Have you ever wondered how bankruptcy can impact your credit and what steps you can take to rebuild it afterward? In this article, we will delve into the details of how filing for bankruptcy can affect your credit score and the various ways you can start rebuilding your credit.

If you’re feeling overwhelmed by the aftermath of bankruptcy and unsure of where to start, fear not! We have a wealth of information and practical tips to guide you through the process. From understanding the basics of credit scores to debunking common myths, we will provide you with the knowledge and tools you need to set yourself on the path to credit repair. Whether you choose to hire a professional credit repair company or opt for a DIY approach, we will explore all the options available to you. So, sit tight and get ready to learn how you can rebuild your credit after bankruptcy.

Understanding Bankruptcy

What is bankruptcy?

Bankruptcy is a legal process in which individuals or businesses declare themselves unable to pay their debts. It provides them with a fresh start by eliminating or reducing their financial obligations, but it comes with several consequences.

Types of bankruptcy

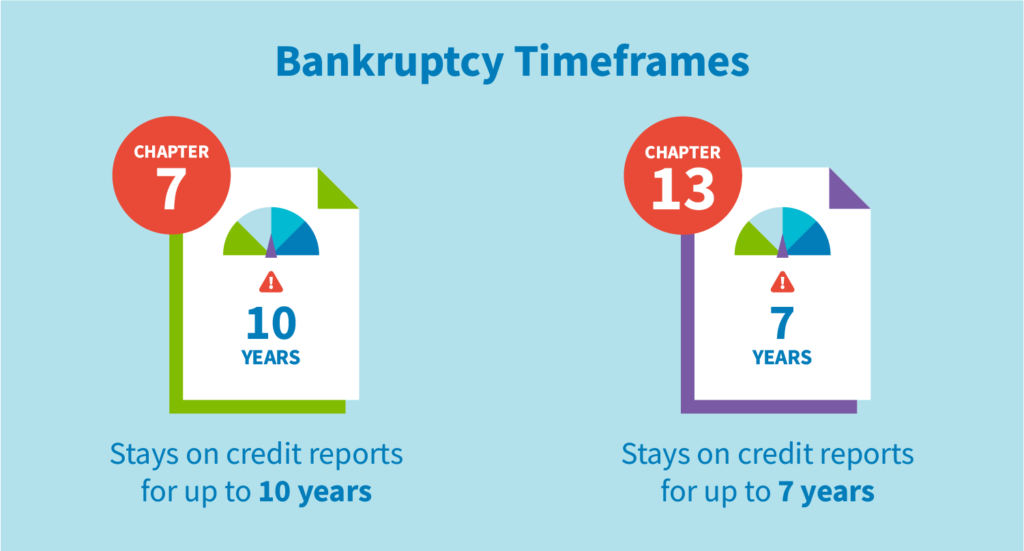

There are several types of bankruptcy, each with its own set of rules and requirements. The most common types for individuals are Chapter 7 and Chapter 13 bankruptcy.

-

Chapter 7 bankruptcy, also known as liquidation bankruptcy, allows individuals to have their debts discharged entirely. However, it involves selling off non-exempt assets to repay creditors.

-

Chapter 13 bankruptcy, also known as reorganization bankruptcy, creates a repayment plan that allows individuals to pay off their debts gradually over three to five years.

Effects on credit scores

Bankruptcy is a significant negative event that can have a lasting impact on your credit score. It will remain on your credit report for up to ten years, making it difficult to obtain new credit or qualify for favorable loan terms.

Your credit score will likely drop significantly immediately after filing for bankruptcy. However, as time passes and you take steps to rebuild your credit, the impact of bankruptcy will gradually diminish.

How bankruptcy is reflected on credit reports

Once you file for bankruptcy, it will be included in the public records section of your credit report. This information is accessible to lenders and can influence their decision-making process when considering your creditworthiness.

Bankruptcy can also lead to the inclusion of additional negative information, such as late payments, charge-offs, or accounts sent to collections. These derogatory marks further damage your credit score and stay on your credit report for up to seven years.

Rebuilding Credit After Bankruptcy

The importance of rebuilding credit

Rebuilding credit after bankruptcy is crucial for regaining financial stability and achieving long-term financial goals. By improving your creditworthiness, you increase your chances of qualifying for better loan options, lower interest rates, and other favorable financial opportunities.

