So you’ve run into some trouble with collections and charge-offs, huh? Don’t worry, you’re not alone. Many people have faced these challenges on their credit repair journey. In the world of credit, collections and charge-offs can be daunting and confusing, but fear not! In this article, we’ll provide you with some valuable steps to take when navigating through collections and charge-offs.

If you’re curious about how to handle collections and charge-offs on your credit report, this article will be your guide. We’ll break down the process and give you practical strategies to navigate this complex terrain. From understanding the difference between collections and charge-offs to taking the necessary steps to improve your credit, we’ve got you covered. So, stay tuned and get ready to take action on your credit repair journey!

Understanding Collections and Charge-Offs

What are collections?

Collections occur when a creditor or lender is unable to collect payment for a debt and outsources the task to a collection agency. These agencies are responsible for pursuing the debt on behalf of the original creditor, using various methods such as phone calls, letters, and even legal action.

What are charge-offs?

A charge-off is a declaration by the original creditor that they do not expect to collect a debt. It is often seen as a last resort after unsuccessful attempts at collection. While a charge-off does not absolve the debtor of their responsibility to repay the debt, it does have significant implications for their credit score and overall financial standing.

How do collections and charge-offs affect credit scores?

Both collections and charge-offs have a detrimental impact on credit scores. When a debt goes into collections, it is immediately reflected on the debtor’s credit report, resulting in a decrease in their credit score. The same applies to charge-offs, as they are considered a severe dereliction of payment.

These negative marks can stay on a credit report for up to seven years, making it difficult for individuals to access credit or obtain favorable loan terms. Lenders and creditors view collections and charge-offs as red flags, indicating a higher risk borrower.

Common misconceptions about collections and charge-offs

There are several misconceptions surrounding collections and charge-offs that may add confusion and anxiety to individuals dealing with these situations. It is important to clarify these misunderstandings to provide a clearer understanding of what to expect.

One common misconception is that paying off a collection or charge-off will immediately erase the negative mark from a credit report. In reality, paying off these debts may improve the overall creditworthiness of the individual and show responsible behavior, but it does not entirely remove the negative mark.

Another misconception is that settling a debt for less than the full amount owed will automatically be regarded as a positive outcome by lenders. While settling an outstanding debt is generally preferable to leaving it unresolved, lenders may still view it as a less favorable outcome compared to full repayment.

It is essential to recognize and address these misconceptions to make informed decisions when navigating collections and charge-offs.

Steps to Navigate Collections and Charge-Offs

Review your credit report

The first step in dealing with collections and charge-offs is to obtain a copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion. Reviewing your credit report will help you understand the extent of the collections and charge-offs, as well as any other negative marks on your credit history.

Verify the debt

Once you have identified the specific collections and charge-offs on your credit report, you should verify the accuracy of the debts listed. It is not uncommon for mistakes to occur, so it is crucial to ensure that the debt being pursued is legitimate and belongs to you.

Understand your rights as a consumer

As a consumer, you have rights when dealing with collections and charge-offs. The Fair Debt Collection Practices Act (FDCPA) outlines specific rules and regulations that collection agencies must follow when attempting to collect a debt. Familiarize yourself with your rights to protect yourself from abusive or unethical collection practices.

Communicate with the collection agency

Establishing open lines of communication with the collection agency is crucial in navigating collections effectively. Contact the agency and discuss the debt, ensuring that you fully understand the details and potential options for resolving it. Be proactive in finding a solution that works for both parties and seek to negotiate a settlement if possible.

Negotiate a settlement

If you are unable to pay the full amount owed, it may be possible to negotiate a settlement with the collection agency. This involves offering to pay a reduced amount as a final payment for the debt. Keep in mind that negotiating a settlement may still result in a negative mark on your credit report, but it can help you resolve the debt and potentially avoid legal action.

Consider credit counseling

If you are struggling to manage your debts and navigate collections effectively, credit counseling can provide valuable guidance and support. Credit counseling agencies can help you analyze your financial situation, develop a budget, and provide education on managing your credit and debts responsibly.

Rebuilding your credit after collections and charge-offs

While collections and charge-offs have a significant impact on your credit score, it is not the end of your creditworthiness. You can begin rebuilding your credit by focusing on positive credit habits. This includes making timely payments, keeping credit card balances low, and avoiding new debt.

Monitor your credit regularly

Even after resolving collections and charge-offs, it is essential to monitor your credit regularly to ensure accuracy and prevent future issues. You can sign up for free credit monitoring services or use commercially available credit monitoring tools to keep track of any changes to your credit report.

