In the realm of credit repair, effective marketing strategies play a pivotal role in attracting the attention of potential clients seeking financial redemption. This article explores the intriguing world of credit repair marketing, delving into the various techniques employed to promote such services and engage with a target audience. By examining the intricate dynamics between credit repair and marketing, a deeper understanding can be achieved regarding the tools and tactics utilized to navigate this ever-evolving landscape.

Understanding Credit Repair Marketing

In today’s financial landscape, credit repair is an essential service that many individuals and businesses seek to improve their creditworthiness. Credit repair marketing plays a crucial role in connecting credit repair companies with potential clients and building trust and credibility in the industry. This article aims to provide a comprehensive guide to understanding credit repair marketing strategies, including the importance of marketing, creating a marketing strategy, key components of credit repair marketing, leveraging social media, effective content marketing strategies, optimizing a credit repair website, harnessing email marketing, utilizing paid advertising, and measuring success.

Importance of Credit Repair Marketing

Enhancing brand visibility

A central aspect of credit repair marketing is enhancing brand visibility. With numerous credit repair companies competing for clients, it is essential to make your brand stand out in the market. By utilizing various marketing channels, such as social media, websites, and paid advertising, you can increase your brand’s visibility and establish a strong presence in the industry.

Attracting potential clients

Credit repair marketing is crucial in attracting potential clients to your business. Through targeted marketing campaigns, you can reach individuals and businesses who are in need of credit repair services. By effectively communicating the benefits and value of your services, you can capture the attention of potential clients and persuade them to choose your company over competitors.

Building trust and credibility

Trust and credibility are vital components of any successful credit repair business. Building trust with potential clients can be achieved through an effective marketing strategy that focuses on transparency, professionalism, and expertise. By showcasing testimonials, case studies, and success stories, you can instill confidence in potential clients and establish your business as a trustworthy and credible solution for their credit repair needs.

This image is property of yesassistant.com.

Creating a Credit Repair Marketing Strategy

Identifying target audience

Before implementing any marketing strategy, it is crucial to identify your target audience. Understanding the demographics, financial situations, and credit repair needs of your potential clients will allow you to tailor your marketing efforts effectively. This analysis will enable you to create targeted messages that resonate with your audience and increase the likelihood of converting leads into clients.

Setting marketing goals

Setting clear marketing goals is essential for measuring the success and effectiveness of your credit repair marketing efforts. Whether you aim to increase website traffic, generate leads, or improve brand awareness, setting specific and measurable goals will enable you to track your progress and make data-driven decisions. Regularly reviewing and adjusting your goals ensures that your marketing strategies remain aligned with your business objectives and adapt to changing market conditions.

Choosing appropriate marketing channels

Effective credit repair marketing relies on choosing the appropriate marketing channels to reach and engage with your target audience. It is essential to select channels where your potential clients are most active and receptive to your messages. Some common marketing channels for credit repair companies include websites, social media platforms, email marketing, search engines, and paid advertising. By understanding the strengths and weaknesses of each channel, you can allocate your resources wisely and maximize the impact of your marketing efforts.

Key Components of Credit Repair Marketing

Website optimization

Website optimization is a crucial component of credit repair marketing. Your website serves as a hub for potential clients to learn about your services, expertise, and credibility. Optimizing your website involves improving its design, user experience, and search engine visibility. By creating a visually appealing and user-friendly website and optimizing it for search engines, you increase the chances of attracting and converting leads into clients.

Content marketing

Content marketing plays a pivotal role in credit repair marketing, as it allows you to establish thought leadership, educate potential clients, and build trust. Creating informative and educational content, such as blog articles, videos, and ebooks, can position your business as a trusted resource in the credit repair industry. By addressing common credit repair challenges, providing tips and insights, and showcasing your expertise, you can attract and engage potential clients.

