firm Life Plan also offers guidance on savings and investment strategies. Credit firms help you develop a plan to grow your savings and invest in opportunities that align with your risk tolerance and financial objectives. By having a well-structured plan in place, you can work towards achieving long-term financial security and build wealth over time.

Drawbacks of Credit Firm Life Plan

While a Credit Firm Life Plan offers numerous benefits, it is essential to be aware of potential drawbacks before engaging in such a plan. Some of the drawbacks to consider include:

Potential Fees and Charges

Credit firms may charge fees for their services, including financial advice, debt consolidation, or credit repair. It is crucial to fully understand the fees involved and ensure that they fit within your budget. Additionally, it is vital to carefully review the terms and conditions of any contractual agreements to avoid unexpected charges.

Potential for Impersonal Service

Some individuals may find that working with a credit firm does not provide the same level of personalization as managing their finances independently. While credit firms offer expert guidance, the process may be less individualized compared to self-managed financial decisions.

Risk of Financial Mismanagement

It is important to choose a reputable and trustworthy credit firm to minimize the risk of financial mismanagement. In rare instances, some individuals or businesses may encounter unscrupulous credit firms that mismanage funds or provide poor advice. Conduct thorough research to ensure the credibility and reliability of any credit firm you choose to work with.

Role of Credit Firms in Life Plan

Credit firms play a crucial role in helping individuals and businesses navigate their financial journey effectively. Some of the key roles credit firms fulfill include:

Provision of financial advice

Credit firms offer expert financial advice based on their extensive knowledge and experience. They provide guidance on budgeting, saving, investment, and planning for the future. This advice is tailored to individual circumstances and provides valuable insights to help individuals and businesses make informed financial decisions.

Debt consolidation services

Credit firms specialize in debt consolidation, which involves combining multiple debts into a single loan. This simplifies debt management and allows individuals and businesses to make a single monthly payment at a potentially lower interest rate. Debt consolidation can offer significant relief, reduce financial stress, and help individuals and businesses regain control over their finances.

Credit repair services

Credit firms assist individuals and businesses in repairing their credit by analyzing credit reports, identifying negative items, and developing strategies to address them. Their expertise and knowledge of credit regulations enable them to guide individuals and businesses through the credit repair process and effectively improve their credit scores.

Investment planning

Credit firms provide investment planning services to help individuals and businesses make the most of their financial resources. They offer insights into viable investment opportunities, risk management strategies, and asset allocation techniques. By working closely with credit firms, individuals and businesses can develop investment plans that align with their financial goals and risk tolerance.

Types of Credit Firm Life Plan Services

Credit firms offer a variety of services designed to address different financial needs and goals. Some of the common types of Credit Firm Life Plan services include:

Debt counselling

Debt counselling involves working with credit firms to develop a plan for managing and eliminating debt. Credit firms analyze your financial situation, negotiate with creditors, and design a structured repayment plan that fits within your budget. Debt counselling aims to alleviate financial burdens and provide a clear path towards debt freedom.

Credit reporting

Credit reporting services involve regular monitoring of your credit report to identify any changes or inaccuracies. Credit firms keep track of credit activities, provide you with updates, and assist in disputing or removing any harmful information that may negatively impact your credit score.

Investment advice and planning

Credit firms offer investment advice and planning services to help individuals and businesses make informed investment decisions. They analyze your financial goals, risk tolerance, and investment opportunities to develop an investment plan that aligns with your needs and objectives. This enables individuals and businesses to maximize their investment potential and grow their wealth over time.

Retirement planning

Retirement planning services assist individuals in preparing for their retirement years. Credit firms help assess your retirement needs, develop savings and investment strategies, and provide guidance on maximizing retirement income. With a well-structured retirement plan, individuals can enjoy their golden years with financial security and peace of mind.

Measuring Success of Credit Firm Life Plan

Monitoring and measuring the success of your Credit Firm Life Plan is crucial to ensure that you are on track to achieve your financial goals. Some key indicators of success include:

Monitoring credit score

Regularly monitoring your credit score allows you to gauge the effectiveness of your Credit Firm Life Plan. As you work with credit firms to improve your creditworthiness, tracking your credit score enables you to see the progress you have made and identify areas that require further attention.

Keeping track of financial goals

Revisiting and evaluating your financial goals periodically ensures that you are making progress towards achieving them. By monitoring your savings, investment, and debt repayment efforts, you can assess if you are on track to meet your objectives. Adjustments may be necessary along the way to align your plan with any changes in circumstances or priorities.

Regular reviews and updates of plan

Regularly reviewing and updating your Credit Firm Life Plan is essential to ensure its continued effectiveness. Life events, economic conditions, and personal circumstances may change over time, requiring adjustments to your plan. By staying proactive and engaging in frequent reviews with your credit firm, you can make informed decisions and adapt your plan as needed.

Adapting Life Plans in Response to Life Events

Life is full of unexpected events that can significantly impact your financial situation. It is essential to adapt your Credit Firm Life Plan in response to these events to ensure your financial stability. Some key considerations include:

Adjusting plans following significant life events

Significant life events such as marriage, childbirth, divorce, job loss, or inheritances can impact your financial goals and priorities. Adapting your plan to accommodate these events ensures that you are still on track despite the changes. Consult with your credit firm to assess how these events may affect your overall financial strategy and make necessary adjustments.

Reassessing financial situation periodically

Regularly reassessing your financial situation allows you to identify any changes or areas that require attention. This may include reviewing your income, expenses, debts, and assets. By staying proactive and keeping tabs on your financial health, you can address any emerging issues or opportunities promptly.

Reconfiguring plans with credit firm

When life events occur, it is crucial to work closely with your credit firm to reconfigure your Credit Firm Life Plan. They can provide guidance on the necessary adjustments, help you set new financial goals, and develop strategies to navigate new circumstances. By leveraging their expertise, you can effectively respond to life events and maintain a stable financial course.

Credit Firm Life Plan Vs Personal Financial Management

Choosing between a Credit Firm Life Plan and personal financial management requires careful consideration of various factors. Each approach has its benefits and implications, which should be weighed against individual preferences and circumstances. Understanding the key differences is crucial in making an informed decision:

Benefits of professional assistance

A Credit Firm Life Plan offers the advantage of professional assistance from experienced credit firms. They provide expert guidance, specialized services, and market insights that may be beyond the reach of personal financial management. Working with a credit firm can save time, minimize risks, and potentially yield better financial outcomes.

Cost implications

Engaging with a credit firm incurs fees for their services, which must be factored into your financial plan. Personal financial management, on the other hand, may require a significant investment of time and effort. Consider your budget, financial goals, and willingness to invest in professional assistance when deciding which approach is right for you.

Impact on credit score and overall financial health

A poorly managed Credit Firm Life Plan or personal financial management approach can both have negative impacts on credit score and overall financial health. However, credit firms specialize in credit repair and improving creditworthiness, which may be beneficial if your credit score needs immediate attention. Personal financial management allows for full control over decision-making but requires a deep understanding of financial concepts and regulations.

In conclusion, a Credit Firm Life Plan can be instrumental in effectively managing your finances, improving your credit score, and achieving your long-term financial goals. By considering the factors influencing your plan, starting the process with thorough assessment, leveraging the expertise of credit firms, and continuous monitoring and adaptation, you can navigate your financial journey with confidence. Whether you choose a Credit Firm Life Plan or personal financial management, it is essential to make informed decisions and prioritize your financial well-being. Remember, your financial future is in your hands, and enlisting professional help can set you on the path to success.