Creating a budget and financial plan

Developing a comprehensive budget is the first step toward rebuilding credit after bankruptcy. It allows you to track your income, expenses, and debt payments and identify areas where you can cut back to free up funds for savings and debt repayment.

A financial plan goes beyond budgeting and involves setting measurable goals, such as saving for emergencies, paying off debt, and improving your credit score. Breaking these goals into smaller milestones makes them more achievable and helps you stay motivated throughout the process.

Building an emergency fund

One of the essential components of a solid financial plan is having an emergency fund. This fund serves as a safety net in case of unexpected expenses or income loss, reducing your reliance on credit cards or loans in challenging times.

It’s recommended to save at least three to six months’ worth of living expenses in your emergency fund. Start by setting aside a portion of your income each month and gradually increase the amount as your financial situation improves.

Secured credit cards

Secured credit cards are a useful tool for rebuilding credit after bankruptcy. Unlike traditional credit cards, secured cards require a cash deposit that serves as collateral against the credit limit.

By making small purchases and consistently paying off the balance in full and on time, you demonstrate responsible credit behavior. Over time, this positive payment history will help rebuild your credit score.

Credit builder loans

Credit builder loans provide an opportunity to establish or rebuild credit. These loans work by depositing the loan amount in a secured savings account, which you can access only after successfully repaying the loan.

As you make timely payments on the credit builder loan, the lender reports this positive behavior to the credit bureaus, gradually improving your credit history. At the end of the loan term, you receive the loan amount plus any interest earned.

Obtaining a co-signer or authorized user

If you’re unable to qualify for credit on your own after bankruptcy, you may consider obtaining a co-signer or becoming an authorized user on someone else’s credit card account.

A co-signer is someone with good credit who agrees to be equally responsible for repaying the debt. Their positive credit history can help you secure credit, but it’s important to recognize that both parties are equally liable for the debt.

Being an authorized user on someone else’s credit card allows you to benefit from their positive payment history. However, it’s crucial to ensure that the primary cardholder uses the card responsibly and consistently makes payments on time.

Staying current on payments

Maintaining a positive payment history is crucial for rebuilding credit. It’s essential to make all debt payments on time, including credit cards, loans, and any other obligations.

Late payments can have a significant negative impact on your credit score, undoing the progress you’ve made. Consider setting up automatic payments or reminders to ensure you never miss a due date.

Monitoring credit reports

Regularly monitoring your credit reports is essential for tracking your progress and identifying any errors or discrepancies. You are entitled to a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year.

Review each report carefully for accuracy and report any errors or fraudulent activity immediately. Disputing and resolving these issues can help improve your credit score.

Improving credit utilization

Credit utilization, or the ratio of your credit card balances to your credit limits, is a crucial factor in determining your credit score. Keeping your credit utilization low demonstrates responsible credit management and can positively impact your score.

Aim to keep your credit card balances below 30% of your credit limits, but lower is even better. Paying off your balances in full each month shows lenders that you can responsibly manage credit without accruing excessive debt.

Avoiding new debt

While rebuilding credit, it’s important to avoid taking on new debt unless necessary. Opening new credit accounts or taking out loans can be tempting, but it’s important to consider whether you can handle the additional financial responsibility.

Focus on paying off existing debts and improving your credit score before taking on new credit. This disciplined approach will help you maintain financial stability and ensure that you’re not taking on more than you can handle.

This image is property of www.lexingtonlaw.com.

Credit Repair Strategies

Identifying and disputing errors on credit reports

Even after bankruptcy, it’s essential to review your credit reports and ensure they are accurate. Mistakes can still occur, and these errors may be negatively impacting your credit score.

Carefully review each section of your credit reports, including personal information, account details, and payment history. If you find any inaccuracies, such as accounts that don’t belong to you or incorrect payment history, you have the right to dispute them with the credit bureaus.

Debunking common credit repair myths

There are many misconceptions surrounding credit repair, and it’s important to separate fact from fiction. Some common myths include the belief that closing old accounts will improve your score and that paying off collections will remove them from your credit report.