Social media marketing

Social media platforms provide powerful tools for credit repair marketing. By leveraging platforms such as Facebook, Instagram, LinkedIn, and Twitter, you can reach a wide audience and engage with potential clients in a more informal and interactive manner. Social media marketing involves creating engaging content, building and nurturing communities, and utilizing paid social media advertising to expand your reach and connect with your target audience effectively.

Email marketing

Email marketing is a highly effective strategy for credit repair companies to keep in touch with potential clients, nurture leads, and drive conversions. Building an email subscriber list allows you to maintain regular communication and provide valuable insights, tips, and updates to your audience. Segmentation and personalization enable you to tailor your email content to the specific needs and interests of individual subscribers, increasing engagement and the likelihood of conversion. Automation tools can also be utilized to streamline and optimize your email campaigns, saving time and maximizing results.

Search engine optimization (SEO)

Search engine optimization (SEO) ensures that your credit repair website ranks high in search engine results when potential clients search for relevant keywords. By conducting keyword research and optimizing your website’s content, meta tags, and structure, you increase the chances of attracting organic traffic from search engines. An effective SEO strategy involves both on-page and off-page optimization techniques to improve your website’s visibility and drive targeted traffic.

Paid advertising

Paid advertising can be a valuable component of credit repair marketing, providing instant exposure and targeted reach to potential clients. Whether through search engine advertising (such as Google Ads), display advertising, or social media advertising, paid advertising allows you to reach potential clients who are actively seeking credit repair services or belong to your target audience. By setting a budget, defining specific targeting criteria, and monitoring the return on investment (ROI), you can effectively utilize paid advertising to generate leads and accelerate your business growth.