Dealing with repeated collections or charge-offs

If you find yourself facing repeated collections or charge-offs, it may be indicative of underlying financial issues that need to be addressed. Take a close look at your spending habits, budget, and overall financial strategy to identify any areas for improvement.

Seek professional help if needed

If you find navigating collections and charge-offs overwhelming or complex, it may be beneficial to seek professional help from a credit repair company or a certified credit counselor. These professionals can provide guidance, negotiate with collection agencies on your behalf, and help you develop a comprehensive credit repair plan.

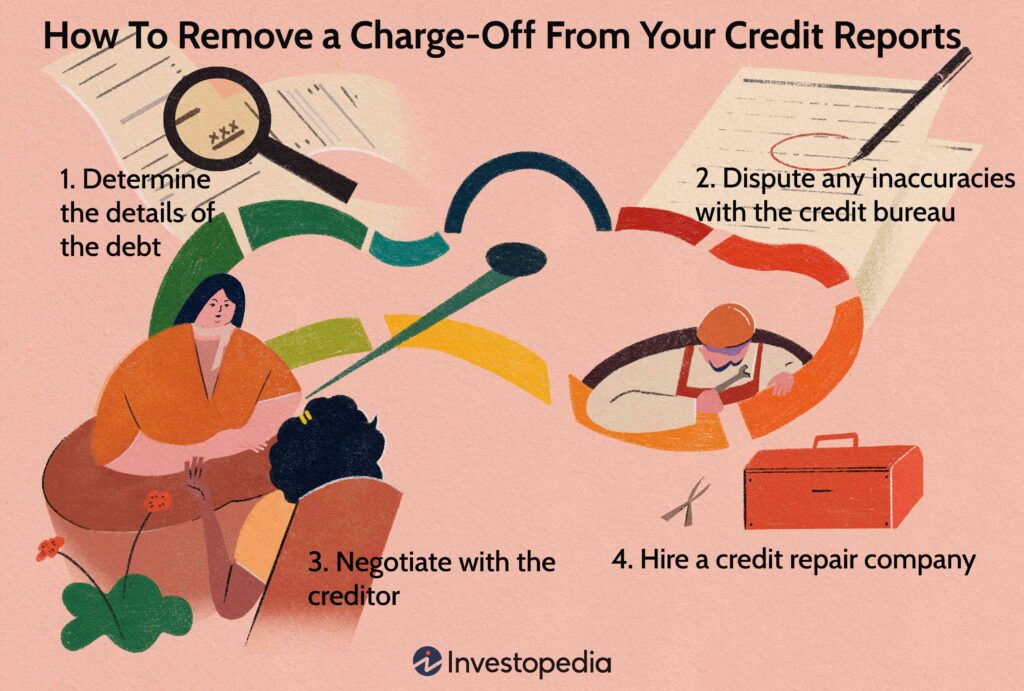

This image is property of www.investopedia.com.

Dealing with Collections

Responding to collection calls and letters

When dealing with collection calls and letters, it is important to remain calm and assertive. Listen to the collector but avoid providing any personal or financial information over the phone. Request written communication instead and ask for proof of the debt.

Understanding different types of collections

There are different types of collections, including medical bills, credit card debts, and student loans. Each type may have its specific rules and regulations governing collection practices. Understanding the specific type of collection you are dealing with will help you navigate it more effectively.

Requesting debt validation

If you are unsure about the accuracy or legitimacy of the debt, you have the right to request debt validation from the collection agency. They must provide documentation proving that you owe the debt, including the original creditor, the amount owed, and any relevant account information.

Creating a budget to address collections

Developing a budget is an essential step in addressing collections and managing your finances effectively. By analyzing your income and expenses, you can allocate funds towards resolving the debt and avoid falling into further financial difficulties.

Setting up payment plans

In some cases, collection agencies may be willing to work with you to set up a payment plan that fits your financial situation. This allows you to repay the debt in manageable installments over a specified period. Be sure to negotiate terms that you can comfortably afford to avoid defaulting on the plan.

Avoiding scams and fraudulent collection agencies

Unfortunately, there are fraudulent collection agencies that prey on unsuspecting individuals. To protect yourself, be vigilant and verify the legitimacy of any collection agency you are dealing with. Research their reputation, check for proper licensing, and report any suspicious activity to the appropriate authorities.

Addressing Charge-Offs

What is a charge-off?

A charge-off occurs when a creditor gives up hope of receiving payment on a debt and removes it from their books as an asset. However, this does not mean that you are no longer responsible for repaying the debt. It remains a valid obligation, and you should still work towards resolving it.