In reality, closing old accounts can lower your credit score by reducing your available credit and shortening your credit history. Paying off collections will update the status of the account but won’t remove it from your credit report.

Negotiating settlements with creditors

If you have outstanding debts that were not discharged in bankruptcy, negotiating settlements with creditors can be an effective strategy for debt relief. Creditors may be willing to accept a lump sum payment that is less than the total amount owed.

When negotiating settlements, it’s important to work with your creditors directly or seek the assistance of a reputable debt settlement company. Make sure to get any agreements in writing and only make payments once you have a formal settlement offer.

Utilizing credit counseling services

Credit counseling services can provide valuable guidance and resources for rebuilding credit after bankruptcy. These nonprofit organizations offer financial education, budgeting assistance, and debt management plans to help individuals regain control of their finances.

When seeking credit counseling services, it’s important to work with reputable organizations that have certified counselors. Research the organization, check for reviews and certifications, and ensure that they offer services tailored to your specific needs.

Hiring credit repair companies

Credit repair companies advertise the ability to fix your credit quickly and effortlessly. However, it’s important to approach these claims with caution.

While some legitimate credit repair companies can assist you in disputing errors or negotiating with creditors, many operate unscrupulously and charge high fees for services you can do yourself. Before hiring a credit repair company, thoroughly research their reputation, fees, and success rate.

DIY credit repair tips

If hiring a credit repair company is not the right option for you, there are several DIY credit repair strategies you can implement. These include:

- Disputing errors on your credit reports

- Paying off outstanding debts

- Negotiating payment plans with creditors

- Establishing a positive payment history with responsible credit use

- Monitoring your credit reports regularly

Implementing these strategies requires discipline, patience, and a thorough understanding of the credit repair process. However, when done correctly, DIY credit repair can be an effective and cost-saving approach.

Strategies for improving creditworthiness

Improving your creditworthiness goes beyond repairing your credit. It involves developing good financial habits and demonstrating responsible credit behavior consistently over time.

Some strategies for improving creditworthiness include:

- Paying bills on time: Consistently meeting payment deadlines demonstrates to lenders that you are reliable and responsible.

- Keeping credit utilization low: Maintaining low credit card balances compared to your credit limits shows responsible credit management.

- Regularly monitoring credit reports: Staying aware of your credit status allows you to identify and resolve issues promptly.

- Avoiding unnecessary debt: Only take on new debt when necessary and ensure you can comfortably manage the payments.

- Saving for emergencies: Having a financial cushion can prevent the need to rely on credit cards or loans in times of unexpected expenses.

By implementing these strategies, you increase your chances of being seen as creditworthy by lenders and obtaining better loan terms.

Recovering from identity theft

Identity theft can have severe consequences on your credit, especially if it leads to fraudulent accounts or missed payments. If you suspect that your financial information has been compromised, taking immediate action is crucial.

File a police report and contact the credit bureaus to place fraud alerts on your credit reports. Scrutinize your credit reports for any fraudulent activity and dispute any unauthorized accounts or transactions.

Recovering from identity theft may take time and effort, but taking swift action can minimize the damage and help restore your creditworthiness.

Case studies of successful credit repair

Reading about the successes of others who have been through the credit repair journey can be inspiring and informative. Case studies provide real-life examples of individuals who have faced financial challenges, including bankruptcy, and successfully improved their credit scores.

These stories can offer valuable insights into the strategies, tactics, and mindset that contributed to their success. They serve as a reminder that credit repair is possible, regardless of the starting point.

Maintaining good credit habits

Once you have rebuilt your credit after bankruptcy, it’s important to maintain good credit habits to ensure long-term success. This requires consistent financial discipline and responsible credit management.

Some essential habits for maintaining good credit include:

- Paying bills on time: Avoid late payments and make it a priority to meet all payment deadlines.

- Keeping credit utilization low: Aim to keep your credit card balances well below their limits.

- Regularly monitoring credit reports: Stay vigilant and address any errors or issues promptly.

- Avoiding unnecessary debt: Be mindful of your financial obligations and only take on debt when necessary and manageable.

- Saving for emergencies: Continue building your emergency fund to provide a financial safety net.

- Maintaining a budget: Keep track of your income and expenses to ensure financial stability.