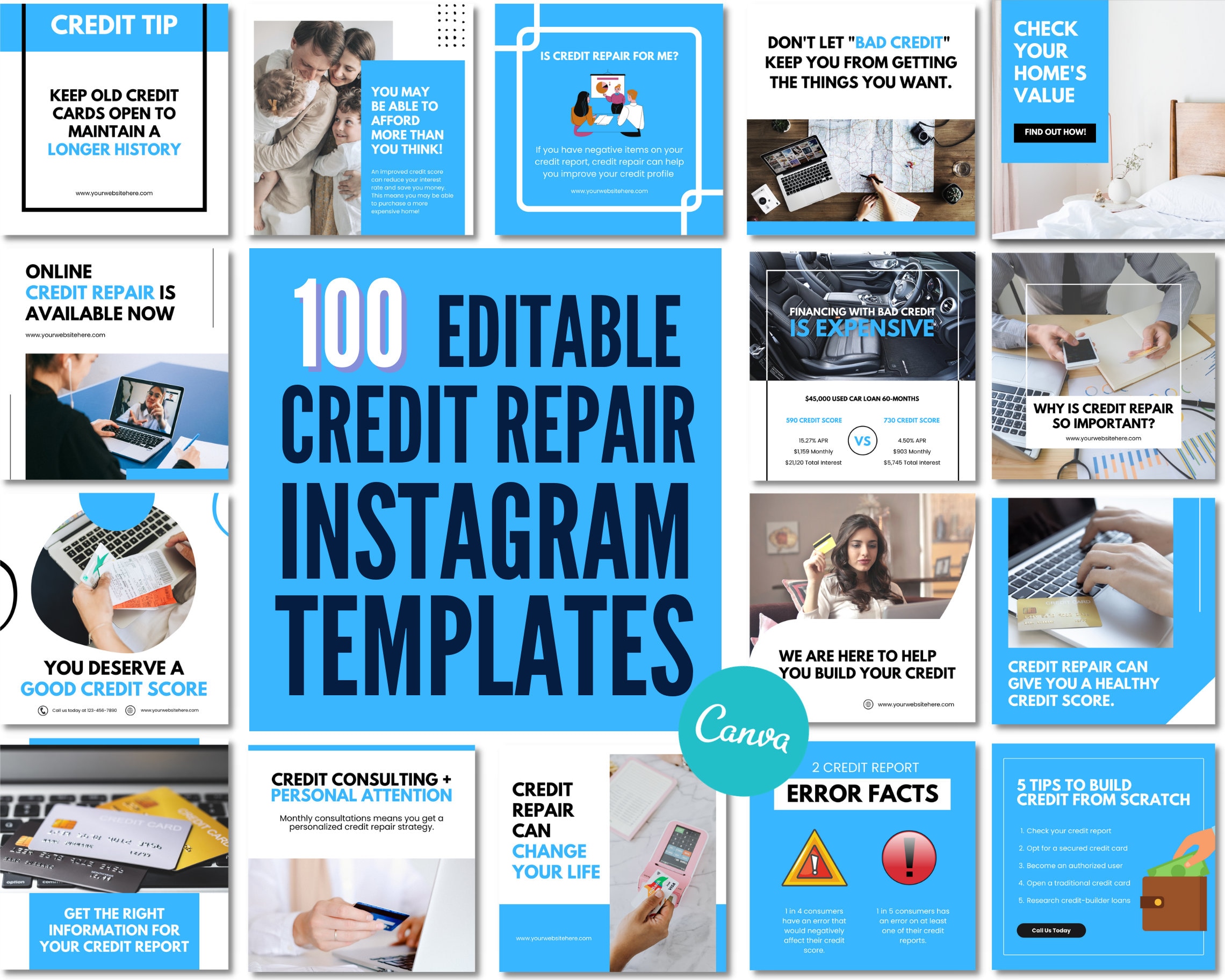

This image is property of i.etsystatic.com.

Leveraging Social Media for Credit Repair Marketing

Importance of social media platforms

Social media platforms have become integral to credit repair marketing due to their wide reach, engagement opportunities, and cost-effectiveness. Platforms such as Facebook, Instagram, LinkedIn, and Twitter offer diverse audiences and allow for targeted advertising to reach potential clients who may be in need of credit repair services. By leveraging the power of social media platforms, credit repair companies can effectively showcase their expertise, build credibility, and engage with their target audience directly.

Creating engaging content

To leverage social media effectively for credit repair marketing, it is essential to create engaging content that captures the attention of your target audience. This can include informative posts, visually appealing graphics, engaging videos, and interactive polls or quizzes. By providing valuable insights, tips, and advice related to credit repair, you can position your brand as a trusted resource and keep your audience engaged and interested in your services.

Building and nurturing communities

Social media platforms provide an ideal environment for credit repair companies to build and nurture communities. By creating groups or forums related to credit repair, businesses can encourage discussions, answer questions, and provide support to individuals seeking credit repair guidance. Building a sense of community fosters trust and loyalty, as individuals feel they are part of a like-minded group that understands their specific credit repair challenges.

Utilizing paid social media advertising

Paid social media advertising can significantly enhance the reach and impact of your credit repair marketing efforts. Platforms like Facebook, Instagram, and LinkedIn offer advanced targeting options that enable you to reach individuals who match your ideal client demographics and interests. By designing compelling ad creatives, utilizing persuasive copy, and leveraging the targeting capabilities of social media platforms, you can deliver your marketing messages directly to potential clients and drive conversions.

Effective Content Marketing Strategies for Credit Repair

Creating educational and informative content

Content marketing is a powerful tool for credit repair companies to educate potential clients and build credibility. Creating educational and informative content helps address common credit repair challenges and provides actionable tips and insights. By sharing your expertise and showcasing your industry knowledge, you position your brand as a trusted authority in the credit repair field and gain the trust and confidence of potential clients.

Using storytelling to connect with the audience

Storytelling is a compelling content marketing strategy that enables credit repair companies to connect with their audience on a deeper level. By sharing personal stories, testimonials, or case studies of individuals or businesses who have successfully repaired their credit, you can evoke emotions and create a bond with your audience. Storytelling helps potential clients relate to the experiences of others and envision the positive outcomes credit repair can bring.