Negotiating with original creditors

If a debt has been charged off, you may have the opportunity to negotiate directly with the original creditor. They may be willing to work out a settlement or payment plan that can help you resolve the debt and improve your credit standing.

Considering debt settlement

Debt settlement involves negotiating with the creditor or collection agency to accept a reduced amount as payment in full for the debt. While this can be a viable option for resolving charge-offs, it is crucial to understand the potential implications and risks involved.

Understanding the impact of charge-offs on credit reports

Charge-offs have a significant impact on credit reports and can lower your credit score by a significant amount. This negative mark will stay on your credit report for up to seven years, making it more challenging to access credit or obtain favorable loan terms.

Rebuilding credit after a charge-off

Rebuilding your credit after a charge-off involves practicing good credit habits consistently. Make timely payments, keep credit card balances low, and work towards reducing your overall debt. Over time, these positive behaviors will help improve your credit score and demonstrate your creditworthiness to lenders.

Removing charge-offs from credit reports

In some cases, it may be possible to have a charge-off removed from your credit report. This can be done through a process called credit dispute, where you challenge the accuracy or legitimacy of the charge-off with the credit bureaus. However, this process can be complex, and it is advisable to seek professional help if you decide to go this route.

This image is property of m.foolcdn.com.

The Legal Aspects of Collections and Charge-Offs

The Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law that governs the behavior and practices of collection agencies. It sets guidelines for how collection agencies can communicate with consumers, what information they can disclose, and the actions they can take to collect a debt. Familiarize yourself with the FDCPA to understand your rights and protect yourself from abusive collection practices.

Know your rights as a consumer

In addition to the FDCPA, consumers also have rights under various state laws that govern collections and charge-offs. These laws provide additional protections and regulations that collection agencies and creditors must adhere to when pursuing a debt. Research the specific laws applicable to your state to ensure your rights are protected.

How to dispute inaccurate collections

If you believe that a collection is inaccurate or does not belong to you, you have the right to dispute it. You can submit a dispute to the credit bureaus, providing any supporting documentation or evidence that proves the debt is not valid. The credit bureaus are obligated to investigate your dispute and remove any inaccurate information from your credit report if they find it to be valid.

What to do if your rights are violated

If you believe that your rights have been violated by a collection agency or creditor, there are steps you can take to address the issue. Keep detailed records of all interactions, document any violations, and file a complaint with the Federal Trade Commission (FTC) and your state’s attorney general’s office.

Legal options for dealing with collections and charge-offs

If you find yourself in a situation where a collection agency or creditor has violated your rights or engaged in illegal practices, you may have legal options to pursue. Consult with an attorney who specializes in consumer law to understand the potential legal remedies available to you.

Additional Tips for Managing Collections and Charge-Offs

Documenting all communication

When dealing with collections and charge-offs, it is crucial to keep thorough records of all communication, whether it is phone calls, letters, or emails. This documentation can serve as evidence in case of disputes or violations of your rights.

Seeking professional credit repair services

If you are overwhelmed by the complexities of collections and charge-offs or would prefer professional assistance, consider hiring a reputable credit repair company. These companies specialize in navigating the intricacies of credit repair and can provide valuable guidance and support in resolving collections and charge-offs.

Understanding the statute of limitations

Each state has a statute of limitations that dictates the time frame in which a creditor or collection agency can sue you for an outstanding debt. Understanding the statute of limitations is crucial, as it can help you determine the best course of action when dealing with older debts.

Avoiding common pitfalls when dealing with collections

When dealing with collections, it is essential to remain vigilant and avoid common pitfalls that can worsen your financial situation. Be cautious of making promises you cannot keep, providing personal or financial information to unknown parties, or paying off debts without verifying their accuracy or legitimacy.

Educating yourself on credit laws and regulations

To navigate collections and charge-offs successfully, it is vital to educate yourself on credit laws and regulations. Stay up to date with changes in consumer protection laws, credit reporting guidelines, and debt collection practices. This knowledge will empower you to make informed decisions and protect your rights as a consumer.

This image is property of i.ytimg.com.

Conclusion

Navigating collections and charge-offs can be a daunting task, but it is essential to take action and address these issues in a thoughtful and strategic manner. By understanding the steps outlined in this article and empowering yourself with knowledge, you can successfully navigate collections and charge-offs, protect your creditworthiness, and build a solid credit repair plan. Remember, taking proactive steps to address these challenges will help you regain control of your financial future and set you on the path to a brighter credit future.