By consistently practicing these habits, you can continue to build and maintain a strong credit profile.

Impact of Bankruptcy on Different Situations

Bankruptcy’s effect on millennials’ credit

Millennials, the generation born between 1981 and 1996, have faced unique financial challenges, including high student loan debt and limited job opportunities. These factors, combined with the impact of the global recession in 2008, have resulted in a higher bankruptcy rate among millennials.

Bankruptcy can have a significant impact on millennials’ credit scores, making it difficult to secure loans, obtain favorable interest rates, or rent apartments. However, with appropriate credit repair strategies and a commitment to financial discipline, millennials can rebuild their credit and overcome the challenges brought on by bankruptcy.

Handling student loans after bankruptcy

Student loans are generally not dischargeable in bankruptcy, meaning that the borrower remains responsible for repaying them after the bankruptcy process is complete. However, bankruptcy can still provide relief by eliminating other forms of debt and creating a more manageable financial situation.

It’s important for individuals with student loan debt to explore repayment options, such as income-driven repayment plans or loan forgiveness programs. Making consistent payments on student loans and establishing a positive payment history can help rebuild credit after bankruptcy.

Credit repair for small business owners

Bankruptcy can have a significant impact on small business owners, as it affects not only their personal credit but also their business credit. Small business owners may face difficulties obtaining loans or credit lines for their businesses, hindering growth and expansion opportunities.

To rebuild credit after bankruptcy, small business owners should focus on separating personal and business finances, establishing a strong business credit profile, and seeking alternative financing options, such as secured business credit cards or loans.

Rebuilding credit for homebuyers post-bankruptcy

Bankruptcy can make it challenging to qualify for a mortgage, as lenders consider it a significant risk factor. However, with time, responsible credit management, and a steady income, it is possible to rebuild credit and eventually qualify for a home loan.

Homebuyers post-bankruptcy should focus on rebuilding their credit profiles by implementing credit repair strategies, saving for a down payment, and demonstrating positive financial behavior over an extended period. It may take time, but with patience and persistence, homeownership can be within reach.

Navigating credit repair during a divorce

Divorce can be a challenging time emotionally and financially, and bankruptcy may be a consideration for some individuals going through this process. It’s important to understand that bankruptcy can have implications for both spouses’ credit scores and financial situations.

To navigate credit repair during a divorce, individuals should focus on disentangling their finances, closing joint accounts, and establishing individual credit profiles. They should also monitor their credit reports for any changes or inaccuracies resulting from the divorce.

Strategies for seniors recovering from bankruptcy

Bankruptcy can have a significant impact on seniors, as they may be living on fixed incomes and rely on credit for daily expenses or unexpected medical costs. Rebuilding credit after bankruptcy is crucial for seniors to maintain financial stability and access necessary resources.

Seniors recovering from bankruptcy should focus on creating a budget that aligns with their income, actively monitoring their credit reports, and exploring ways to secure credit, such as becoming an authorized user on a family member’s credit card or obtaining a secured credit card.

This image is property of www.lexingtonlaw.com.

Resources for Rebuilding Credit

Credit counseling agencies

Credit counseling agencies offer a range of services to help individuals rebuild credit after bankruptcy. These nonprofit organizations provide financial education, budgeting assistance, and debt management plans to aid in debt repayment and credit improvement.

It’s important to research and select reputable credit counseling agencies that have certified counselors and good reviews. Many agencies offer free initial consultations to assess your financial situation and provide tailored guidance.

Credit repair books and guides

There are numerous books and guides available that provide insights and strategies for credit repair. These resources can be helpful in understanding the credit repair process, debunking myths, and implementing effective strategies.

When choosing credit repair books or guides, look for reputable authors with proven expertise in the field. Consider reading reviews and checking the publication dates to ensure that the information is up to date.

Websites and online resources

Websites and online resources offer a wealth of information on credit repair strategies, credit education, and financial planning. These resources can help individuals navigate the credit repair process, understand credit score factors, and access tools to monitor and manage their credit.

Reputable websites and online resources often provide comprehensive guides, calculators, and frequently asked questions to support individuals in their credit repair journey.