Leveraging case studies and success stories

Case studies and success stories provide tangible evidence of the effectiveness of your credit repair services. By showcasing real-life examples of clients who have benefited from your expertise, you provide potential clients with concrete proof that your services yield results. Case studies and success stories can highlight the challenges faced by clients, the strategies employed to overcome those challenges, and the positive impact credit repair has had on their financial situations.

Guest blogging and influencer collaborations

Collaborating with industry influencers and guest blogging on reputable websites can extend your reach and enhance your credibility in the credit repair field. By sharing your expertise on influential platforms, you can tap into their existing audience and gain exposure to individuals who may be seeking credit repair services. Collaborating with influencers and guest blogging also helps build relationships with industry leaders and positions your brand as a trusted resource within the credit repair community.

This image is property of i.etsystatic.com.

Optimizing Credit Repair Website for Maximum Impact

Improving website design and user experience

A well-designed and user-friendly website is essential for maximizing the impact of your credit repair marketing efforts. Your website should be visually appealing, easy to navigate, and responsive across different devices. By creating a seamless user experience, you ensure that potential clients can easily find the information they need, understand your services, and take necessary actions, such as submitting contact forms or signing up for consultations.

Optimizing for search engines

Search engine optimization (SEO) techniques play a vital role in ensuring maximum visibility for your credit repair website. By conducting keyword research and strategically incorporating relevant keywords into your website’s content, meta tags, and headings, you improve your chances of ranking higher in search engine results. Additionally, optimizing your website’s loading speed, mobile compatibility, and site structure enhances user experience and improves your overall SEO performance.

Implementing lead generation tactics

Your credit repair website should serve as a lead generation tool, capturing potential clients’ information and turning them into qualified leads. Implementing lead generation tactics, such as prominent call-to-action buttons, contact forms, and opt-in opportunities, prompts visitors to provide their contact details and express interest in your services. By strategically placing these lead generation elements throughout your website, you increase the chances of converting website visitors into potential clients.

Leveraging customer testimonials and reviews

Customer testimonials and reviews are powerful tools for building trust and credibility in the credit repair industry. Incorporating genuine testimonials from satisfied clients on your website helps potential clients see the positive experiences others have had with your services. Displaying reviews and ratings from reputable review platforms also reinforces the trustworthiness and effectiveness of your credit repair services. By leveraging the positive feedback from your clients, you strengthen your brand’s reputation and make potential clients feel more confident in choosing your services.

Harnessing the Power of Email Marketing for Credit Repair

Building an email subscriber list

Email marketing allows credit repair companies to establish regular communication with potential clients and build lasting relationships. Building an email subscriber list is a crucial step in harnessing the power of email marketing. Encouraging website visitors to sign up for your newsletter, offering valuable resources or discounts in exchange for email addresses, and utilizing lead magnets are effective strategies to grow your subscriber list. The larger your email subscriber base, the wider your reach and the greater potential for conversions.

Segmentation and personalization

Segmenting your email subscriber list enables you to send targeted and personalized messages to different groups of potential clients. By categorizing subscribers based on their interests, geographical location, or stage in the credit repair journey, you can tailor your email content to their specific needs. Personalizing emails with recipients’ names and dynamically generated content further enhances engagement and increases the likelihood of conversions.

Engaging and valuable email content

Engaging and valuable email content is the key to keeping your subscribers interested and nurturing them towards conversion. Providing educational resources, tips, and insights related to credit repair positions your brand as a trusted advisor and builds credibility. Additionally, sharing success stories, case studies, and testimonials through email helps potential clients envision the benefits of credit repair and motivates them to take action. Regularly sending valuable content keeps your brand top of mind and increases the chances of potential clients choosing your services when they are ready.

Automating email campaigns

Email automation allows credit repair companies to streamline their email marketing efforts and deliver timely and personalized messages to subscribers automatically. Automation can include welcome emails, nurture sequences, abandoned cart reminders, or re-engagement campaigns. By setting up automation workflows based on triggers or actions taken by subscribers, you ensure that your email campaigns are relevant, timely, and increase the chances of conversion. Automating email campaigns saves time, maximizes efficiency, and allows for ongoing communication with potential clients.

This image is property of i.ytimg.com.

Utilizing Paid Advertising for Credit Repair Marketing

Understanding different paid advertising options

Paid advertising offers credit repair companies an effective way to accelerate their marketing efforts and reach a larger audience. Understanding the different paid advertising options is essential to make informed decisions and allocate your budget effectively. Common paid advertising options include search engine advertising (such as Google Ads), display advertising on relevant websites, and social media advertising. Each option has its unique advantages and targeting capabilities to ensure your advertisements are seen by individuals who are likely to be interested in credit repair services.

Setting a budget and measuring ROI

Setting a budget for paid advertising allows credit repair companies to control their spending and allocate resources wisely. By analyzing your marketing goals and potential return on investment (ROI), you can determine an appropriate budget that aligns with your business objectives. Additionally, it is crucial to track and measure the results of your paid advertising efforts to determine the effectiveness and adjust your strategy accordingly. Measuring metrics such as click-through rates, conversion rates, and cost per conversion provides insights into the performance of your paid advertising campaigns and helps optimize your marketing budget.

Utilizing targeted ads for better results

Targeted advertisements enable credit repair companies to reach specific audiences who are more likely to be interested in their services. By defining targeting criteria, such as demographics, interests, and behaviors, you can ensure that your ads are displayed to individuals who match your ideal client profile. Targeted ads increase the relevance and effectiveness of your advertising campaigns, leading to higher click-through rates, conversions, and a better return on investment.

Measuring Success and Tracking Performance

Defining key performance indicators (KPIs)

Measuring the success of your credit repair marketing efforts requires defining key performance indicators (KPIs) aligned with your marketing goals. KPIs provide a tangible way to track and evaluate the performance of your marketing strategies and determine whether they are helping you achieve your desired outcomes. Common KPIs for credit repair marketing include website traffic, lead generation, conversion rates, customer acquisition costs, and customer retention rates. By regularly monitoring and analyzing these metrics, you can make data-driven decisions, optimize your strategies, and improve overall performance.

Using analytics tools

Analytics tools play a pivotal role in measuring the success of your credit repair marketing efforts. Tools such as Google Analytics provide valuable insights into website traffic, user behavior, conversion rates, and audience demographics. By leveraging analytics tools, you gain a comprehensive understanding of how your marketing strategies are performing, where potential improvements can be made, and which channels or campaigns are driving the best results. Regularly analyzing these data points helps identify trends, optimize marketing efforts, and make informed decisions to maximize the impact of your credit repair marketing.

Monitoring conversion rates

Conversion rates are an essential metric to monitor when evaluating the effectiveness of your credit repair marketing efforts. Whether it is measuring the percentage of website visitors who complete a contact form, sign up for a consultation, or become paying clients, conversion rates provide insights into the success of your marketing strategies. By monitoring conversion rates, you can identify areas for improvement, test different approaches, and optimize your marketing tactics to increase conversion rates over time.

Adjusting and optimizing strategies

Measuring the success of your credit repair marketing efforts is not enough; it is essential to adjust and optimize your strategies based on the data and insights gained. Continuous monitoring, testing, and refining allow you to identify what works best for your business and adapt to changing market conditions. By reviewing your marketing goals, analyzing data, and implementing improvements, you can ensure that your credit repair marketing strategies remain effective and aligned with your business objectives.

In conclusion, credit repair marketing is a vital aspect of connecting with potential clients, building trust, and establishing credibility in the credit repair industry. By enhancing brand visibility, attracting potential clients, and utilizing various marketing channels, credit repair companies can effectively reach their target audience and provide valuable solutions to their credit repair needs. Creating a comprehensive marketing strategy that incorporates website optimization, content marketing, social media marketing, email marketing, paid advertising, and measuring success through tracking performance allows credit repair companies to maximize their marketing efforts and achieve their business objectives.

This image is property of i.ytimg.com.