Secured credit card options

Secured credit cards are an excellent resource for rebuilding credit after bankruptcy. These cards require a cash deposit that serves as collateral against the credit limit, making them accessible to individuals with low credit scores or a history of bankruptcy.

When choosing a secured credit card, compare fees, interest rates, and any additional benefits or perks. Look for cards that report to all three major credit bureaus, as this is crucial for building credit.

Financial planning tools

Financial planning tools can help individuals establish and maintain a budget, track expenses, and set financial goals. These tools provide a clear snapshot of one’s financial health, offering insights into saving opportunities, debt repayment strategies, and overall progress.

Several free financial planning tools are available online, while others may require a subscription or purchase. It’s important to choose tools that align with your specific needs and preferences.

Online credit monitoring services

Online credit monitoring services allow individuals to track changes to their credit reports, receive alerts for suspicious activity, and access tools to improve their credit scores. These services can play a vital role in credit repair and provide peace of mind regarding one’s credit profile.

When selecting an online credit monitoring service, consider factors such as the frequency of credit report updates, the comprehensiveness of credit monitoring, and the availability of educational resources.

Benefits of Rebuilding Credit

Access to better loan options

Rebuilding credit after bankruptcy opens doors to better loan options and credit terms. Lenders are more likely to offer lower interest rates and more favorable repayment terms to individuals with good creditworthiness.

By improving your credit score, you increase your chances of qualifying for mortgages, auto loans, and personal loans, providing opportunities to achieve financial goals and secure assets.

Lower interest rates

One of the most significant benefits of rebuilding credit is the ability to access credit at lower interest rates. With good credit, lenders see you as a less risky borrower, leading to lower interest rates on loans and credit cards.

Lower interest rates can save you thousands of dollars over the life of a loan, making it easier to manage debt and improve your financial standing.

Improved financial stability

Rebuilding your credit after bankruptcy leads to improved financial stability. By managing your credit responsibly and reducing debt, you gain control over your finances and reduce the likelihood of facing financial hardships in the future.

Financial stability provides peace of mind, reduces stress, and enables you to focus on long-term financial goals, such as homeownership, retirement planning, or starting a business.

Increased chances of approval for credit applications

Having good credit significantly increases your chances of credit approval. Lenders and creditors consider your credit history and credit score when evaluating credit applications, and a strong credit profile increases their confidence in your ability to repay the debt.

By rebuilding your credit after bankruptcy, you demonstrate your commitment to financial responsibility and increase the likelihood of approval for credit applications.

Ability to qualify for competitive insurance rates

Insurance companies often use credit-based insurance scores to assess risk and determine premium rates. When you have good credit, you are more likely to qualify for competitive insurance rates on auto, home, or renter’s insurance.

By rebuilding your credit, you can potentially lower your insurance premiums and save money on monthly expenses.

Greater financial independence

Rebuilding credit after bankruptcy provides greater financial independence. With a strong credit profile, you have more control and flexibility in managing your financial life.

You can apply for credit without relying on co-signers, secure loans with favorable terms, and negotiate better rates and fees. This independence allows you to make financial decisions based on your goals and priorities.

This image is property of www.creditrepair.com.

Developing Healthy Credit Habits

Paying bills on time

One of the most essential habits for maintaining good credit is paying bills on time. Late payments can significantly impact your credit score, making it crucial to prioritize submitting payments before their due dates.

Consider setting up automatic payments or calendar reminders to ensure you don’t miss any payment deadlines. By promptly paying your bills, you show responsibility and reliability to lenders and creditors.

Keeping credit utilization low

Credit utilization, the ratio of your credit card balances to your credit limits, plays a significant role in determining your credit score. Keeping your credit utilization low demonstrates responsible credit management and can positively impact your score.

Aim to keep your credit card balances below 30% of your credit limits, but lower is even better. Paying off your balances in full each month shows lenders that you can responsibly manage credit without accruing excessive debt.

Regularly monitoring credit reports

Regularly monitoring your credit reports is crucial for understanding your credit profile and identifying any errors or suspicious activity. It’s recommended to review your credit reports from each of the three major credit bureaus at least once a year.

By reviewing your credit reports, you can ensure that they are accurate and up to date. Any inaccuracies or fraudulent activity should be reported immediately to the credit bureaus for investigation and resolution.

Avoiding unnecessary debt

Taking on unnecessary debt can hinder your credit repair progress and lead to financial stress. It’s important to carefully consider your financial situation and only take on debt when necessary and manageable.

Before making a purchase that requires debt, ask yourself if it is something you truly need or if there are alternative options. Taking a proactive approach to debt management helps maintain financial stability and allows for better credit repair outcomes.

Saving for emergencies

One of the key habits for financial security is saving for emergencies. Having a robust emergency fund protects you from unexpected expenses or income loss and reduces your reliance on credit cards or loans.

Start by setting aside a portion of your income each month and gradually increase the amount as your financial situation improves. Aim to save at least three to six months’ worth of living expenses, but any amount is better than none.

Maintaining a budget

Developing and maintaining a budget is essential for good financial management. A budget allows you to track your income, expenses, and debt payments, enabling you to make informed decisions about your finances.

Create a monthly budget that details your income, fixed expenses, and variable expenses. Identify areas where you can cut back on unnecessary spending and allocate funds toward debt repayment and savings.

By sticking to your budget, you maintain control over your finances, reduce the risk of overspending, and increase your chances of achieving your financial goals.

Long-Term Credit Repair Success

Consistency in financial management

Consistency is key to long-term credit repair success. It’s important to remain committed to the healthy financial habits you’ve developed and maintain responsible credit behavior.

This includes paying bills on time, keeping credit utilization low, regularly monitoring credit reports, avoiding unnecessary debt, and saving for emergencies. By practicing these habits consistently, you can lay the foundation for a strong and stable credit profile.

Continued credit monitoring

Credit repair is an ongoing process, and it’s important to continue monitoring your credit even after you’ve achieved your desired credit score. Regularly checking your credit reports allows you to identify any changes, errors, or suspicious activity that may arise.

By staying vigilant, you can take immediate action to resolve any issues and ensure that your credit remains in good standing. This proactive approach protects your credit profile and minimizes the risk of potential setbacks.

Adjusting strategies as needed

As your financial situation evolves, it’s important to evaluate and adjust your credit repair strategies as needed. This may involve revisiting your budget, exploring new credit-building opportunities, or reassessing your financial goals.

Flexibility and adaptability are key to long-term credit repair success. Stay open to new strategies and be willing to adjust your approach as circumstances change.

Seeking professional advice when necessary

While many individuals can successfully navigate the credit repair process on their own, there may be instances where professional advice is beneficial. If you’re facing complex financial challenges or struggling to make progress on your own, seeking guidance from credit counselors, financial advisors, or bankruptcy attorneys can provide valuable insights and support.

Professional advice can help you develop a tailored credit repair plan, address specific challenges, and provide expertise in managing complex financial situations. It’s important to research and select professionals with experience and a solid reputation.

Building positive credit history over time

Rebuilding credit takes time, and building positive credit history is a crucial aspect of the process. Consistently demonstrating responsible credit behavior, such as making timely payments and keeping credit utilization low, establishes a track record that lenders and creditors view as favorable.

Continue to use credit responsibly and avoid any actions that could negatively impact your credit, such as late payments or taking on excessive debt. Patience and persistence are key, as positive credit history is built over time.

Celebrating milestones and progress

Rebuilding credit after bankruptcy is a challenging journey. It’s important to celebrate milestones and progress along the way to stay motivated and positive.

Whether it’s reaching a specific credit score, paying off a significant amount of debt, or achieving a financial goal, acknowledge your accomplishments and reward yourself. Recognizing your achievements helps maintain motivation and keeps you focused on the ultimate goal of credit repair success.

This image is property of www.lexingtonlaw.com.

Conclusion

Rebuilding credit after bankruptcy is a challenging but achievable process. By implementing strategies such as budgeting, responsible credit management, and credit repair techniques, you can rebuild your credit and regain financial stability.

Commitment to financial discipline, patience, and persistence are crucial throughout the credit repair journey. It’s important to leverage available resources, seek professional guidance when necessary, and maintain healthy credit habits to ensure lasting success.

Although bankruptcy has significant consequences on your credit, it does not define your financial future. With determination and the right strategies, anyone can overcome the challenges of bankruptcy and achieve credit repair success.